-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: FOMC Takes Centre Stage

MNI US Open: FOMC Takes Centre Stage

HIGHLIGHTS

- Focus today is on the upcoming FOMC meeting, which comes amid surging inflation

- US and Russian presidents meet today with expectations running low

- Israel launches airstrikes on the Gaza Strip in response to incendiary balloons

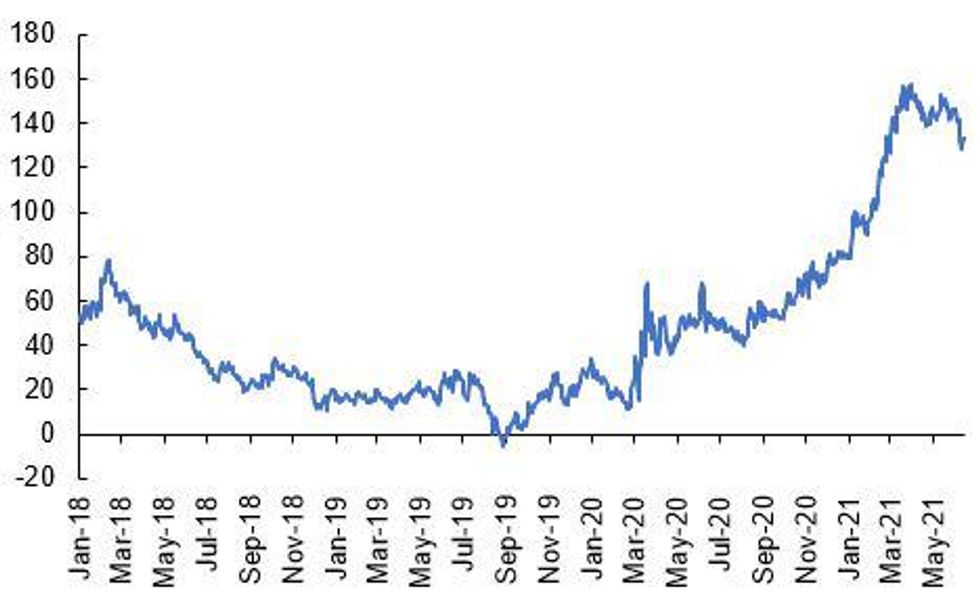

Source: MNI, Bloomberg

NEWS

US-RUSSIA (REUTERS): U.S. President Joe Biden and Russian President Vladimir Putin square up on Wednesday for their first meeting since Biden took office with deep disagreements likely and expectations low for any breakthroughs. Both have said they hope their talks in a lakeside Geneva villa can lead to more stable and predictable relations, even though they remain at odds over everything from arms control and cyber-hacking to election interference and Ukraine. "We're not expecting a big set of deliverables out of this meeting," a senior U.S. official told reporters aboard Air Force One as Biden flew to Geneva, saying the two are expected to talk for four or five hours starting at around 1.30 p.m. (1130 GMT). "I'm not sure that any agreements will be reached," said Putin's foreign policy adviser Yuri Ushakov.

ISRAEL-PALESTINE (GUARDIAN) : Israel has launched airstrikes on the Gaza Strip, the first since a truce ended 11 days of conflict last month, in response to incendiary balloons launched from the Palestinian territory. The flare-up in violence, a first test for Israel's new government sworn in three days ago, followed a march in East Jerusalem on Tuesday by Jewish nationalists that had drawn threats of action by Hamas, the ruling militant group in Gaza. The Israeli military said its aircraft attacked Hamas armed compounds in Gaza City and the southern town of Khan Younis in the early hours of Wednesday, and was "ready for all scenarios, including renewed fighting in the face of continued terrorist acts emanating from Gaza".

UK (BLOOMBERG): One in five jobs based in the U.K. could be outsourced to other countries in the wake of the coronavirus pandemic, threatening the loss of well-paid white collar employment. That's according to the Tony Blair Institute for Global Change, which warned that 5.9 million "anywhere" workers -- from graphic designers to software programmers -- are at risk, many of them in London and southeast England. "If left unaddressed, the outsourcing and offshoring of these roles would have political, economic and social consequences similar to the loss of manufacturing jobs in the 1970s, but on an accelerated time frame," the research group said in a report published Wednesday.

FIXED INCOME: Focus on the Fed

Bund futures are only marginally changed this morning as the market looks ahead to the FOMC meeting later today.

