-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI US Open: ECB Officials Wary Of Surging Yields

EXECUTIVE SUMMARY:

- SCHNABEL SAYS E.C.B. MAY NEED TO ADD SUPPORT IF YIELDS HIT GROWTH

- LANE SAYS E.C.B. WATCIHNG YIELDS BUT NOT CONTROLLING CURVE

- PFIZER-BIONTECH VACCINE COULD SIGNIFICANTLY REDUCE TRANSMISSION RISK AFTER A SINGLE DOSE -UK STUDY

- MERKEL SIGNALS SHE'S READY TO RETHINK GERMANY'S LOCKDOWN PLAN

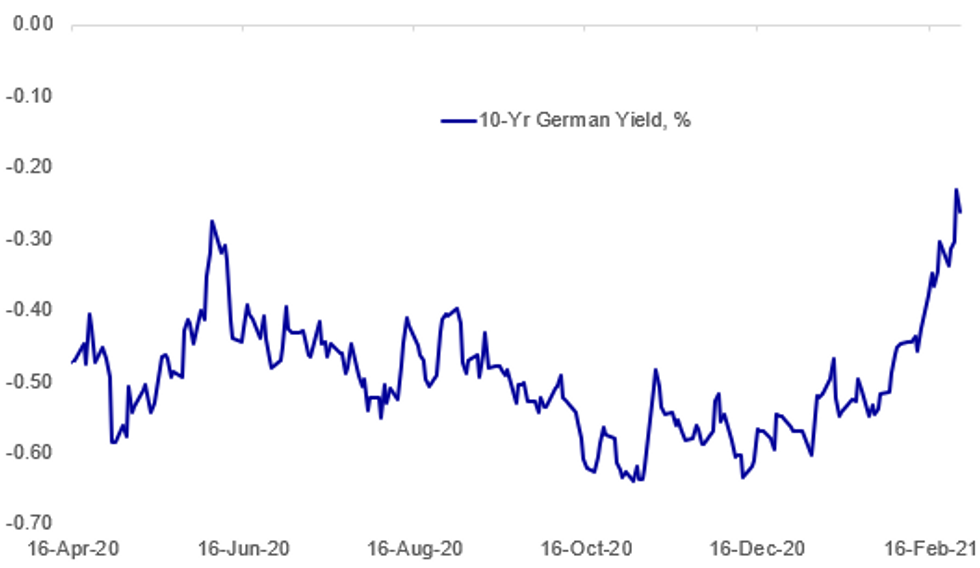

Fig. 1: E.C.B. Officials Eyeing Rising Yields

BBG

BBG

NEWS:

ECB (BBG): The European Central Bank may need to boost its monetary support for the economy if rising government borrowing costs hurt growth, Executive Board member Isabel Schnabel said. "A rise in real long-term rates at the early stages of the recovery, even if reflecting improved growth prospects, may withdraw vital policy support too early and too abruptly given the still fragile state of the economy," she said in a virtual conference on Friday. "Policy will then have to step up its level of support."Isabel Schnabel. Schnabel's remarks add to a sense of concern from the ECB that the bond market threatens to stifle the euro region's recovery even before it's begun.

ECB (RTRS): The European Central Bank is monitoring the recent surge in government bond borrowing costs but will not engage in controlling the yield curve, ECB chief economist Philip Lane told a Spanish newspaper. "At this stage, an excessive tightening in yields would be inconsistent with fighting the pandemic shock to the inflation path," he told Expansión in an interview. "But at the same time, it is crystal clear that we are not engaged in yield curve control, in the sense that we want to keep a particular yield constant," he added.

ECB: Key excerpts from Lane interview below (note these are not the full answers to any questions, for more see the full interview here):

- Asked whether if lockdowns are extended forecasts will be revised lower: "If the lockdown lasts a few weeks longer it won't have much of an impact on the final growth picture in 2021. We think a lot of the pandemic shock will have been offset by the end of the year."

- Asked if ECB debt purchases can be effective if bond yields increase due to inflation expectations rising he said: "There is more than one mechanism through which asset purchasing can influence the market. But at the same time, it is crystal clear that we are not engaged in yield curve control, in the sense that we want to keep a particular yield constant. With the purchase programme we are trying to move the curve in a certain direction and with enough force to support inflation dynamics."

