-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: FOMC, Brexit, PMIs, Fish...

EXECUTIVE SUMMARY:

- FISHERIES MAIN PROBLEM IN EU-UK TRADE TALKS NOW, EU REJECTS UK OFFER OF PHASED ACCESS TO UK WATERS OVER THREE YEARS - EU OFFICIAL - Reuters

- FOMC IS LIKELY TO ADOPT NEW ASSET PURCHASE GUIDNACE BUT FALL SHORT OF ADJUSTING ITS PROGRAMME IN EITHER SCOPE OR SIZE - MNI Markets Preview.

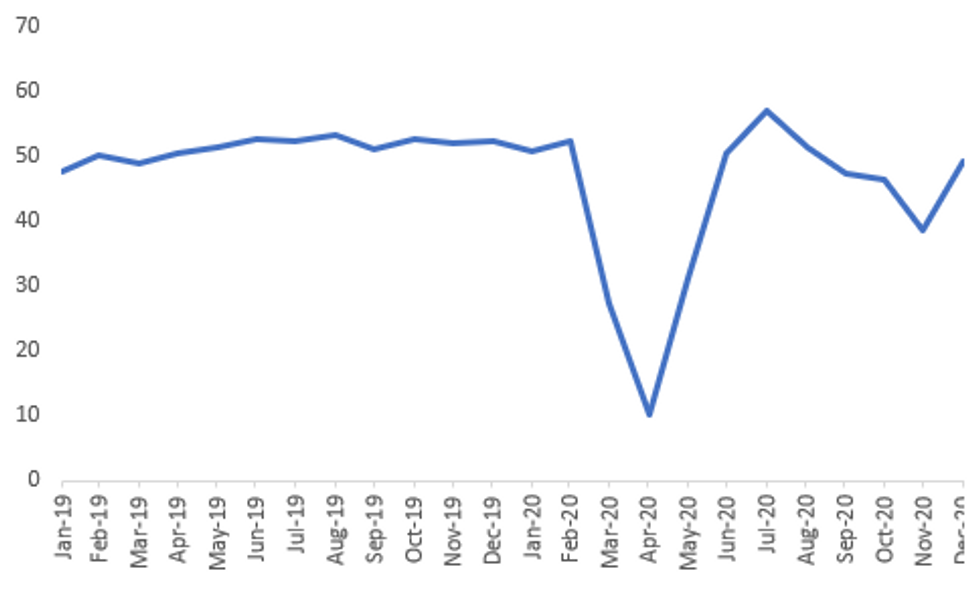

- EUROZONE PMIs (PARTICULARLY SERVICES) BEAT EXPECTATIONS - LED BY FRANCE

- UK INFLATION SOFTER THAN EXPECTED DRIVEN BY FALLING PRICES FOR CLOTHING, FOOTWEAR AND FOOD

Fig 1. French Services PMI Almost Back to 50

Source: MNI, Bloomberg

NEWS:

MNI FEDERAL RESERVE PREVIEW: The FOMC is likely to adopt new guidance on asset purchases at the December FOMC, but will fall short of adjusting its purchase program in either scope or size, preferring to wait for further clarity over the outlook before taking such a step. While an increase in the weighted average maturity of the Fed's asset purchases is not the consensus outcome from this meeting, it is expected by some market participants – setting up the potential for a mildly hawkish disappointment on Wednesday. Full preview here.

BREXIT: Agreeing fishing rights is the main sticking point now in EU-UK trade talks, an official in the bloc's hub Brussels said on Wednesday. They spoke after EU chief executive said EU and UK negotiators agreed on the so-called non-regression clause, advancing on one of the most contentious issues in the negotiations related to safeguarding economic fair play - Reuters

UK DATA: Annual headline inflation ticked down to 0.3% in Nov, falling short of market expectations of a small downtick to 0.6%. This marks the 16th reading below the BOE 2% target. Core inflation eased to 1.1% in Nov, the lowest level since Aug and below market forecasts for a 1.4% gain. Nov's downtick was mainly driven by falling prices for clothing and footwear as well as food prices due to tighter restrictions across the UK. Clothing and footwear prices fell 3.6% on an annual basis, shaving off 0.24pp of price growth. The ONS said an increase of price discounting is observable in the dataset and Black Friday sales were more spread out than usual this year. They further noted that prices for clothing usually increase at this time of the year in contrast to Nov's m/m decline of 2.7%, signalling a distortion of seasonal patterns. Food prices showed the second largest negative contribution to price growth, subtracting 0.11pp from CPI. Output inflation fell by 0.8%, while input inflation declined by 0.5%, a 10th consecutive negative reading. Again, petroleum products and crude oil was the largest downward contribution to output and input inflation.

