-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI US Open: Fed's Hawkish Turn Still Being Digested

EXECUTIVE SUMMARY:

- REBUKES FOR MACRON AND LE PEN AS FRENCH VOTERS AVOID 1ST ROUND OF REGIONAL ELECTIONS

- SWEDEN SINKS INTO POLITICAL CHAOS AS P.M. LOSES CONFIDENCE VOTE

- CHINA ASKS BANKS, ALIPAY NOT TO INVOLVE IN CRYPTO OPERATIONS

- E.U. SET TO APPROVE MORE BELARUS SANCTIONS OVER RYANAIR FLIGHT

Fig.1: Spread Of Treasury Yields Over Bunds Continues To Narrow

Source: BBG, MNI

Source: BBG, MNI

NEWS:

FRANCE (MNI POLITICS): Both President Emmanuel Macron's Republique En March (REM) and Marine Le Pen's right-wing nationalist National Rally (RN) performed well below expectations in the first round of elections for France's regional presidencies held on Sunday according to preliminary results. The outperformers were France's historically dominant political groups, the centre-right Gaullist Les Republicains (LR) and their allies, and the centre-left Socialist Party (PS) and their allies.

- The RN came in first place in the first round in only one province, Provence-Alpes-Côte d'Azur in the far south-east of the country. This compares starkly with the last regional elections held in 2015, when the then-National Front came first in six regions in the first round vote.

- REM and its allies are not leading in any regions, and in the north eastern Hauts-de-France region the party looks set to fail to make the second round (where winning just 10% of the vote is required).

- Alongside the poor performance of the two parties expected to make it through to the second round of the presidential election in 2021, the major story of the election was the poor turnout. Initial estimates put turnout at just 32%, well down on the 49% recorded in 2015 and 53% in 2010. LR and PS were able to exploit this low turnout in their historic heartlands to secure victories in areas where they are incumbents heading into the second round.

- Focus this week will turn to moderate parties that came in third place or below in the first round. Many will be under pressure to withdraw from the second round and lend their support to other moderates in order to keep the RN candidate from winning power, although there is no guarantee such an agreement will take place.

SWEDEN (BBG): Sweden's Prime Minister Stefan Lofven lost a confidence vote in parliament, toppling his minority coalition and plunging the largest Nordic economy into political chaos.Lofven now has a week to decide whether to call snap elections. He's due to hold a press conference at 11:30 a.m. local time. If Swedes are forced to head to the polls early, it would be the first time since 1958. If Lofven doesn't call a snap election, the speaker of parliament will ask the biggest parties to try to form a new government.

CHINA/CRYPTOCURRENCY (BBG): China's PBOC has recently summoned Alipay and several local banks over providing services to virtual currency tradings, according to a statement.

E.U.-BELARUS (BBG): European Union governments are set to sanction several sectors of Belarus's economy including industries connected to the soil nutrient potash and petroleum, as well as 86 individuals and entities, as the bloc increases pressure on President Alexander Lukashenko.Josep Borrell, the EU's foreign policy chief, said foreign ministers meeting in Luxembourg on Monday will approve the measures targeting people and companies and discuss a separate package of economic sanctions which will be presented to EU leaders at a summit later this week.The economic sanctions "will affect sectors of the Belarusian economy which are directly linked to exports," Borrell told reporters on his way into the meeting. "Sanctions are a way of putting pressure on the government of Belarus, and these are going to hurt the economy of Belarus, heavily."

HONG KONG / COVID (BBG): Hong Kong will shorten hotel quarantine to seven days for fully vaccinated residents traveling from most places, as well as non-residents inoculated against Covid-19, in its most significant move yet to ease one of the strictest border curbs in the world.The keenly anticipated moves are part of a broader loosening of restrictions announced by Chief Executive Carrie Lam at a briefing Monday, which she said was a symbolic day as it marked two weeks without any new local coronavirus cases. Other plans include lifting capacity restrictions at some restaurants and swimming pools.The shortening of hotel quarantine will begin on June 30 and apply for Hong Kong residents, Lam said, adding that non-residents could be eligible within a month from that date. At present, travelers are required to serve mandatory hotel quarantine of up to 21 days.

EUROZONE: Euro area house prices grew at their fastest rates since mid-2007, according to the June edition of the European Central Bank's Economic Bulletin, with growth hitting 5.8% in the last quarter of 2020 compared with 4.3% at the end of 2019. By contrast, house prices contracted during both the financial crisis of 2008 and the 2010 sovereign debt crisis.

EUROZONE: Europe's current account surplus narrowed from 2.3% to 2.2% of GDP between 2019 and 2020, the European Central Bank's latest Economic Bulletin shows, although a sharp drop in nominal GDP as a result of the Covid-19 pandemic and lockdown restrictions saw its real value fall from EUR 280 billion to EUR 250 billion.

FIXED INCOME: Already looking ahead to later in the week

Core fixed income is off the highs seen in the Asian session and on the European open but Treasuries and gilts are still a bit higher than Friday's close (Bunds largely unch).

- There's a lighter calendar to start the week today but there are some big events to look ahead to this week. Eurozone PMI data on Wednesday, the German IFO and US durable goods orders/claims on Thursday and US personal income/spending are the highlights on the data calendar.

- On top of this we have the Bank of England MPC meeting this week, with the decision and MPS due to be published on Thursday. There is little expectation of any policy change, or change to the 8-1 vote to keep the APF intact (Haldane is again expected to vote to lower the target). The Bank is expected to acknowledge the better than expected growth data and higher-than-expected inflation but to also point to higher uncertainty.

- Peripheral bond spreads are tighter this morning.

