-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI US Open: Earnings, CPI In Focus

EXECUTIVE SUMMARY:

- U.S. FINANCIALS EARNINGS, SEPTEMBER CPI REPORT TAKE FOCUS

- U.K. AUG GDP HIGHER; JUL REVISED TO SHOW DECLINE

- E.U. TO OFFER BREXIT CONCESSIONS AHEAD OF NEW ROUND OF U.K. TALKS

- BOJ CONCERNED ENERGY COSTS COULD DAMPEN GROWTH (MNI INSIGHT)

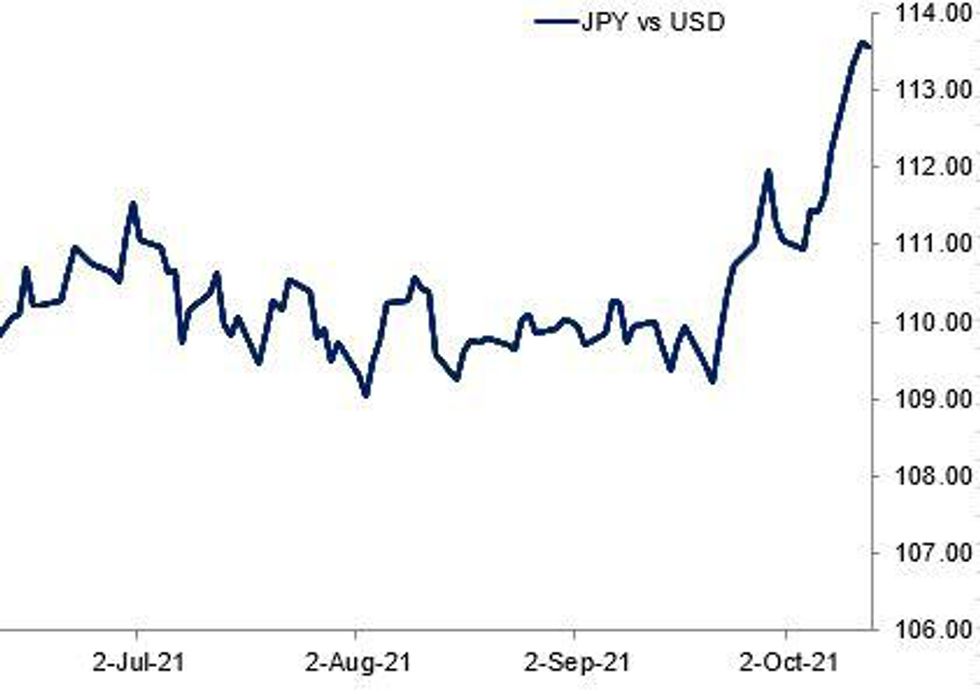

Fig. 1: Yen Underperforming

Source: BBG, MNI

Source: BBG, MNI

NEWS:

U.S. EARNINGS: US quarterly earnings cycle kicks off in earnest today, with financials taking focus. Highlights today include:- Blackrock (~1115BST/0615ET)- JPMorgan (1200BST/0700ET)- Delta Airlines (Pre-market)Bank of America, Citigroup, Morgan Stanley and Wells Fargo report tomorrow. Full schedule with timings, EPS & revenue estimates here

U.S. CPI: The Bloomberg survey median expectation for M/M September headline CPI is +0.3% (average 0.33%, std deviation 0.06%, range of 0.1-0.4%) and for core is 0.2% (average 0.25%, std deviation 0.06%, range of 0.0-0.4%). In August, headline CPI came in at 0.3% while core was 0.1%.

E.U./UK. (BBG): The European Union will offer a new package of concessions to the U.K. that would ease trade barriers in Northern Ireland, as the two sides prepare for a new round of contentious Brexit negotiations.Later Wednesday, Maros Sefcovic, the EU's chief Brexit negotiator, will offer to cut as much as 50% of the customs checks in Northern Ireland and up to 80% of the sanitary checks on food imports, according to officials familiar with the proposal. Procedures for medicines would remain largely unchanged, with U.K. packaging and labeling.

