-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI US Open: Long-End Treasuries Continue To Sell Off

EXECUTIVE SUMMARY:

- E.U. BRACES FOR HEALTH REGULATOR DECISION ON ASTRAZENECA VACCINE

- ASTRA SHIPMENT FROM INDIA SAID TO BE BEHIND U.K. VACCINE DELAY

- B.O.J. STILL MULLING MODEST WIDENING OF 10-YR BAND

- B.O.E. SET TO LEAVE POLICY UNCHANGED TODAY

- NORGES BANK HOLDS RATES, DECEMBER RATE HIKE NOW PRICED

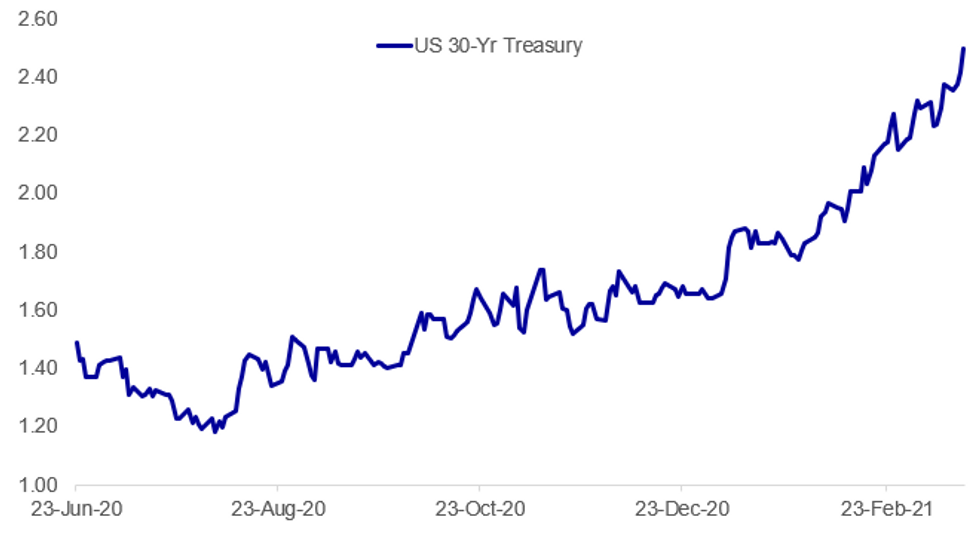

Fig. 1: No Let-Up For Long End Treasury Yields

BBG, MNI

BBG, MNI

NEWS:

COVID VACCINE / EU (BBG): The European Union is bracing for a decision by its health regulator on whether AstraZeneca Plc's Covid-19 vaccine is safe to use, a key step in the bloc's efforts to move past a messy suspension by several countries. The European Medicines Agency, which has consistently backed the shot even amid concerns about the risk of blood clotting, will issue updated guidance on Thursday. While a positive recommendation should give governments in France, Germany and elsewhere the confidence to resume using the vaccine, there's already been some damage done.

COVID VACCINE/ UK (BBG): A delayed shipment of AstraZeneca Plc's Covid-19 vaccine from India is behind a cut in the U.K.'s supply starting later this month, according to a person with knowledge of the situation. Vaccine doses made by one of Astra's manufacturing partners, the Serum Institute of India, were delayed, said the person, who didn't want to be identified because the supply details are private. The Serum Institute has already contributed to the U.K. supply with doses this quarter, the person said.

B.O.J.: Despite Bank of Japan Governor appearing to rule out a tweak in the central bank's 'tolerated' trading band for JGBs when he spoke to legislators earlier this week, a report in Thursday's Nikkei suggests policymakers are still mulling a very slightly tweaked range that would allow 10-year yields to diverge by 25 bps either side of the 0% target range, very slightly wider than the current 20bps permitted. Any such decision, Nikkei noted, would be to preserve both the accommodative financial environment and help promote market function. The BOJ will also clarify ETF purchases will only be made in unstable markets, with tweaks also to the wording of the scale and pace of buys.

