-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Focus On European Supply (Vaccines And Bonds)

EXECUTIVE SUMMARY:

- GERMAN HEALTH MINISTER DENIES REPORT OF LOW EFFICACY OF ASTRAZENECA VACCINE

- ITALY PM CONTE TO MEET PRESIDENT AT 12PM C.E.T. TO RESIGN

- MNI FED PREVIEW - TAPER TALK LOOKS PREMATURE

- E.U. BONDS SPUR RECORD MONTH FOR EUROPE PUBLIC-SECTOR DEBT SALES

- RBNZ TO TAPER QE THIS YEAR, EX-OFFICIAL SAYS (MNI INTERVIEW)

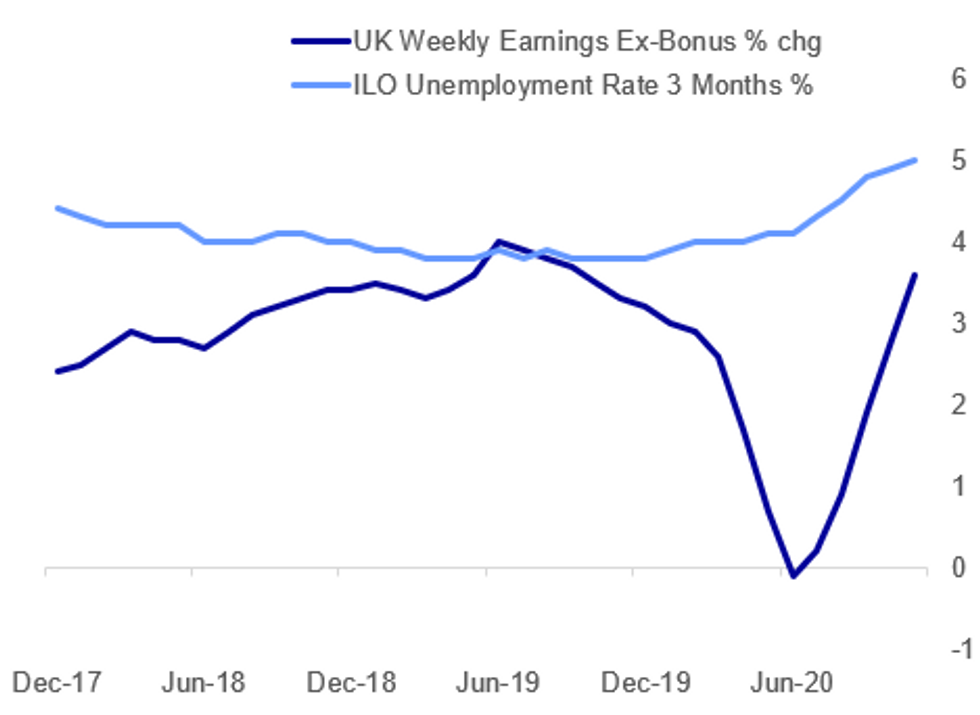

Fig. 1: U.K. Employment Earnings Accelerate

ONS, BBG, MNI

ONS, BBG, MNI

NEWS:

GERMANY/COVID: Alex Wickham at Politico tweets: "The German Health Ministry has DENIED the Handelsblatt report claiming the AstraZeneca had only 8% efficacy for over-65s. They say there has been confusion and 8% actually refers to the number of people in the study between 56 and 69 years old." The denial comes after a bombshell article from German outlet Handelsblatt last night, which claimed that according to a German Health Ministry study, the AstraZeneca/Oxford University COVID-19 vaccine was only 8% effective for the over-65's. This sparked immediate and angry rebukes from AstraZeneca as well as the UK gov't. Politico this morning quotes a 'Whitehall insider' accusing the German press of 'Russian-style disinformation'.

E.U./COVID (RTRS): Manufacturers of COVID-19 vaccines must honour their delivery obligations, European Commission President Ursula von der Leyen said, adding that Brussels would establish a mechanism to monitor vaccine exports from the bloc.Astrazeneca told the EU last week that it could not meet agreed supply targets by the end of March."Europe invested billions to help develop the world's first COVID19 vaccines. To create a truly global common good. And now, the companies must deliver. They must honour their obligations," the head of the EU executive said at a virtual meeting of the World Economic Forum."This is why we will set up a vaccine export transparency mechanism. Europe is determined to contribute. But it also means business," von der Leyen added.

ITALY (PTI): Italian Premier Giuseppe Conte was meeting Tuesday with his cabinet before heading to the presidential palace to offer his resignation after a key coalition ally pulled his party's support over Conte's handling of the coronavirus pandemic.Conte is hoping to get President Sergio Mattarella's support for forming a new coalition government that can steer the country through the pandemic, economic recession and a spending plan for 209 billion euros in European Union recovery funds.

MNI FED PREVIEW: The main talking point for Federal Reserve watchers in January has been the Fed's tapering intentions, and expectations for the timing of a taper are beginning to subtly shift forward. We have seen sell-side analysts increasingly eye end-2021 for a potential taper alongside upgrades to inflation and growth forecasts since the beginning of the year. And some FOMC participants have openly speculated that a taper by end-2021 is possible. But Chair Powell and other key Fed members have batted away speculation of such an early taper, and absent extraordinary upside surprises in the labor market and inflation, the Fed will almost certainly remain cautious on tapering for the next few FOMC meetings at least. For full preview please see the following link: https://marketnews.com/mni-fed-preview-january-202...

