-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US Open: Dollar Bouncing

EXECUTIVE SUMMARY:

- CASH-RICH U.S. BANKS MOVE TO REDUCE CORPORATE DEPOSITS (FT)

- RATES ON HOLD AT R.B.A., Q.E. DECISION IN JULY

- E.C.B.'S VILLEROY SAYS DON'T FRET ABOUT EUROPE'S INSOLVENCY RISKS

- ITALY MULLS BOOSTING TAX BENEFITS FOR BUYING LOSS-MAKING BANKS

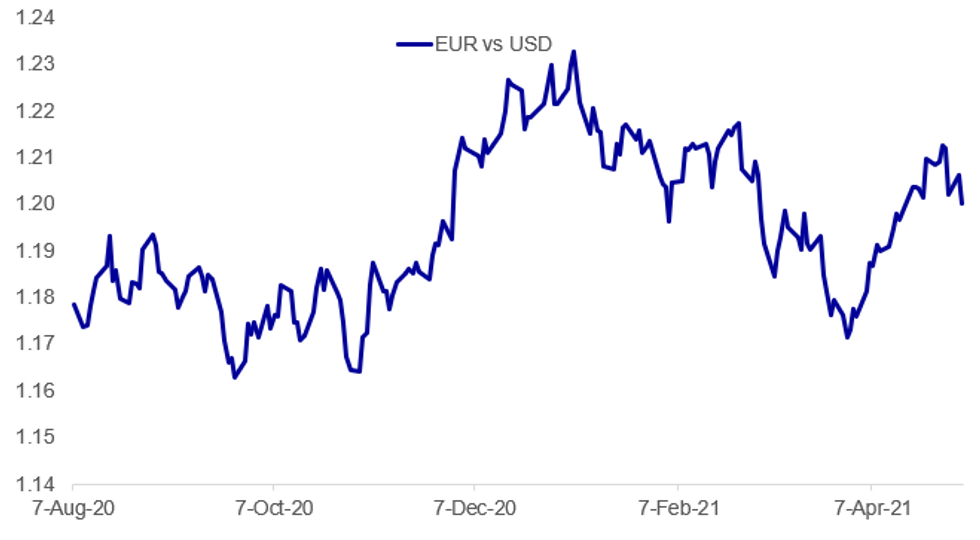

Fig.1: Euro Sags, Dollar Gains In Early Tuesday Trade

Source: BBG / MNI

Source: BBG / MNI

NEWS:

U.S. BANKS (BBG): Several large U.S. banks have held conversations with large corporate clients about moving cash away from deposits and into money market funds, the Financial Times reports, citing people familiar with the matter. The F.T. adds that this move has followed the Fed decision in March to end the pandemic-related measures which allowed banks to have looser capital requirements.

R.B.A. (MNI STATE OF PLAY): The Reserve Bank of Australia maintained policy settings as expected and said it will wait until July to consider any extension of its QE program and its yield target to government bonds maturing in November 2024. The bank held the official rate steady at the historic low of 0.10%, maintained its AUD200 billion bond purchase program and the parameters of its term funding facility for commercial banks. For full article contact sales@marketnews.com

E.C.B. (BBG): There is overblown alarm about a possible wave of insolvencies engulfing the European economy as governments taper aid for firms, Bank of France Governor Francois Villeroy de Galhau said. The number of insolvencies has been around 40% below normal since the pandemic struck Europe, making it difficult for courts to operate normally and prompting governments to provide blanket support to companies. "A catch-up effect in the coming period would not signify an economic breakdown, but a return to a more natural tempo," Villeroy said in a speech at a European Investment Bank conference.

ITALY/BANKS (BBG): Italy is mulling extending the fiscal benefits for banking mergers and acquisitions it introduced at the end of last year, according to a draft decree seen by Bloomberg.The move could further entice potential buyers of state-owned Banca Monte Paschi di Siena SpA, which Italy must sell before the end of 2021 as part of an agreement with the European Union.The preliminary draft, which is still under discussion and subject to change, raises the tax relief for buyers from 2% to 3% of assets. It also pushes back by six months, to June 2022, the deadline to make use of the relief.

INDIA/CRICKET (BBG): India's cricketing regulator suspended the Indian Premier League after multiple players contracted Covid-19, bringing a temporary halt to a tournament that has divided the nation on whether it was appropriate to play sport as thousands of citizens die each day.The Board of Control for Cricket in India, in an emergency meeting, decided to defer the Indian Premier League 2021 season, according to an emailed statement. The BCCI will help arrange for the "secure and safe passage" of all the participants in IPL, according to the statement.

SPAIN POLITICS: Madrid holds elections for its regional assembly today with incumbent regional president, Isabel Diaz Ayuso from the conservative People's Party (PP), looking likely to retain power. Polls indicate that in order to form a majority administration the PP will require support from another party, which is likely to come in the form of the right-wing nationalist Vox.

