-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: PMIs & Chinese Support Provide Interest Ahead Of NFPs

EXECUTIVE SUMMARY

- MNI US PAYROLLS PREVIEW: STRIKES TO POTENTIALLY MUDDY UNDERLYING TREND

- CHINA TO TAKE MORE ACTION TO REVIVE PROPERTY SECTOR (RTRS)

- PBOC CUTS FX RRR TO SHORE UP THE YUAN (MNI)

- ECB'S VILLEROY: OPTIONS OPEN AT UPCOMING RATE MEETINGS (RTRS)

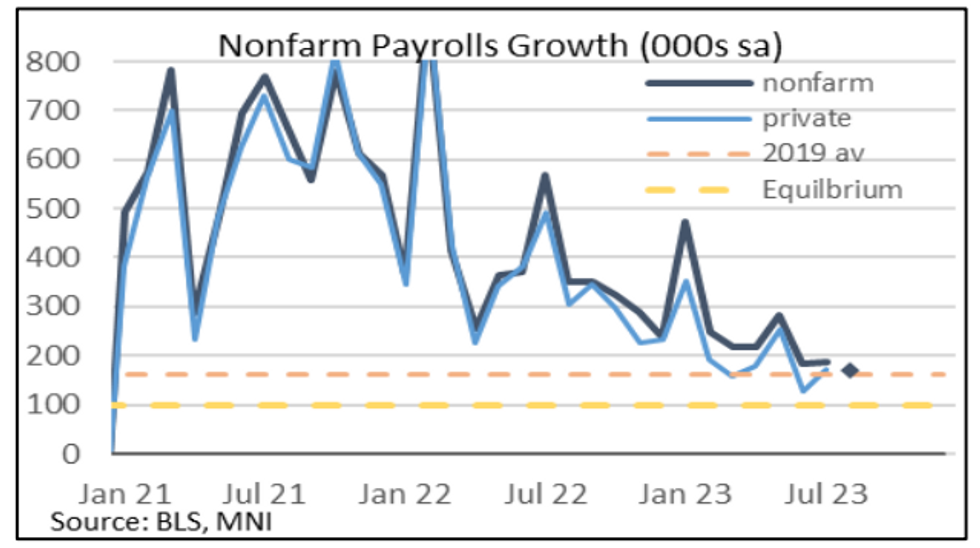

Fig. 1: Nonfarm Payrolls Growth

NEWS

PAYROLLS PREVIEW (MNI): The Bloomberg median sees nonfarm payrolls rising 170k in July (primary dealer 165k), after July’s 187k saw the second consecutive month of undershooting expectations.

ECB (RTRS): The European Central Bank has a range of options at its next interest rate meeting, although interest rates are near their high point and there are signs underlying inflation has peaked, ECB policymaker Francois Villeroy de Galhau said on Friday.

EUROZONE CPI REVIEW (MNI): Eurozone August flash headline HICP printed 5.3% Y/Y and 0.6% M/M (vs 5.3% Y/Y and -0.1% M/M prior), roughly in line with expectations. Core HICP was 5.3%, a small step down from July and generally in line with expecations made before and after the national

CHINA (RTRS): China is set to take further action including relaxing home-purchase restrictions as it scrambles to tackle a deepening crisis in its massive debt-riddled property sector, four people familiar with the matter said.

CHINA (RTRS): Five of China’s biggest banks on Friday cut interest rates on a range of deposits in a coordinated effort to ease pressure on their shrinking margins, as Beijing ramps up measures to shore up the country’s faltering economy.

YUAN (MNI): The People's Bank of China cut the FX reserve requirement ratio for banks on Friday to help support the yuan which has weakened over recent months. The central bank reduced the FX RRR by 200bp from 6-4%, the first cut since Sept 2022, making it effective from Sept 15th. The PBOC said it would “improve financial institutions' capacity to use foreign funds."

YUAN (MNI): Authorities recent efforts to boost the economy will strengthen the Yuan towards the end of the year, according to Guan Tao, former director of State Administration of Foreign Exchange.

CHINA STOCKS (MNI): Chinese insurance companies have room to increase their investment in stocks as they embrace regulators’ recent calls to boost the proportion of equity in their portfolios, the Securities Daily reports Friday.

CHINA STOCKS (MNI): China’s latest efforts to support the equity market will likely have limited impact, while share sale and IPO restrictions may increase financing difficulties for some companies, market experts and policy advisors told MNI.

AUSTRALIA (MNI): China’s economic slowdown could reduce demand for Australia’s commodity exports and further weaken the Australian dollar, adding inflationary pressure, but the overall impact should be limited or even positive depending on the strategy Chinese authorities implement to bolster the economy, former Reserve Bank of Australia economists told MNI.