E.U.: Later today at 1200CET (0600ET, 1100BST), Energy Commissioner Kadri Simson is set to outline the European Commission's so-called 'energy toolbox' to assist member states (MS) dealing with soaring energy prices amid a crunch in gas supplies. There has been significant focus on what the Commission could do to ease pressure on MS' and consumers, but expectations are that at this stage the Commission is more likely to remind MS' of their already-available options rather than launch a major new relief scheme. Politico reports that in the short term MS' will be reminded of the ability to subsidise failing energy companies and cut taxes in order to prop firms up without breaching EU state aid rules while vouchers created using the Emissions Trading System can be used to assist low-income households struggling with energy bills.

BOJ (MNI INSIGHT): A weaker yen has drawn more concern from the Bank of Japan as sustained high energy import costs could lower corporate profits and cut household spending, blunting the expected economic recovery, MNI understands. For full article contact sales@marketnews.com

CHINA (MNI REALITY CHECK): China's consumer prices may accelerate only modestly in September, as continuing declines of pork prices weigh on the wider index despite service prices seeing limited upticks following and easing of sporadic outbreaks of Covid-19 cases, industry leaders and analysts told MNI. For full article contact sales@marketnews.com

RUSSIA / ENERGY (BBG): Russia is still injecting natural gas into its storage facilities and will complete the process by Nov. 1 as planned, said the country's deputy energy minister.There's now enough of the fuel in domestic inventories to get the country through the winter, however cold it may be, Evgeny Grabchak told reporters at Russian Energy Week in Moscow on Wednesday. "Do we expect a very cold weather? We don't," the deputy minister said. "Are we ready for it? We are."

HONG KONG / EQUITIES (BBG): Hong Kong suspended schools and the city's $6.3 trillion stock market canceled trading Wednesday as strong winds and rain from typhoon Kompasu lashed the financial hub.Hong Kong Exchanges and Clearing Ltd. canceled securities trading, including the Hong Kong-China stock connect and derivatives markets, for all of Wednesday after Kompasu halted after-hours trading the day before. The city raised the storm warning alert to No. 8, the third-highest on its scale, from No. 3 Tuesday afternoon.

