-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Eurozone Inflation Jumps To Decade High

EXECUTIVE SUMMARY:

- EUROZONE AUG INFLATION HIGHEST SINCE 2011; FRENCH INFLATION AT 3-YR HIGH

- GERMAN UNEMPLOYMENT RATE FALLS TO LOWEST SINCE MARCH 2020

- EVERGRANDE SAYS IT HAS RISKS OF DEFAULTS ON BORROWINGS

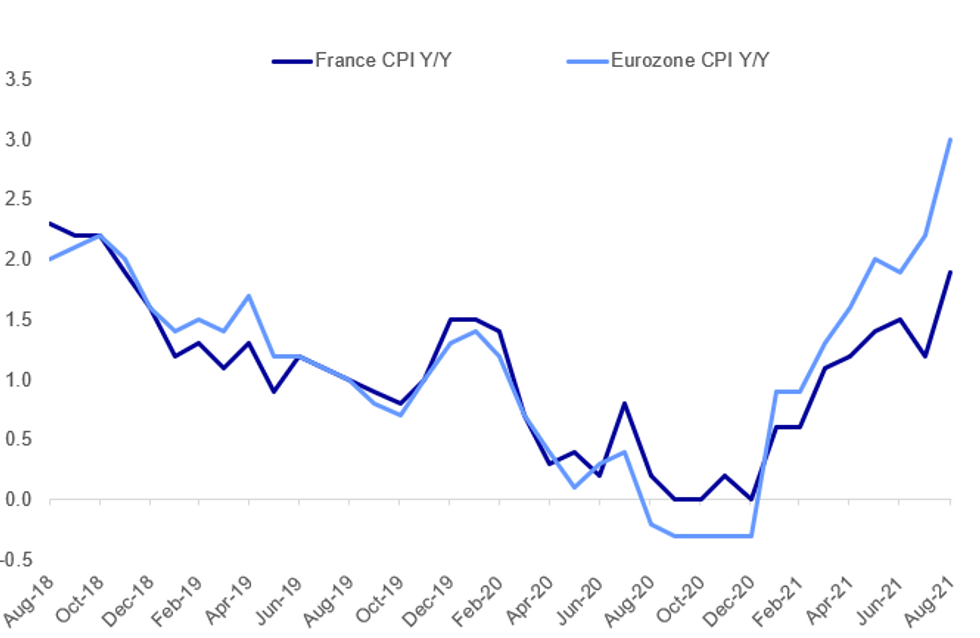

Fig. 1: French And Eurozone Flash August Inflation Exceeds Expectations

Source: Eurostat, Insee, BBG, MNI

Source: Eurostat, Insee, BBG, MNI

NEWS:

FRANCE INFLATION (BBG):French inflation rose to its highest level since late 2018 as food and energy costs accelerated and manufactured goods prices rebounded with the end of the sales season. August's 2.4% year-on-year increase in consumer prices in the euro area's second largest economy is above the European Central Bank's 2% target and also beats the median 2.1% estimate predicted by economists.

CHINA EVERGRANDE (BBG): China Evergrande says it has risks of defaults on borrowings and cases of litigation outside of its normal course of business, according to Hong Kong stock exchange filing.There have been adverse effects on the company's liquidity following negative reports about the company circulating in the market: statement.

U.S.-AFGHANISTAN (BBG): The Taliban called for good ties with the U.S. hours after the last American soldiers flew out of Kabul to end 20 years of war, with the militant group now facing a host of fresh challenges. "The Islamic Emirate wants a good and diplomatic relationship with the Americans," Zabihullah Mujahed, the Taliban's main spokesman, told reporters on Tuesday from the Hamid Karzai International Airport, which was the last place under American control. Key Taliban leaders walked across the tarmac to mark their victory. "We highlight to every occupier that whoever sees Afghanistan with an evil eye will face the same fate as the Americans have faced," he added. "We've never given up to pressure or force, and our nation has always sought freedom."

RUSSIA-U.S.: [RTRS] RUSSIAN FOREIGN MINISTER SAYS NEW ROUND OF TALKS WITH THE U.S. ON NUCLEAR STRATEGIC STABILITY WILL BE HELD IN SEPT - IFAX:This is a positive step for Russia-US relations as the prior meetingestablished constructive foundations for more talks. However, with Biden on the backfoot over the Afghanistan situation - he might like to gain a bit more favour at home by being slightly firmer against Russia.

DATA:

Euro Area inflation surges to near-10-year high

Eurozone HICP surged to an annual rate of 3.0% in August, according to flash data released by Eurostat on Tuesday, far exceeding analysts' expectations of a jump to 2.7% from 2.2% in July.

- That matches the highest rate of inflation since November 2011; inflation hasn't been higher since touching 3.2% in October 2008.

- Energy prices accounted for much of the increase, rising by 1.0% between July and August and by 15.4% over the same month 2020. Excluding energy, food, alcohol and tobacco, core inflation surged to an annual rate of 1.6% from 0.7% in July, but remained below the European Central Bank's 2.0% target.

