-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Deals Down To A Matter Of "Hours"

EXECUTIVE SUMMARY:

- E.U. BARNIER'S NEGATIVE TONE MIRRORS U.K. JOHNSON'S AS DEAL HOPES WANE

- WORK CONTINUES OVERNIGHT ON U.S. COVID RELIEF BILL, STILL NO TEXT

- U.K. RETAIL SALES DATA AND GERMAN IFO BEAT EXPECTATIONS

- B.O.J. WON'T ALTER FRAMEWORK; NEGATIVE RATE POLICY: GOV KURODA

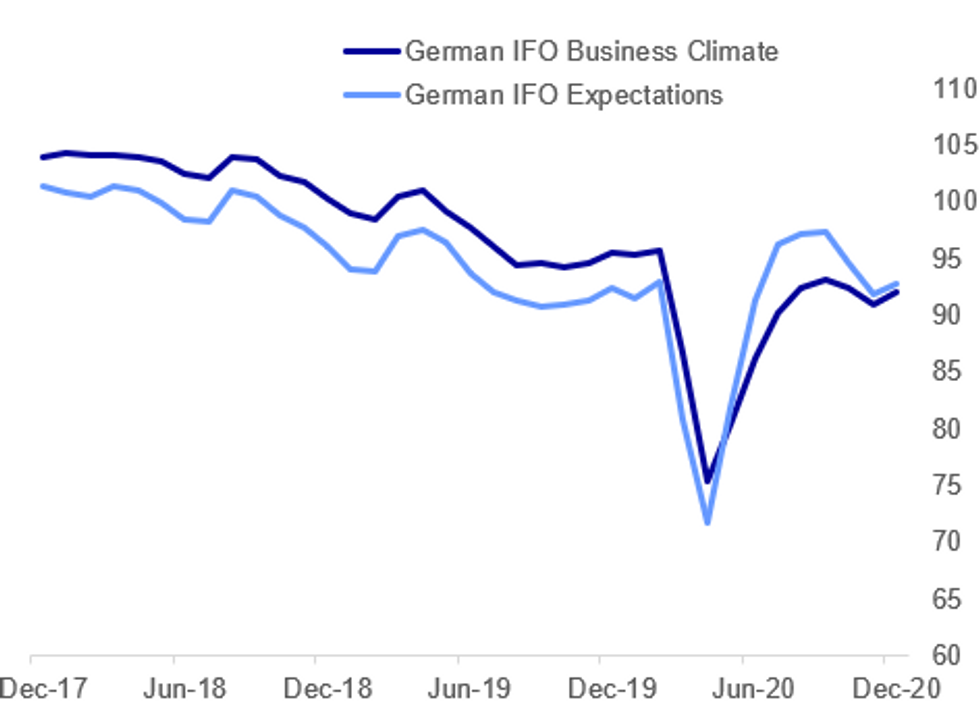

Fig.1: German IFO Beats Expectations

IFO, MNI

IFO, MNI

NEWS:

UK-EU: Chief EU negotiator Michel Barnier addressing the European Parliament sounds fairly downbeat on the prospect of an FTA deal being reached with the UK.

- Says there are "a few hours left" in talks and that it was the "moment of truth" as both sides tackled the "hard nuts to crack".

- Says that the EU "respects UK sovereignty" on fisheries, but that it wouldnt be fair for EU fishermen to have no transitory rights in UK waters.

- Comes after a phone call last night between UK PM Boris Johnson and European Commission President Ursula von der Leyen, in which Johnson expressed how the EU would need to bend on fisheries for a deal to be possible.

UK DATA: UK retail sales declined by 3.8% in Nov as the second lockdown kicked in, slightly better than markets expected and in line with MNI's latest Reality Check. Nevertheless, sales remain above their pre-pandemic levels with monthly sales 2.6% higher than in Feb. Annual sales grew by 2.4% in Nov after increasing by 5.8% in the previous month. Clothing and fuel sales took the largest hit during the winter lockdown with clothing and footwear sales plunging by 19.0% m/m, while fuel sales were down 16.6% m/m. Household goods and food stores were the only categories to see a monthly increase as firms noted that consumers brought forward their Christmas shopping, particularly on festive home products and DIY. Household good stores saw sales rise by 1.6% and food sales ticked up 3.1% in Nov. Internet sales accelerated to 6.3% m/m, up from 4.8% seen in Oct, shifting the proportion of all retailing up to 31.4% in Nov, its highest since June. Compared to Nov 2019 online sales were 74.7% higher in value terms.

GERMANY DATA: The Ifo business climate indicator ticked up to 92.1 in Dec, in contrast to markets looking for a small downtick (BBG: 90.0). Current conditions improved as well to 91.3, above market projections (expected 89.0) Expectations ticked up to 92.8 in Dec, slightly outperforming forecasts looking for an increase to 92.5. Companies were less sceptical about the coming six months and they were generally more satisfied with the current situation.However, the lockdown is hitting certain sectors particularly hard, such as tour operators, accommodation services and creative artists.

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Friday the central bank has no plans to change its policy framework or its negative rate policy and will continue to seek a way to hit the elusive 2% price target. "Downward pressure stemming from coronavirus on economy and prices will be prolonged," making it difficult for the BOJ to achieve the 2% price target, Kuroda told reporters. Kuroda added that there were no plans to change either the framework or price target, but said the BOJ would assess its easy policy,

CHINA-AUSTRALIA (MNI EXCLUSIVE): China has no pressing need for Australian coal since it accounts for just a small part of total consumption and domestic capacity is more than sufficient to make up for any shortfall, policy advisors and industry experts said, adding that they expect domestic coal production to pick up with the release of fresh quotas for the new year. For full article contact sales@marketnews.com

CHINA (MNI INTERVIEW): China's GDP growth could exceed 8.5% next year if other major economies rebound in the second half on the back of Covid vaccination programmes, a senior advisor to the People's Bank of China told MNI in an interview, adding that there was no danger of deflation in the world's second-largest economy. For full interview contact sales@marketnews.com

CHINA-E.U.: Negotiations over the China-E.U. investment deal is now at the final stage and both parties still hope to achieve the goals set by leaders on both sides said Foreign Ministry Spokesman, Wang Wenbin, on Friday. The China-E.U. Bilateral Investment Deal, or Comprehensive Investment Deal, has been under negotiation for seven years and both parties have pledged to conclude the negotiation this year.