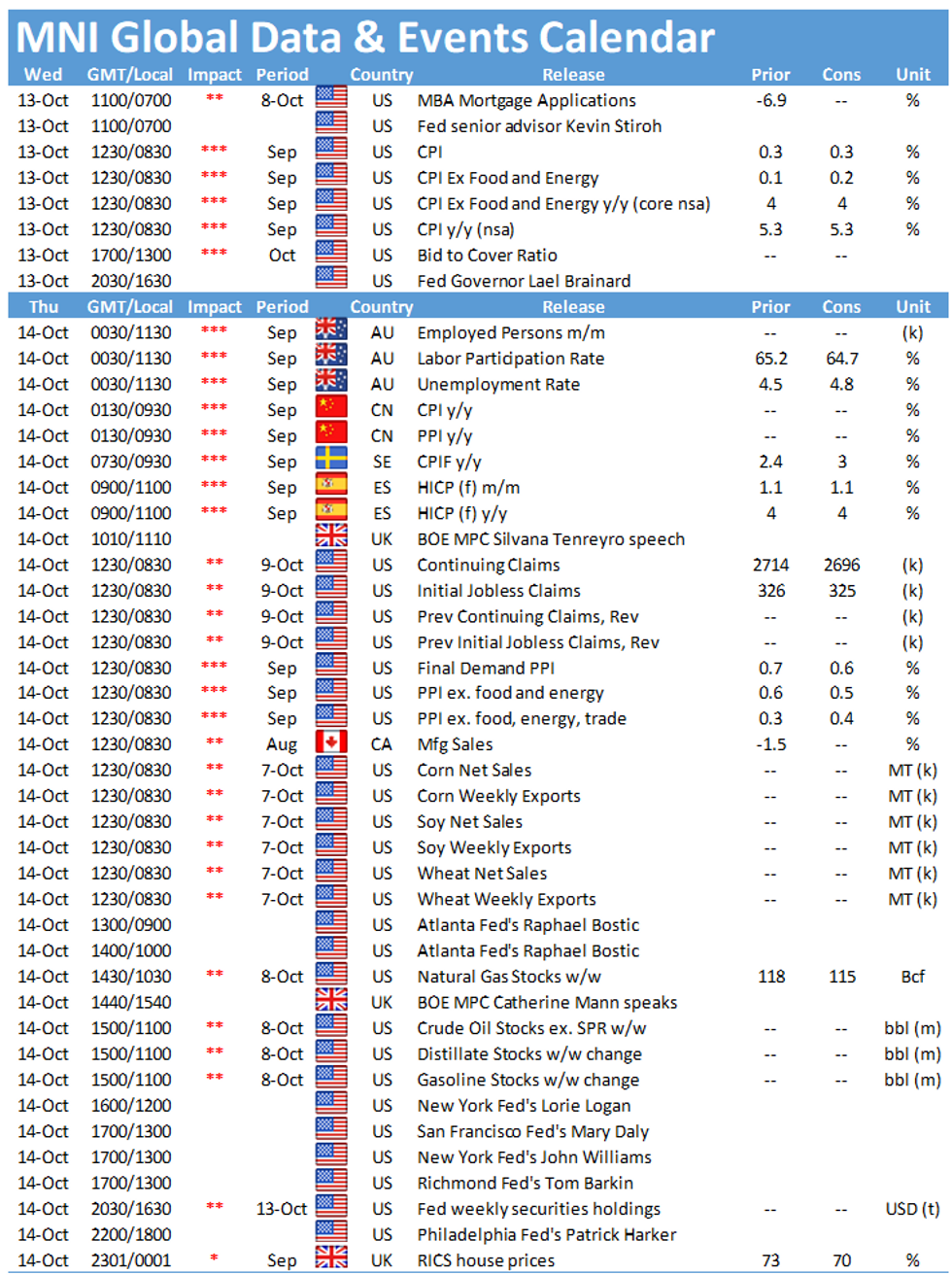

DATA:

UK AUG GDP +0.4% M/M (MEDIAN +0.5%, JUL +0.1%,)

MNI BRIEF: UK August GDP Higher; July Revised to Show Decline

UK GDP grew by 0.4% in August, slightly slower than expectations, but output in July contracted after a revision, dropping by 0.1% versus the previously-reported 0.1% rise. That lease output 0.8% below February 2020 levels -- helped by the earlier upward revision to Q2. The data will raise questions over whether the UK recovery came to an end in Q3, which September likely to be very soft, owing to petrol shortages and a sharp rise in natural gas prices that dampened some industrial activity.

Services expanded by a slower-than-expected 0.3% in August, lifted by a 1.2% rose in consumer-facing activities. All other services rose by just 0.1%. Manufacturing increased by 0.5%, lifting production by 0.8%, while construction declined by 0.2%. The downward revision in July stemmed from downwardly-revised data for motor vehicles oil and gas. Manufacturing declined by 0.6% in July, compared to the originally-reported outturn of no term.

MNI BRIEF: UK Aug Trade Deficit Expands to Pre-Pandemic High

The total UK trade deficit widened to GBP3.716 billion in August, the biggest gap since December 2019. The goods trade gap expanded less dramatically, to GBP11.211 billion from GBP11.147 billion in July, still the biggest shortfall since March 2021. Goods exports increased by 0.9% in August, while imports rose by 1.2%.

Exports to non-EU nations fell slightly to GBP12.998 billion, while EU shipments declined to GBP12.809, narrowing the gap between the two export destinations that opened up at the start of the year following the UK's withdraw from the transitional EU trading arrangement.

MNI: EZ AUG IND PROD -1.6% M/M, +5.1% Y/Y; JUL +1.4%R M/M

MNI BRIEF: EZ August Production Down Sharply

Eurozone industrial production fell sharply in August, declining by 1.6%, the biggest fall since April of 2020, more than erasing a 1.4% increase in July (revised downward from the originally-reported 1.5% increase). Energy output increased by 0.5% in August, the first rise since April, but all other categories suffered significant retreats. Production of capital goods fell by 3.9%, while durable consumer goods slumped by 3.4%.