- The higher-than-expected result follows a string of upside surprises in member-state inflation rates.

- The outturn could lead to some vigorous debate at next week's European Central Bank meeting, with some central bank heads publicly querying the ECB forecast of transient above-target inflation.

ITALY DATA: GDP Confirms 2.7% Q/Q Rise In Q2

Final adjusted 2Q GDP +2.7% q/q (confming prelim. data)

Final adjusted 2Q GDP+17.3% y/y (confming prelim. data)

- Private consumption, cap investment drive 2Q GDP gains-Istat says

- 1Q 2021 real SA WDA GDP +0.2% q/q (revised up), -0.7% y/y (revised up)

- Net exports up +3.2% q/q, imports up +2.3% Q/Q

- Final net domestic demand contributed +3.1 pts to GDP

- Inventory changes subtracted -0.8 pts from GDP

MNI DATA BRIEF: German Unemployment Falls; Jobless Rate Lower

German unemployment retreated by 53,000 in August, exceeding the 40,000 decline forecast by City analysts, following a 90,000 fall in July (originally reported as -91,000). Some 2.538 million people were unemployed in August, down from 2.591 million in July.

That takes the unemployment rate down to 5.5% in August, from a downwardly-revised 5.6% in July (initially reported as 5.7%) and well below the 6.3% touched in the same month of 2020. Vacancies rose by 22,000 last month, extended a 40,000 increase in July.

MNI: FRANCE JUL FLASH HICP +0.7% M/M, +2.4% Y/Y; JUL +1.5% Y/Y

MNI: FRANCE JUL PPI +1.1% M/M, +8.0% Y/Y; JUN +7.2%r Y/Y

FRANCE Q2 FINAL REAL SA GDP 1.1%r Q/Q, +18.7% Y/Y

MNI: FRANCE JUL CONSUMER SPENDING -2.2% M/M, -4.6% Y/Y

Italy Inflation Higher In August

Prel Aug HICP +0.3% m/m, +2.6% y/y (Jul +1.0% y/y)

Main domestic index (NIC) Aug +0.5% m/m, +2.1% y/y (Jul+1.9% y/y)

- Aug core HICP inflation +1.0% y/y vs Jul -0.6% y/y.

- Net-of-energy Aug HICP index +1.0% y/y vs Jul -0.6% y/y

- Flash Aug HICP data provides +1.2% "acquired" inflation.

FIXED INCOME: Bunds lower as HICP higher

Treasuries are flat, Bunds lower while gilts are higher (but only due to a higher open following yesterday's bank holiday).

- The highlight of the morning has been the release of Eurozone CPI. The flash estimate came in above expectations at 3.0%Y/Y (2.7% exp, 2.2% prev) with core CPI also printing higher than expected at 1.6%Y/Y (1.5% exp, 0.7% prev). Bunds fell on the release of the data.

