-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US Open: European Growth Momentum Waning

EXECUTIVE SUMMARY:

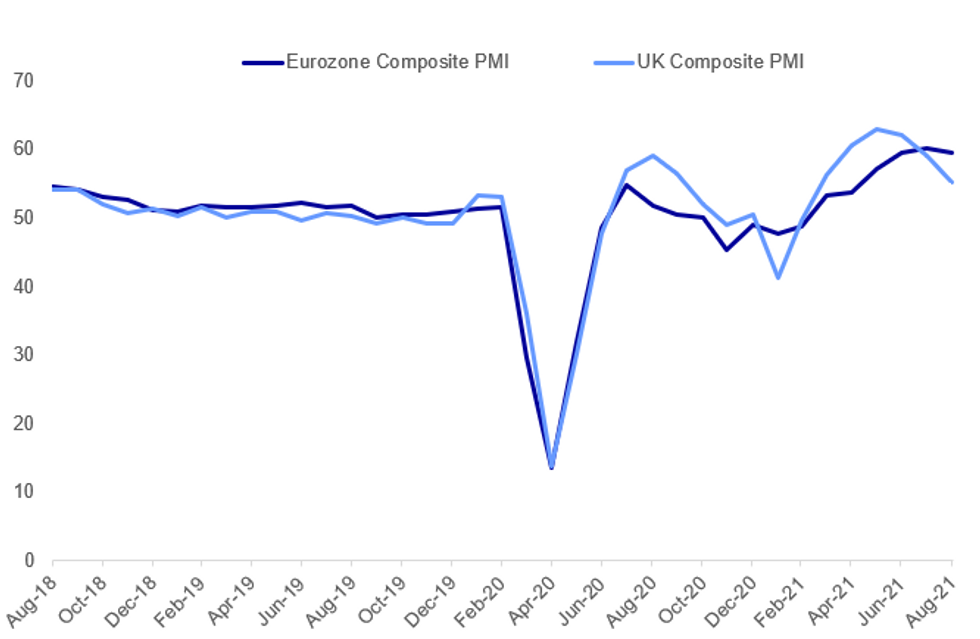

- U.K. PMIS SLOW SHARPLY IN AUGUST

- GERMAN FLASH AUGUST MANUFACTURING PMI WEAKER THAN EXPECTED

Fig. 1: PMIs Show European Deceleration

Source: IHS Markit, MNI

Source: IHS Markit, MNI

NEWS:

CHINA / EQUITIES (BBG): China's market regulator halted 42 initial public offerings in Shanghai and Shenzhen after starting a probe into an investment bank, a law firm and other parties involved in the deals. The news of the shelved IPOs was reported by Shanghai Securities News, which cited disclosures by the exchanges and company filings.

OIL (BBG): Brent oil climbed amid a broader market rebound after capping the longest run of declines in more than three years on economic strains from the latest Covid-19 comeback and a stronger dollar. Futures in London rose 1.9% on Monday, rallying with equities in Asia and other commodities, after falling for a seventh session on Friday for the worst streak since February 2018. China has made progress in containing the fast-spreading delta variant, bringing local cases down to zero, but the coronavirus continues to impact other nations and cloud the outlook for fuel demand.

INDIA / INFRASTRUCTURE (BBG): India plans to raise 6 trillion rupees ($81 billion) from selling state-owned infrastructure assets over next four years to help bolster the government's finances and plug its budget deficit, according to people familiar with the matter. The plan will include sale of road and railway assets, airports, power transmission lines and gas pipelines, said the people who asked not to be identified as they aren't authorized to share the details. Finance Minister Nirmala Sitharaman is scheduled to make the road-map public later Monday.

JAPAN POLITICS: Prime Minister Yoshihide Suga suffered a political blow over the weekend as his aide and former public safety chief Hachiro Okonogi was defeated in the Yokohama mayoral race. Suga and his Liberal Democratic Party had backed Okonogi, but the incumbent opposition-backed mayor, Takeharu Yamanaka, emerged victorious. The defeat comes as Suga confirms he will seek re-election as head of the LDP in September, ahead of the Japanese legislative elections due by 22 October. Given the dominance of the LDP over Japanese politics and the current weakness of the opposition parties, whoever emerges as LDP leader is very likely to become prime minister following the election. Suga is already struggling with record-low approval ratings, amidst an escalation in COVID-19 infections.

CRYPTO (BBG): Bitcoin topped $50,000 for the first time since May as crypto prices continued an ongoing recovery from a disorderly rout just three months ago. The largest virtual coin advanced 3.5% to $50,122 in early London trading on Monday, with other tokens including Ether and Cardano's ADA also rising. The revival in virtual currencies has excited the animal spirits of the crypto faithful, putting predictions of $100,000 or more for Bitcoin back in vogue.