- Q: You always repeat this, but is lowering rates further really an option? A: "We wouldn't say we could use this tool if we didn't believe it. When we say that we can move rates lower [the deposit facility rate is currently -0.5 per cent], we do all sorts of calculations and analytics to make sure that it's a credible and honest statement."

PFIZER/COVID (RTRS): A single dose of the Pfizer COVID-19 vaccine developed in partnership with BioNTech could significantly reduce the risk of transmission after a single dose, results of a UK study found on Friday. Researchers analysed results from thousands of COVID-19 tests carried out each week as part of hospital screenings of healthcare staff in Cambridge, eastern England.

GERMANY (BBG) Chancellor Angela Merkel opened the door to a looser approach to managing Germany's coronavirus outbreak, as she faces pressure to ease curbs despite resurgent infections. For months, Merkel has relied on the so-called incidence rate to determine pandemic policy. First, she set the threshold at 50 infections per 100,000 people over seven days and then lowered it to 35 to unwind lockdown restrictions locally.She now appears to be backing away from a rigid reliance on the metric, with no signs that the country can hit her targets.

US-SYRIA (BBG): The U.S. carried out air strikes in eastern Syria overnight on sites connected to Iranian-backed groups believed to be involved in recent attacks in Iraq, the first overt use of military force under President Joe Biden. The assault came after a series of rocket attacks in recent days on facilities in Iraq used by the United States, including one that killed a contractor working with the U.S.-led coalition in the country.

SWEDEN (MNI INTERVIEW): Liquidity has improved in Sweden's domestic sovereign debt market as Riksbank quantitative easing slows, the head of debt management at the Swedish National Debt Office told MNI, adding that the country will continue to borrow in foreign currency and could diversify beyond dollars and euros. For full article contact sales@marketnews.com

BOJ: The Bank of Japan will keep to the same frequency and the scale of JGB buying operations in March as in February, the bank said Friday, as financial markets await the result of next month's policy review, to see if the bond-buying framework changes.

DATA:

MNI: FRANCE FEB FLASH HICP 0.0% M/M, +0.7% Y/Y; JAN +0.8% Y/Y

MNI: FRANCE JAN PPI +1.2% M/M, +0.4% Y/Y; DEC -1.0% Y/Y

MNI: FRANCE JAN CONSUMER SPENDING -4.6% M/M, 0.0% Y/Y

FRANCE Q4 FINAL REAL SA GDP -1.4% Q/Q, -4.9% Y/Y

MNI: SWISS Q4 GDP +0.3% Q/Q (SA), -1.6% Y/Y

MNI: SWISS FEB KOF ECON BAROMETER 102.7; JAN 96.5

FIXED INCOME: Big move higher for Bunds, but within yesterday's range

- Bunds have retraced much of the weakness seen yesterday in volume-heavy but volatile markets this morning. Yesterday's intraday range saw Bund futures trade between 172.08-174.25, moving to the lows of the yesterday after the cash market closed. Today's moves have seen us move as high as 173.79, before falling back a bit to 173.33 at the time of writing. To put this in perspective, between today and yesterday, cash Bund yields have been in a range of more than 9bp from -0.294% to -0.202.

- Gilts moved higher on the open but are now little changed compared to yesterday's close while moves in Treasuries have been more subdued.

- There have been no obvious underlying reasons for the retracement, other than to say this could be a short-term snap higher after the relentless sell-off we have seen in core FI recently. There have been a couple of notable comments from ECB policy makers Lane and Schnabel with the latter suggesting that if real yields rise substantially at the long-end this could be undesirable with the recovery still very fragile. With the sharp sell-off in fixed income (and relatively smaller moves in equities) there could also be some month-end fixed income demand to rebalance portfolios back to their benchmarks.

- TY1 futures are up 0-7 today at 132-25+ with 10y UST yields down -4.4bp at 1.479% and 2y yields down -2.4bp at 0.151%.

- Bund futures are up 0.28 today at 173.34 with 10y Bund yields down -2.2bp at -0.255% and Schatz yields unch at -0.659%.

