-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Credit Supply Pipeline

US Treasury Auction Calendar

MNI US Open: Equities Shrug Off Political Risk

EXECUTIVE SUMMARY:

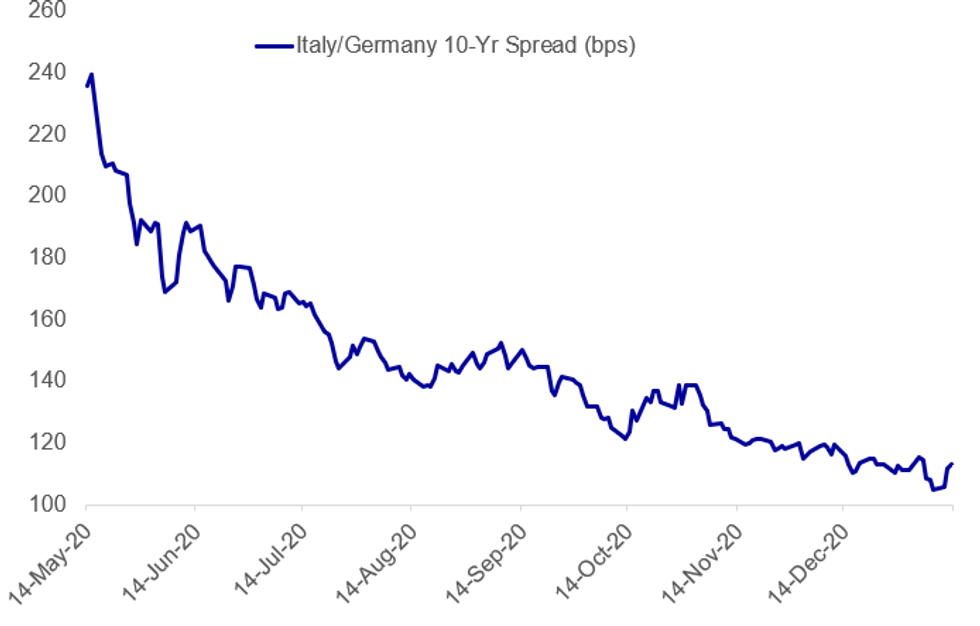

- ITALY COALITION RISKS COLLAPSE

- U.S. HOUSE OF REPRESENTATIVES SET FOR IMPEACHMENT VOTE AS REPUBLICANS BREAK FROM TRUMP

- E.C.B. FORECASTS STILL STAND IF LOCKDOWNS LIFT BY END-MARCH: LAGARDE

- E.C.B. NEEDS ABILITY TO EXCEED 2% INFLATION TEMPORARILY: VILLEROY

- JAPAN EXPANDS VIRUS EMERGENCY; TO SUSPEND ENTRY OF ALL FOREIGNERS

Fig. 1: Italian Political Risk Creeps Higher

BBG,MNI

BBG,MNI

NEWS:

ITALY (BBG): The government of Italian Prime Minister Giuseppe Conte is at risk of collapsing as a junior ally prepared to abandon the coalition as early as Wednesday, just as the administration seeks to push through measures to battle the pandemic and boost the economy.Ex-Premier Matteo Renzi, leader of the Italy Alive party, will hold a news conference at 5:30 p.m. in Rome after a decision on whether to pull his two ministers out of the coalition in a long-simmering clash with Conte. Renzi's party has only 3% support in opinion polls but a pullout would still rob Conte of his parliamentary majority.Renzi's ministers are expected to resign from the government in a letter they will send at 5 p.m. Wednesday afternoon, daily la Repubblica reported.

U.S. (BBG): The U.S. House prepared to vote on a history-making second impeachment of Donald Trump as lawmakers seethed over his role inciting last week's mob attack on the Capitol and the president's once-firm control over the Republican party began to break down. Trump's impeachment appeared inevitable in a vote Democrats anticipated would come Wednesday with the resolution's sponsors claiming broad support from Democrats and public backing from several Republicans, including Liz Cheney, the No. 3 House GOP leader and daughter of former Vice President Dick Cheney. The House is set to begin debate shortly after 9 a.m. with the vote on the impeachment resolution expected by mid- to late afternoon, according to House Rules Chairman Jim McGovern. Under rules in place because of the coronavirus pandemic, members will vote in staggered groups on the House floor, and some by proxy, concluding before 5 p.m.

ECB (RTRS): The European Central Bank's forecast of an economic rebound this year still stands despite fresh restrictions to activity in several euro zone countries, provided those measures are lifted by end-March, ECB President Christine Lagarde said on Wednesday."I think our last projections in December are still very clearly plausible," Lagarde said in an interview at the Reuters Next conference. "Our forecast is predicated on lockdown measures until the end of the first quarter."She added it would be "a concern" if curbs to economic activity continued in the second quarter.

ECB (BBG): The European Central Bank's 2% inflation target must be symmetrical and judged over the medium term, Bank of France governor Francois Villeroy de Galhau tells lawmakers at the National Assembly's finance committee."Today we describe it as close to but below 2%. If that's a ceiling, we will never get there on average as we will hit the ceiling. So we need to have the capacity to temporarily go beyond 2% without it automatically triggering a tightening of monetary policy."

