-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI US Open: European Stocks Hit Record Highs

EXECUTIVE SUMMARY:

- E.U. WILL NEAR VIRUS IMMUNITY BY END-JUNE, INTERNAL MEMO SHOWS

- CREDIT SUISSE TAKES $4.7BN ARCHEGOS HIT, CUTS DIVIDEND

- U.S. POSITION ON MINIMUM TAX IS VERY POSITIVE: FRENCH OFFICIAL

- R.B.A. RATE GUIDANCE DECISION "LATER IN YEAR"

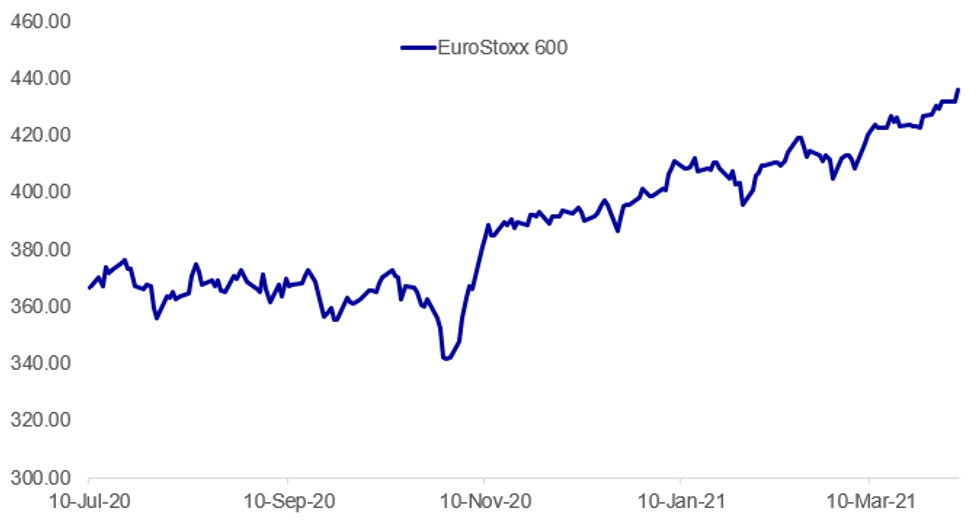

Fig. 1: EuroStoxx 600 Recovers Pandemic Losses

BBG, MNI

BBG, MNI

NEWS:

E.U. / COVID VACCINE (BBG): Most European Union member states will have sufficient Covid vaccine supplies to immunize the majority of people by the end of June, much earlier than the bloc's official target, according to an internal memo seen by Bloomberg. Germany, France, Italy, Spain and the Netherlands will be in a position to fully inoculate more than 55% of their total populations, projections in the document show. The EU wants to immunize 70% of adults by the end of the summer, which -- depending on the demographics of each member state -- corresponds to around 55-60% of total population.

CREDIT SUISSE / ARCHAGOS (BBG): Credit Suisse Group AG will take a 4.4 billion franc ($4.7 billion) writedown tied to the implosion of Archegos Capital Management and replace more than half a dozen executives in response to the firm's worst trading debacle in over a decade. The charge will result in a pretax loss of about 900 million francs for the first quarter, the bank said in a statement Tuesday, putting it on track for its second straight net loss. Credit Suisse scrapped bonuses for top executives, cut its dividend and suspended share buybacks to protect its capital. Investment bank head Brian Chin and Chief Risk Officer Lara Warner are leaving.

ARCHAGOS (BBG): Stocks tied to the Archegos Capital Management crisis fell in premarket trading as Credit Suisse Group AG was said to have hit the market with block trades that totaled more than $2 billion, the latest bulk share sale as part of a fallout from the liquidation of Bill Hwang's fund.ViacomCBS Inc. slipped 2.2% and Vipshop Holdings Ltd. dropped 2.1% as of 4:07 a.m. in New York, while Farfetch Ltd. declined 2.1% after the Swiss bank unloaded shares.

ASTRAZENECA VACCINE / UK (BBG): The U.K.'s medicines regulator is being urged to change its guidance on the use of the Oxford-AstraZeneca vaccine in younger people over concerns about rare blood clots, Channel 4 News reported on April 5, citing two unidentified people familiar with the matter. Despite unclear data, there are growing arguments that would justify offering younger people below the age of 30, especially women, a different vaccine, Channel 4 reports citing two unidentified senior sources.

COVID VACCINE (BBG): Valneva SE plans to start final-phase clinical trials on its Covid-19 vaccine candidate this month, a step forward for a French drugmaker's low-tech shot that's being backed by the U.K. government.The Lyon-based company said Tuesday a phase 1/2 test gave positive results for a high dose. Valneva shares rose as much as 8.4% in early Paris trading.

U.S./E.U./ GLOBAL TAX (BBG): U.S. Treasury Secretary Janet Yellen's comments pushing for a minimum tax are very positive for efforts to strike a global deal on taxation at the end of the first half of the year, a French finance ministry official says. An agreement on both minimum and digital tax at the end of the first half of 2021 at the Organization for Economic Cooperation and Development is possible and France continues to work toward that.

R.B.A.: The Reserve Bank of Australia left all monetary policy settings unchanged Tuesday, including its target for yields on three year Government bonds expiring in April 2024. RBA Governor Philip Lowe said the RBA will consider "later in the year" whether to extend the target to bonds expiring in November 2024, a move which would effectively extend forward guidance on interest rates, which remain at the historic low of 0.1%. Lowe said that with vaccines rolling out, the "central case" for the economic recovery had improved.

