-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI BRIEF: Limited Economic Impact Of French Crisis - EC

MNI US OPEN: ECB Set For First Hike In 11 Years

EXECUTIVE SUMMARY:

- ECB SET TO HIKE RATES FOR FIRST TIME SINCE 2011

- ITALY'S DRAGHI RESIGNS, PRESIDENT ASKS IF HE CAN REMAIN CARETAKER PM

- BOJ'S EASY VIEWS INTACT DESPITE HIGHER CPI (MNI STATE OF PLAY)

- RUSSIA RESUMES NORD STREAM GAS FLOW, BRINGING RESPITE FOR EUROPE

- UKRAINE DEVALUES HRYVNIA OVER RUSSIAN INVASION

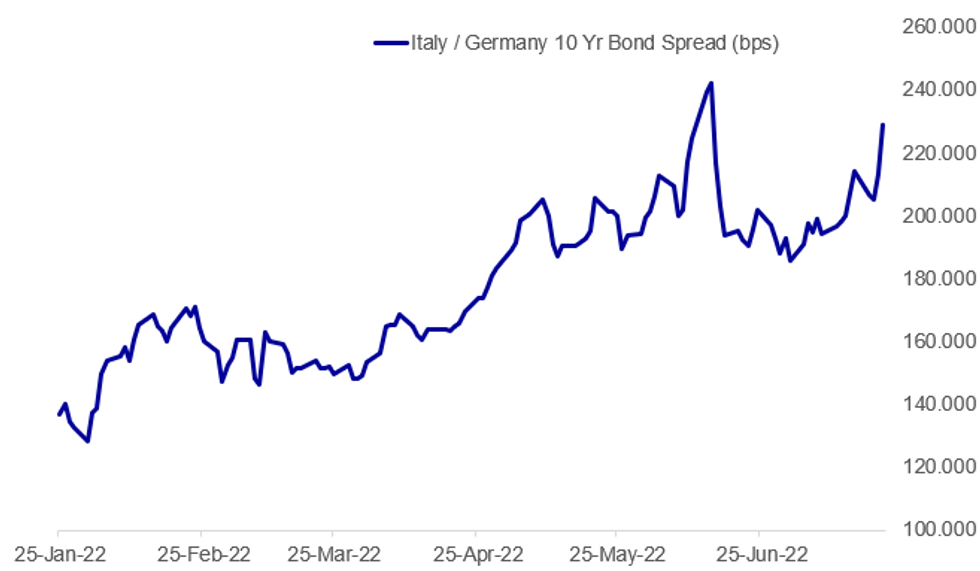

Fig. 1: BTP Spreads Nearing June's Highs On Political Uncertainty

Source: BBG, MNI

Source: BBG, MNI

NEWS:

ECB (MNI PREVIEW): The ECB is likely to hike policy rates by 25bp in July as already telegraphed. While there does not appear to be enough momentum behind a larger move for now, it should not be discounted entirely. Indeed, it may prove easier to hike aggressively now, than attempt to do so later in the year should economic activity abruptly deteriorate. A sufficiently large (likely limitless) and flexible anti-fragmentation tool is expected to be announced at the July meeting. Delaying the announcement would be risky for spreads given the previous market disappointment at the unscheduled mid-June meeting for discussing fragmentation risks.

ITALY: In a statement the Italian President Sergio Mattarella has confirmed that PM Mario Draghi has resigned from office. Also states that he has asked Draghi to remain in place as a caretaker PM until another gov't can be found.

ITALY: Quirinale Palace (the residence and office of the Italian president) confirms that President Sergio Mattarella will meet this afternoon with the presidents of the Chamber of Deputies and the Senate, pursuant to Article 88 of the Italian Constitution, which will see the parliament dissolved and snap elections called. First date for election would be 25 September, but this falls on the Jewish holiday of Rosh Hashanah, and therefore 2 October could be a possible date for the vote. Gerardo Fortuna at Euractiv tweets: "...Italy's president Mattarella is to dissolve the Parliament 8 months before the natural end. Elections should be in October, exactly when the country's yearly budget should be decided and the reform of the Stability Pact will be discussed in Brussels."

BOJ (MNI STATE OF PLAY): Bank of Japan Governor Haruhiko Kuroda on Thursday said there is no reason to pull back from easy policy, although the board’s median forecast for inflation rates this fiscal year was revised up above the target of 2%. But the board assess the higher inflation target was not sustainable as wages lag and growth was at the same time tipped down slightly , showing that price levels will not be achieved in the projection period in a decision widely expected.