G20 (RTRS): Chinese President Xi Jinping is likely to skip a summit of G20 leaders in India next week, sources familiar with the matter in India and China told Reuters, a development that would dash chances of a meeting there with U.S. President Joe Biden.

HONG KONG (RTRS): Hundreds of flights were cancelled in China's Guangdong province and Hong Kong as Super Typhoon Saola moved closer to the mainland on Friday, forcing authorities to raise a strong storm advisory and closing businesses, schools and financial markets.

EQUITIES (BBG): Samsung Electronics Co. leapt more than 6% on speculation the company has won the right to compete with arch-foe SK Hynix Inc. to supply advanced memory chips to AI leader Nvidia Corp

GAS/ENERGY (RTRS): Chevron workers at two of Australia's largest liquefied natural gas (LNG) facilities have rejected a company pay and conditions offer, a union alliance said on Friday, and planned work stoppages will go ahead next week pending another deal.

DATA

EUROZONE AUG, F HCOB MANUFACTRING PMI 43.5; PRELIM 43.7; JUL 42.7

(S&P Global) The eurozone manufacturing sector remained under intense pressure midway through the third quarter, according to the latest HCOB PMI® survey data, as plummeting new orders and rapidly depleting backlogs of work put a considerable squeeze on production lines across the single currency union.

GERMANY AUG, F HCOB MANUFACTRING PMI 39.1; PRELIM 39.1; JUL 38.8

(S&P Global) The downturn in Germany's manufacturing sector extended into August, according to the latest HCOB PMI® survey conducted by S&P Global, with output falling at a faster rate amid rapidly declining new orders.

FRANCE AUG, F HCOB MANUFACTRING PMI 46.0; PRELIM 46.4; JUL 45.1

(S&P Global) France's manufacturing sector continued to struggle in August, latest HCOB PMI® data showed, with an accelerated decline in new orders putting production and employment under pressure.

ITALY AUG HCOB MANUFACTRING PMI 45.4; MEDIAN 45.7; JUL 44.5

(S&P Global) The Italian manufacturing sector remained mired in a downturn during August. Output and new orders again fell at severe rates, with market demand reported to be subdued.

SPAIN AUG HCOB MANUFACTRING PMI 46.5; MEDIAN 48.8; JUL 47.8

(S&P Global) Faced with a challenging demand environment, operating conditions across the Spanish manufacturing sector worsened once again during August.

UK AUG, F S&P GLOBAL/CIPS MANUFACTRING PMI 43.0; PRELIM 42.5; JUL 45.3

(S&P Global) August saw manufacturing sink into a deeper downturn, with rates of contraction in output and new orders among the steepest registered outside of events such as the global financial crisis or COVID-19 pandemic.

UK AUG NATIONWIDE HOUSE PRICE INDEX -0.8% M/M; MEDIAN -0.4%; JUL -0.3%

UK AUG NATIONWIDE HOUSE PRICE INDEX -5.3% Y/Y; MEDIAN -4.9%; JUL -3.8%

(Nationwide) August saw a further softening in the annual rate of house price growth to -5.3%, from -3.8% in July, the weakest rate since July 2009. Prices fell by 0.8% over the month, after taking account of seasonal effects.

SWITZERLAND AUG CPI +1.6% Y/Y; MEDIAN +1.5%; JUL +1.6%

SWITZERLAND AUG CPI +0.2% M/M; MEDIAN +0.2%; JUL -0.1%

SWITZERLAND AUG CORE CPI +1.5% Y/Y; MEDIAN +1.5%; JUL +1.7%

CHINA AUG CAIXIN MANUFACTURING PMI 51.0; MEDIAN 49.0; JUL 49.2

(Caixin) August PMI data signalled that operating conditions across China's manufacturing sector strengthened, and at the quickest rate for six months. Firms recorded fresh increases in both output and total new work amid reports of firmer market demand.

MARKETS

FOREX: USD Has Pared Overnight Gains, NFP In Focus

The Dollar has pared of all its gains during the European morning session, after the Emini recovered from its lows, helping EU Equities also off their lows.

- The Dollar now leans in the red against G10, although AUD is still down just 0.14%.

- Some of the notable mover was the SEK in early trade initially falling, following a pretty poor Manufacturing PMI, but the currency has since faded the move to trade back at pre Swedish PMI levels.

- Most FX pair/Crosses trade within ranges, as investors await the US NFP/AHE.

- NOK is the best performer, albeit by just 0.17%, with the latter aided by the move higher in Oil this Morning, with WTI breaking above $84.

