-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: EU Sees French, Spanish Growth Fuelling Recovery

EXECUTIVE SUMMARY:

- EU COMMISSION SEES FRENCH, SPANISH GROWTH FUELLING EUROZONE RECOVERY

- CONSENSUS SEES Y/Y US CPI RISING TO NEW DECADE HIGH

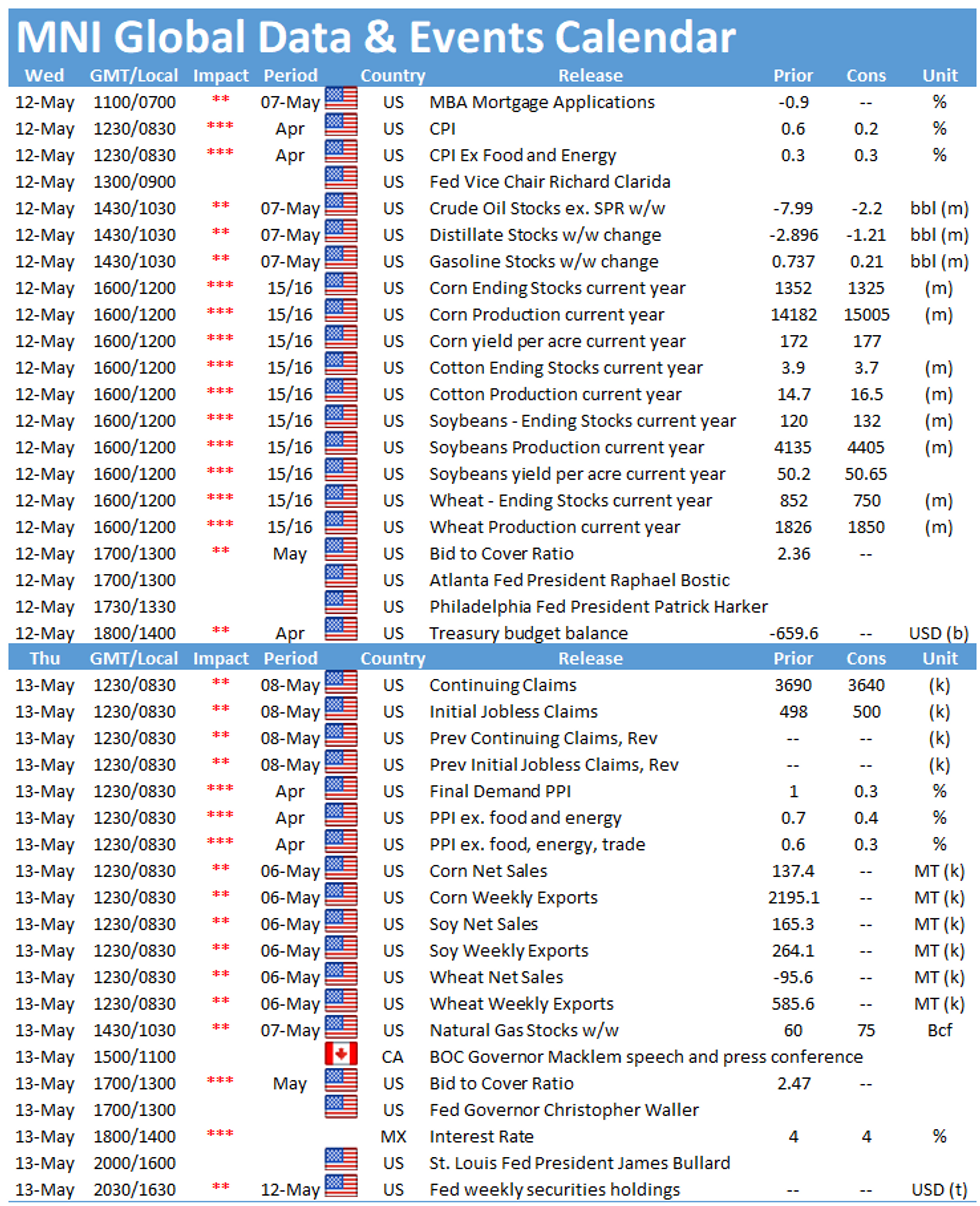

- FEDSPEAK PICKS UP, WITH CLARIDA, ROSENGREN, BOSTIC & HARKER DUE

- USD/CAD CIRCLES KEY SUPPORT

Figure 1: Y/Y CPI seen lurching to highest since 2011:

NEWS

EUROPE (MNI): EU Commission Ups Growth Outlook, Inflation Lags

Spain and France are expected to see growth above 5% in 2021, leading the recovery for the bloc as German GDP expands by about 3.5%, the European Commission said in its spring forecasts.

Inflation is seen rising, but at no point in the forecast horizon does it exceed the European Central Bank's target of 'below, but close to 2%.' Eurozone CPI is expected to be 1.7% in 2021, up from a winter forecast of 1.3%, with 2022 now seen at 1.3%, down from 1.5%. The scale of the ECB's upcoming communications challenge was underlined by a forecast for German inflation at 2.4% in 2021.

EUROPE (BBG): France Aims to Block U.K. Finance Firms From EU Over Fish Spat

France aims to delay access to the European single market for U.K. financial firms until it considers that the British government is honoring its post-Brexit commitments on fishing rights, according to people familiar with the matter. French officials are looking to stall a regulatory cooperation agreement on finance as part of a broader effort to bring pressure to bear on the U.K., the people said, asking not to be named discussing private conversations.

EUROPE (BBG): Finland to Delay EU Recovery Fund Vote as Debate Extended

Finland's parliament is set to delay the vote on the European Union recovery fund ratification that was slated to take place Wednesday. Debate on the topic was halted in the early hours of the morning and is set to continue during the day, Speaker of Parliament Anu Vehvilainen said in a message posted on Twitter. It's likely that the vote will take place at a later time, she said.

MIDDLE-EAST (BBG): Israel, Hamas Escalate Deadly Strikes as U.S. Calls for Calm

Israel unleashed a relentless attack on the Hamas-ruled Gaza Strip after a massive rocket barrage over the country's commercial heartland, as the death toll climbed and the sides edged closer to all-out war.Thirty-five people have been reported killed in Gaza, and five in Israel, since the most serious fighting since 2014 exploded on Monday night. A total of 850 rockets have been fired, and Israeli has carried out some 500 raids, according to the Israeli military.

ASIA (BBG): SoftBank's $17.7 Billion Profit Sets New Record in Japan

SoftBank Group Corp. reported the highest ever quarterly profit for a Japanese company thanks to an unprecedented windfall from its investment business. Net income was 1.93 trillion yen ($17.7 billion) for the three months ended March 31, the most for a listed Japanese company dating back to 1990, data compiled by Bloomberg show. Most of it came from SoftBank's Vision Fund investment arm, whose 2.3 trillion yen profit was supercharged by the successful initial public offering of Coupang Inc. in March.

DATA

Swedish Inflation Jumps In April

Swedish inflation jumped to 2.5% in April from 1.9% in March on the Riksbank's preferred target CPIF (fixed interest rate) measure, with Statistics Sweden stating that it was largely a result of base effects, reflecting the very sharp drop last April as the Covid pandemic hit.

UK GDP Declines IN Q1 Despite March Rebound

The UK economy contracted by 1.5%:https://www.ons.gov.uk/releases/gdpfirstquarterlye... the first quarter, slightly outperforming expectations, even as output rebounded by a stronger-than-forecast 2.1% in March ahead of an expected reopening of the economy, the Office for National Statistics said Wednesday. All output components contracted in Q1, led by a 2.0% slump in services, which shaved 1.9 percentage points from GDP.

The UK lagged the US (+1.6% in Q1) and the euro zone (-0.6%) over the opening months of the year, but outperformed Germany, which suffered a 1.7% fall in output.

