-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US Open: Positive Risk Sentiment Ahead Of US ISM

EXECUTIVE SUMMARY:

- ITALIAN AND SPANISH PMIS UNEXPECTEDLY RISE IN AUGUST

- NEXT 18-24 MONTHS CRUCIAL: ECB'S DE GUINDOS

- STOURNARAS URGES E.C.B. CAUTION IN ASSESSING SPIKE IN INFLATION

- DOWNSIDE RISK MAY PROMPT POLICY STEPS: BOJ'S WAKATABE

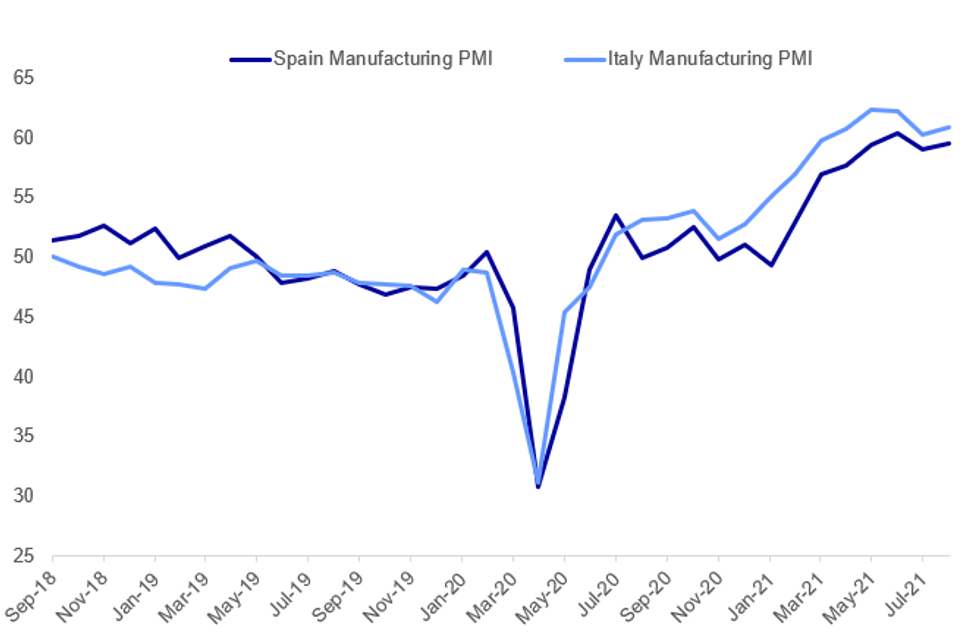

Fig. 1: Italy And Spain Manufacturing PMIs Tick Higher

Source: IHS Markit, MNI

Source: IHS Markit, MNI

NEWS:

ECB: September's Eurosystem staff macroeconomic projections will show that Europe's economy has performed better than previously expected, ECB Executive Board member said in an interview published Wednesday, with the next 18-24 months to be "defined by attempts to leave the economic consequences of the pandemic behind us and to minimise its structural impact." De Guindos would not be drawn on the future of PEPP, but said some of the short-term impact of the Covid-19 crisis have been successfully mitigated. However, negative structural effects remain for both the European and world economies - including possible scarring in the jobs market and increased inequality.

ECB (BBG): The European Central Bank shouldn't over-interpret the spike in euro-area inflation as it prepares for a policy decision next week, according to Governing Council member Yannis Stournaras. "According to most estimates, the recent jump in inflation is due to temporary factors related to various supply-side bottlenecks caused by the pandemic," he said in a Bloomberg interview.

BOJ: Bank of Japan Deputy Governor Masazumi Wakatabe on Wednesday said the pace of economic recovery has been delayed and that the central bank would need to take policy action if downside risks materialise. Wakatabe told reporters that there are risks that the economy could worsen or deviate from a recovery path because of the spread of Delta variants of Covid-19.

U.S.-RUSSIA-UKRAINE (BBG): President Joe Biden will seek to reassure Ukrainian President Volodymyr Zelenskiy that the U.S. is committed to countering Russian expansion in the region as the leaders meet for the first time on Wednesday at the White House. The two plan to discuss Ukraine's national security as it relates to Russia and ways the U.S. can provide assistance, according to a senior Biden administration official. They will also discuss the Ukraine's anti-corruption efforts.

FRANCE POLITICS: Latest opinion polling from Ifop/Fiducial shows disapproval ratings for French President Emmanuel Macron hitting the-highest level since September 2020 in a poll by that outlet, with 62% of respondents disapproving of the president's record and just 38% approving.

UK DATA: UK house prices surged in August, recording the second-highest month-on-month gain in 15 years and now stand 'around 13% higher' than when the pandemic started, the Nationwide Building Society said Wednesday. The move higher took many by surprise, including Robert Gardner, the Nationwide's chief economist, who said the tapering of stamp duty relief in June 'had been expected to take some of the heat out of the market.'

