-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI US Open: COVID Concerns Hit Equities

EXECUTIVE SUMMARY:

- TREASURIES AND DOLLAR STRENGTHEN, EQUITIES AND OIL SINK

- U.K. SET FOR BIG REOPENING AS CASES SOAR MOST IN THE WORLD

- EVERGRANDE RESUMES DOWNWARD SPIRAL AS INVESTORS PREP FOR CRISIS

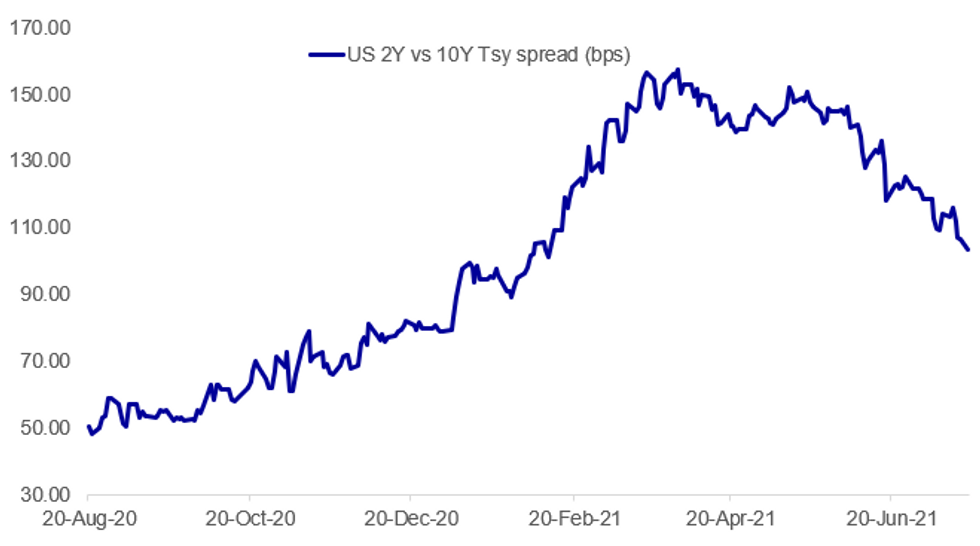

Fig. 1: U.S. Curve Continues To Flatten, With 10Y Yields Hitting 5-Month Lows

Source: BBG, MNI

Source: BBG, MNI

NEWS:

UK: "Freedom day" is here with the vast majority of legal restrictions due to Covid-19 ending across England today. However, the market is more focused on MPC speakers following last week's hawkish comments from Saunders in particular, alongside Ramsden and Cunliffe. BOE's Haskel speaks later this morning (0600ET/1100BST).

UK (BBG): Boris Johnson's plan to get the U.K. back to normal is at risk of being derailed amid a public outcry over his attempt to dodge pandemic isolation rules, as Covid-19 cases soar the most in the world.Coronavirus restrictions expired in England on Monday, a moment that was meant to herald the full reopening of an economy battered by its deepest recession in 300 years.But the lifting of curbs came against a fraught backdrop of surging infections and political strife for Johnson. The U.K. added more than 54,000 new cases Saturday, and over 47,600 on Sunday, more than Indonesia, the current pandemic epicenter, according to data compiled by Johns Hopkins University.

CHINA / HONG KONG / EQUITIES (BBG): Investor doubts over troubled developer China Evergrande Group turned into panic on Monday as a creditor's successful demand to freeze some assets showed growing concern over the company's ability to raise funds.The company's shares plummeted 16% to close at a four-year low in Hong Kong, while its bonds also fell.A Chinese court froze a 132 million yuan ($20 million) deposit held by Evergrande's main onshore subsidiary, Hengda Real Estate Group, at the request of China Guangfa Bank Co., according to a court ruling released on July 13 that circulated among traders over the weekend. Evergrande said in response it will sue Guangfa Bank, with the loan not coming due until March, according to a statement.