DATA:

EZ FLASH AUG MFG PMI 61.5; JUL 62.8 EZ FLASH AUG SERVICES PMI 59.7; JUL 59.8 EZ FLASH AUG COMPOSITE PMI 59.5; JUL 60.2

UK FLASH AUG MFG PMI 60.1; JUL 60.4 UK FLASH AUG SERVICES PMI 55.5; JUL 59.6 UK FLASH AUG COMPOSITE PMI 55.3; JUL 59.2

UK DATA: Aug PMI: Slowing Momentum Mainly Reflects Supply Constraints

The UK posted a much weaker than expected August flash services PMI reading of 55.5 (vs 59.1 expected, 59.6 prior), but manufacturing decelerated by less than expected at 60.1 (vs 59.5 expected, 60.4 prior).

- The services figure was a 6-month low, with manufacturing at a 5-month low.

- According to IHS Markit, the main culprit in the weak readings was supply-side constraints on output rather than weakness in demand: "Survey respondents widely reported constraints on business activity due to staff shortages and supply chain issues. Efforts to rebuild capacity and strong optimism towards the business outlook contributed to the fastest rise in employment numbers since the index began in January 1998. Nonetheless, backlogs of work increased for the sixth month in a row as businesses struggled to keep up with customer demand."

- Indeed, "incidences of reduced output due to shortages of staff or materials were fourteen times higher than usual and the largest since the survey began in January 1998."

- So economic momentum is slowing, but a large portion of this is due to supply constraints.

- Notably though, while there were reports of higher wages, inflation pressures overall appeared to have moderated in August (input cost inflation was a 3-month low).

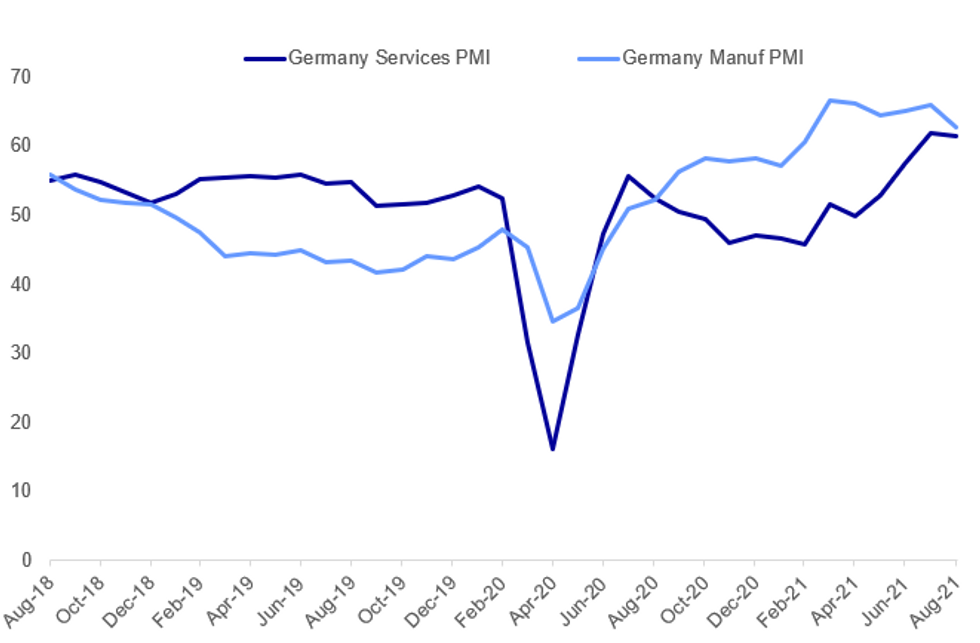

GERMANY FLASH AUG MFG PMI 62.7; JUL 65.9GERMANY FLASH AUG SERVICES PMI 61.5; JUL 61.8 GERMANY FLASH AUG COMP PMI 60.6; JUL 62.4