DATA:

MNI: SPAIN AUG MFG PMI 59.5; JUL 59.0

SPAIN DATA: Aug Mfg PMI: Output Soars, But Supply-Side Issues Linger

Spanish manufacturing PMI came in a little ahead of expectations in August at 59.5 (vs 59.0 expected, 59.0 prior).

- This included the biggest rise in output since May 1998, despite continued supply-side constraints on manufacturing.

- It's yet another report that suggests that inflation continues to be coming through the manufacturing pipeline, but it's coming alongside stronger job growth and overall business conditions (new business up for the 7th consecutive month albeit the softest since April, and biggest strengthening in overall business conditions in survey history to Feb 1998).

- From the IHS Markit report: "A further improvement in demand supported strong growth in new orders and production during August, with Spanish manufacturers posting a near-record rise in output. As a result, firms took on extra staff at a faster pace and ramped up their purchasing activity. That said, supply-chain disruption remained severe, contributing to further steep rises in input costs and selling prices."

- Spanish 10Y spreads vs Germany have dropped by 0.7bp since the release.

MNI: ITALY AUG MFG PMI 60.9; JUL 60.3

ITALY DATA: Aug Mfg PMI: Inflation Pressures Ease Slightly, But Still Elevated

Italian manufacturing PMI unexpectedly accelerated in August to 60.8, from 60.3 prior and versus 60.1 expected. This was the third-highest reading in series history and was the 14th consecutive month above the 50 mark.

- It's a strong report, highlighted by improvements in both new orders and output, with job growth improving amid higher backlogs.

- This was despite the continuing theme of Italian manufacturers reporting supply-side problems (material shortages, logistics delays, etc).

- This was inflationary, but not to such an acute degree as previous months, with cost and charge inflation rates easing.

- From the IHS Markit report: "Output and new orders rose at quicker rates and rapidly overall amid reports of strong demand conditions. Subsequently, backlogs of work increased again, and companies continued to take on additional staff. Inflationary pressures meanwhile remained severe, although the rates of increase in both costs and charges eased on the month."

- Market reaction to the slight beat was limited.

MNI: GERMANY FINAL AUG MFG PMI 62.6; FLASH 62.7; JUL 65.9

MNI: FRANCE FINAL AUG MFG PMI 57.5, FLASH 57.3; JUL 58.0

MNI: EZ FINAL AUG MFG PMI 61.4; FLASH 61.5; JUN 62.8

MNI: UK FINAL JUL MFG PMI 60.3; FLASH 60.1; JUL 60.4

FIXED INCOME: A busier session for Govies

- A busier morning session for EGBs, with a clear pick up in volumes.

- Bund remains under pressure following Hawkish ECB talks yesterday, and also helped, following the jump in EU inflation.

- There's been a massive jump in Bobl spread this morning, already trading a whooping 315k outright.

- Peripherals have tightened somewhat, with Italy and Greece circa 1bp.

- Gilt have traded inline with their European counter part, also weighted by the UK supply.

- UK curve has also steepened in early trade.

- US Treasuries are better offered, taking their cues from the Bund price action US Curves are bear steeper, but sill well short of last week's best levels.