- Final pre-election poll (carried out after legal ban on opinion polls enforced): PP: 41.5%, 60 seats; PSOE: 19.9%, 29 seats; Mas Madrid: 17.0%, 24 seats; Vox: 9.4%, 13 seats; Unidas Podemos: 7.1%, 10 seats; Citizens: 3.9%, 0 seats. Electopanel/Electomania. Fieldwork: 2 May. 2,000 respondents.

- With 69 seats required for a majority, a PP-Vox coalition would just hold enough seats to govern with no other parties. Previously, the PP had governed in coalition with the Citizens party.

- Ayuso has led a populist campaign, and a strong performance may see her become a major challenger for the PP leadership at the federal level.

- The PP and Vox have never governed at the autonomous community-level without the centrist Citizens party also present as a moderating force. If the PP and Vox do end up forming a gov't in the capital it could be seen as setting a precedent for a future federal coalition of the same composition.

- See our Political Risk team's article 'Spain PM Eyeing Madrid Vote Result' for more details on the race.

GERMANY: Germany's auto industry saw business conditions at a two-year high in April, with expectations also improving markedly, the Ifo Institute said Tuesday. "Carmakers have now overcome the slump they suffered due to the coronavirus," according to Klaus Wohlrabe, Head of Surveys at ifo. However, supply issues are a concern, with 60.4% of the responding firms planning to introduce short-term work again due to the shortage of silicon chips. Employment plans in general continue to signal job losses in the industry, reflecting a structural change towards electrical vehicles, where the production is less labour intensive, Ifo note.

BANK OF THAILAND (MNI STATE OF PLAY): Thailand's central bank is expected to cut its domestic growth forecast for the second time this year as a resurgence of the virus impacts the economy but leave its policy rate unchanged at the record low of 0.50% as any cut could further weaken the baht. For full article contact sales@marketnews.com

DATA:

UK Mortgage Market Remains Strong

MAR MORTGAGE APPROVALS 82,735 VS FEB 87,385

MAR NET CONSUMER CREDIT -GBP0.535BN VS FEB -GBP1.168BN

MAR NET CHANGE SECURED LENDING GBP11.832BN VS FEB GBP6.434BN

- The UK mortgage market remained strong in Mar with mortgage borrowing surging to GBP11.8bn, its highest reading since the series began in 1993. Borrowing was boosted by the expected end of the stamp duty tax relief, which has now been prolonged. Mortgage approvals eased slightly to 82,735, which is lower than Nov's peak but above the level seen in Feb 2020. Approvals for remortages remained unchanged at 34,800 in Mar. The effective rate on new mortgages rose to 1.94% in Mar, up from 1.91% seen in Feb.

- Households continued to make net repayments of consumer credit, recording GBP 0.5bn in Mar, which was smaller than the net repayment seen in Mar 2020. Hence, the annual growth rate of consumer credit remained weak, but rose to -8.6% in Mar, up from the series low of -10.0% seen in Feb.

- The effective interest rate on new consumer credit ticked down to 5.03% in Mar, while the cost of credit card borrowing fell to 18.01%.

FIXED INCOME: A steady early session for Bonds

A calmer morning session for Govies

- Bund trade flat on the session with no spillovers from or into Equities.

- Indices were initially better bid, but have since faded.

- German 5/30s, tested another multi year high (steepest since July 2019) on the cash open, but we have since reversed the early move to trade bear flatter on the margin.

- Peripherals are generally trade close to flat versus Germany, albeit Greece 1.4bp wider

- Gilts saw better bid on the open, as the UK comes back from a bank holiday.

- The contract has since faded and trade at the lower part of the range , although still just down 2 ticks at the time of writing

- US Treasuries trade within overnight ranges, in what was a quieter session, given Japan and China out on Holiday.

- US curve also trade flat, with the long strip just a few ticks in the red.