GERMAN DATA: Aug PMI: Moderating, But Still Robust

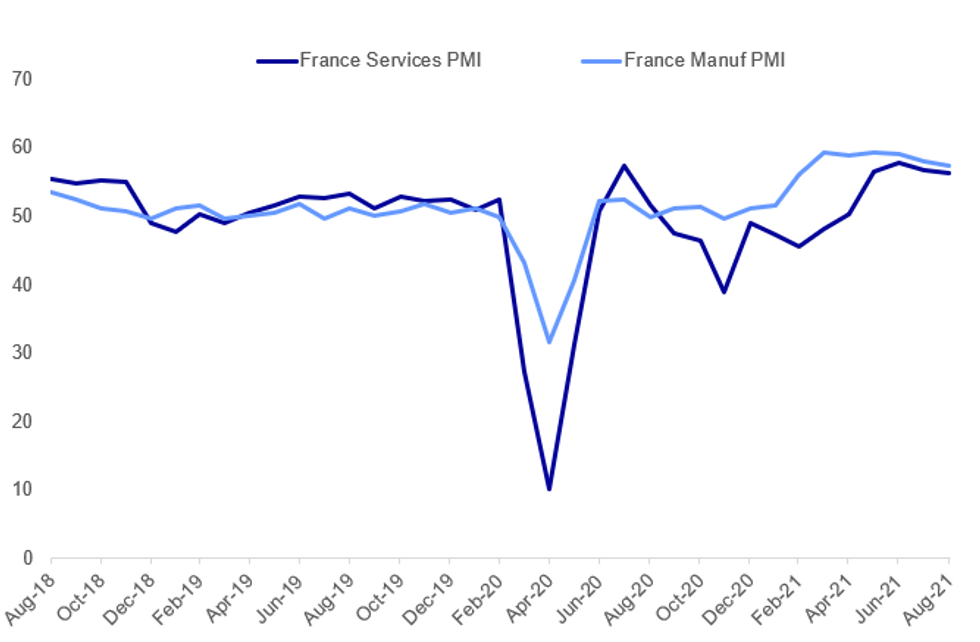

French August flash PMI readings were largely in line with expectations: Manufacturing 57.3 (vs 57.2 expected, 58.0 prior) and Services 56.4 (56.3 expected, 56.8 prior).

- While these represented multi-month lows (4 months for services and 6 for manufacturing), they suggested French economic activity was still firmly in expansionary territory.

- Several key themes remain prevalent: strong customer demand including from abroad; strengthening labour market (jobs growth reading strongest since Oct 2018) amid rising backlogs; and of course, higher price pressures amid bottlenecks (though inflation rates "eased marginally").

- From the IHS Markit report: "Demand for French goods and services increased strongly as firms remarked on improving tourism and a still-robust appetite to spend among clients. Consequently, employment grew at the sharpest pace in almost three years, although backlogs of work continued to rise. Meanwhile, inflationary pressures eased marginally, but were still notable, and business confidence eased to a seven-month low."

Source: IHS Markit

Source: IHS Markit

FRANCE FLASH AUG MFG PMI 57.3; JUL 58.0FRANCE FLASH AUG SERVICES PMI 56.4; JUL 56.8 FRANCE FLASH AUG COMPOSITE PMI 55.9; JUL 56.6

GERMAN DATA: Aug PMI: Manufacturing Remains Supply Constrained

German August flash PMIs came in mixed, with services beating expectations at 61.5 (vs 61.0 expected and 61.8 prior), but manufacturing decelerating more quickly than expected at 62.7 (vs 65.0 expected and 65.9 prior).

- These were multi-month lows (2 months for services, 6 months for manufacturing) but still strong readings, with services down from a record-high in July and one of the highest in series history.

- The manufacturing miss will get more attention, and the underlying explanation appears to be rising supply chain constraints and not weaker demand per se.

- From the IHS Markit report: "a number of reports from goods producers of material and component shortages weighing on factory production volumes. Manufacturing order book volumes were also reportedly impacted, growing at the slowest rate for six months but one that nevertheless remained faster than that of output and was strong by historical standards".

- In this context, manufacturing firms "struggled to keep pace with demand" and with input inflation rising, continued to raise prices. They also hired aggressively to keep up with orders (as with their service sector counterparts).

Source: IHS Markit

Source: IHS Markit

FIXED INCOME: Bunds And Gilts Ignore Soft PMI Readings

The week has begun with a risk-on tone with European cash curves bear steepening amid stronger equities, though the US curve is fairly flat to start the week.

