-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Europe Rate Hike Bets Rise Ahead Of ECB

EXECUTIVE SUMMARY:

- TRADERS DOUBLE BETS ON ECB RATE HIKE AS EUROPE INFLATION BITES

- BOJ'S KURODA COMFORTABLE WITH YEN FALL

- UK DMO'S STHEEMAN ON LINKERS AND Q.T. (MNI INTERVIEW)

- EUROZONE ECONOMIC CONFIDENCE UNEXPECTEDLY RISES ON SERVICES

- SPANISH INFLATION HITS 3-DECADE HIGH

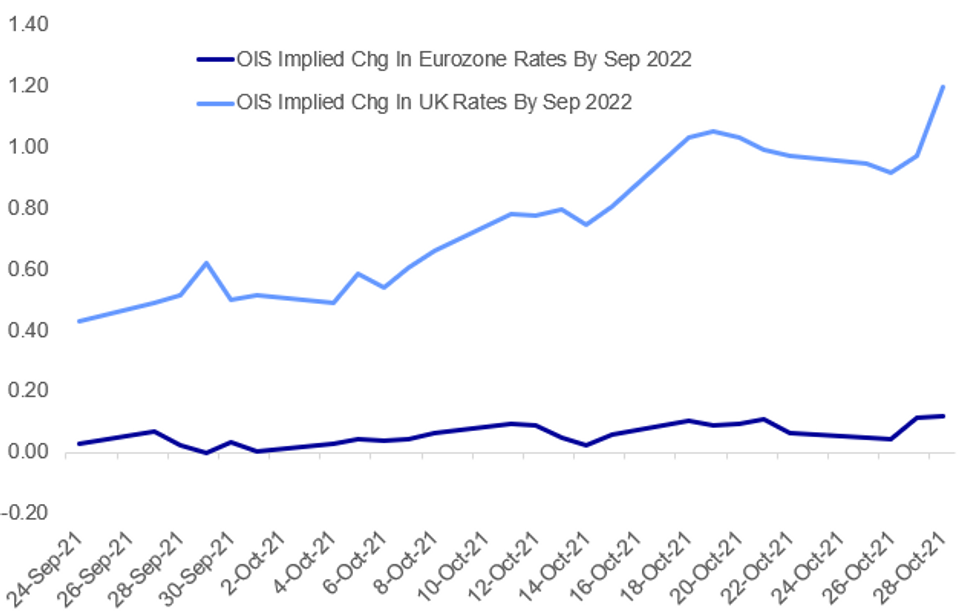

Fig.1: Rate Hike Pricing Rises In Europe (Figures In Percentage Points)

Source: BBG, MNI

Source: BBG, MNI

NEWS:

ECB (BBG): Traders are ramping up bets the European Central Bank will raise borrowing costs by the end of next year, adding pressure on policy makers as they gather for a rate decision on Thursday. Money markets expect the central bank to raise the deposit facility rate by 20 basis points to minus 0.3% by December 2022, spurred by mounting inflation expectations. The expectations have doubled since Tuesday and defy policy makers' stance that consumer-price surges are temporary.

BOE / UK (BBG): Chancellor of the Exchequer Rishi Sunak's unexpected budget giveaway increased the prospects of a Bank of England interest-rate hike next week.Economists and investors moved to solidify bets that the U.K. central bank will deliver its first post-pandemic increase in borrowing costs after Sunak defied expectations for fiscal restraint with a 75 billion pounds ($103 billion) of stimulus.The additional Treasury money will pour into an economy already overheating because of supply-chain bottlenecks that caused shortages of goods and workers. Those strains are likely to push inflation past 5% in the coming months, the BOE's chief economist has warned, more than double the 2% target.

EUROZONE RATES (BBG): The benchmark rate for euro funding fell to an all-time low, driven by a near-record high level of spare cash in the economy. Three-month Euribor -- the rate at which banks can theoretically borrow from one another -- fell to a record minus 0.557% on Thursday. Euribor futures expiring in December expect a subsequent increase to minus 0.535% suggesting money markets don't expect further declines by year-end.

UK GILTS (MNI INTERVIEW): MNI interviews UK DMO head Robert Stheeman about linkers and QT - On MNI Policy MainWire now, for more details please contact sales@marketnews.com

EUROZONE CONFIDENCE (BBG): Economic confidence in the euro area unexpectedly improved in October, with optimism in services making up for concern in industry that a global supply squeeze will damp production. The European Commission's monthly sentiment gauge rose to 118.6 from 117.8. All economists surveyed by Bloomberg had expected a decline. Sentiment also improved in construction and to a lesser extent in retail trade. Consumers turned more pessimistic amid concerns over the economic outlook and their future financial situation.

