-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Gilt Week Ahead

MNI US Open: Looming Deadlines Weigh On Risk Appetite

EXECUTIVE SUMMARY:

- E.U.'S VON DER LEYEN TELLS SUMMIT THAT 'NO DEAL' MOST LIKELY SCENARIO AHEAD OF SUNDAY "DEADLINE"

- B.O.E. BAILEY: READY TO ACT ON BREXIT SHOCK IF NEEDED

- U.S. GOVERNMENT SHUTDOWN LOOMS AT MIDNIGHT

- VARIOUS REPORTS INDICATE E.C.B. DECISION THURSDAY WAS A COMPROMISE

- SANOFI AND GSK DELAY COVID VACCINE

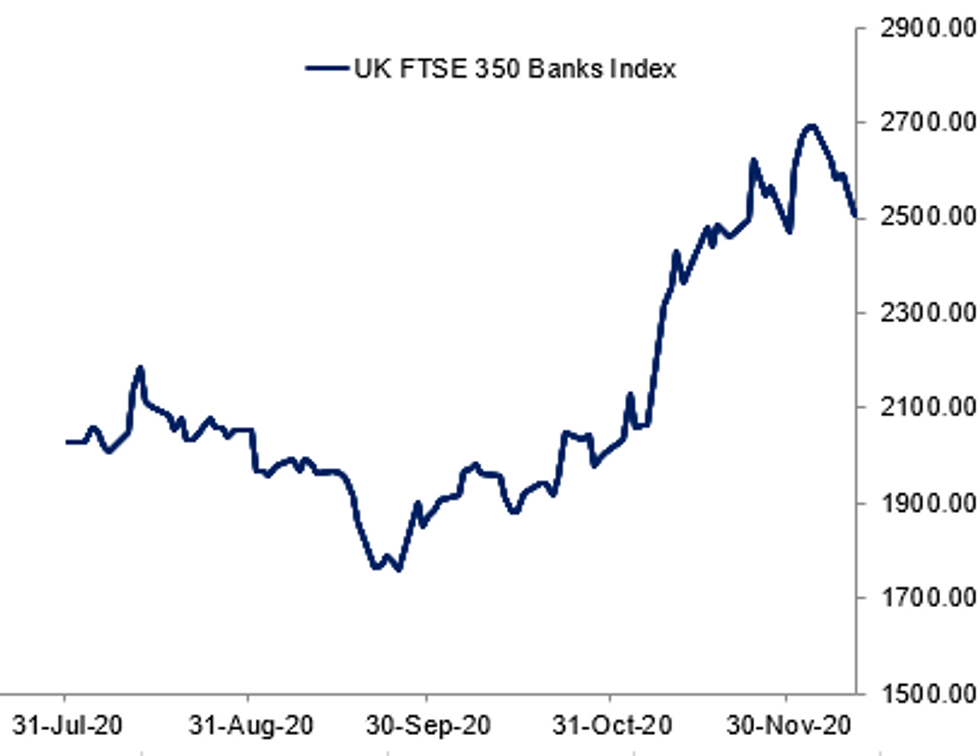

Fig. 1: Growing Doubts Over A Brexit Deal

BBG/MNI

BBG/MNI

NEWS:

E.U.-U.K. Bruno Waterfield at The Times tweets a thread on Commission President Ursula von der Leyen's comments to the European Council summit:

- "During her #EUCO briefing Von der Leyen said she would not put a % odds on outcome but that there is a higher probability for no deal than a deal. Spain's Sanchez told her that if no deal decision by Sunday all EU countries must stick to the same clear message"

- "Ireland's Martin praised Sefcovic/Gove for closing deal on withdrawal deal implementation. He stressed no deal will be big loss for all: UK, Ireland, and EU etc. But noted deal cannot come at all cost."