UK Non-EU Imports Exceed EU Imports In Q1

The UK's imports of goods from non-EU countries were higher than those from EU countries in Q1, the first time that has happened since records began in 1997, the Office for National Statistics: https://www.ons.gov.uk/releases/uktrademarch2021 said Wednesday.

Overall imports for Q1 stood at GBP103.8 billion, as goods coming in from the EU totalled GBP50.6 billion in the period, while imports from the rest of the world stood at GBP 53.2 billion. In Q4, imports totalled GBP118.4 billion, with the EU share at 64.7 bn vs non-EU at 53.7 billion.

FRANCE APR FINAL CPI +0.1% M/M, +1.2% Y/Y; MAR +1.1% Y/Y

- APR FINAL CPI +0.1% M/M, +1.2% Y/Y; MAR +1.1% Y/Y

GERMANY APR FINAL CPI +0.7% M/M, +2.0% Y/Y; MAR +1.7% Y/Y

- APR FINAL CPI +0.7% M/M, +2.0% Y/Y; MAR +1.7% Y/Y

BOND SUMMARY: Focus on CPI

- After yesterday's sell-off, core fixed income markets have retraced somewhat this morning, although Treasuries, Bunds and gilts are still substantially lower than Monday's close.

- Focus remains firmly on the US CPI data due at 13:30BST/8:30ET with analysts looking for a substantial pickup.

- There will be a number of Fed speakers, too. Clarida is the only member who is due to explicitly discuss the economic outlook with Rosengren, Bostic and Harker all due to speak too.

- TY1 futures are up 0-1 today at 132-15+ with 10y UST yields down -0.6bp at 1.617% and 2y yields down -0.2bp at 0.158%.

- Bund futures are up 0.24 today at 169.69 with 10y Bund yields down -1.2bp at -0.174% and Schatz yields down -0.1bp at -0.674%.

- Gilt futures are up 0.16 today at 127.93 with 10y yields down -1.3bp at 0.819% and 2y yields down -0.3bp at 0.056%.

FOREX: USD/CAD Continues to Test Key Support

- CAD is the strongest currency in G10 ahead of Wednesday's NY open, with USD/CAD keeping key support at 1.2062 under pressure. A break through here would be a sizeable break of support for the pair, leaving USD/CAD at the lowest levels since 2015. Better WTI and Brent crude markets are supporting the price here, with a firm crude futures curve underpinning CAD strength.

- At the other end of the table, AUD and NZD trade poorly, with continued weakness in US index futures draining risk sentiment. Immediate support for NZD/USD undercuts at $0.7205, with long covering in AUD/USD also adding pressure.

- Plenty of focus will be paid to today's US CPI release, with markets expecting Y/Y CPI to tick higher to 3.6%, the highest since 2011. Inflationary concerns have been the primary driver of markets this week, so the market response to today's release could be outsized.

EQUITIES: Mixed morning for equities

- Japan's NIKKEI down 461.08 pts or -1.61% at 28147.51 and the TOPIX down 27.97 pts or -1.47% at 1877.95

- China's SHANGHAI closed up 20.906 pts or +0.61% at 3462.751 and the HANG SENG ended 217.23 pts higher or +0.78% at 28231.04

- German Dax up 28.6 pts or +0.19% at 15149.81, FTSE 100 up 41.26 pts or +0.59% at 6989.66, CAC 40 up 2 pts or +0.03% at 6269.91 and Euro Stoxx 50 up 3.65 pts or +0.09% at 3950.23.

- Dow Jones mini down 101 pts or -0.3% at 34079, S&P 500 mini down 9.25 pts or -0.22% at 4137.25, NASDAQ mini down 53.75 pts or -0.4% at 13293.5.

COMMODITIES: Precious metals under pressure as copper rallies

- WTI Crude up $0.45 or +0.69% at $65.73

- Natural Gas down $0.02 or -0.58% at $2.937

- Gold spot down $4.03 or -0.22% at $1833.27

- Copper up $3.75 or +0.79% at $479.75

- Silver down $0.25 or -0.89% at $27.3692

- Platinum down $1.27 or -0.1% at $1239.13

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.