-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Equity Caution Ahead Of Earnings Season

EXECUTIVE SUMMARY:

- HIGHER YIELDS EYED AHEAD OF QUARTERLY CORPORATE EARNINGS SEASON

- UK JOBS GROWTH AT 6-YEAR HIGH; EARNINGS MODERATE

- ZEW: ASSESSMENT OF THE ECONOMIC SITUATION IN GERMANY HAS WORSENED

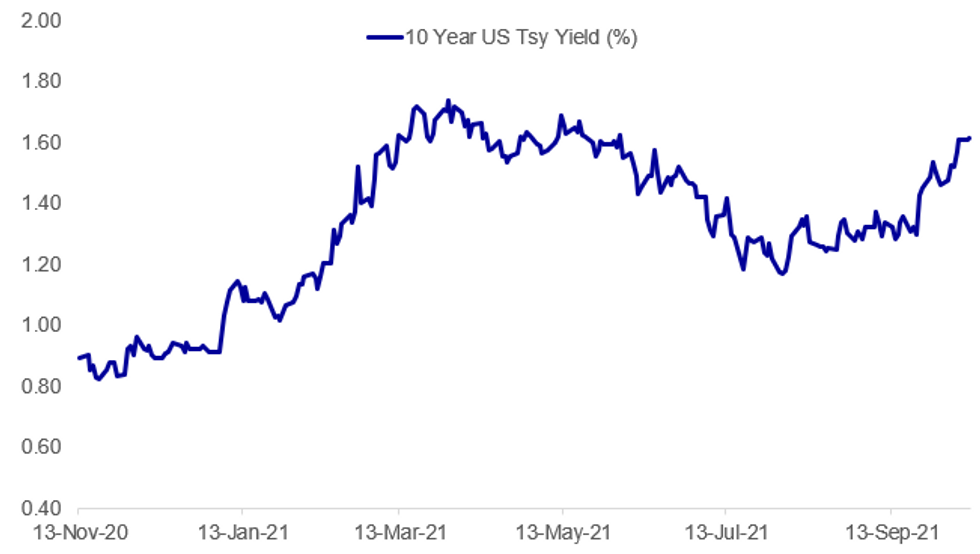

Fig. 1: Yields Resume Rise After Holiday

Source: BBG, MNI

Source: BBG, MNI

NEWS:

U.S. EARNINGS: Market focus turns to the earnings schedule, with financials and banks kicking off the quarterly reporting cycle this week. Reports from the likes of JP Morgan, Goldman Sachs, Bank of America, Citigroup and Morgan Stanley are first up, with focus on whether the steeper US yield curve and the prospect of rising central bank rates are helping prop net interest margins and overall earnings. Full schedule with timings, EPS & revenue estimates here

CHINA / GLOBAL SHIPPING (BBG): The number of vessels waiting to enter one of the world's busiest ports jumped to the most since August, threatening to further snarl global supply chains strained by a surge in consumer demand for everything from cars to computers. China's Yantian port in Shenzhen suspended pick-up and drop-off of containers as tropical cyclone Kompasu approached the nation's southern coastline. The number of ships waiting outside the port rose to 67, the most since Aug. 26, according to shipping data compiled by Bloomberg.

CHINA (BBG): China's competition watchdog is planning to hire more people in its Beijing head office and creating departments to better oversee deals and probes, keeping up the pressure after a yearlong crackdown on monopolies. The State Administration for Market Regulation will boost staffing at its anti-monopoly bureau, which will be split into three separate divisions focusing on antitrust investigations, market competition and mergers oversight, according to people with knowledge of the matter, asking not to be identified as the information hasn't been made public. It's planning to increase the number of antitrust officials from over 40 currently to 100, before reaching 150 within five years, two of the people said.

CHINA / PROPERTY (BBG): Fantasia Holdings Group Co.'s woes mounted after two directors quit the troubled Chinese developer, leaving it in breach of Hong Kong listing rules. Days after defaulting on a dollar bond, Fantasia said Ho Man resigned, expressing concern "that he had not been kept fully informed of certain crucial matters of the company in a timely manner." Another independent non-executive director, Wong Pui Sze, also left, saying she had no disagreement with the board.

FRANCE (BBG): French President Emmanuel Macron will on Tuesday unveil his 'France 2030' investment plan that could range between 30 billion euros and 50 billion euros, Les Echos reported. The funds will be spent on sectors that are seen as the emerging industries of the future, the newspaper said.

IMF (BBG): Kristalina Georgieva will remain as head of the International Monetary Fund after the lender's board reviewed accusations that she improperly influenced a World Bank ranking of China's business climate.The fate of Georgieva -- a Bulgarian economist and the first person from an emerging-market nation to run the IMF -- had been in limbo since Sept. 16. That's when a report written by law firm WilmerHale and commissioned by the World Bank, her previous employer, asserted that she pressured subordinates to boost China's position in the bank's influential "Doing Business" report.