- "EU's agreed lines for #EUCO's PMs and prezs: Situation is difficult. Main obstacles remain. Probability of a no deal is higher than of a deal. Negotiations resuming today. To be seen by Sunday whether a deal is possible. Contingency measures published yesterday. Good progress WA"

B.O.E.: The Bank of England's Financial Policy Committee sees the UK banking system remains resilient to a range of economic outcomes, with the capacity to support business and households even if conditions worsen, the Financial Stability Report Friday. On Brexit and the disruption to cross-border financial services post-transition, the BOE says most financial stability risks have been mitigated. However, the Bank says financial stability is not the same as market stability, adding that financial markets can be expected to react to the outcome of the negotiations on arrangements for trading goods and services between the UK and EU.

B.O.E.: There could be market disruption and volatility as the UK's transition period before leaving the EU comes to a close, the Bank of England's Financial Policy Committee warned Friday However, that UK banks were resilient and that financial stability was not likely to be endangered by any market disruptions.

U.S.: Fox's Chad Pergram sums up today's Congressional docket:

- "Talks continue behind the scenes today on a potential coronavirus package. But unclear what the path forward is. Also work on the omnibus spending bill"

- "Senate today takes procedural vote to end debate on final version of defense bill. It's possible the Senate could take last vote on the bill itself, too -if there's an agreement to proceed"

- "Senate still has not approved stopgap spending measure to avert a shutdown this wknd. Senate could do that today. Otherwise, gov't shuts down after 11:59:59 pm et tonight. Bill funds gov't through December 18"

E.U.-U.K. Morgan Stanley notes potential market moves under 'no deal' Brexit, per Reuters:

- MS sees EUR rallying to 0.95 under "No Deal"

- Sees negative rates and further QE top up in 2021

- FTSE 250 to fall 6-10% and Bank stocks 10-20%

E.C.B. (RTRS): European Central Bank policymaker Vitas Vasiliauskas said he had reservations about providing too much extra stimulus for the euro zone economy but considered the agreement the central bank reached on Thursday as good and positive. Speaking to reporters on Friday, he said he also had concerns about the ECB's rather downbeat assessment of risk, since there were several positive factors on the horizon. "My position was that we need to shoot selectively rather than with a machine gun, without care," Vasiliauskas said.

E.C.B. (RTRS): The European Central Bank is targeting favourable financing conditions rather than pumping a given amount of liquidity into the economy with its latest stimulus decision, ECB policymaker Francois Villeroy de Galhau said on Friday. Villeroy, who is also head of France's central bank, said on BFM Business radio that the aim was not "to invest a certain amount each month, but rather a result", which is favourable financing conditions for the economy. "We will do less if the financing conditions remain favourable like today. If the opposite is needed, we will do more," he said.

COVID (RTRS): Sanofi and GlaxoSmithKline said clinical trials of their COVID-19 vaccine showed an insufficient immune response in older people, delaying its launch to late next year and marking a setback in the global fight against the pandemic.The announcement on Friday, which highlighted the challenges of developing shots at record speed, hinders efforts to develop the multiple options that experts say the world needs to counter a disease that has killed over 1.5 million people.The news, which came on the same day as Australia axed a domestic vaccine project, is also a blow for many governments that have booked hundreds of millions of doses of the shot, including the European Union, United States and Britain.

COVID (RTRS): Britain's AstraZeneca signalled on Friday it would investigate combining its own experimental COVID-19 vaccine shot with Russia's Sputnik V, a move Russian scientists have suggested could sharply boost efficacy. The developers of Sputnik V last month used Twitter to suggest AstraZeneca try the combination. They said it was worth experimenting with the Russian model and using two different shots rather than the same ones.

DATA:

GERMANY NOV FINAL HICP -1.0% M/M, -0.7% Y/Y; OCT -0.5% YY

MNI: SPAIN NOV FINAL HICP +0.1% M/M, -0.8% Y/Y; OCT-0.9% Y/Y

FIXED INCOME: Brexit provides a busy session

A very busy early morning session for Bonds and EGBs.

- Multi cross assets were all led after EU VDL told the EU Summit "no deal" was the likely option.

- FTSE DAX, Estoxx, traded lower, with UK Bank stocks coming under pressure following the news.

- The move provided some decent flattening in the German curve, long end led semi core higher, and Spain 10yr printed a record low yield at 0%.

