-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI US Open: Dollar And Oil Gains Stand Out

EXECUTIVE SUMMARY:

- ECB'S KNOT: DUTCH, EUROPEAN, WORLD ECONOMIES RECOVERING QUICKER THAN EXPECTED

- EUROZONE PIPELINE INFLATION AT 13-YR HIGH, LED BY ENERGY PRICE RISES

- DOLLAR UP BUT CRUDE OIL HOLDS GAINS; ENERGY STOCKS OUTPERFORMING EARLY WEDNESDAY

- BOJ'S ADACHI: NO SILVER BULLET TO BOOST INFLATION

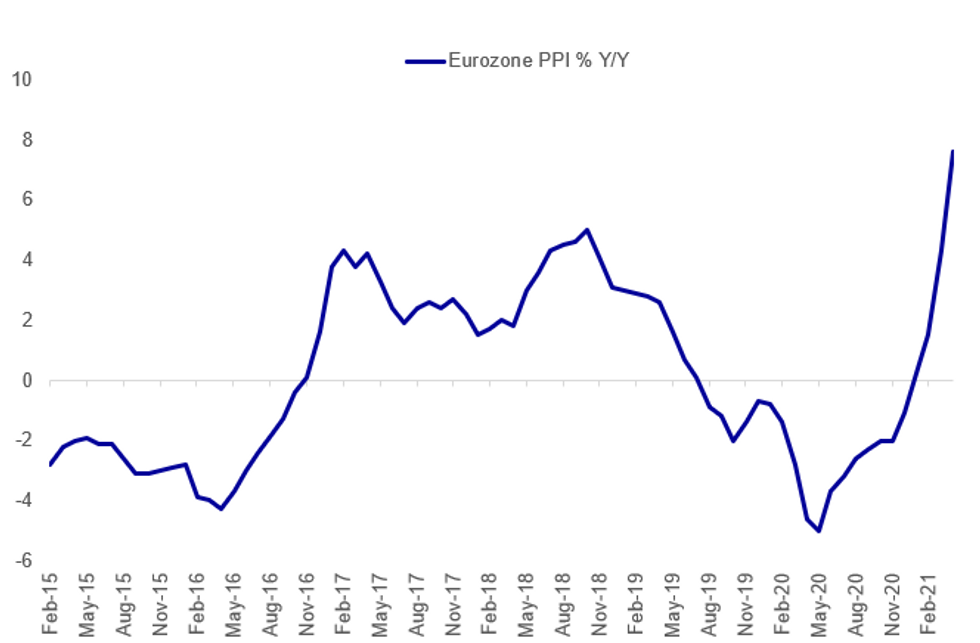

Fig. 1: Eurozone PPI Rises Sharply

Source: Eurostat, MNI

Source: Eurostat, MNI

NEWS:

ECB (RTRS): The head of the Netherlands' Central Bank Klaas Knot said on Wednesday the Dutch economy is recovering more quickly than expected from the economic crisis caused by the coronavirus pandemic. "We are completely positive at the Dutch Central Bank about the prospects for the Netherlands' economy, and that's also true for the European economy, and also the world economy seems to be recovering faster than we expected," Knot said in testimony to a panel in Dutch parliament.Knot is also a member of the European Central Bank.

EUROZONE DATA: Eurozone producer prices rose sharply in April, with prices increasing at an annual rate of 7.6%, the highest level since 2008, Eurostat said Wednesday. In March, prices rose 4.3%. Just 6 months ago, in November, eurozone PPI stood at -2.0% y/y. Higher factory gate prices will be closely watched by policymakers at the European Central Bank, although for now, it remains in their core view of supply side constraints and base effects from 2020's decline.

CHINA-US: China's Vice Premier Liu He held a video call with U.S. Treasury Secretary Janet Yellen on Wednesday, Xinhua News Agency reported. The two officials conducted "extensive exchanges" on the macroeconomic situation and cooperation in multilateral and bilateral areas with equality and mutual respect, and they frankly shared views on issues of mutual concern, Xinhua said. Both expressed willingness to continue communication, Xinhua said.

BOJ: Bank of Japan board member Seiji Adachi said Wednesday that the BOJ has no choice but to wait for price rises, while keeping the current easy policy in place. "There is no policy tool that the BOJ can use to accelerate a rise in prices. If there were such a tool, the BOJ would have already implemented it," he said.

