-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - Lawmakers Move to Impeach South Korea President

MNI China Daily Summary: Wednesday, Dec 4

MNI US Open: Commodities Rally Continues

EXECUTIVE SUMMARY:

- METALS PRICES HEAD FOR RECORD

- EUROPE'S GAS BENCHMARK PRICE SURGES DESPITE PUTIN SUPPLY PLEDGE

- BOE'S TENREYRO CAUTIOUS ON RECOVERY

- RBNZ RATES AT 1.5% BY END-2022 (MNI INTERVIEW)

- FOCUS TURNS TO U.K. RESPONSE FOLLOWING E.U. OFFER ON N. IRELAND PROTOCOL

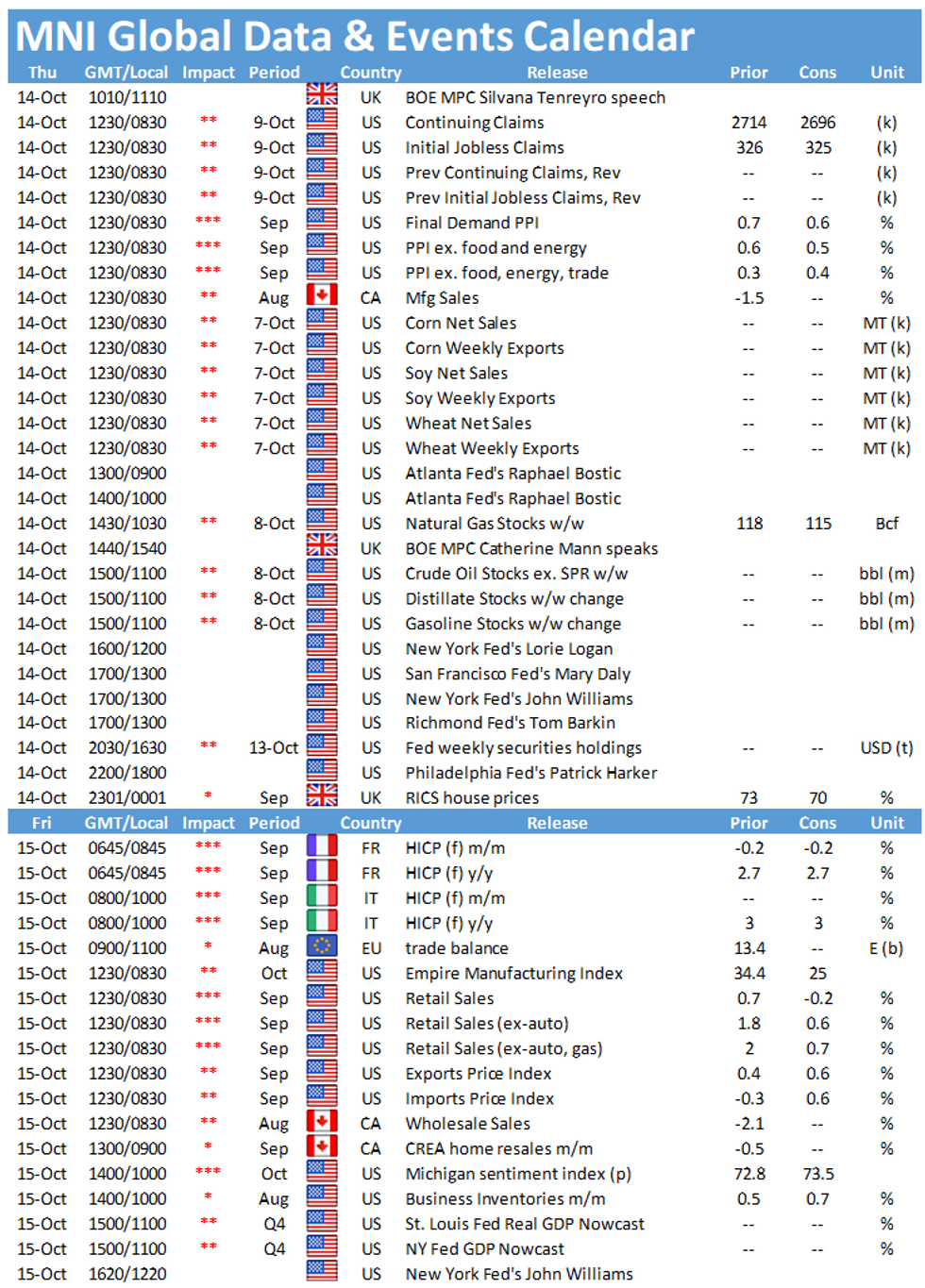

Fig. 1: Metals Prices Soaring

Source: BBG, MNI

Source: BBG, MNI

NEWS:

COMMODITIES (BBG): Base metals surged, led by zinc which spiked to the highest since 2007 after European smelters became the latest casualties in a global energy crisis that's knocking supply offline and heaping pressure on manufacturers. Zinc rose as much as 6.9% on the London Metal Exchange, and a gauge of six industrial metals rapidly closed in on an all-time high. Aluminum, one of the most energy-intensive commodities, is at the highest since 2008. Copper bounced closer to the $10,000-a-ton mark, and spreads are pointing to a sharply tighter market -- spot copper contracts are trading at the biggest premium over futures in nearly a decade as global inventories shrink.