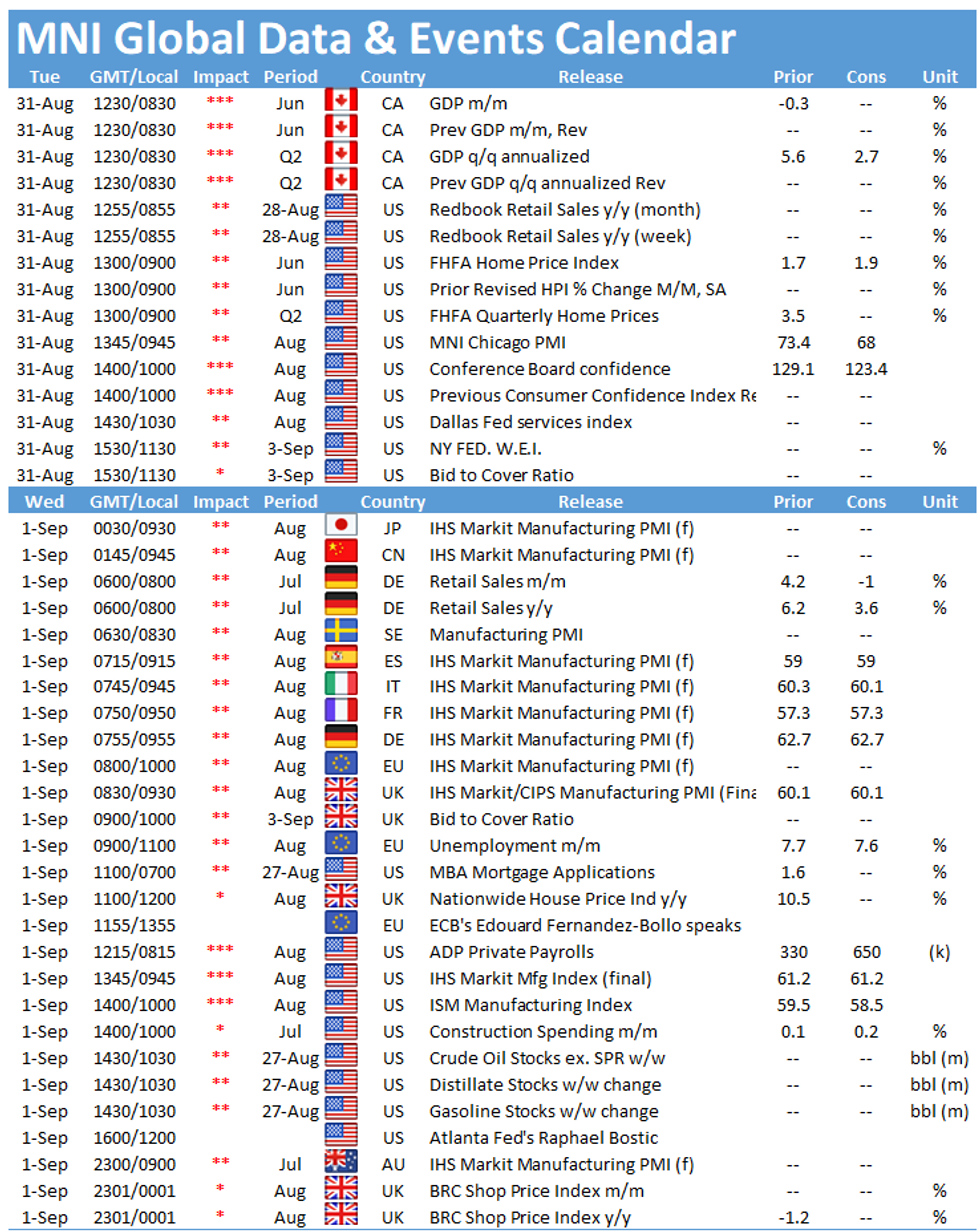

- Looking ahead the highlight will the MNI Chicago Business Barometer and the Conference Board Consumer Confidence data. These data will set the tone ahead of tomorrow's ISM print and payrolls on Friday.

- TY1 futures are down0-0+ today at 134-03+ with 10y UST yields up 0.3bp at 1.284% and 2y yields up 0.2bp at 0.204%.

- Bund futures are down -0.26 today at 176.02 with 10y Bund yields up 2.1bp at -0.420% and Schatz yields up 0.9bp at -0.742%.

- Gilt futures are up 0.20 today at 128.85 with 10y yields down -1.4bp at 0.658% and 2y yields down -0.5bp at 0.186%.

FOREX: Modest USD Weakness Helps Support Equity Uptrend

- The greenback trades weaker, with the minor losses most notable against the antipodean currencies - AUD, NZD are both higher today. Markets have largely shrugged off the poor China data overnight, which showed both the manufacturing and non-manufacturing sectors slowed far faster than forecast.

- The most USD decline comes alongside further equity strength, suggesting the ongoing uptrend in risk appetite is persisting. The e-mini S&P hit a new alltime ahead of the NY crossover today.

- Canadian monthly GDP data crosses later today, with monthly GDP seen bouncing back into positive territory at +0.7%, although still insufficient to prevent a slowdown in Y/Y growth - seen edging down to +8.8% from +14.6% previously.

- The data comes as USD/CAD continues to exhibit bearish technical signals, after the Aug 20 price pattern was a bearish shooting star candle. An extension lower would expose 1.2526, the 50-day EMA.

- The MNI Chicago Business Barometer is the data highlight, with markets expecting a slowdown to 68.0 from July's 73.4.

EQUITIES: U.S. Futures Pointing To New Highs Yet Again

- Asian stocks closed higher, with Japan's NIKKEI up 300.25 pts or +1.08% at 28089.54 and the TOPIX up 10.56 pts or +0.54% at 1960.7. China's SHANGHAI closed up 15.789 pts or +0.45% at 3543.94 and the HANG SENG ended 339.45 pts higher or +1.33% at 25878.99.

- European equities are mixed but mostly higher, with the German Dax up 83.64 pts or +0.53% at 15887.31, FTSE 100 down 12.48 pts or -0.17% at 7148.01, CAC 40 up 0.83 pts or +0.01% at 6687.3 and Euro Stoxx 50 up 15.67 pts or +0.37% at 4198.8.

- U.S. futures are in fresh record territory, with the Dow Jones mini up 63 pts or +0.18% at 35415, S&P 500 mini up 9.75 pts or +0.22% at 4535, NASDAQ mini up 49.5 pts or +0.32% at 15647.

COMMODITIES: Oil Retreats As Hurricane Damage Assessed

- WTI Crude down $0.79 or -1.14% at $68.61

- Natural Gas up $0 or +0.05% at $4.322

- Gold spot up $3.84 or +0.21% at $1815.69

- Copper down $1.2 or -0.27% at $437.75

- Silver up $0.06 or +0.27% at $24.1485

- Platinum up $0.5 or +0.05% at $1012.76

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.