UK TRADE / CPTPP: A virtual meeting of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) commission on Wednesday decided to formally begin negotiations with the United Kingdom on its potential entry to the bloc, stated the Japanese minister heading up CPTPP talks, Yasutoshi Nishimura. Japan, as the chair of the CPTPP commission this year, made the official proposal of starting negotiations following the UK's application to join submitted on 1 February. The UK would be the first non-Pacific country to join the group. Current members are: Japan, Canada, Australia, New Zealand, Brunei, Chile, Malaysia, Mexico, Singapore, Peru, and Vietnam, with seven of these having ratified the treaty (which came into force provisionally in 2018).

DATA:

FIXED INCOME: Looking for direction from Fed speakers later

Moves in core fixed income markets have been relatively subdued this morning with little change to yesterday's close while peripheral spreads are marginally wider on the day.

- Data this morning has seen German retail sales miss expectations, Eurozone PPI largely in line with expectations while UK mortgage approvals were a little better than expected.

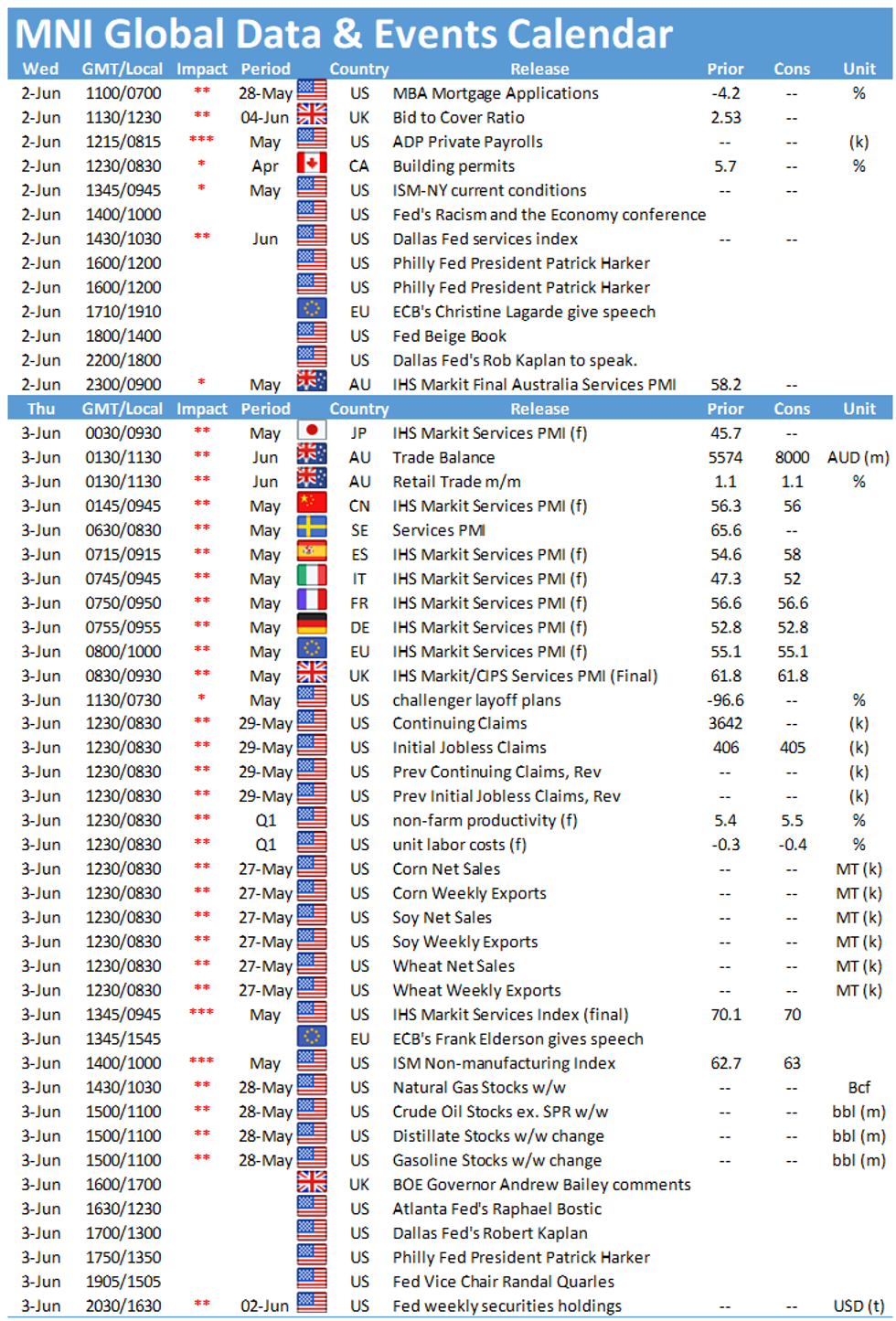

- Looking ahead, the Fed's Harker, Evans, Bostic and Kaplan are all due to speak while the Fed releases the Beige Book.