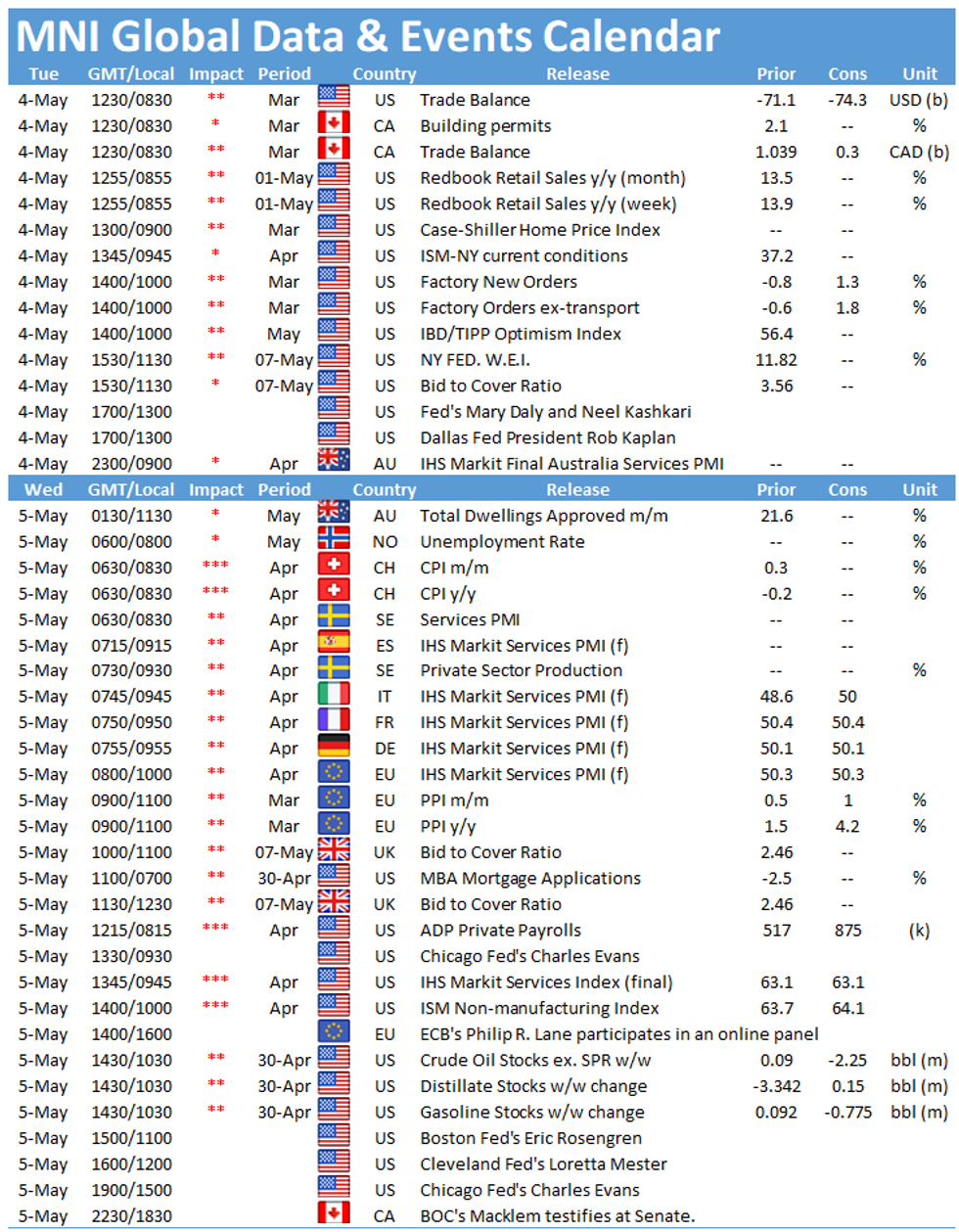

- Looking ahead, US Trade balance, Factory orders, and durable goods (Final reading).

- Speakers, sees Fed Daly and Kaplan, and for Canada Senate committee appearance by Governor Macklem

FOREX: Dollar Bounce Putting Major Pairs Under Pressure

- The greenback is staging a decent bounce after suffering through the bulk of the Monday session. The USD is trading at the day's best levels at the NY crossover, with the USD Index looking to progress through the Monday high.

- The USD's strength has pressured EUR/USD through the Monday lows to hit the lowest level since April 22nd and (briefly) below 1.20.

- Antipodeans trade poorly, with AUD, NZD the softest currencies so far Tuesday. The RBA rate decision saw policy unchanged, with the bank dropping the latest signal that their bond purchase program will be reviewed in July, likely shifting the 3-yr bond yield target to the November 2024 bond line. NZD/USD edged through the 50-dma at 0.7146 just ahead of NY hours.

- Focus turns to US and Canadian trade balance data as well as March factory orders and final durable goods orders. Fed speak remains a focus, with Fed's Daly and Kaplan both on the docket.

EQUITIES: Mixed Open, FTSE Leads Gains Post-Holiday

- Most Asian markets are observing holidays Tuesday.

- European equities are mixed, with the German Dax down 104.3 pts or -0.68% at 15160.35, FTSE 100 up 33.88 pts or +0.49% at 7018.63, CAC 40 up 11.44 pts or +0.18% at 6327.57 and Euro Stoxx 50 down 8.62 pts or -0.22% at 3996.73.

- U.S. futures are a little lower, with the Dow Jones mini down 37 pts or -0.11% at 33971, S&P 500 mini down 9.75 pts or -0.23% at 4176, NASDAQ mini down 59 pts or -0.43% at 13731.

COMMODITIES: Precious Metals Sag On Stronger Dollar

- WTI Crude up $0.69 or +1.07% at $64.48

- Natural Gas down $0.02 or -0.57% at $2.959

- Gold spot down $6.98 or -0.39% at $1785.37

- Copper down $1.1 or -0.24% at $449.6

- Silver down $0.1 or -0.36% at $26.7904

- Platinum up $7.77 or +0.63% at $1231.5

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.