BOJ (MNI STATE OF PLAY): Bank of Japan yield curve control policy is not a cause of recent yen weakness against the dollar, Governor Haruhiko Kuroda said on Thursday after the two-day policy board meeting held steady, adding the currency decline is not a "bad" development. The remarks by Kuroda were a rare evaluation on weak yen moves, signalling the role the currency is now playing in economic assessments. from energy costs to corporate profits and inflation and growth rates, see: MNI INSIGHT: BOJ Concerned Energy Costs Could Dampen Growth.

SPAIN INFLATION (BBG): Spanish inflation accelerated to the highest level in almost three decades, underscoring the continent's intensifying struggle with soaring energy costs. The rate jumped to 5.5% in October, based on a national measure, the highest since 1992. The so-called harmonized gauge also hit 5.5%, far exceeding the 4.6% median forecast of economists in a Bloomberg survey.

CHINA EVERGRANDE (BBG): China Evergrande Group's next bond payment deadline is fast approaching as investors scrutinize the developer for clues on the severity of a cash crunch that's eroding confidence in other highly indebted peers. The 30-day grace period on Evergrande's $45.2 million coupon payment that was initially due Sept. 29 is set to end on Friday. The closely-watched deadline comes amid a selloff in Chinese junk bonds that was paced on Thursday by Kaisa Group Holdings Ltd., one of the property sector's largest issuers of dollar debt.

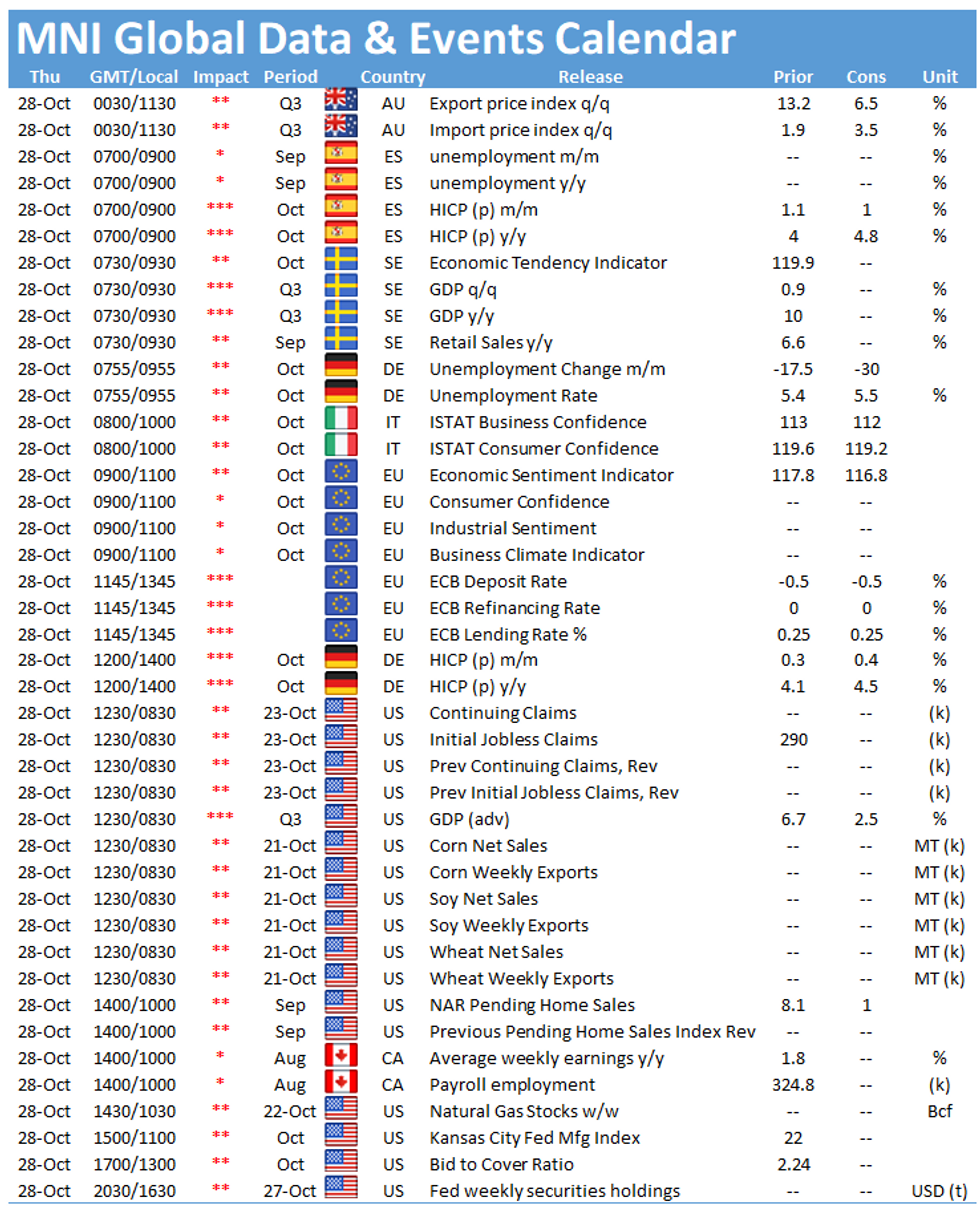

DATA:

MNI: GERMANY OCT UE RATE (SA) 5.4%; SEP 5.5%

MNI: BAVARIA OCT CPI +0.5% M/M, +4.6% Y/Y; AUG +4.2% Y/Y

MNI: SAXONY OCT CPI +0.4% M/M, +4.5% Y/Y; SEP +4.1% Y/Y

MNI: BAVARIA OCT CPI +0.5% M/M, +4.6% Y/Y; AUG +4.2% Y/Y

SPAIN OCT FLASH HICP +1.7% M/M, +5.5% Y/Y; SEP +4.0% Y/Y

FIXED INCOME: Short end strips collapse

- A really busy morning session, with way above average volumes.

- Price action was more limited in the EGB's, Bund and the long end, but we are nonetheless seeing further flattening bias across the board.

- All of the action is in the short end 3 months, with collapses in Euribor, Eurodollar and Short Sterling, as desks reprice larger hikes for the UK, and target December 2022 for Europe and the US.

- Peripheral spread are wider against the German 10yr, Portugal and Greece by 1.7bp.

- All the action is in Short sterling for the UK with the front whites down 16/20 ticks.

- LH2 (March 2022) is below the October low and lowest since May 2019.

- LU2 (September 2022) sees next support at the 3rd January 2019 low at 98.54.

- UK 5s/30s is flattest since 10/03/20.

- UK 2s/10s eye a test at the October low 40.14, now at 41.391.

- Similar flow for the US, with Eurodollar seeing big ranges, and Volumes,.

- The strip is down 7 ticks at the time of typing.

- US curves, sees 5s/30s flattest since March 2020 while the 2s/10s drifts towards lowest level since the 5th August.

- Looking ahead, attention turns to the ECB, and out of the US sees the GDP release

FOREX: JPY On Top Following Equity Dip Late Wednesday

- The JPY trades solidly across the board early Thursday, following downside pressure in USD/JPY ahead of the Wednesday close, that resulted in a showing back below previous resistance-turned-support at 113.41. This level remains a focus headed into NY hours as the USD Index trades in negative territory and just above key support at the 93.3495 50-dma.

- The single currency trades poorly ahead of the ECB decision, with markets continuing to reflect on the policy divergence between the ECB and other major global central banks. Short-term rates markets across the UK and US continue to accelerate pricing for earlier, sharper interest rate hikes, while the Eurozone equivalent lags considerably, translating to the EUR being one of the poorest performers so far in G10.

- Focus turns to the ECB rate decision, at which the bank are expected to double down on their view that the current surge in inflationary pressures is transitory, and their current policy mix remains relevant. Today's meeting is seen as a final hurdle ahead of the December decision, at which the bank will have full access to fresh economic projections and may tweak their asset purchase programme.

EQUITIES: Nasdaq Gaining In Mixed Session So Far

- Asian stocks closed weaker, with Japan's NIKKEI down 278.15 pts or -0.96% at 28820.09 and the TOPIX down 14.15 pts or -0.7% at 1999.66. China's SHANGHAI closed down 43.888 pts or -1.23% at 3518.417 and the HANG SENG ended 73.01 pts lower or -0.28% at 25555.73.

- European shares are mixed, with the German Dax down 16.59 pts or -0.11% at 15654.16, FTSE 100 down 24.18 pts or -0.33% at 7234.85, CAC 40 up 8.77 pts or +0.13% at 6772.27 and Euro Stoxx 50 up 6.97 pts or +0.17% at 4213.17.

- U.S. futures are a little higher, led by Tech, with the Dow Jones mini up 43 pts or +0.12% at 35433, S&P 500 mini up 9.75 pts or +0.21% at 4554.5, NASDAQ mini up 71.25 pts or +0.46% at 15659.

COMMODITIES: Metals Outperforming Energy

- WTI Crude down $0.37 or -0.45% at $81.84

- Natural Gas down $0.04 or -0.56% at $6.162

- Gold spot up $4.86 or +0.27% at $1802.47

- Copper up $5.35 or +1.22% at $443.2

- Silver up $0.02 or +0.09% at $24.1432

- Platinum up $4.13 or +0.41% at $1020.92

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.