BITCOIN (BBG): Bitcoin is flirting with a run toward its all-time high after jumping more than 90% since a low in July.The largest cryptocurrency was trading just above $57,000 as of 7:52 a.m. in London, some $7,700 shy of its April record. A recent rally in digital tokens like Bitcoin and second-ranked Ether contrasts with the travails of assets such as stocks, bonds and gold amid a bout of jitters in global markets.

U.K. (BBC): The UK's failure to do more to stop Covid spreading early in the pandemic was one of the worst ever public health failures, a report by MPs says. The government approach - backed by its scientists - was to try to manage the situation and in effect achieve herd immunity by infection, it said. This led to a delay in introducing the first lockdown, costing lives. But the report by the cross-party group said there had been successes too - in particular the vaccination programme. It described the whole approach - from the research and development through to the rollout of the jabs - as "one of the most effective initiatives in UK history".

U.K.-E.U.-NORTHERN IRELAND: UK Cabinet Office minister Lord Frost is set to deliver a speech in Lisbon, Portugal later today on the ongoing row between the UK and EU over the implementation of the Northern Ireland protocol of the Brexit withdrawal agreement. Speculation continues that the UK could seek to invoke Art.16 of the protocol, which would see it suspended to allow for smoother NI-GB trade, but risking NI-RoI stability and a hard border on the island of Ireland. Speech set to begin around 1615CET (1015ET, 1515BST) and can be watched on the No.10 Downing St. YouTube link here.

AUSTRIA POLITICS: The senior partner in Austria's governing coalition, the centre-right People's Party (OVP) has seen its support crash in the latest opinion poll carried out in the midst of the resignation of Chancellor Sebastian Kurz. Kurz left office on 11 October following the confirmation that he faced an investigation into alleged corruption relating to the supposed bribing of various media outlets to secure favourable coverage for the gov't. The polling from IFDD shows the OVP down 9% from July, now just one point ahead of the centre-left Social Democrats (SPO). The right-wing populist Freedom Party (FPO) holds onto third place with 21% (the party's best polling score since September 2019). The environmentalist Greens and liberal Neos each sit on 11%.

DATA:

UK DATA: Jobs Growth At 6-Year High; Earnings Moderate

UK employment surged in the three months to August, rising by an as-expected 235,000, the biggest rise since the three months to September 2015, according to data released by the ONS on Tuesday. That took the unemployment rate down to 4.5%, in line with forecasts, the lowest level since the three months to August 2020.

More recent RTI data, which measure salaried employment, rose by a record-high 207,000, some 122,000 above the level of February 2020. Wage growth moderated, with total earnings rising by an annual rate of 7.2% in the three months to August, slightly above expectations, from 8.3% in the three months to July. Regular earnings rose by 6.0%, down from 6.8% in the previous period.

Statisticians estimate that underlying regular earnings rose by an annual rate of between 4.1% and 5.6%. Vacancies continued to soar, jumping by 239,000 in the the third quarter, up 370,000 from pre-Covid levels, touching a record-high of 1.2 million in September,

GERMANY OCT ZEW CURRENT CONDITIONS 21.6

- GERMANY OCT ECONOMIC SENTIMENT INDEX 22.3

FIXED INCOME: Supply the story of the day

Core bonds have moved a little higher this morning despite some dips in pricing earlier for EGBs and gilts as the market digested the day's supply.

- The headline of the day has been the launch of the inaugural Green EU bond, a long 15-year bond which has been sold for E12bln with books in excess of E135bln. The Netherlands, UK and Germany have all also sold bonds this morning. Later the US will launch a new 3-year note and reopen the 10-year note at auction today, too.

- TY1 futures are up 0-6 today at 131-01 with 10y UST yields down -0.8bp at 1.606% and 2y yields up 2.8bp at 0.348%.

- Bund futures are up 0.09 today at 168.87 with 10y Bund yields down -0.7bp at -0.129% and Schatz yields down -0.6bp at -0.704%.

- Gilt futures are up 0.15 today at 123.90 with 10y yields down -1.7bp at 1.171% and 2y yields down -2.0bp at 0.569%.

FOREX: JPY Tipping Over Multi-Decade Trendline

- JPY is extending the losses seen Monday, with the currency again the poorest performer in G10. Tuesday's high in USD/JPY puts the pair above key downtrendline resistance drawn off the December 1975 high at 113.41 - a level which, if closed above, could signal a new medium-term range for the pair.

- NOK, NZD and SEK are among the session's strongest performers, while USD, EUR and JPY are the laggards.

- Newsflow and data catalysts have been few and far between so far, with markets instead focusing on the imminent beginning of earnings season, with major US banks scheduled to start reporting from today. Germany's ZEW survey came and went with little consequence, despite the numbers coming in below expectations.

