-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Dollar Ending The Year On A Weak Note

EXECUTIVE SUMMARY:

- CHINA ADJUSTS CFETS RMB INDEX BASKET, CUTTING DOLLAR WEIGHTING

- CHINA CONFIRMS FIRST CASE OF UK CORONAVIRUS VARIANT

- CHINA IS SAID TO WEIGH REQUIRING ANT TO SELL FINANCE INVESTMENTS (BBG)

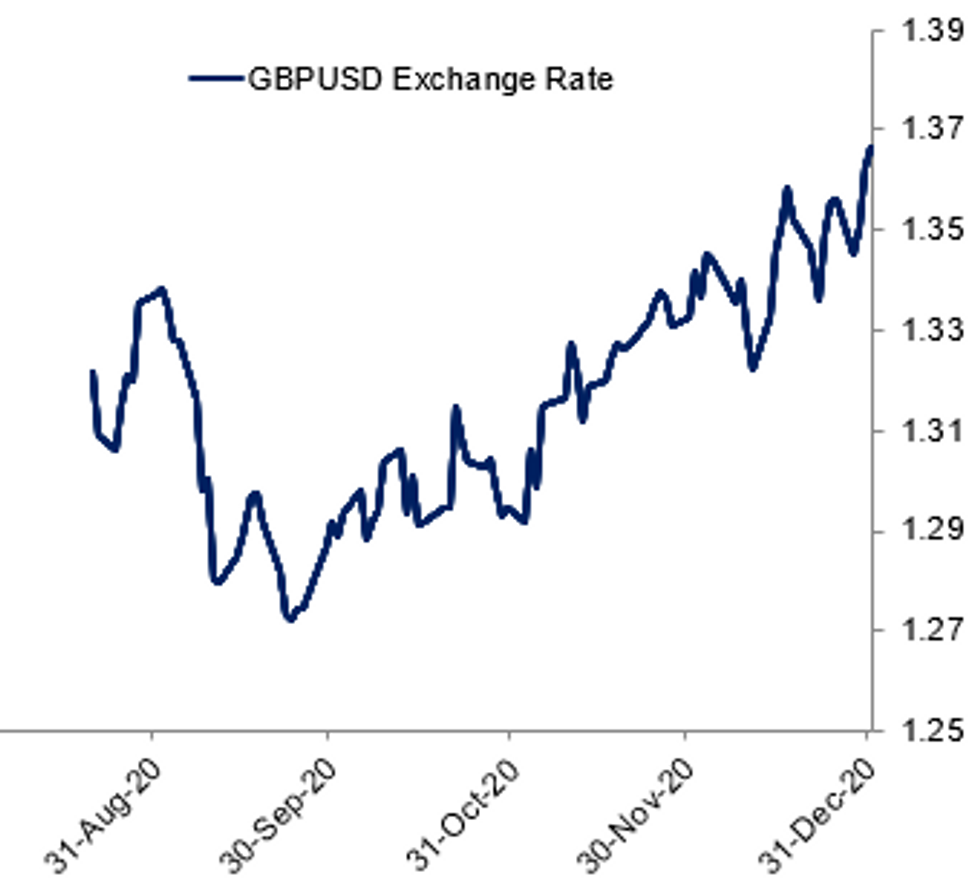

Fig. 1: Sterling Stronger Into Year-End

BBG, MNI

BBG, MNI

NEWS:

CHINA/CNY (BBG): China will adjust the weightings of currencies in its currency basket that helps set the yuan's daily reference rate, effective from Jan. 1, according to a statement from China Foreign Exchange Trade System. USD weighting will be cut to 0.1879 from 0.2159, Euro weighting will rise to 0.1815 from the current 0.1740, Japanese Yen's weighting will be 0.1093 vs 0.1116

CHINA/ COVID (STRAITS TIMES): China has confirmed its first case of a new coronavirus variant that was recently detected in Britain, health officials said. The new strain, which experts say potentially spreads faster than the original variant, has prompted travel restrictions on the UK by more than 50 countries - including China, where the coronavirus first emerged late last year. The first patient in China with the new variant is a 23-year-old woman from Shanghai who arrived from Britain on Dec 14, the Chinese Centre for Disease Control said in a research note published on Wednesday (Dec 30).

CHINA/TECH (BBG): Chinese regulators are studying plans to force Ant Group Co. to divest equity investments in some financial companies, curbing the company's influence over the sector, according to a person familiar with the matter. The plans, which would involve pushing Ant to sell some of its minority shares in operations such as banking-related businesses, are part of a push by watchdog agencies to regulate so-called financial holding companies, the person said, requesting not to be named because the matter is private.