COVID VACCINATIONS: The UK's minister in charge of vaccinations Nadhim Zahawi tweets: "A really good start to the vaccination program. It's been 7 days and we have done: England: 108,000, Wales: 7,897, Northern Ireland: 4,000, Scotland: 18,000 ,U.K Total 137,897. That number will increase as we have operationalised hundreds of PCN (primary care networks)." Due to the nature of how the vaccinations are recorded by the NHS, it seems that the figures on how many people have been vaccinated will come on a weekly, rather than a daily basis (at least for the time being). If this speed of vaccination is maintained, it will take 112.4 weeks (just over two years) to give the entire UK population over the age of 60 (who are deemed to be of the highest risk), not including frontline NHS workers or care home staff, their first jabs (two doses are required for immunity). However, as the minister states, the weekly vaccination rate is likely to rise as more care networks are brought online for the rollout of the vaccine, and indeed as more vaccines are approved by the MHRA. The only vaccine currently in use, from Pfzier/BioNTech is also likely to experience the slowest rollout, given that it needs to be kept below -70 degrees Celsius, compared to those from Moderna and AstraZeneca/Oxford University that can be kept in normal freezers or fridges (MNI Political Risk).

MNI NORGES BANK PREVIEW: This makes the Bank's September assumptions well out of date. In their most recent monetary policy report they wrote: "If a vaccine is found quickly, growth will likely turn out higher than currently projected." As such, it seems likely a positive revision will be made to both growth and inflation projections this month, both of which will add upward pressure to the rate path. Full preview here.

MNI SNB PREVIEW: Downside pressure on EUR/CHF has alleviated and EUR rates markets are signalling little chance of a further cut to the ECB's deposit rate, lessening the pressure on the SNB to take any near-term policy action to maintain the rate differential. Throughout 2020, the Bank have made clear that they still have room to manoeuvre on interest rates. But, it's clear that – for the time being - this suite of tools has succeeded in containing financial market fragmentation. As such, the Bank will likely reaffirm their vigilance this quarter, stressing that the CHF is "even more highly valued", but decline to cut rates or expand their current toolkit amid a calmer market outlook. Full preview here.

DATA:

UK DATA:

UK NOV CPI -0.1% M/M, +0.3% Y/Y VS +0.7% Y/Y OCT

UK NOV CORE CPI -0.1% M/M, +1.1% Y/Y VS +1.5% Y/Y OCT

UK NOV RPI +0.9% Y/Y; OCT +1.3% Y/Y

UK NOV OUTPUT PPI +0.2% M/M, -0.8% Y/Y VS -1.4% Y/Y OCT

UK NOV INPUT PPI +0.2% M/M, -% Y/Y VS -0.5% Y/Y OCT

EUROZONE DATA:

EZ OCT SA TRADE BALANCE +EUR25.9 BN; SEP +EUR23.7 BN

EZ OCT EXPORTS +2.1% M/M SA, -9.0% Y/Y NSA

EZ OCT IMPORTS +1.0% M/M SA, -11.7% Y/Y NSA

EZ OCT CONS OUTPUT +0.5% M/M, -1.4% Y/Y; SEP -2.7% M/M

PMI DATA:

FRANCE FLASH DEC MFG PMI 51.1; NOV 49.6

FRANCE FLASH DEC SERVICES PMI 49.2; NOV 38.8

FRANCE FLASH DEC COMPOSITE PMI 49.6; NOV 40.6

GERMANY FLASH DEC MFG PMI 58.6; NOV 57.8

GERMANY FLASH DEC SERVICES PMI 47.7; NOV 46.0

GERMANY FLASH DEC COMP PMI 52.5; NOV 51.7

EZ FLASH DEC MFG PMI 55.5; NOV 53.8

EZ FLASH DEC SERVICES PMI 47.3; NOV 41.3

EZ FLASH DEC COMPOSITE PMI 49.8; NOV 45.3

UK FLASH DEC MFG PMI 57.3; NOV 55.6

UK FLASH DEC SERVICES PMI 49.9; NOV 47.6

UK FLASH DEC COMPOSITE PMI 50.7; NOV 49.0

BOND SUMMARY: A busy morning session

A busy early morning session for EGBs, with elevated volumes noted in the longer end (Bund).