JAPAN (BBG): Japan's government has declared a state of emergency for seven more prefectures later Wednesday in a bid to stem a sharp rise in coronavirus cases and relieve pressure on hospitals. The additional restrictions will apply to the western Japanese prefectures of Osaka, Hyogo and Kyoto, the central prefectures of Gifu and Aichi, which includes Nagoya, as well as the southern prefecture of Fukuoka and the eastern prefecture of Tochigi and will last until Feb. 7, as it does for Tokyo and its surrounding prefectures of Kanagawa, Saitama and Chiba. The move means the major urban centers of Tokyo, Osaka and Nagoya will all now be under states of emergency.

JAPAN (NHK): The Japanese government plans to suspend the entry of all foreigners as the coronavirus continues to spread around the world. Japan halted all new arrivals of non-nationals last month after new strains of the coronavirus that are believed to be highly transmissible were confirmed in the UK and elsewhere. But it continued to allow entry by businesspeople from 10 Asian countries and Taiwan. The government plans to suspend the entry of travelers, regardless of whether a coronavirus variant has been detected in their country, as part of its tighter entry restrictions following the declaration of a state of emergency. No foreigners will be allowed to enter Japan, except for special reasons, such as a relative's funeral or childbirth.

EU-UK (BBG): Less than two weeks after Brexit fully kicked in, European regulators say some bankers are already resorting to "questionable practices" to improperly preserve their previous business arrangements. The Paris-based European Securities and Markets Authority said some companies outside the bloc are skirting rules on solicitation, which allow these firms to handle business for an EU client only when the customer has sought it on their own. ESMA said on Wednesday that "some firms appear to be trying to circumvent MiFID II requirements by including general clauses in their terms of business or through the use of online pop-up 'I agree' boxes whereby clients state that any transaction is executed on the exclusive initiative of the client."

ITALY DATA: Italian Industrial Production Down in Nov* Nov SA industrial output declined by 1.4% m/m (Oct revised higher to +1.4%m/m), while the annual output fell by -4.2% y/y WDA* Nov's reading is below market expectations looking for a flat reading* Nov SA m/m intermediate goods rose, while consumer, capital and energy goodsdecreased-ISTAT* Nov WDA y/y consumer, capital, intermediate goods and energy alldeclined--ISTAT* There were 21 working days in Nov 2020 vs. 20 in Nov 2019.

RIKSBANK: The Riksbank is moving to a self-financed foreign exchange reserve, replacing foreign currency loans issued via the Swedish National Debt Office and instead purchasing around SEK 5 billion per month in the FX market. The central bank intends to repay the currency loans taken by the Swedish National Debt Office as they mature.

DATA:

EZ Nov Industrial Production Beats Expectations

EZ IP: +2.5% m/m, -0.6% y/y (vs. cons +0.2% m/m, -3.2% y/y); Prev (Oct): +2.3% m/m, -3.5% y/y

- The EZ industrial sector recovered further in Nov, rising by 2.5% on a monthly basis and coming stronger than markets expected (BBG: 0.2%).

- Oct's growth rate was revised up to 2.3% m/m from 2.1% reported previously, while the annual rate was revised to -3.5% from -3.8%.

- Yearly production improved sharply to -0.6% in Nov, up from -3.5% seen in the previous month.

- Nov's uptick was driven by a sharp increase in capital goods production, rising by 7.0%, while intermediate goods output was up 1.5%.

- On the other hand, energy production fell by 3.9%, while non-durable and durable consumer goods eased by 1.7% and 1.2%, respectively.

- Among the member states for which data is available, Ireland (+52.8%), Greece (6.3%) and Slovakia (+3.1%) recorded the largest gains, while Portugal (-5.1%), Belgium (-3.5%) and Malta (-2.1%) saw the biggest declines.

FIXED INCOME: Supply and politics

- There have been three main talking points in fixed income markets this morning: heavy supply again, Italian politics and what time will Biden speak tomorrow (no set time yet).

- Italian politics have returned to the forefront of attention again and Italy Alive leader Renzi will hold a press conference today at 16:30GMT (9:30ET). Renzi may pull Italy Alive ministers from government positions which would likely require a vote of confidence to be held and it is far from certain that the government would survive. BTPs are off their lows today but 10-year spreads are still 1.7bp wider on the day.

- In terms of supply, today has seen Spain holding a 10-year syndication while Germany is due to launch its new Bobl and Portugal and a number of SSAs/corporates add to a heavy day of issuance.

- Against this backdrop, core fixed income markets have reversed some of their early gains, but remain above yesterday's close.

- TY1 futures are up 0-2 today at 136-14+ with 10y UST yields down -0.7bp at 1.123% and 2y yields up 0.5bp at 0.151%.

- Bund futures are up 0.46 today at 176.90 with 10y Bund yields down -2.8bp at -0.497% and Schatz yields down -0.8bp at -0.703%.

- Gilt futures are up 0.22 today at 133.91 with 10y yields down -1.8bp at 0.332% and 2y yields down -0.7bp at -0.91%.