COMMODITIES (BBG): The European gas benchmark surged back above 100 euros a megawatt-hour as traders shrugged off Russia's pledge to deliver as much as the continent needs.Europe's largest gas supplier is raising deliveries in line with requests from customers and is "prepared to discuss any additional steps" to stabilize the market, President Vladimir Putin said on Wednesday. He blamed the region's energy crisis on flawed policies rather than a lack of supply. Despite Putin's assurances, European gas prices continued to rise. The Dutch front-month contract climbed as much as 10% on Thursday to 102.96 euros a megawatt-hour, exceeding 100 euros for the first time since last Friday. The U.K. equivalent jumped as much as 9.9%.

BOE: MPC member Silvana Tenreyro is still sounding very cautious about the economic recovery and the ability of the BoE to stop inflation moving higher in the short-term. She still sounds some way off hiking.

- "That in part has been driven by global prices in energy and other commodities which push up on inflation, but these effects in general tend to be short-lived."

- "That's a question whether this is just a big readjustment and a one-off, or whether those adjustments will keep over time, and that is part of the uncertainty that we face... Assuming this is just a one-off effect, trying to respond to that would only succeed in making inflation more volatile, since the effects of energy prices would have faded by the time policy was able to have an effect on inflation."

- "Activity has come in weaker than we anticipated in our last forecast and we remain a normal sized recession below the pre-Covid level of GDP. If you measure relative to that we are in a full sized recession, even more if you think about the trend that we were projecting pre-Covid."

- "It is interesting what is going on in the labour market and this is one of the biggest uncertainties that we are facing now as a committee and we need to try and work out what is going on."

- Full comments available here.

RBNZ (MNI INTERVIEW): A member of the 'shadow' board of the Reserve Bank of New Zealand believes the central bank will continue to hike rates to 1.5% by the end of 2022. For full article contact sales@marketnews.com

E.U./U.K.: Following yesterday's offer from the EU to strip away as much as 80% of the customs checks on food and retail goods entering Northern Ireland from Great Britain, in an effort to reach an agreement with the UK over the Northern Ireland protocol, focus now turns to the UK gov'ts response. The two sides are set to enter a month of negotiations on changes to the protocol, and while the EU's offer marks the most significant concessions Brussels has been willing to allow the UK there remains a significant gulf between what the EU will countenance (various amendments to SPS, medicines, political participation) and what the UK is demanding (a full renegotiation of the protocol).

ESMA (BBG): The European Council is expected to appoint Verena Ross as head of the European Securities and Markets Authority on Friday, according to two EU officials familiar with the matter. The Council selected Ross in September, the European Parliament confirmed the decision and she will take up the role before year-end, one official said, asking not to be identified as a matter of policy.

U.S. / TECH (BBG): A bipartisan group of senators are planning to introduce legislation to prevent the biggest U.S. technology giants like Amazon.com Inc.and Apple Inc. from giving an advantage to their own products over those of competitors. The bill, announced on Thursday by Amy Klobuchar, a Minnesota Democrat, and Iowa Republican Chuck Grassley, would prohibit the companies from using data to hurt competition, stacking search results in their favor or restricting the way other services use their platforms. The measure matches a House proposal that tech groups have warned would risk user security and make it harder to use services that consumers enjoy.

UK (BBG): The Bank of England's quarterly Credit Conditions Survey suggests competition is holding down rates on lending to households. Spreads relative to the BOE benchmark rate or the appropriate swap rate were expected to narrow for both secured and unsecured lending in the fourth quarter.

U.K. / ENERGY (BBG): Glencore-backed U.K. gas shipper CNG Group Ltd. will no longer provide gas to its utility clients, a move that threatens to prompt a raft of further failures in the British energy market.CNG supplies wholesale gas to utilities that then sell it to households. The U.K. energy market is already in crisis and the exit threatens to unleash a new wave of turmoil.

E.U. (MNI BRIEF): The EU Commission's Recovery Fund bond issuance programme is attracting a new global investor base, DG Budget Gert-Jan Koopman said today. Speaking at a Brussels conference, Koopman said. "Across the globe investors are looking at Europe from a new perspective." "There's a lot of demand to diversify away from the dollar and our safe assets are very attractive from that point of view." Referring to Tuesday's first EU green bond issue under the Recovery Fund programme, Koopman said, "this is just the beginning of the process. There's massive interest in the markets for these bonds."