- Looking ahead, US NFP/AHE, and final Manufacturing PMI.

- Range for NFP is 120k/230k, Median 170k, whisper 155k.

- Speakers include, Fed Bostic (non voter, on Mon Pol), Mester (non voter, on Inflation).

EGBS: Core Curves Twist Steepen, ECB Speak, PMIs & ECB Forecasts Eyed Ahead Of NFPs

Late Thursday comments from ECB President de Guindos (September hike debate open, little change set to be made to updated inflation forecasts) were earmarked as a potential source of the modest pressure placed on EGBs early today, although curves moved steeper as opposed to flatter.

- A late NY downtick in U.S. Tsys will have also aided early the direction of travel.

- On the other side, slightly softer than flash readings in the final Eurozone manufacturing PMI data and Morgan Stanley calling time on the ECB rate hiking cycle limited the weakness (ECB-dated OIS now shows ~7bp of tightening for this month, with terminal deposit rate pricing hovering around 3.91%).

- Bund futures are -20, off lows, while the major German cash benchmarks sit 1bp richer to 2bp cheaper as the curve twist steepens.

- Most other core/semi-core curves also twist steepen, with spreads vs. Bunds little changed on the day.

- Peripherals have seen less generic moves.

- Matters offshore are set to dominate for the rest of the day, with the monthly U.S. NFP release and ISM manufacturing survey eyed.

GILTS: Off Lows, A Touch Cheaper On The Day, Looking Elsewhere For Cues

Gilt futures sit around the middle of a 35-tick session range, last showing -25, operating within yesterday’s boundaries.

- The major cash benchmarks print 1-2bp cheaper on the day, as the curve flattens at the margin.

- The space has looked elsewhere for direction at times.

- SONIA futures are +0.5 to -4.0 through the blues, twist steepening, but off session lows.

- BoE-dated OIS is little changed on the day,

- Final manufacturing PMI data saw an improvement on the flash reading at the headline level, but the index remains deep in contractionary territory.

- There was a larger than expected fall in the monthly Nationwide house price index, with worry surrounding the property space well-documented.

- There has also been some coverage of the increase in the usage of buy now pay later schemes to cover essential UK household costs such as grocery shopping, which isn’t a welcome finding.

- Comments from BoE’s Pill shouldn’t be too market moving later today, as he spoke yesterday, with more focus on the impending tier 1 U.S. data releases.

EQUITIES: S&P 500 E-Minis Testing Resistance At The Former Channel Base

Eurostoxx 50 futures remain closer to recent highs despite the latest pullback The contract has traded above resistance at the 50-day EMA at 4329.9. A continuation higher would signal scope for a climb towards resistance at 4420.00. The bull trigger is 4358.00, the Aug 30 high. On the downside, a breach of 4187.00, the Aug 18 low, would be a bearish development and confirm a resumption of the downtrend. The E-mini S&P contract maintains a firmer short-term tone. Price has traded above resistance at 4526.29, the base of a bull channel, drawn from the Mar 13 low that was breached on Aug 16. A clear break of this level would strengthen the upleg and open 4560.75, the Aug 4 high. Initial support to watch lies at 4455.40, the 50-day EMA. A return below the average would be a bearish development.

COMMODITIES: Gold Correction Remains In Play

The uptrend in WTI futures remains intact and yesterday’s gains reinforce this theme. Price is approaching key resistance at $84.16, the Aug 10 high. A clear break would be bullish and confirm a resumption of the uptrend. This would open $85.24, a Fibonacci projection. On the downside, initial support to watch is $80.43, the 20-day EMA. A break would signal a short-term top and expose the 50-day EMA at $78.18. A short-term correction in Gold remains in play and the yellow metal has breached resistance at the 50-day EMA - at $1931.5. This strengthens the current bull cycle and signals scope for a stronger recovery. Attention turns to $1948.3, 61.8% of the Jul 20 - Aug 21 bear leg. It has been pierced, a clear break would open $1963.3, the 76.4% retracement. On the downside, initial firm support lies at $1903.9, the Aug 25 low.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/09/2023 | 1000/0600 |  | US | Atlanta Fed's Raphael Bostic | |

| 01/09/2023 | 1000/1100 |  | UK | BoE's Pill speaks at South African Reserve Bank conference | |

| 01/09/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/09/2023 | 1230/0830 | *** |  | US | Employment Report |

| 01/09/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 01/09/2023 | 1345/0945 |  | US | Cleveland Fed's Loretta Mester | |

| 01/09/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/09/2023 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/09/2023 | 1400/1000 | * |  | US | Construction Spending |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.