FOREX: Sterling Within Reach of Multi-Year Highs

GBP trades well for a second session, outperforming all others in G10, as markets trim further their expectations for negative interest rate policy in the near term. GBP/USD now trades well within range of the recent 1.3704 high printed on Jan 4th - the highest level in two-and-a-half years.

Elsewhere, the USD is a touch firmer, partially reversing yesterday's downtick, but price action is muted so far. Antipodean currencies are soft, with AUD and NZD weaker despite generally solid commodities early Wednesday.

Equity futures in the US are broadly flat ahead of the unofficial beginning of earnings season. E-mini S&P sits just above unchanged.

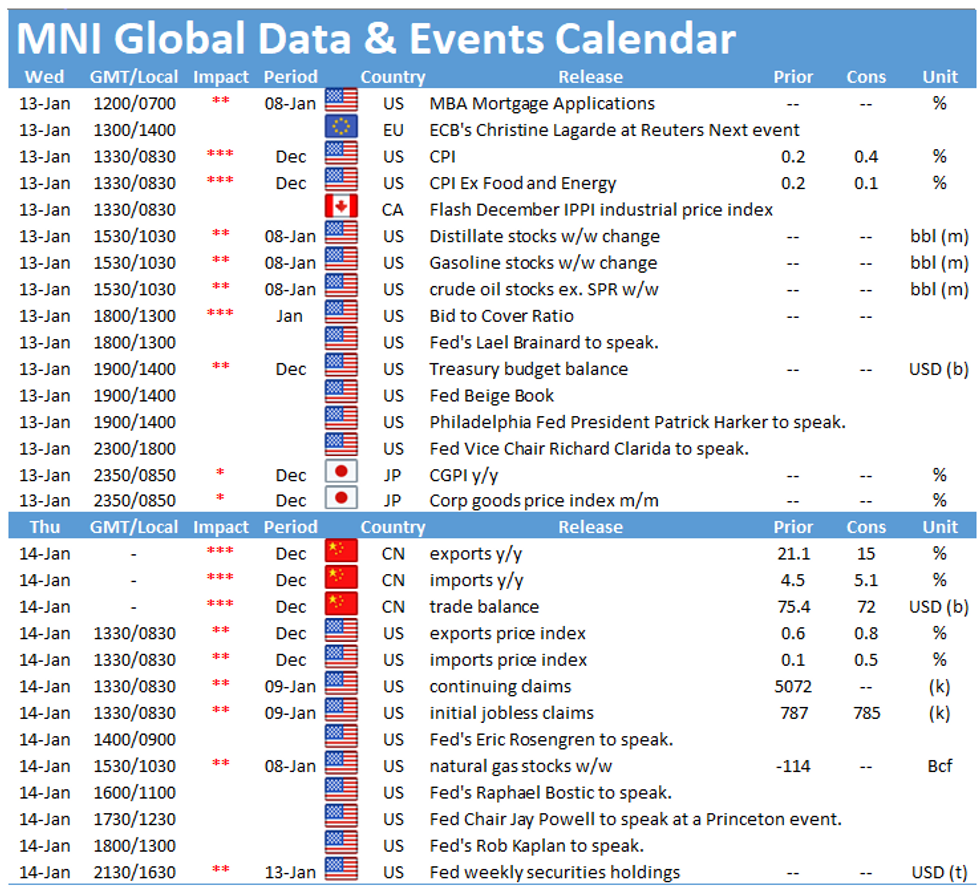

US CPI takes focus going forward, with Fed's Beige Book crossing later in the session. There's plenty of Fedspeak to mull over, with speeches from Bullard, Kashkari, Brainard, Harker and Clarida all due.

EQUITIES: Stocks Shrug Off Italian, U.S. Political Risk

- Asian stocks closed mixed, with Japan's NIKKEI up 292.25 pts or +1.04% at 28456.59 and the TOPIX up 6.46 pts or +0.35% at 1864.4. China's SHANGHAI closed down 9.687 pts or -0.27% at 3598.652 and the HANG SENG ended 41.15 pts lower or -0.15% at 28235.6.

- European equities are higher, with the German Dax up 15.36 pts or +0.11% at 13910.68, FTSE 100 up 7.02 pts or +0.1% at 6748.04, CAC 40 up 19.96 pts or +0.35% at 5649.89 and Euro Stoxx 50 up 7.08 pts or +0.2% at 3610.48.

- U.S. futures are higher, with the Dow Jones mini up 35 pts or +0.11% at 31009, S&P 500 mini up 5.25 pts or +0.14% at 3799.75, NASDAQ mini up 29.75 pts or +0.23% at 12920.

COMMODITIES: Crude Off Highs But Still Outperforming

- WTI Crude up $0.29 or +0.55% at $53.47

- Natural Gas down $0 or -0.04% at $2.752

- Gold spot up $1.05 or +0.06% at $1857.72

- Copper up $1.1 or +0.31% at $360.85

- Silver down $0.11 or -0.41% at $25.4504

- Platinum up $0.59 or +0.05% at $1077.38

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.