- TY1 futures are down 0-00+ today at 131-25 with 10y UST yields up 0.3bp at 1.610% and 2y yields unch at 0.148%.

- Bund futures are up 0.17 today at 170.00 with 10y Bund yields down -0.9bp at -0.188% and Schatz yields unch at -0.667%.

- Gilt futures are up 0.11 today at 126.98 with 10y yields down -0.5bp at 0.820% and 2y yields down -0.4bp at 0.063%.

FOREX: USD Clears to Weekly High, With Fedspeak in Focus

- Headed through the European morning, the dollar broke out of a tight overnight range, with the greenback the strongest across G10 ahead of the NY crossover. Fundamental newsflow is few and far between, but the USD strength has pushed GBP/USD through to new weekly lows and lower for a second session.

- EUR is similarly weak, but EUR/GBP continues to gravitate either side of the 50-dma at 0.8626. EUR/JPY holds just below the cycle highs posted yesterday at 134.13.

- AUD and NZD are among the poorest performers so far, but recent ranges have been largely respected.

- There's little data on the slate Wednesday, keeping focus on the central bank speaker slate ahead of the Fed blackout period this weekend. ECB's Villeroy, Elderson, Lagarde and Weidmann are on the docket as well as Fed's Harker, Evans, Bostic and Kaplan.

EQUITIES: Cautious Start, With Energy Stocks Leading Gains

- Asian markets closed mixed, with Japan's NIKKEI up 131.8 pts or +0.46% at 28946.14 and the TOPIX up 16.15 pts or +0.84% at 1942.33. China's SHANGHAI closed down 27.576 pts or -0.76% at 3597.138 and the HANG SENG ended 170.38 pts lower or -0.58% at 29297.62

- European equities are slightly higher, with the German Dax up 7.57 pts or +0.05% at 15618.73, FTSE 100 up 20.74 pts or +0.29% at 7080.46, CAC 40 up 6.83 pts or +0.11% at 6489.4 and Euro Stoxx 50 up 0.96 pts or +0.02% at 4081.74.

- U.S. futures are flat/lower, with the Dow Jones mini up 9 pts or +0.03% at 34559, S&P 500 mini down 2.5 pts or -0.06% at 4196, NASDAQ mini down 20.75 pts or -0.15% at 13628.

COMMODITIES: Oil Holds Its Ground As Dollar Strength Weighs On Metals

- WTI Crude up $0.32 or +0.47% at $67.86

- Natural Gas down $0.02 or -0.64% at $3.084

- Gold spot down $3.99 or -0.21% at $1898.34

- Copper down $1.85 or -0.4% at $464.25

- Silver down $0.17 or -0.61% at $27.7889

- Platinum down $9.98 or -0.83% at $1189.86

11 Pacific Nations Begin Talks On Possible UK CPTPP Entry

- The 11 CPTPP members accounted for just 7.5% of UK exports in 2019, compared to 47.0% going to countries in the European Union. Moreover, the relative economic sizes of the blocs is also in the EU's favour, with nominal GDP standingUSD17.1trn for the EU in 2021 according to IMF data, with the CPTPP nations equating to a combined USD12.0trn (although this would rise to USD34.7trn if the US rejoined). The demographic advantage for the CPTPP comes in its population, standing at 509.7mn, compared to 447.7mn for the EU, providing the UK with a larger base of potential consumers for its exports than the EU.

- As well as officially proposing talks with the UK begin, Japan - in its position as chair - has attempted to try to bring the US back into the deal. Former President Donald Trump took the US out of the deal in one of the first acts of his presidency. Incumbent President Joe Biden has shown little interest in taking the US back in, with FTAs often being viewed with significant suspicion among key swing voters in the US midwest and north east whose switch from Trump to Biden gave the former VP victory in the 2020 presidential election.

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.