Over the year to August, output rose by 5.1%, after an upwardly-revised 8.0% increase in July (initially reported as +7.7%). German production was particularly hard hit in August, sliding by 4.1%, while French output rose 1.0%, Italy declined by 0.2% and Spain rose by 0.1%.

FIXED INCOME: Moving on up ahead of US CPI

Core fixed income has drifted higher across the board this morning led by Bunds and gilts.

- The move in Bunds seems to be largely just a retracement from yesterday's move after yields moved within 1.1bp of the highs of the year (which were seen in May). Possibly there is some position squaring ahead of the US CPI print today - this is likely the driver for Treasuries to move a little higher too.

- Gilts have been grinding higher all day, not helped by the slightly disappointing GDP data earlier this morning. Short sterling Greens/Blues in particular have seen a bit of a larger move higher than Euribor/Eurodollars.

- US CPI is of course the highlight of the day with 61% of the analysts in the Bloomberg survey looking for a 0.3%M/M print and 36% looking for a 0.4%M/M print.

- TY1 futures are up 0-3+ today at 131-08 with 10y UST yields down -1.9bp at 1.560% and 2y yields up 0.6bp at 0.345%.

- Bund futures are up 0.38 today at 168.79 with 10y Bund yields down -3.7bp at -0.124% and Schatz yields down -1.0bp at -0.697%.

- Gilt futures are up 0.46 today at 124.53 with 10y yields down -4.3bp at 1.104% and 2y yields down -0.5bp at 0.552%.

FOREX: JPY Remains Weaker Despite BoJ Concern

- For a third consecutive session, JPY is the poorest performing currency in G10, with USD/JPY securing a break above the multi-decade downtrendline drawn off the December 1975 high. Moves come alongside the Bank of Japan issuing caution over the weaker currency, with the central bank concerned that high energy import costs could crimp corporate profits and household spending.

- Elsewhere, GBP trades more favourably, with markets shrugging off a lower-than-expected monthly GDP reading in favour of strong industrial and manufacturing data for August. GBP/USD trades around 60 pips off the week's lowest levels, and now needs to top 1.3674 to secure any further progress.

- Equity futures trade in minor positive territory, with the e-mini S&P higher by 5-10 points ahead of the unofficial beginning of the earnings cycle. JPMorgan and BlackRock are the key reports Wednesday, with more financials names following on Thursday.

- US CPI takes focus going forward, with markets expecting CPI to hold at an above-target 5.3%. Core is also seen inline with the prior at 4.0%.

- Fed minutes cross later in the session, with markets focusing on the prospects for a November taper announcement. Central bank speakers due Wednesday also include BoE's Cunliffe and Fed's Brainard.

EQUITIES: Tech Leading Gains With U.S. Financial Earnings Eyed

- Asian stocks closed mixed, with Japan's NIKKEI down 90.33 pts or -0.32% at 28140.28 and the TOPIX down 8.85 pts or -0.45% at 1973.83. China's SHANGHAI closed up 14.826 pts or +0.42% at 3561.762.

- European equities are mostly higher (UK excepted)with the German Dax up 98.87 pts or +0.65% at 15241.96, FTSE 100 down 18.12 pts or -0.25% at 7098.64, CAC 40 up 14.08 pts or +0.22% at 6541.66 and Euro Stoxx 50 up 20.74 pts or +0.51% at 4073.25.

- U.S. futures are gaining, led by tech, with the Dow Jones mini up 45 pts or +0.13% at 34310, S&P 500 mini up 7.75 pts or +0.18% at 4349.25, NASDAQ mini up 56.5 pts or +0.39% at 14712.5.

COMMODITIES: NatGas Continues To Retrace From Peak

- WTI Crude down $0.41 or -0.51% at $80.47

- Natural Gas down $0.09 or -1.62% at $5.457

- Gold spot up $6.63 or +0.38% at $1768.31

- Copper up $4.7 or +1.09% at $437.1

- Silver up $0.23 or +1.02% at $22.8585

- Platinum up $2.31 or +0.23% at $1017.15

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.