OIL (BBG): OPEC and its allies struck a deal to inject more oil into the recovering global economy, overcoming an internal split that threatened the cartel's control of the crude market.An unusually public dispute that tested the group's unity was resolved in a classic compromise -- with Saudi Arabia meeting the United Arab Emirates halfway in its demand for a more generous output limit.The deal, agreed at a hastily convened Sunday meeting ahead of a long Islamic holiday, allows for monthly supply hikes of 400,000 barrels a day. It puts OPEC+ back in control of the market after two volatile weeks, in which traders considered the possibility that the alliance could unravel.

TECH / SPYWARE (BBG): Israeli company NSO Group Ltd.'s Pegasus spyware was used in attempted and successful hacks of 37 smartphones belonging to journalists, activists and business executives worldwide, according to an investigation by The Washington Post and its media partners.Among the findings is that the spyware was used to target the smartphones of both the wife and the fiancee of murdered Saudi columnist Jamal Khashoggi. Their phone numbers appeared on a list of more than 50,000 numbers, which the consortium said were possible targets for surveillance by governments using Pegasus.

JAPAN: Japan's government has left its monthly economic assessment unchanged for a third straight month but upped its assessment of business conditions as the economy continues to recover from the pandemic, the Cabinet Office said Monday. According to the government, businesses still sees many aspects remaining severe, but there are signs of picking yup. The upward revision is the first since March 2021, while the assessment of other components was largely unchanged from June.

CHINA / COMMODITIES: China will continue to organize the release of state reserves of copper, aluminum and zinc to further ease cost pressures, and commodity prices are expected to gradually return to a reasonable range, said Wan Jinsong, director of the Price Department at the National Development and Reform Commission at a briefing on Monday. With the government's move to tame prices, the prices of steel, copper and aluminum fell by 3-14% from their peaks in May, which drove down the June PPI by 1.3 percentage points from the previous month, said Wan, adding that the NDRC will increase crackdowns on speculation and hoarding. Producer prices rose 0.3% m/m or 8.8% y/y in June.

DATA:

No key data in the European morning.

FIXED INCOME: Significant moves higher as Covid-19 concerns compound

There has been a risk-off mood to markets opening this week with core fixed income higher, peripheral spreads wider while equities and oil are both lower. Concerns over how bumpy the roads out of lockdown will be are the main talking point this morning.

- Looking at US Treasuries we are at key levels for a number of reasons: on the yield chart on a medium-term basis we have not traded below the 200-dma since November 2020 (which comes in at 1.2530%) nor have we yet closed below the 1.2882 Fibo level (the 38.2% retracement of the August 2020 to March 2021 rally). There is also support in yields at 1.2216% (the gap in mid-February). And on a short-term basis in futures, we are challenging to break out of the top of the bull channel.

- Bund futures are similarly at their highest levels since mid-February while gilts are moving largely in line with Bunds rather than Treasuries and gilt futures remain below Thursday's highs.

- Moves in fixed income are significant but much smaller than some of the comparable moves seen in FX ore equity markets.

- TY1 futures are up 0-9 today at 134-02 with 10y UST yields down -3.1bp at 1.261% and 2y yields down -0.4bp at 0.219%.

- Bund futures are up 0.28 today at 175.15 with 10y Bund yields down -1.3bp at -0.368% and Schatz yields down -0.2bp at -0.689%.

- Gilt futures are up 0.15 today at 129.27 with 10y yields down -1.5bp at 0.611% and 2y yields unch at 0.112%.

FOREX: Risk Off Pervades, Boosting JPY, USD

- Stocks traded on the backfoot from the off Monday, with US futures pointing to a negative open on Wall Street later today. Downside in stocks and persistent pressure on global government bond yields have buoyed haven currencies, resulting in JPY and USD being among the strongest in G10 ahead of the NY crossover.