- TY1 futures are up 0-5+ today at 132-15+ with 10y UST yields down -0.7bp at 1.433% and 2y yields up 0.2bp at 0.257%.

- Bund futures are down -0.10 today at 172.50 with 10y Bund yields up 0.3bp at -0.199% and Schatz yields up 0.3bp at -0.668%.

- Gilt futures are up 0.07 today at 127.76 with 10y yields down -0.1bp at 0.750% and 2y yields up 2.0bp at 0.145%.

FOREX: Extended Fed Reaction Continues to Roil Markets

- The extended reaction to last week's Fed rate decision continues to roil markets, with further US curve flattening keeping asset markets on their toes. The US dollar is edging off its recent highs, allowing the likes of EUR/USD and GBP/USD to recover off the lows printed late last week. The moves this morning, however, look corrective in nature, with the technical outlook still in favour of further greenback gains.

- As a result, the dollar is among the weakest in G10, with last week's hardest hit currencies, namely AUD, NZD and GBP, among Monday's best performers.

- Equity markets started the week poorly, but have undergone a decent reversal, with the e-mini S&P back in positive territory ahead of the Monday bell and indicating a stronger open.

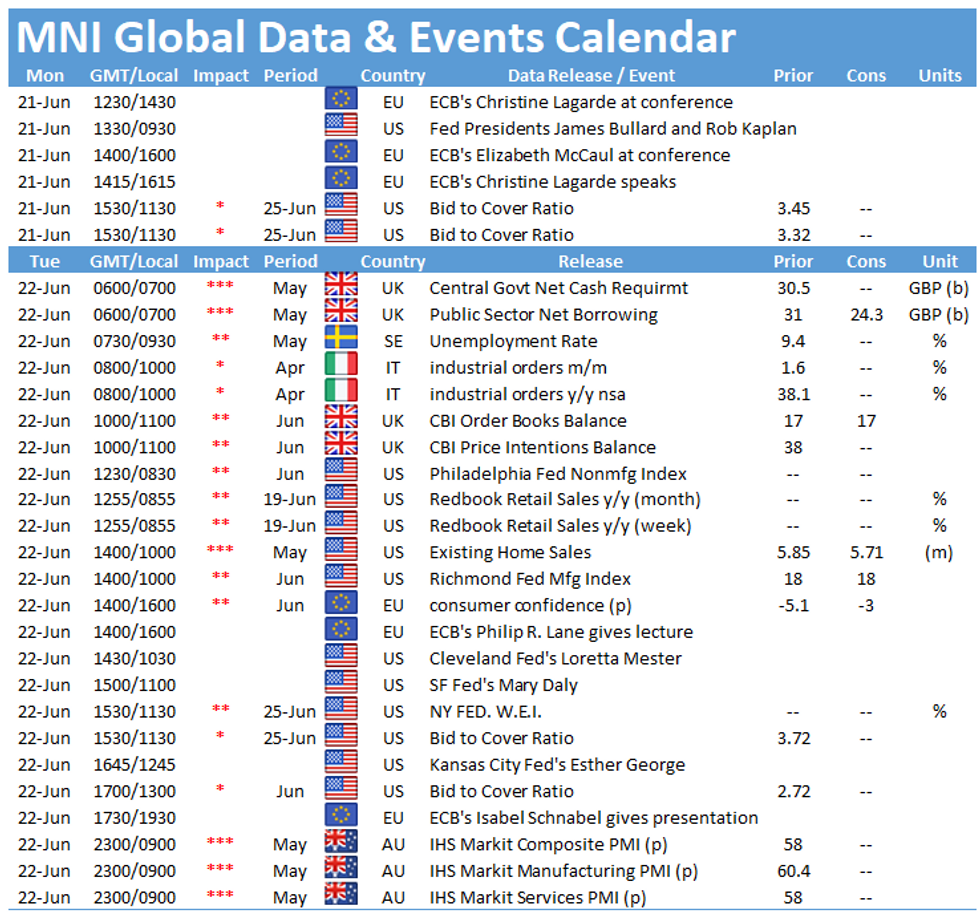

- Tier one data releases are few and far between Monday, with Chicago Fed National Activity Index the sole release of note. Central bank speak may be of more consequence, with ECB's Lagarde on the docket (she speaks after the ECB met to discuss their policy strategy review this weekend) as well as Fed's Bullard, Kaplan and Williams.

EQUITIES: Futures Clawing Back Some Of Last Week's Lost Ground

- Asian stocks closed mostly weaker, with Japan's NIKKEI down 953.15 pts or -3.29% at 28010.93 and the TOPIX down 47.11 pts or -2.42% at 1899.45. China's SHANGHAI closed up 4.086 pts or +0.12% at 3529.183 and the HANG SENG ended 312.27 pts lower or -1.08% at 28489.

- European equities are mixed, with the German Dax up 32.83 pts or +0.21% at 15448.04, FTSE 100 down 7.39 pts or -0.11% at 7017.47, CAC 40 down 13.56 pts or -0.21% at 6569.16 and Euro Stoxx 50 up 5.41 pts or +0.13% at 4083.37.

- U.S. futures are higher, with the Dow Jones mini up 135 pts or +0.41% at 33289, S&P 500 mini up 14 pts or +0.34% at 4167.25, NASDAQ mini up 63 pts or +0.45% at 14095.75.

COMMODITIES: Precious Metals Gain With Dollar Slightly Softer

- WTI Crude up $0.2 or +0.28% at $71.64

- Natural Gas down $0.03 or -0.84% at $3.186

- Gold spot up $21.11 or +1.2% at $1779.24

- Copper down $3.5 or -0.84% at $411.05

- Silver up $0.26 or +1% at $25.9935

- Platinum up $0.38 or +0.04% at $1039.46

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.