RBNZ: A former chairman of the Reserve Bank of New Zealand told MNI the central bank should withdraw from monetary stimulus policies fueling a dangerous asset price bubble. Arthur Grimes, RBNZ chairman from 2003 to 2013 after previously serving as chief economist, said in an interview that the RBNZ had "gone overboard with schemes which are not necessary."

DATA:

UK Nov Retail Sales Dip, But Beat Expectations

UK NOV RETAIL SALES -3.8% M/M; +2.4% Y/Y, ABOVE BBG -4.1% M/M

UK NOV RETAIL SALES EX-FUEL -2.6% M/M; +5.6% Y/Y

UK OCT TOTAL SALES REVISED AT +1.3% M/M

UK NOV RETAIL SALES DEFLATOR -1.8% Y/Y; EX-FUEL -1.2% Y/Y

GERMAN DEC IFO

DEC IFO BUSINESS CLIMATE INDEX 92.1; NOV 90.9

DEC IFO CURRENT CONDITIONS 91.3; NOV 90.0

DEC IFO EXPECTATIONS 92.8; NOV 91.8

FIXED INCOME: Bear steepening this morning

EGB's have bear steepened during the morning session, with long end part of the curve sold on Equity buying.

- Bid in risk is option expiry related, as gamma kicked in.

- Peripheral were also sold hard, pushing spread against Germany 10s wider.

- Greece sit at 7.6bps, while Italy, Portugal and Spain trend around 3bps wider this morning.

- Gilts has held onto gains, with Brexit still at the forefront, ahead of the MEP Sunday deadline.

- Gap still remain, and the window is clearly narrowing with just 2 weeks to the end of the transition period.

- We await on potential update from Boris Johnson.

- Treasuries have traded in tandem with EGBs, also weighted by US stimulus hope.

- @ChadPergram: "Work continues behind the scenes on coronavirus bill. Still no bill text. Government funding expires tonight at 11:59:59 pm et. Interim bill likely to avert shutdown tonight. Weekend work likely in Congress to finish up"

- Looking ahead, sees little in terms of data, with all eyes on Brexit and US stimulus going into the weekend.

- Fed's Brainard Discusses Climate Change and Financial regulations.

- Mar Bund futures (RX) down 33 ticks at 177.36 (L: 177.32 / H: 177.85)

- Mar Gilt futures (G) down 2 ticks at 134.61 (L: 134.53 / H: 134.82)

- Mar BTP futures (IK) down 54 ticks at 151.54 (L: 151.48 / H: 152.18)Italy / German 10-Yr spread 2.3bps wider at 113.3bps

- Mar OAT futures (OA) down 34 ticks at 167.42 (L: 167.38 / H: 167.91)

- US Mar 10-Yr futures (TY) down 2.5/32 at 137-25 (L: 137-24.5/ H: 137-30.5)

FOREX: GBP Extending Pullback Ahead of Another Weekend Deadline

After a particularly positive first half of the week, GBP is softer early Friday, extending the pullback that began in late US hours after Boris Johnson warned there was still a distinct possibility of No Deal should the EU not move further on rules surrounding fisheries post-transition. Betting markets have pared the implied odds of a trade deal being struck by the end of the year to 66%, from around 80% mid-week. GBP/USD has mirrored the sentiment, briefly showing below the $1.35 handle pre-NY hours.

The greenback trades somewhat firmer, with the dollar gaining against most others in G10, recovering from the Fed-induced weakness seen throughout the Thursday trading day.

Focus turns to Canadian retail sales, US leading index data and a speech from Fed's Brainard.

EQUITIES: Off Lows With Eurostoxx Option Expiry In Focus

Stocks have bounced sharply from their overnight lows. Attention in Europe is on a large option expiry today, with 301k worth of OI 3600 calls in Eurostoxx 50.

- Asian equities closed mixed, with Japan's NIKKEI down 43.28 pts or -0.16% at 26763.39 and the TOPIX up 0.66 pts or +0.04% at 1793.24. China's SHANGHAI closed down 9.977 pts or -0.29% at 3394.896 and the HANG SENG ended 179.78 pts lower or -0.67% at 26498.6.

- European stocks are up, with the German Dax up 30.75 pts or +0.23% at 13687.24, FTSE 100 up 41.69 pts or +0.64% at 6563.36, CAC 40 up 2.9 pts or +0.05% at 5542.75 and Euro Stoxx 50 up 9.57 pts or +0.27% at 3564.75.

- U.S. futures are slightly higher, with the Dow Jones mini up 18 pts or +0.06% at 30311, S&P 500 mini up 3.5 pts or +0.09% at 3724.75, NASDAQ mini up 0.75 pts or +0.01% at 12751.75.

COMMODITIES: Mixed Start Amid Dollar Strength

- WTI Crude down $0.02 or -0.04% at $48.34

- Natural Gas up $0.05 or +1.78% at $2.683

- Gold spot down $6.74 or -0.36% at $1879.12

- Copper up $2.4 or +0.67% at $362.5

- Silver down $0.32 or -1.21% at $25.7475

- Platinum down $5.59 or -0.53% at $1043.26

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.