- As equities slip, commodities are trading poorly, resulting in WTI and Brent crude futures touching the lowest levels of the month. This has worked further against oil-tied FX, with CAD and NOK among the poorest performers of the day.

- EUR/USD downside sees the pair touch the lowest levels since April, narrowing the gap with key support and the bear trigger at the year's low of 1.1704.

- There are no major data releases due Monday, keeping focus on the central bank speakers slate. BoE's Haskel and ECB's Perrazzelli are due to speak. Earnings season continues, with healthcare, tech and communication services taking focus.

EQUITIES: Energy, Financials Leading European Stocks Lower

- Stocks in Asia closed lower, with Japan's NIKKEI down 350.34 pts or -1.25% at 27652.74 and the TOPIX down 25.06 pts or -1.3% at 1907.13. China's SHANGHAI closed down 0.181 pts or -0.01% at 3539.123 and the HANG SENG ended 514.9 pts lower or -1.84% at 27489.78.

- European equities are sharply lower, with the German Dax down 294.24 pts or -1.89% at 15335.53, FTSE 100 down 123.59 pts or -1.76% at 6904.1, CAC 40 down 114.64 pts or -1.77% at 6351.19 and Euro Stoxx 50 down 81.85 pts or -2.03% at 3973.75.

- U.S. futures are being dragged down as well, with the Dow Jones mini down 350 pts or -1.01% at 34215, S&P 500 mini down 33 pts or -0.76% at 4285.5, NASDAQ mini down 62 pts or -0.42% at 14608.75.

COMMODITIES: Oil Sinks On OPEC+ Supply Deal, Broader Risk-Off

- WTI Crude down $2.06 or -2.87% at $70.64

- Natural Gas up $0.02 or +0.52% at $3.695

- Gold spot down $8.23 or -0.45% at $1806.81

- Copper down $6.3 or -1.46% at $427.75

- Silver down $0.32 or -1.25% at $25.4239

- Platinum down $26.82 or -2.43% at $1095.34

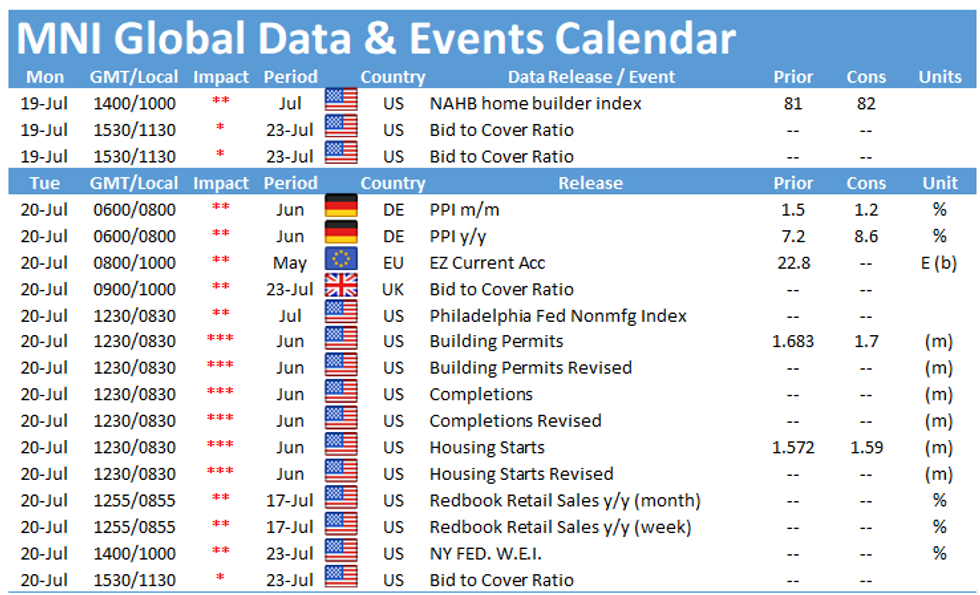

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.