U.S. - IRAN (AP): Efforts to bring the United States back into the 2015 deal on Iran's nuclear program are to step up a gear on Tuesday as Iran and the five world powers remaining in the accord meet in Vienna while the U.S. is due to start indirect talks with Tehran.Friday's announcement that Washington and Tehran would begin indirect talks through intermediaries was one of the first signs of tangible progress in efforts to return both nations to the terms of the accord, which bound Iran to restrictions in return for relief from U.S. and international sanctions.

FRANCE (BBG): French Finance Minister Bruno Le Maire says the state will become Air France's biggest shareholder after agreeing on an aid package with the European Commission. Le Maire says France has "definitive" agreement with the Commission on aiding Air France. France will inject as much as 1 billion euros ($1.2 billion) into Air France as part of a capital increase, bringing its stake to a little less than 30% and making the state the largest shareholder, Le Maire says.

GERMANY: German auto makers continued to fill their order books in March, Klaus Wohlrabe, Head of Surveys at ifo said Tuesday, noting that "Spring has arrived for carmakers." Overall, business activity improved among manufacturers and their suppliers, although overall there was less optimism about the coming months than recently, the survey finds.

DATA:

No key data in the European morning session.

FIXED INCOME: Treasuries steady as gilts and Bund sell-off on the open

Treasury futures have given up the gains seen during the Asian session while Bund and gilt futures have sold off this morning on the European open after being closed for the long weekend and catching up with the moves seen on Friday in Treasuries post-payrolls.

- Equities are on the front foot this morning, too, as risk continues to rally as Europe and the UK come back into the office.

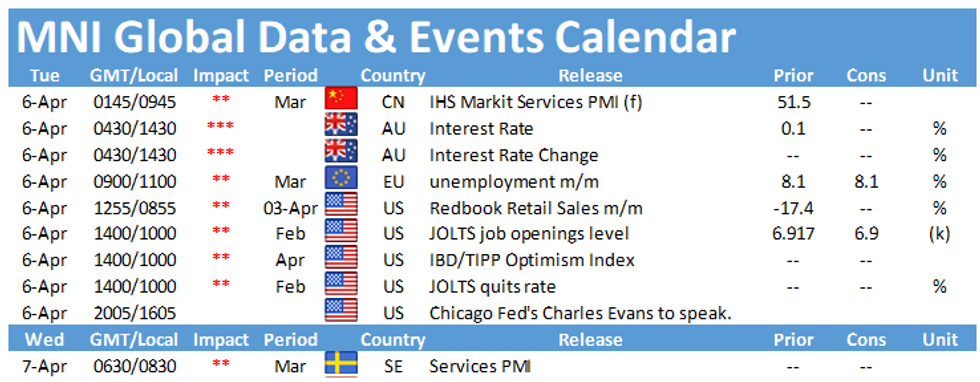

- It's a pretty light data calendar today, with focus turning instead to tomorrow's FOMC Minutes.

- TY1 futures are up 0-1 today at 131-04+ with 10y UST yields up 0.8bp at 1.710% and 2y yields up 0.2bp at 0.169%.

- Bund futures are down -0.48 today at 171.35 with 10y Bund yields up 3.2bp at -0.297% and Schatz yields up 1.0bp at -0.703%.

- Gilt futures are down -0.35 today at 127.72 with 10y yields up 3.3bp at 0.827% and 2y yields up 1.8bp at 0.086%.

FOREX: Dollar Holding Bulk of Monday Losses

- After Monday's weakness, USD is bouncing ahead of Tuesday NY hours, with EUR also gaining. Nonetheless, the greenback is yet to erase Monday's weakness, holding the bulk of the losses. GBP is among the session's poorest performers, although GBP/USD still managed to hit a new April high at $1.3919 before retracing.

- Both AUD & NZD also lag. The RBA rate decision overnight was unchanged - as expected - however the board stressed that they would wait for further signs of economic normalization before making any decisions on forward guidance.

- Stocks hit new alltime highs in early Asia-Pac trade, but are pulling very slightly lower ahead of NY hours. The e-mini S&P is off around 0.2% but remains above the key 4,000 level that was topped late last week.

- There are no major data releases among developed markets Tuesday, with February JOLTs job openings numbers the only notable release. Fed's Barkin is due to take part in an online discussion at 1930BST/1430ET.

EQUITIES: Europe Catches Up With Rally Post-Long Weekend

- Asian stocks closed lower, with Japan's NIKKEI down 392.62 pts or -1.3% at 29696.63 and the TOPIX down 29.2 pts or -1.47% at 1954.34. China's SHANGHAI closed down 1.425 pts or -0.04% at 3482.967.

- European stocks are higher, with the German Dax up 140.65 pts or +0.93% at 15268.07, FTSE 100 up 91.68 pts or +1.36% at 6809.33, CAC 40 up 44.65 pts or +0.73% at 6128.46 and Euro Stoxx 50 up 32.04 pts or +0.81% at 3975.52.

- U.S. futures are a little weaker, with the Dow Jones mini down 28 pts or -0.08% at 33387, S&P 500 mini down 8.25 pts or -0.2% at 4059.5, NASDAQ mini down 44.5 pts or -0.33% at 13541.25.

COMMODITIES: Oil Bounces With Iran Nuclear Talks Eyed Tuesday

- WTI Crude up $1.05 or +1.79% at $59.52

- Natural Gas up $0.04 or +1.59% at $2.545

- Gold spot up $5.78 or +0.33% at $1730.44

- Copper down $4.55 or -1.1% at $408.65

- Silver up $0.13 or +0.52% at $24.9422

- Platinum down $3.18 or -0.26% at $1207.04

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.