- German curve took its cue from the French, German and EZ PMIs beat.

- Curve is bear steeper as the long end comes under pressure and the Bund contract is down 42 ticks at the time of typing.

- 5/30s trades at the high of the session.

- Peripherals are lower too, but at a slower pace, translating in tighter spreads against German 10s.

- Greece leads at 2.3bps.

- Gilts have traded inline with EGBs, with the long end underperforming on Brexit hopes, pushing the curve bear steeper, and 5/30s at the high of the session.

- US treasuries continue to trade in a tight range with investors awaiting news on US stimulus and the FOMC.

- Looking ahead, US Retail sales and PMI are the notable data. Speakers sees ECB Guindos, de Cos, Schnabel and Weidmann.

- ALL EYES on Brexit, US stimulus and especially the Fed.

- TY1 futures are unch today at 137-27 with 10y UST yields up 1.0bp at 0.920% and 2y yields up 0.4bp at 0.120%.

- Bund futures are down -0.39 today at 177.88 with 10y Bund yields up 2.3bp at -0.589% and Schatz yields up 1.2bp at -0.754%.

- Gilt futures are down -0.30 today at 134.46 with 10y yields up 2.5bp at 0.284% and 2y yields up 1.0bp at -0.53%.

FOREX SUMMARY

FX took its cue from Risk, Brexit hope and the European PMIs release.

- The beat in the French, German and EC PMI saw Estoxx and the EUR rally.

- The push higher in risk spilled over into the USD, and the Greenback saw broad base selling.

- EURUSD rallied above 1.2200 and the pair is now at its highest since April 2018.

- EURUSD printed a 1.2212 high, just short of MNI tech next resistance at 1.2222 1.500 proj of the Nov 4 - 9 rally from the Nov 11 low.

- GBP is also trading on the front foot, on Brexit hopes, but the risk on tone and USD selling got Cable above the 1.3500 handle.

- Cable now targets the December high at 1.3539 (managed 1.3521 high this morning), which will also be the highest level since May 2018.

- Brexit comment this morning; VDL:" Governance issue largely resolved, but still Fisheries and level playing field left"

- USD trade in the red against all major, besides the CAD, up 0.23%.

- Looking ahead, US Retail sales and PMI are the notable data.

- We also get few more speakers including ECB Guindos, de Cos, Schnabel and Weidmann.

- Nonetheless, ALL EYES are on Brexit, US stimulus and especially the Fed.

EQUITIES: Most stock markets higher this morning

- Japan's NIKKEI up 69.56 pts or +0.26% at 26757.4 and the TOPIX up 4.78 pts or +0.27% at 1786.83

- China's SHANGHAI closed down 0.25 pts or -0.01% at 3366.983 and the HANG SENG ended 253 pts higher or +0.97% at 26460.29

- The German Dax up 216.32 pts or +1.62% at 13587.08, FTSE 100 up 61.13 pts or +0.94% at 6572.26, CAC 40 up 44.52 pts or +0.81% at 5573.07 and Euro Stoxx 50 up 33.87 pts or +0.96% at 3558.2.

- Dow Jones mini up 73 pts or +0.24% at 30279, S&P 500 mini up 10.5 pts or +0.28% at 3705.75, NASDAQ mini up 41.25 pts or +0.33% at 12637.

COMMODITIES: Weak dollar benefitting commodities; silver leading the way

- WTI Crude up $0.13 or +0.27% at $47.77

- Natural Gas down $0.04 or -1.31% at $2.647

- Gold spot up $8.82 or +0.48% at $1862.26

- Copper up $2.1 or +0.59% at $356.55

- Silver up $0.65 or +2.67% at $25.1466

- Platinum up $9.38 or +0.9% at $1050.01

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.