- As we point out in the MNI Fed Preview, the FOMC is likely to begin "talking about talking" about tapering at its June meeting but Chair Powell will make clear that the FOMC is not yet ready to move any further than that on reducing asset purchases. The 2023 Fed funds rate dots in the SEP are likely to show further support for a hike, with a good chance the median rises. The outlook for "transitory" inflation will also be eyed in the projections. The Fed is likely to hold off on tweaking the IOER and ON RRP rates (though prevailing analyst consensus is that this is a very close call).

- Gilts opened a bit weaker this morning after strong inflation data saw headline CPI climb above 2.0% for the first time since July 2019 (3 tenths above expectations at 2.1%). Core CPI saw an even larger move, 5 tenths above expectations at 2.0% for the first time since August 2018. RPI was in line with expectations at 3.3%Y/Y.

- TY1 futures are up 0-1 today at 132-18 with 10y UST yields down -0.2bp at 1.491% and 2y yields unch at 0.164%.

- Bund futures are up 0.08 today at 172.40 with 10y Bund yields down -0.5bp at -0.237% and Schatz yields down -0.3bp at -0.680%.

- Gilt futures are up 0.01 today at 127.65 with 10y yields up 0.1bp at 0.759% and 2y yields up 1.1bp at 0.086%.

UK SUPPLY UPDATE: DMO sells GBP2.5bln of the 0.625% Jul-35 gilt

Strong auction

| 0.625% Jul-35 Gilt | Previous | |

| Amount | GBP2.50bln | GBP2.50bln |

| Avg yield | 1.115% | 1.264% |

| Bid-to-cover | 2.74x | 2.53x |

| Tail | 0.1bp | 0.2bp |

| Avg price | 93.614 | 91.718 |

| Pre-auction mid | 93.554 | |

| Previous date | 19-May-21 |

FOREX - All eyes on Fed

- FX have generally stayed mixed in the early European session, as market participants awaits the US FOMC.

- As per our MNI Fed preview:

- The 2023 Fed funds rate dots in the SEP are likely to show further support for a hike, with a good chance the median rises. The outlook for "transitory" inflation will also be eyed in the projections.

- The Fed is likely to hold off on tweaking the IOER and ON RRP rates (though prevailing analyst consensus is that this is a very close call).

- Early action in G10s, was better buying interest of the British Pound, following the inflation beat.

- Cable pushed higher to print a 1.4123 high, just short of small resistance at 1.4130, but the cross has now faded to trade back below 1.4100 at the time of typing.

- Worst performers in G10s versus the USD, are the Scandis, with NOK down 0.32% and SEK 0.18%.

- USDSEK tested yesterday's high at 8.3428, printed 8.3430 high so far today.

- Above the latter eye the June high at 8.3619.

- In USDNOK, yesterday's high is situated at 8.3500.

- Nonetheless crosses are in fairly tight ranges on the margin, EURUSD in a 1.217 low, 1.2135 high, so far today.

- Looking ahead, all eyes are of course on the US FOMC and presser.

EQUITIES: Chinese stocks leading markets a bit lower

- Japan's NIKKEI down 150.29 pts or -0.51% at 29291.01 and the TOPIX up 0.38 pts or +0.02% at 1975.86.

- China's SHANGHAI closed down 38.23 pts or -1.07% at 3518.329 and the HANG SENG ended 201.69 pts lower or -0.7% at 28436.84.

- German Dax down 36.18 pts or -0.23% at 15693.59, FTSE 100 up 9.62 pts or +0.13% at 7182.2, CAC 40 up 4.65 pts or +0.07% at 6644.3 and Euro Stoxx 50 up 0.22 pts or +0.01% at 4143.84.

- Dow Jones mini down 49 pts or -0.14% at 34239, S&P 500 mini down 1.5 pts or -0.04% at 4245.25, NASDAQ mini up 12.25 pts or +0.09% at 14042.75.

COMMODITIES: Mixed moves this morning

- WTI Crude up $0.11 or +0.15% at $72.25

- Natural Gas down $0.02 or -0.59% at $3.222

- Gold spot up $0.17 or +0.01% at $1859.24

- Copper up $0.15 or +0.03% at $434.3

- Silver up $0.08 or +0.28% at $27.7428

- Platinum down $5.07 or -0.44% at $1151.92

Source: MNI, Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.