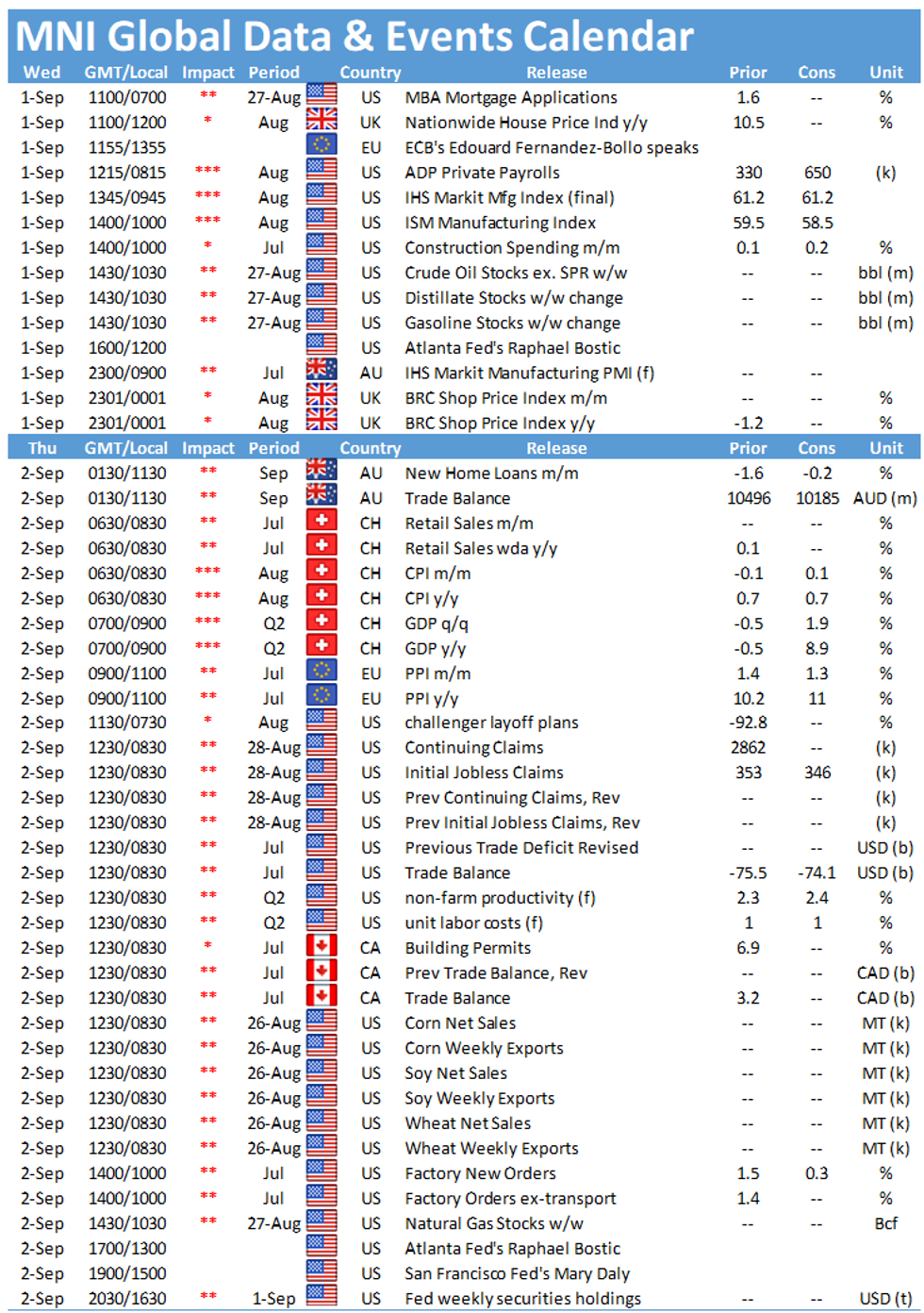

- Looking ahead, sees US ADP, Manufacturing PMI will be final reading, so more focus on the ISM Manufacturing.

- Speakers include ECB's Weidmann at Bundesbank symposium, and Fed Bostic discusses bringing an inclusive Economy.

- TY1 futures are down -0-4+ today at 133-29 with Bund futures down -0.17 at 175.28 and Gilt futures down -0.05 at 129.24.

FOREX: JPY Dips as Equities Reverse Tuesday Weakness

- Following yesterday's mixed finish for equities (both Europe and US indices closed lower), risk sentiment has been far more positive early Wednesday, with mainland Europe bouncing nicely. Markets across Asia also traded positively, helping start the session with a risk-on tone, and leading the JPY to underperform all others.

- Australian GDP data came in ahead of expectations, with Q2's quarterly reading at 0.7% vs. Exp. 0.4%. Prior readings were also revised higher, giving AUD a boost to the top of the G10 table so far Wednesday.

- The USD has traded more rangebound, with the USD Index either side of the 92.592 50-dma.

- US ISM Manufacturing data takes focus going forward, with markets looking to gauge clues ahead of Friday's Nonfarm Payrolls release. ECB's Weidmann and Fed's Bostic are both scheduled to speak.

EQUITIES: US Stocks Once Again Near All-Time Highs

- Asian markets closed stronger, with Japan's NIKKEI up 361.48 pts or +1.29% at 28451.02 and the TOPIX up 20.09 pts or +1.02% at 1980.79. China's SHANGHAI closed up 23.161 pts or +0.65% at 3567.101 and the HANG SENG ended 149.3 pts higher or +0.58% at 26028.29.

- European markets are gaining early, with the German Dax up 111.93 pts or +0.71% at 15835.09, FTSE 100 up 61.91 pts or +0.87% at 7119.7, CAC 40 up 87.95 pts or +1.32% at 6680.18 and Euro Stoxx 50 up 48.97 pts or +1.17% at 4196.41.

- U.S. futures are higher, with the Dow Jones mini up 146 pts or +0.41% at 35486, S&P 500 mini up 17 pts or +0.38% at 4537.5, NASDAQ mini up 28.75 pts or +0.18% at 15611.25. Yesterday the emini contract set an all-time intraday high of 4542.25.

COMMODITIES: Industrial Metals Lower On Weak China PMI

- WTI Crude up $0.33 or +0.48% at $68.91

- Natural Gas up $0.06 or +1.33% at $4.417

- Gold spot down $2.44 or -0.13% at $1816.29

- Copper down $6.85 or -1.57% at $429.65

- Silver down $0.06 or -0.23% at $23.8668

- Platinum down $1.79 or -0.18% at $1015.21

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.