- Gilt futures are down -0.10 today at 128.03 with 10y yields up 0.8bp at 0.790% and 2y yields down -0.5bp at 0.094%.

FOREX: USD Remains Stronger Post-Yield Tumult

After a tumultuous Thursday, markets are more sanguine this morning, but the USD has retained an underlying bid tone and is outperforming all others in G10 so far Friday. This is pressuring EUR/USD into close proximity to the Wednesday low and has prompted a sizeable pullback in GBP/USD - which is now over 300 pips off the weekly high.

- ECB speakers have drawn focus this morning, with both Lane and Schnabel speaking. Schnabel stated that the ECB could act to add support should European government bond yields hinder growth in the region, while Lane stressed that the ECB has more ammo if required, but they are not engaged in yield curve control. The EUR is mixed this morning.

- Commodity-tired and growth-proxy currencies are suffering slightly in a post-US yield rally hangover. Both AUD and NZD are the poorest performers so far.

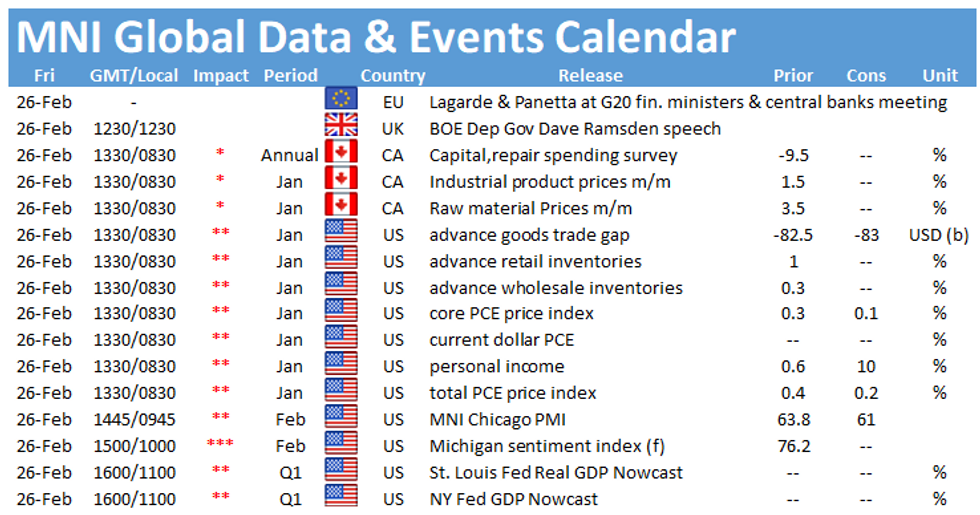

- Focus turns to another raft of US data, with January trade balance, wholesale inventories, and personal income/spending as well as the MNI Chicago Business Barometer. Central bank speakers include BoE's Haldane & Ramsden. There are no Fed speakers of note.

EQUITIES: Tentative Stability

- Asian stocks closed sharply lower, with Japan's NIKKEI down 1202.26 pts or -3.99% at 28966.01 and the TOPIX down 61.74 pts or -3.21% at 1864.49. China's SHANGHAI closed down 75.966 pts or -2.12% at 3509.08 and the HANG SENG ended 1093.96 pts lower or -3.64% at 28980.21

- European equities are off the lows, with the German Dax down 43.24 pts or -0.31% at 13846.1, FTSE 100 down 26.64 pts or -0.4% at 6628.85, CAC 40 down 26.04 pts or -0.45% at 5760.72 and Euro Stoxx 50 down 19.32 pts or -0.52% at 3666.37.

- U.S. futures are likewise clawing back some overnight losses, with the Dow Jones mini down 24 pts or -0.08% at 31345, S&P 500 mini up 3.25 pts or +0.08% at 3831.25, NASDAQ mini down 9 pts or -0.07% at 12822.75.

COMMODITIES: Slide Continues

- WTI Crude down $0.6 or -0.94% at $63.13

- Natural Gas down $0.06 or -2.2% at $2.719

- Gold spot down $7.75 or -0.44% at $1763.51

- Copper down $6.4 or -1.5% at $420.7

- Silver down $0.58 or -2.1% at $26.8788

- Platinum down $11.88 or -0.97% at $1208.89

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.