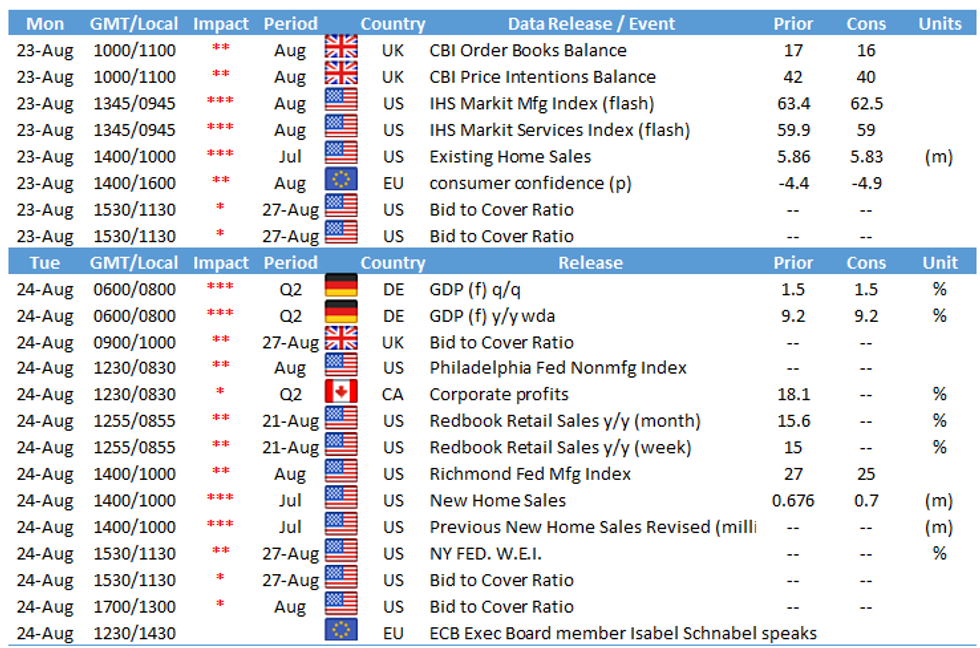

- August flash PMIs in Europe have been largely disappointing vs expectations and have pointed to slowing economic momentum in 3Q. The US reading is the sessions' remaining data highlight (0945ET/1445BST).

- That has not benefited core FI though. Bunds have pulled back fairly sharply despite a weaker-than-expected German manufacturing PMI reading; RXU1 futures have broken below 176.85, with next support at 176.68. Likewise Gilts are weaker despite a large services PMI miss.

- Periphery EGB spreads are mixed, with Italy underperforming.

- The only supply today is bills (Germany, France, US), and no central bank speakers scheduled, with the Fed's Jackson Hole summit eyed later this week.

Latest levels:

- Sep US 10-Yr futures (TY) down 3/32 at 134-01 (L: 133-31.5 / H: 134-06)

- Sep Bund futures (RX) down 39 ticks at 176.76 (L: 176.66 / H: 177.16)

- Sep Gilt futures (G) down 25 ticks at 130.04 (L: 129.97 / H: 130.27)

- Sep BTP futures (IK) down 49 ticks at 154.84 (L: 154.75 / H: 155.33)

- Italy / German 10-Yr spread 1bps wider at 105.1bps

FOREX: USD Underperforms Against the Majors

- USD has broadly been better offered, but crosses have mainly stayed within ranges, as investors focus on the European, UK PMI releases.

- The data were mixed across countries, whilst we are still printing into expansion, some of the release saw numbers above survey, but down versus last.

- The USD trades in the red against all majors, besides the Yen, on the back of underpinned Equity market, albeit off their best levels for the session.

- GBP saw some offers hitting the currency, after the UK PMI service missed expectation, but downside for the British Pound have been limited, with the currency taking its cue from the better offered Dollar.

- The EUR is mixed, down 0.62% against the NOK, and up 0.5% versus the Yen.

- EURGBP tested 0.8593 100-dma, printed a 0.85936 high)

- Above the latter opens to 0.8618 76.4% retracement of the Jul 20 - Aug 10 sell-off.

- Looking ahead, US PMIs will be the main focus, ahead of the awaited Jackson Hole on Friday.

- We have no speakers scheduled for today.

EQUITIES: Strong Start To Week Led By Energy Stocks

- Asian markets closed higher, with Japan's NIKKEI up 480.99 pts or +1.78% at 27494.24 and the TOPIX up 34.46 pts or +1.83% at 1915.14. China's SHANGHAI closed up 49.798 pts or +1.45% at 3477.132 and the HANG SENG ended 259.87 pts higher or +1.05% at 25109.59.

- European equities are higher, with the German Dax up 27.28 pts or +0.17% at 15808.04, FTSE 100 up 20.61 pts or +0.29% at 7087.9, CAC 40 up 35.59 pts or +0.54% at 6626.11 and Euro Stoxx 50 up 19.31 pts or +0.47% at 4147.5.

- U.S. futures are also up slightly, with the Dow Jones mini up 115 pts or +0.33% at 35173, S&P 500 mini up 13.25 pts or +0.3% at 4450.25, NASDAQ mini up 50.25 pts or +0.33% at 15136.75.

COMMODITIES: Oil Outperforms Amid Broad Rally

- WTI Crude up $1.88 or +3.03% at $63.18

- Natural Gas up $0.05 or +1.27% at $3.864

- Gold spot up $5.91 or +0.33% at $1786.11

- Copper up $6.65 or +1.61% at $414.3

- Silver up $0.36 or +1.57% at $23.2563

- Platinum up $21.32 or +2.14% at $1015.12

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.