BOJ (MNI BRIEF): Bank of Japan Governor Haruhiko Kuroda said on Thursday that the recent rapid weak yen is increasing uncertainties and is undesirable. "As I said repeatedly, it is vital for foreign exchange rates to move in a stable manner reflecting economic and financial fundamentals," Kuroda told reporters add in the BOJ continues to be in close contact with the government with regard to foreign exchange rate moves

RUSSIA / EUROPE /ENERGY (BBG): Russia began sending natural gas to Europe through the Nord Stream pipeline system after a pause, bringing relief to a continent whose economy is starting to wobble under the strain of reduced supplies. Shipments returned to 40% of capacity, their level before flows were halted for 10 days of planned maintenance, data from the pipeline operator showed. Still, there is little expectation of a full revival of supplies amid issues related to gas turbines for the link.

UKRAINE (AFP): Ukraine's central bank on Thursday devalued the official hryvnia exchange rate to protect its foreign reserves as Russia's invasion ravages the economy. The National Bank said in a statement that it was devaluing the official exchange rate from 29.25 hyrvnia to the dollar to 36.57 hyrvnia to the dollar in order to boost the competitiveness of Ukrainian products and shore up economic stability while the war continued.

BANK INDONESIA (MNI BRIEF): Indonesia's central bank has resisted inflationary pressure and a weakening currency and left official interest rates on hold today. Bank Indonesia's key reverse repo rate is unchanged at 3.5% after the two-day Board of Governors meeting, at the same level set in September 2020 at the height of the pandemic,. The meeting was expected to be a "live" meeting, with the board under pressure to raise rates with inflation at a five year high of 4.35% in June, up from the bank's 2% to 4% target

RUSSIA-UKRAINE: Jennifer Jacobs at Bloomberg tweets: "Kremlin is denying it’s planning votes in Ukrainian territories occupied by its troops—even as officials on the ground work to conduct referendums by Sept. 15 on merging with Russia. Effort directed by Sergei Kiriyenko, Kremlin’s 1st deputy chief of staff". Recent comments from Russian Foreign Minister Sergey Lavrov regarding the Russian invasion will have raised concerns in Kyiv and the West that despite major military setbacks and significant resistance from Ukrainian forces, Moscow's territorial ambitions lie beyond the Donbas.

DATA:

MNI: UK JUN PSNCR GBP12.61 BN

*UK JUN PSNB GBP+22.11 BN

*UK JUN PSNB-X GBP+22.88 BN

*UK JUN CGNCR GBP12.2 BN

FIXED INCOME: All eyes on the ECB

- All eyes are on the ECB meeting today, with markets pricing in around 34bp at writing (i.e. 25bp fully priced with around 35% probability of a 50bp hike priced). Following the Reuters sources piece earlier this week, the September meeting has moved to price in a cumulative 98bp and so if there isn't a 50bp hike today and the ECB doesn't strongly hint towards a larger than 50bp hike we are likely to see the curve come back a bit. However, whether that changes expectations of where rates will be in 1-2-years time is more debatable and there is still scope for the ECB to use hawkish language together with a 25bp hike. Note that the timings for ECB decisions have changed. The policy statement / decision will be released at 13:15BST / 8:15ET with the press conference beginning at 13:45BST / 8:45ET.

- There will also be close attention paid to the anti-fragmentation tool, particularly now that Italian political instability (with Draghi resigning) has seen BTP-Bund spreads widen once more. 10-year spreads had been over 20bp wider on the day earlier, but are now back to 13bp wider at the time of writing.

- The morning session has also been busy for issuance with Spain, France and the UK all holding auctions.

- Elsewhere today we will receive US weekly claims data, the Philly Fed survey and the leading index.

- TY1 futures are down -0-4+ today at 117-20+ with 10y UST yields up 1.9bp at 3.046% and 2y yields up 1.0bp at 3.239%.

- Bund futures are down -0.36 today at 150.92 with 10y Bund yields up 3.0bp at 1.284% and Schatz yields up 4.3bp at 0.634%.

- BTP futures are down -2.12 today at 120.73 with 10y yields up 17.1bp at 3.554% and 2y yields up 17.4bp at 1.932%.

- Gilt futures are down -0.44 today at 114.74 with 10y yields up 4.5bp at 2.183% and 2y yields up 5.9bp at 2.110%.