- Gilts and Short Sterling moved higher.

- Gilt resistance is at 135.96 76.4% retracement of the Nov 5 - 11 sell-off (cont)

- US Treasuries too their cue from EGB, curve moved bull flatter, and the long strip is underpinned, also helped, following the lack of an agreement on US stimulus.

- Looking ahead, US PPI and Michigan are the data of note

- Mar Bund futures (RX) up 49 ticks at 178.57 (L: 178.17 / H: 178.75)Germany: The 2-Yr yield is down 1.4bps at -0.78%, 5-Yr is down 1.6bps at -0.803%, 10-Yr is down 2.8bps at -0.631%, and 30-Yr is down 4bps at -0.226%

- Mar Gilt futures (G) up 43 ticks at 135.85 (L: 135.45 / H: 135.9)UK: The 2-Yr yield is down 2.1bps at -0.136%, 5-Yr is down 2.6bps at -0.109%, 10-Yr is down 3.6bps at 0.165%, and 30-Yr is down 4.5bps at 0.699%.

- US: 2-Yr yield is down 0.6bps at 0.131%, 5-Yr is down 1.9bps at 0.367%, 10-Yr is down 2.1bps at 0.8849%, and 30-Yr is down 1.5bps at 1.6118%.* Mar 10-Yr futures (TY) up 5.5/32 at 138-02 (L: 137-26.5 / H: 138-04)

FOREX: GBP plummets on Brexit headline

- EU VDL told the EU Summit "no deal" was the likely option, set the tone for the Pound and across multi assets.

- USD saw further upside continuation following the latest Brexit headline on safe haven, as Equities dipped lower.

- Gold test low of the session on the Dollar move. With next support in the precious metal noted at $1822.5 - Low Dec 7

- Cable fell 130 pips and through multiple supports to print a 1.3185 low.

- Cable has since pared some of the weakness after VDL, added during the EU summit presser, that they will decide Sunday if they are conditions for a deal.

- USD outperforms against most G10s, beside the JPY, given the risk off tone in early trading.

- Some large moves was also seen in EM and particularly the Turkish Lira down 0.86% against the Greenback, on EU and US Sanctions.

- Looking ahead, US PPI and Michigan are the data of note Speakers sees ECB de Cos and Fed George and Quarles, but given blackouts, there will be no mention of monetary policy ahead of the FOMC next week

EQUITIES: Weighed Down By Brexit Deal / U.S. Funding Deadlines

Rising perceived probability of a no-deal Brexit and a looming US federal government funding deadline tonight have contributed to weaken equities in early Friday trade.

- Asian stocks closed mixed, with Japan's NIKKEI down 103.72 pts or -0.39% at 26652.52 and the TOPIX up 5.8 pts or +0.33% at 1782.01. China's SHANGHAI closed down 26.085 pts or -0.77% at 3347.191 and the HANG SENG ended 95.28 pts higher or +0.36% at 26505.87.

- European equities are weaker, with the German Dax down 136.49 pts or -1.03% at 13158.64, FTSE 100 down 42.3 pts or -0.64% at 6551.46, CAC 40 down 39.97 pts or -0.72% at 5496.23 and Euro Stoxx 50 down 34.12 pts or -0.97% at 3483.61.

- U.S. futures are lower too, with the Dow Jones mini down 138 pts or -0.46% at 29872, S&P 500 mini down 21.5 pts or -0.59% at 3647, NASDAQ mini down 78.25 pts or -0.63% at 12322.75.

COMMODITIES: Mixed Start, Copper Underperforming

A mixed start for commodities, with gold up slightly but silver down (so not a clear safe haven move). Copper and other base metals underperforming.- WTI Crude down $0.11 or -0.24% at $47

- Natural Gas down $0.02 or -0.63% at $2.533

- Gold spot up $1.66 or +0.09% at $1832.68

- Copper down $5.05 or -1.41% at $352.8

- Silver down $0.06 or -0.25% at $23.8396

- Platinum down $9.27 or -0.9% at $1024.4

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.