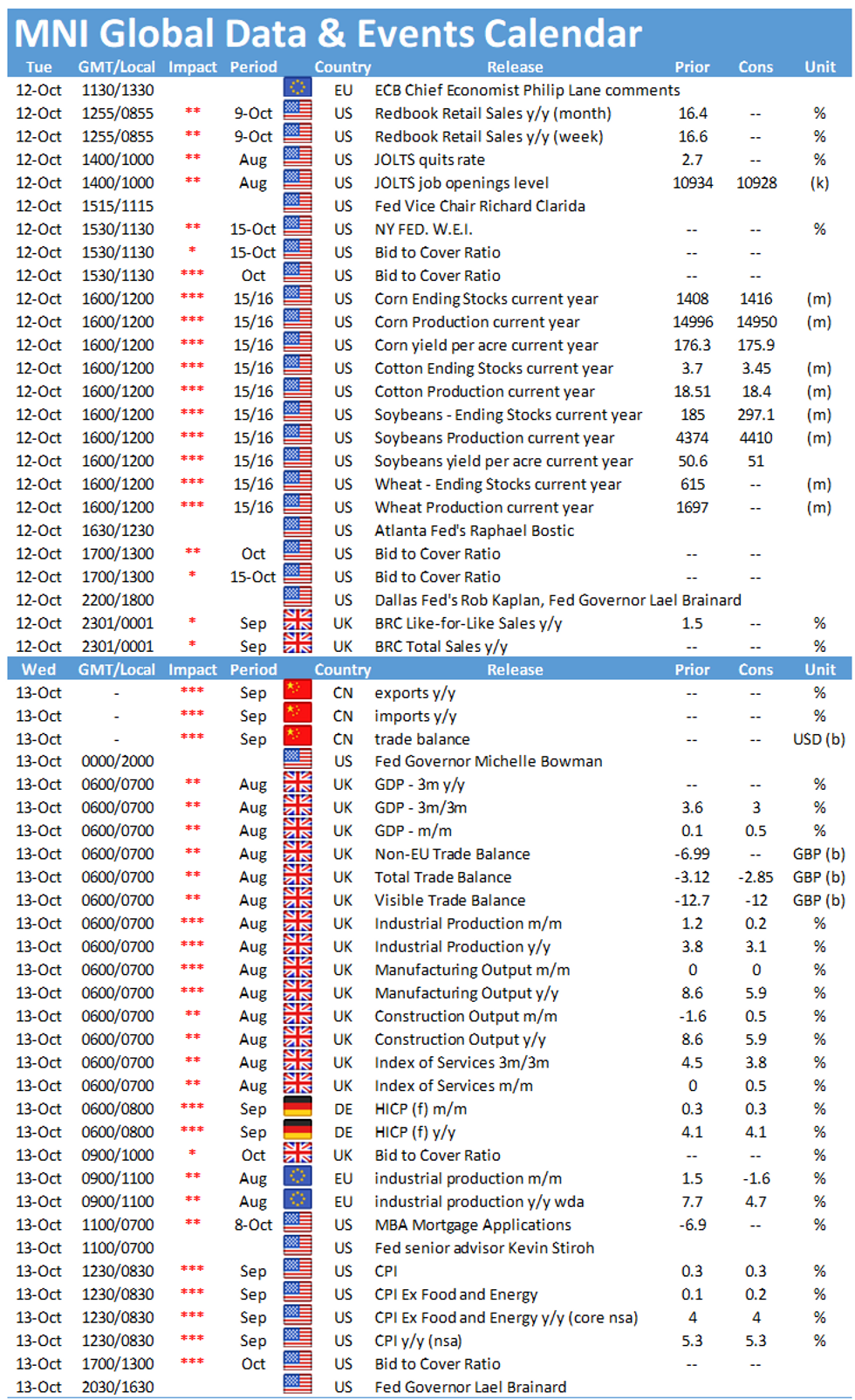

- The Tuesday data slate is relatively light, with just US JOLTs Job Openings on the docket. The speaker slate is busier, with Knot, Villeroy, Lane and Lagarde of the ECB due as well as Fed's Clarida, Bostic and Barkin.

EQUITIES: Futures Weaken With Rising Bond Yields Eyed

- Asian stocks closed weaker, with Japan's NIKKEI down 267.59 pts or -0.94% at 28230.61 and the TOPIX down 13.9 pts or -0.7% at 1982.68. China's SHANGHAI closed down 44.773 pts or -1.25% at 3546.936 and the HANG SENG ended 362.5 pts lower or -1.43% at 24962.59

- European equities are lower, with the German Dax down 105.43 pts or -0.69% at 15076.08, FTSE 100 down 55.08 pts or -0.77% at 7095.63, CAC 40 down 58 pts or -0.88% at 6522.95 and Euro Stoxx 50 down 31.54 pts or -0.77% at 4036.14.

- U.S. futures are a little weaker, with the Dow Jones mini down 76 pts or -0.22% at 34300, S&P 500 mini down 10.25 pts or -0.24% at 4340.75, NASDAQ mini down 21.5 pts or -0.15% at 14679.

COMMODITIES: NatGas Retracement Continues

- WTI Crude up $0.24 or +0.3% at $80.67

- Natural Gas down $0.06 or -1.07% at $5.281

- Gold spot up $3.42 or +0.2% at $1757.86

- Copper down $2.4 or -0.55% at $433.05

- Silver down $0.01 or -0.04% at $22.5644

- Platinum up $4.59 or +0.45% at $1014.6

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.