B.O.E.: The Bank of England Monetary Policy Committee will have its first chance to debate the impact of the UK budget and the U.S.'s USD1.9 trillion fiscal stimulus package at its meeting on Thursday, with the chances for near-term easing receding and a cut likely to the Bank's jobless forecast in May. The BOE looks set to leave the policy rate unchanged at 0.1%, and the target stock and the pace of asset purchases unchanged at the meeting. Nor is news likely on the review, announced at its last meeting, of its existing strategy for eventual tightening, which is currently for any unwind of quantitative easing only to begin once Bank Rate his 1.5%.

NORGES BANK: The Norges Bank left its policy rate unchanged at 0%, but indicates the first hike could come as soon as H1 2021. The new Norges Bank rate path projections were broadly inline with market expectations - signalling the December meeting as the most likely first hike. This first hike has been brought forward by around a quarter. Two further full rate hikes are now priced into 2022 and the terminal rate nudged higher toward 1.5% out to the end of the forecast horizon, which now includes 2024.

JAPAN: Japan's Prime Minister Yoshihide Suga has said that the COVID-19 state of emergency measures in Tokyo and three surrounding prefectures will come to an end on Sunday. He also stated that he was 'concerned about the possibility of a rebound incases'.

US-CHINA: The U.S. and China could still reach another trade agreement by the end of this year when the phase one trade deal expires, Yu Miaojie, a deputy dean of National School of Development of Peking University, said Thursday. China will continue meet its commitment to boost imports this year and a possible trade deal will cover the next two years, Yu, a senior policy advisor, told a forum held by NSD. If China's export stays at the same level this year, its trade surplus, helped by expanded imports, will fall to about CNY3 trillion from CNY3.7 trillion, Yu said.

CHINA: China has the potential to grow on average by 8% annually from 2021 to 2035 but the actual growth may be 5% to 6% as the country needs to focus on high-quality growth, inequality and environment protection, said Justin Yifu Lin, the honorary dean of National School of Development at Peking University, at a forum held by NSD on Thursday. The country's average GDP growth needs to be 4.7% to double per capita GDP in 2035 from 2020, said Lin who was the chief economist with World Bank from 2008 to 2012. China may realize average GDP growth of 4% from 2036 to 2049 then the country's GDP per capita will be half of that of the U.S., he noted.

DATA:

No key data in the European morning session.

FIXED INCOME: Big sell-off

- Core bond markets are under a lot of pressure this morning with Treasury yields with US and gilt 10-year yields both moving markedly higher and reaching their highs since March 2020.

- Indeed, at the time of writing 10-year UST yields are almost 8bp higher on the day with markets focusing on the better economic outlook with little pushback from the Fed yesterday.

- Looking ahead, the main event of the day will be the Bank of England with the Monetary Policy Summary and Minutes due for release at midday GMT/8am ET. The market will watch closely whether the MPC views the positive news on the economy as outweighing the tightening of financial conditions and whether there is any pushback on either money market pricing (likely) or longer-term gilt yields (unlikely). Communication regarding the pace of asset purchases will also be closely watched.

- TY1 futures are down -0-23+ today at 131-11+ with 10y UST yields up 7.5bp at 1.720% and 2y yields up 0.6bp at 0.140%.

- Bund futures are down -0.21 today at 170.87 with 10y Bund yields up 1.7bp at -0.275% and Schatz yields up 0.2bp at -0.687%.

- Gilt futures are down -0.37 today at 127.23 with 10y yields up 3.8bp at 0.866% and 2y yields up 0.1bp at 0.105%.

FOREX: NOK Firms as Norges Bank Bring Forward First Hike

- The greenback remains lower relative to pre-Fed levels yesterday, which was read as dovish, but is clawing back some of the losses against the EUR , CNH and AUD. The move is mirroring the softer equity market this morning, with the e-mini S&P retreating off overnight highs of 3988.75.

- The NOK trades stronger following the release of their Q1 Monetary Policy Report. The Bank signalled that the first post-COVID rate hike would be brought forward by around a quarter to December 2021. Two further full rate hikes are now priced into 2022 and the terminal rate nudged higher toward 1.5%. This steepening of rate path projections underpinned NOK strength this morning, pressuring USD/NOK back toward the 2021 lows of 8.3151.

- SEK, EUR are among the worst performers so far Thursday, with AUD, CAD the strongest.

- Focus turns to rate decisions from the Bank of England and Turkish central bank later today. US weekly jobless claims are also due.