SWITZERLAND/SNB (BBG): Switzerland's central bank spent 11 billion francs ($12.5 billion) on interventions in the third quarter, adding to an every-increasing tally that got the country labeled a currency manipulator by the U.S. The Swiss National Bank acquired the most foreign currency since 2012 this year as it fought to counter the market rout and pandemic-induced haven buying that temporarily pushed the franc to a five-year high against the euro.

CHINA (BBG): Loans to real estate developers will be capped at 40% for the nation's largest state-owned lenders while their mortgage lending should be no more than 32.5% of total outstanding credit, the People's Bank of China and the China Banking and Insurance Regulatory Commission said in a joint statement on Thursday.

FIXED INCOME: Eurex closed in a quiet European session

It's been a very quiet European morning session with the Eurex exchange closed for a holiday and the only cash EGBs trading are Greece and Cyprus. Gilts have surpassed yesterday's higher while Treasuries are a tiny bit higher than at yesterday's close.

- There has been little FI-centric news this morning with year-end flows continuing to dominate. China announced that it would reduce the weighting of USD in its CFETS index in favour of an increase in the weight of EUR. There has been little immediate impact, but this is something that could have some impact on fixed income in the medium-term if China's also increased its FX reserves held in EGBs and reduced Treasury holdings.

- The last noteworthy data release of the year will be jobless claims.

- TY1 futures are up unch today at 137-31 with 10y UST yields down -0.1bp at 0.924% and 2y yields down -0.2bp at 0.122%.

- Gilt futures are up 0.11 today at 135.36 with 10y yields down -0.7bp at 0.204% and 2y yields down -0.9bp at -0.167%.

FOREX SUMMARY

EUR and USD lower during the European morning session

- Turnovers in FX have not too surprisingly been on the lower side, as we close out the year.

- Eurex exchange is closed, while other exchanges will be closing at lunchtime, so little play will be coming from the Govie/rate side.

- In Asian news as reported by Bloomberg:

- "China will adjust the weightings of currencies in its currency basket that helps set the yuan's daily reference rate, effective from Jan. 1",

- Better EUR selling on the margin this morning, with the currency at the low of the session against USD, GBP, JPY, CHF, SEK, NOK, and turning offered versus AUD and CAD..

- GBP trades on the front foot despite some concerns across assets, on lockdown concerns and vaccination logistics,.

- Those concerns have favoured safer haven Gilts, while the FTSE has been under small pressure.

- Looking ahead, US IJC will be the last notable data of the year, as European exchanges closes for the New Year.

EQUITIES: Tech Leads, FTSE Lags

- Asian stocks closed higher (Japan on holiday). China's SHANGHAI closed up 58.616 pts or +1.72% at 3473.069 and the HANG SENG ended 84.02 pts higher or +0.31% at 27231.13.

- European stocks are weaker, with the FTSE 100 down 107.72 pts or -1.64% at 6555.82, CAC 40 down 23.3 pts or -0.42% at 5599.41 and Euro Stoxx 50 down 6.32 pts or -0.18% at 3571.59.

- U.S. futures are mixed, with the Dow Jones mini down 40 pts or -0.13% at 30262, S&P 500 mini down 6.5 pts or -0.17% at 3717.75, NASDAQ mini up 3 pts or +0.02% at 12844.25.

COMMODITIES: Copper Underperforming

- WTI Crude down $0.12 or -0.25% at $48.28

- Natural Gas up $0.09 or +3.72% at $2.511

- Gold spot up $0.21 or +0.01% at $1893.29

- Copper down $3.65 or -1.03% at $351.3

- Silver down $0.21 or -0.78% at $26.46

- Platinum up $4.41 or +0.41% at $1076.38

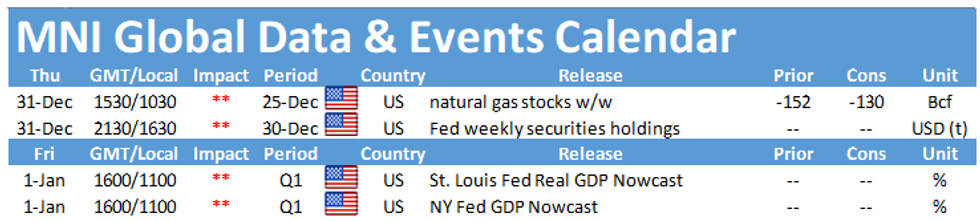

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.