UK DATA: Employment rose in December for the first time since Covid-19 ravaged the economy, but redundancies also hit a record high, providing further evidence of the split in UK employment, with lower-paid jobs most likely to be cut, data released on Tuesday by the Office for National Statistics showed. Employment picked up by 52,000 between November and December, according to PAYE data compiled by HMRC, leaving employment down by 828,000 since March and by 793,000 over the same period of last year. This RTI series is derived from average job losses over the calendar month. That is the first rise since February, although the series has been subject to heavy revision; employment fell by a revised 57,000 in November, compared to the originally-reported 28,000 drop. According to the Labour Force Survey, employment declined by 88,000 in the three months to November, better than the forecast of a 104,000 fall, and the smallest three-month decline since the start of the pandemic. That lifted the unemployment rate to 5.0%, the highest since the three months to August 2016, although analysts expected a larger rise to 5.1%.

EUROPE BOND ISSUANCE (BBG): Europe's primary bond market is set for a record month for public-sector deals, after the European Union extended a Covid-stoked flood of government and agency issuance. The trade bloc will price 14 billion euros ($17 billion) of notes on Tuesday in a two-part deal under an employment program known as Sure. The social bonds will help push Europe's syndicated public-sector sales for the month to about 124 billion euros, exceeding April's record of 122.9 billion euros, according to data compiled by Bloomberg.

RBNZ (MNI INTERVIEW): The Reserve Bank of New Zealand will taper its quantitative easing programme this year as house prices hit record levels, its former assistant governor and chief economist told MNI, adding that the economic recovery means zero or negative official interest rates are now highly unlikely. For full interview contact sales@marketnews.com

BOJ: Japan's fiscal situation is 'extremely severe' and the government needs to ensure sustainability, Bank of Japan Governor Haruhiko Kuroda told lawmakers on Tuesday. However, Kuroda again underlined that the central bank continues to buy huge amounts of JGBs, but the purchases are aimed at achieving the 2% price target and aren't fiscal financing.

GERMANY: Germany's exports improved in January, with the Ifo Institute's export index rising to 6.0, up from 1.9 in December, indicating increased optimism at the start of the year. This marks the highest level since October, with the uptick mainly driven by more clarity regarding Brexit, U.S. elections, a robust industrial economy and the start of the vaccination campaigns.

FIXED INCOME: Heavy European supply; Italian politics and tomorrow's Fed meeting

After yesterday's risk-off moves, we have retraced around a quarter to a third of yesterday's move higher in core fixed income. Equities have also moved to the front foot.

- It has been a heavy morning for European supply again with the highlight a E14bln dual-tranche syndicated offering of EU SURE bonds with the Netherlands, Italy and the UK all coming to market today.

- There has been continued focus on Italian politics with Prime Minister Conte set to resign and seek a mandate from President Mattarella to try and form a new coalition.

- The market will continue to look ahead to tomorrow's FOMC meeting where the FOMC is likely to use the January meeting to reflect on developments over the previous six weeks and assess how they may impact the medium-term economic and monetary policy outlook. See our Fed preview for more.

- TY1 futures are down -0-1+ today at 137-10+ with 10y UST yields up 1.5bp at 1.046% and 2y yields unch at 0.122%.

- Bund futures are down -0.14 today at 177.69 with 10y Bund yields up 0.8bp at -0.543% and Schatz yields up 0.4bp at -0.727%.

- Gilt futures are down -0.18 today at 134.55 with 10y yields up 1.7bp at 0.278% and 2y yields up 0.5bp at -0.135%.

FOREX: USD Creeping Higher, But Progress is Slow

The greenback is the strongest performer in G10 early Tuesday, but progress is slow. EUR/USD came under early pressure, touching new weekly lows of $1.2108, but the pair has recovered since. Italian political wrangling continues to garner focus, with the Italian PM Conte today handing in his resignation in an attempt to kickstart the process of negotiating support for a new coalition.

Despite the Italian uncertainty, EUR is faring well, rising against most others. NZD also trades well, with the currency seeing some support on the back of an MNI interview with RBNZ former Chief Economist, who said he sees the RBNZ tapering their QE programme this year.

Focus today turns to US consumer confidence numbers for January and speeches scheduled from ECB's Centeno and de Cos. Earnings season resumes, with Johnson & Johnson, 3M, Microsoft and Verizon.

EQUITIES: European Stocks Bouncing From Session Lows

- Asian stock markets closed lower, with Japan's NIKKEI down 276.11 pts or -0.96% at 28546.18 and the TOPIX down 14 pts or -0.75% at 1848. China's SHANGHAI closed down 54.809 pts or -1.51% at 3569.429 and the HANG SENG ended 767.75 pts lower or -2.55% at 29391.26

- European equities are bouncing from earlier lows, with the German Dax up 197.99 pts or +1.45% at 13712.18, FTSE 100 up 37.17 pts or +0.56% at 6638.85, CAC 40 up 52.64 pts or +0.96% at 5472.36 and Euro Stoxx 50 up 38.7 pts or +1.09% at 3565.55.

- U.S. futures are a little lower, with the Dow Jones mini down 13 pts or -0.04% at 30855, S&P 500 mini down 5.5 pts or -0.14% at 3843, NASDAQ mini down 34.5 pts or -0.26% at 13441.

COMMODITIES: Copper Recedes

- WTI Crude up $0.19 or +0.36% at $52.71

- Natural Gas up $0.07 or +2.81% at $2.683

- Gold spot down $2.63 or -0.14% at $1852.68

- Copper down $4.15 or -1.14% at $359.5

- Silver up $0.07 or +0.27% at $25.423

- Platinum down $11.91 or -1.08% at $1090.9

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.