EQUITIES: Post-FOMC Gains Fade

- Asian stocks closed higher, with Japan's NIKKEI up 302.42 pts or +1.01% at 30216.75 and the TOPIX up 24.48 pts or +1.23% at 2008.51. China's SHANGHAI closed up 17.517 pts or +0.51% at 3463.068 and the HANG SENG ended 371.6 pts higher or +1.28% at 29405.72.

- European equities are mixed, with the German Dax up 108.76 pts or +0.75% at 14697.5, FTSE 100 down 21.51 pts or -0.32% at 6757.86, CAC 40 down 2.35 pts or -0.04% at 6060.17 and Euro Stoxx 50 up 11.74 pts or +0.31% at 3858.82.

- U.S. futures are lower, with the Dow Jones mini up 18 pts or +0.05% at 33035, S&P 500 mini down 18.75 pts or -0.47% at 3955.25, NASDAQ mini down 165.25 pts or -1.25% at 13036.25.

COMMODITIES: Oil Leads Lower

- WTI Crude down $0.68 or -1.05% at $63.97

- Natural Gas down $0.01 or -0.32% at $2.522

- Gold spot down $8.05 or -0.46% at $1736.26

- Copper down $2.25 or -0.55% at $410.55

- Silver down $0.07 or -0.25% at $26.2441

- Platinum down $3.01 or -0.25% at $1210.63

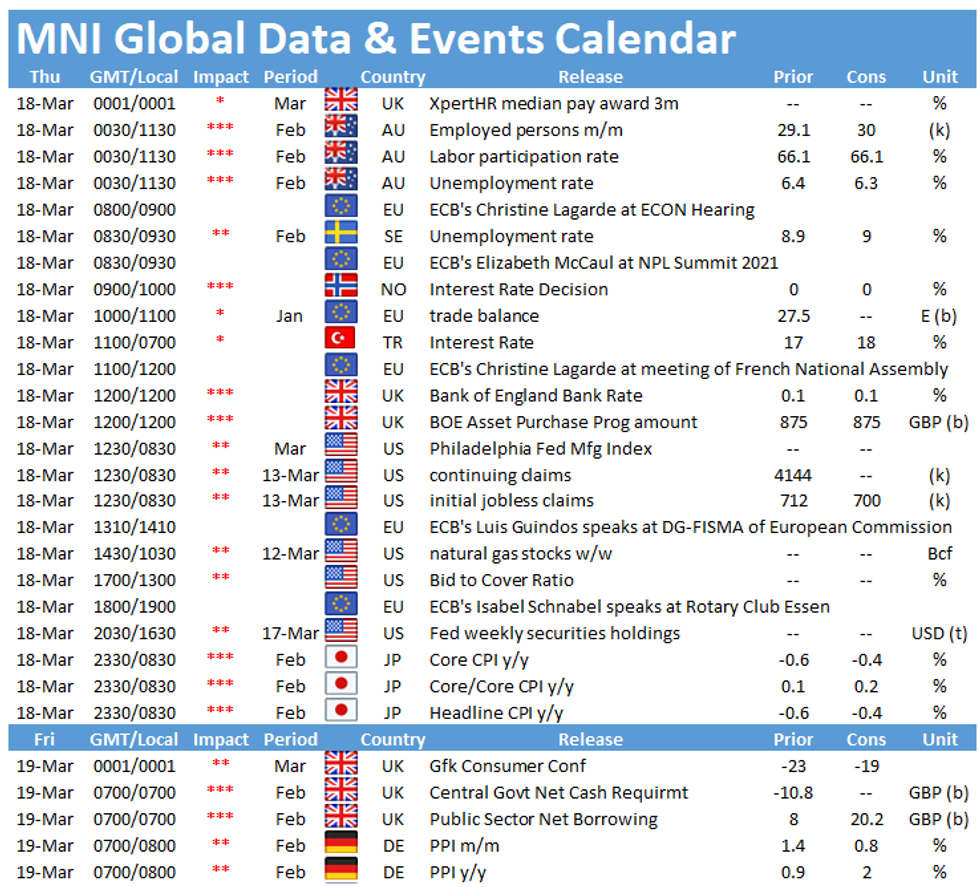

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.