BANKS: The increase in the value of US banks' long-term assets as a result of low policy rates is more than cancelled out by the damage done to bank profits due to squeezed interest rate margins once policy rate falls below a tipping point of 0.55%, according to a paper published as part of the ECB Research Bulletin

GERMANY: German GDP will increase by 2.4% in 2021 and by 4.8% in 2022, according to the latest ifo Germany Joint Economic Forecast, reaching normal capacity utilisation some time next year. Consumer prices are expected to rise by 3% across year and by 2.5% in 2022, the forecast suggests. The German government's debt-to-GDP ratio is expected to decline from 71% in 2021 to 67% in 2022.

DATA:

MNI: SPAIN SEP FINAL HICP +1.1% M/M, +4.0% Y/Y; JUL +3.3% Y/Y

SWEDEN DATA: Downside miss for inflation

- CPI +2.5%Y/Y (exp 2.7%, prev +2.1%)

- CPIF +2.8%Y/Y (3.0% exp, 2.4% prev)

- CPIF ex energy +1.5%Y/Y (exp 1.7%, 1.4% prev)

- Downside miss but note likely to be enough to stop the Riksbank adding some chance of a rate hike at the end of its forecast horizon at the next MPR. With that in mind, expect little market reaction.

FIXED INCOME: Moving higher, led by Bunds

- Core bonds have drifted higher, led by Bunds, and providing some relief to equities as ED/ER/SS strips move higher with less hikes being priced into markets.

- US PPI headlines the calendar for today with a couple of central bank speeches worth watching too - Tenreyro and Mann from BOE, and the Fed's Bullard, Bostic, Logan, Daly and Harker.

- There's been some stabilisation in the long-end of the US curve with 10s30s up around 1.7bp on the day while gilt/Bund 10s30s are marginally lower than yesterday, but also showing tentative signs of stabilising.

- TY1 futures are up 0-5 today at 131-12 with 10y UST yields down -0.2bp at 1.536% and 2y yields down -0.6bp at 0.353%.

- Bund futures are up 0.16 today at 169.10 with 10y Bund yields down -1.6bp at -0.145% and Schatz yields down -0.3bp at -0.695%.

- Gilt futures are down -0.03 today at 124.81 with 10y yields down -1.1bp at 1.075% and 2y yields down -3.2bp at 0.537%.

FOREX: JPY Resumes Slide, Growth Proxies on Front Foot

- JPY remains on the backfoot, with the currency underperforming all others in G10. This puts USD/JPY just below the Y113.50 mark, with the week's highs of Y113.80 the upside target and bull trigger. A break above would open levels not seen since late 2018.

- The greenback also trades offered, with the USD Index extending yesterday's slide to drop to the lowest levels since early October. the moves put EUR/USD back above the 1.16 handle, opening gains toward 1.1640 and the 50-dma at 1.1722.

- Risk appetite appears to have improved, with European equity markets in positive territory with gains of 0.7-1.1%. This has helped growth proxies and high beta currencies to the top of the table, with NZD, AUD and NOK outperforming.

- US PPI data crosses later today, with markets expecting a moderation in price pressures on a M/M basis, although Y/Y metrics are expected to continue to climb, putting PPI Final Demand at 8.7%, another series record. Weekly US jobless claims data also crosses.

- Central bank speak picks up at the NY crossover, with highlights including ECB's Knot, BoE's Tenreyro & Mann as well as FOMC members Barkin, Daly and Harker and Fed's Logan.

EQUITIES: Strong Tech Gains Lead Indices Higher

- Asian equities closed mostly higher, with Japan's NIKKEI up 410.65 pts or +1.46% at 28550.93 and the TOPIX up 13.14 pts or +0.67% at 1986.97. China's SHANGHAI closed down 3.482 pts or -0.1% at 3558.28.

- European equities are gaining, with the German Dax up 110.06 pts or +0.72% at 15249.38, FTSE 100 up 52.7 pts or +0.74% at 7141.82, CAC 40 up 47.98 pts or +0.73% at 6597.38 and Euro Stoxx 50 up 43.66 pts or +1.07% at 4083.28.

- U.S. futures are higher, led by Tech, with the Dow Jones mini up 185 pts or +0.54% at 34442, S&P 500 mini up 29.25 pts or +0.67% at 4384.25, NASDAQ mini up 127.25 pts or +0.86% at 14891.5.

COMMODITIES: Base Metals Gain, Led By Zinc Surge

- WTI Crude up $0.81 or +1.01% at $81.1

- Natural Gas up $0.14 or +2.47% at $5.682

- Gold spot up $3.51 or +0.2% at $1793.44

- Copper up $6.25 or +1.38% at $455.3 (note Zinc rose as much as 6.9%)

- Silver up $0.17 or +0.73% at $23.1977

- Platinum up $12.92 or +1.26% at $1028.38

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.