FOREX: EUR Treads Water Below Week's Highs Ahead of ECB

- Focus turns to the upcoming ECB rate decision, with markets still split as to whether the bank raise rates by 25 or 50bps at today's meeting. Outside of headline rates, markets will also be looking for clarity surrounding the so-called Transmission Protection Mechanism - a mechanic the bank plan to use to combat unwarranted widening spreads in Eurozone government bond markets.

- The conditions surrounding the TPM will be a particular focus today as the Italian 10yr yield surges higher on the resignation of the Italian PM Draghi, who failed to corral sufficient support for his broad coalition. The Italian/German 10y yield spread has blown wider by over 10bps today, with the Italian 10y yield now higher than it's Greek counterpart.

- The Italian news has done little to hinder the EUR's progress, however, with the single currency off the session's best levels but avoiding any test of the late Wednesday lows.

- Equity futures are generally lower early Thursday, indicating a softer open on Wall Street later today. Nonetheless, the risk backdrop remains favourable, with the e-mini S&P printing a new monthly high this week and piercing key resistance at the 55-day EMA.

- Outside of the ECB decision, weekly US jobless claims data is due as well as the July Philadelphia Fed. Outside of G10, both the South African and Turkish central banks also decide on policy.

EQUITIES: A Little Softer Pre-ECB

- Asian markets closed mixed: Japan's NIKKEI closed up 122.74 pts or +0.44% at 27803 and the TOPIX ended 4.15 pts higher or +0.21% at 1950.59. China's SHANGHAI closed down 32.723 pts or -0.99% at 3272.001 and the HANG SENG ended 315.59 pts lower or -1.51% at 20574.63.

- European stocks are weaker pre-ECB, with tech leading and energy dragging (and Italy underperforming amid political uncertainty): German Dax down 89.03 pts or -0.67% at 13317.24, FTSE 100 down 21.31 pts or -0.29% at 7320.4, CAC 40 down 9.51 pts or -0.15% at 6216.02 and Euro Stoxx 50 down 10.69 pts or -0.3% at 3584.12.

- U.S. futures are a little softer, with the Dow Jones mini down 88 pts or -0.28% at 31765, S&P 500 mini down 9.25 pts or -0.23% at 3953.25, NASDAQ mini down 22.75 pts or -0.18% at 12442.5.

EQUITIES: A Little Softer Pre-ECB

- Asian markets closed mixed: Japan's NIKKEI closed up 122.74 pts or +0.44% at 27803 and the TOPIX ended 4.15 pts higher or +0.21% at 1950.59. China's SHANGHAI closed down 32.723 pts or -0.99% at 3272.001 and the HANG SENG ended 315.59 pts lower or -1.51% at 20574.63.

- European stocks are weaker pre-ECB, with tech leading and energy dragging (and Italy underperforming amid political uncertainty): German Dax down 89.03 pts or -0.67% at 13317.24, FTSE 100 down 21.31 pts or -0.29% at 7320.4, CAC 40 down 9.51 pts or -0.15% at 6216.02 and Euro Stoxx 50 down 10.69 pts or -0.3% at 3584.12.

- U.S. futures are a little softer, with the Dow Jones mini down 88 pts or -0.28% at 31765, S&P 500 mini down 9.25 pts or -0.23% at 3953.25, NASDAQ mini down 22.75 pts or -0.18% at 12442.5.

COMMODITIES: Dollar Rebound, Risk-Off Move Weighs

- WTI Crude down $3.44 or -3.44% at $103.5

- Natural Gas down $0.28 or -3.45% at $7.421

- Gold spot down $14.06 or -0.83% at $1707.94

- Copper down $5.9 or -1.77% at $333.05

- Silver down $0.36 or -1.95% at $18.8555

- Platinum down $7.82 or -0.91% at $866.03

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/07/2022 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 21/07/2022 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 21/07/2022 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 21/07/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 21/07/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 21/07/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 21/07/2022 | 1245/1445 |  | EU | ECB Press Conference | |

| 21/07/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 21/07/2022 | 1515/1715 |  | EU | ECB Lagarde Presents Policy Decision via Podcast | |

| 21/07/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 21/07/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 21/07/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 22/07/2022 | 2300/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

| 22/07/2022 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 22/07/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 22/07/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 22/07/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 22/07/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 22/07/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 22/07/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 22/07/2022 | 0800/1000 |  | EU | ECB Survey of Professional Forecasters | |

| 22/07/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 22/07/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 22/07/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 22/07/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 22/07/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 22/07/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 22/07/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 22/07/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 22/07/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 22/07/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.