-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Recovery for Equities Weighs on USD

MNI US OPEN - WSJ Reports on Imminent Ceasefire Deal

MNI US OPEN - RBA Won't "Hesitate" to Hike if Needed

EXECUTIVE SUMMARY

- BOJ MEMBER EMPHASISES NEED TO RAISE POLICY RATE TO 1% NEUTRAL RATE

- RBA WON'T "HESITATE" TO HIKE IF NEEDED, BULLOCK SAYS

- FIGHTING IN RUSSIA'S KURSK CONTINUES AMID MAJOR UKRAINIAN INCURSION

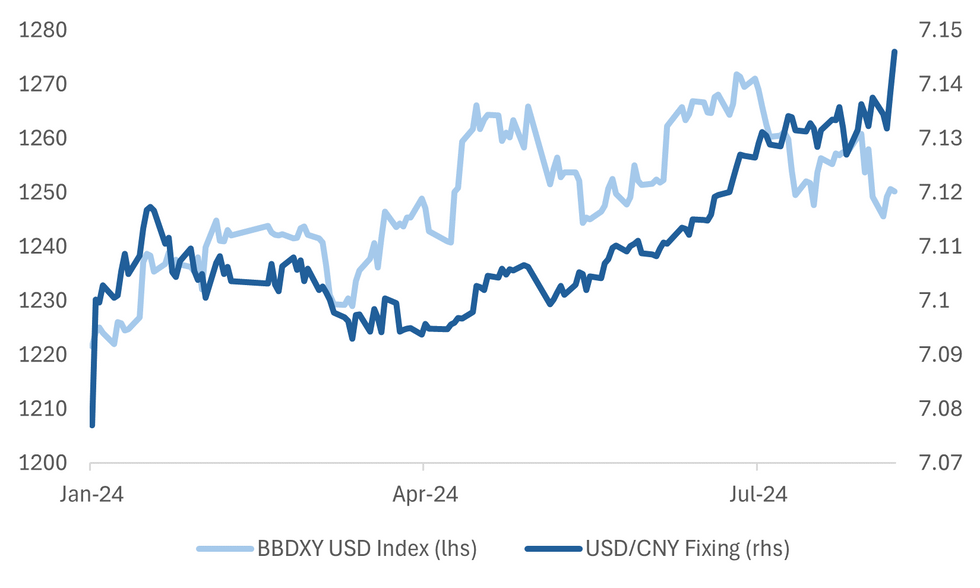

MNI (LONDON) - Figure 1: USD/CNY fixing highest since November

Source: MNI/Bloomberg

NEWS

ECB (MNI EXCLUSIVE): ECB Set For 25bp Sept Cut Despite Volatility

MNI speaks to former ECB markets director Francesco Papadia about rates and market volatility - On MNI Policy MainWire now, for more details please contact sales@marketnews.com

BOJ (MNI EXCLUSIVE): BOJ Still on Course for Hikes Despite Volatility

MNI looks at the BOJ's policy stance in the wake of wild swings in asset prices - On MNI Policy MainWire now, for more details please contact sales@marketnews.com

US (BBG): Harris Rides Momentum in Midwest as Vance Eyes Air Force Two

Vice President Kamala Harris and her new running mate, Minnesota Governor Tim Walz, took their campaign to crucial Midwest swing states to sell voters on their economic message - an effort Donald Trump’s running mate, JD Vance, sought to undercut. The Democratic ticket held rallies in Eau Claire, Wisconsin and Detroit, Michigan - part of a campaign swing covering key battleground states in a bid to seize on momentum for Harris and introduce Walz, her vice presidential pick, to voters. Highlighting the importance of those states, Trump’s campaign also deployed Vance in a bid to counterprogram their opponents.

MIDEAST (BBG): Iran Says Israel Must Agree Gaza Truce to Calm Region

Iran’s president told his French counterpart Emmanuel Macron the US and Europe must urge Israel to accept a truce in Gaza to reduce tensions in the Middle East. Masoud Pezeshkian’s comments on a call with Macron on Wednesday hint at a diplomatic path to de-escalation as Israel braces for retaliation after the killing of a top Hamas leader in Tehran. The call was the latest in a flurry of diplomatic activity by Western and Arab states to try to ensure Iran tempers its response. Israel has said it may react disproportionately to any attack from Iran or its proxy militia groups such as Hezbollah in Lebanon.

UK (BBG): Anti-Racism Protesters Give UK Respite After Days of Riots

Anti-racism protesters turned out in their thousands in towns and cities across the UK to counter far-right demonstrations that failed to materialize on Wednesday evening, offering some relief to a nation that’s been reeling from the worst outbreak of rioting in more than a decade. Police had 6,000 specialist officers ready to guard areas around immigration-related facilities, after online agitators posted messages urging supporters to converge on them. The unrest was initially triggered last week by the fatal stabbings of three young girls and false rumors that the attacker was Muslim asylum-seeker, before morphing into anti-immigration and racist disorder.

SPAIN (MNI): Catalan Police Launch Operation to Arrest Puigdemont -TV3

Wires reporting that according to Catalan state broadcaster TV3, the police have launched an operation to find and arrest former regional president Carles Puigdemont following his appearance at a pro-independence rally in Barcelona. Catalan News reports on what Puidgemont could face in the immediate future if arrested, with the crux of the matter being the amnesty law approved last year.

BOJ (MNI): Neutral Interest Rate Around 1% - BOJ Opinions

At least one Bank of Japan board member emphasised the need to raise the policy interest rate to the estimated 1% neutral rate at the July 30-31 meeting, the summary of opinions showed on Thursday. Another member said further monetary adjustment will be necessary should the Bank confirm positive corporate behaviour, such as solid business fixed investment, sustained wage hikes and a continued pass-through of cost increases. Other members also saw the need to adjust the degree of easy policy but there was no view that the BOJ should hurry to raise the interest rate.

CHINA (BBG): China Ramps Up Fight Against Record Bond Rally as Targets Widen

China widened its battleground against bond speculators, targeting everything from fund companies to rural banks to one of traders’ favorite parts of the debt market. Within a span of 24 hours, China’s state-banks unexpectedly began selling seven-year bonds to pull up yields, undermining a popular sweet spot in the market. Local authorities asked some rural lenders in one of the most affluent provinces to suspend trading in sovereign notes. And regulators were reported to have slowed the approval for new bond funds.

CHINA (MNI): China Iron Ore Imports Expected to Fall in August

MNI (Beijing) China’s iron ore import growth is expected to turn negative in August m/m following July’s 5.3% increase, analysts from the Shanghai Metals Market said in a note on Thursday. Inbound shipments will slow on softer steel demand during the off-season and steel mills reducing loss-making production. Additionally, some international mines are conducting maintenance which has cut shipping volumes.

RUSSIA/CHINA (RTRS): First Russia-China Barter Trade May Come This Autumn, Sources Say

Russia and China may begin using barter trading schemes, three trade and payments sources told Reuters, with two expecting deals involving agriculture as soon as this autumn, as Moscow and Beijing try to limit using banking systems monitored by the United States. Bilateral payment delays were high on the agenda when President Vladimir Putin visited China in May and although workarounds have emerged, such as using small, regional Chinese banks whose activities are harder for Washington to detect, payment issues remain.

RBA (MNI): RBA Won't "Hesitate" to Hike if Needed

RBA Governor Bullock spoke in Armidale on "Economic Conditions in Post-Pandemic Australia with a Regional Lens". She reiterated that at the August meeting a rate hike had been "explicitly considered" and that the Board won't "hesitate" to tighten if it is needed and doesn't see rates coming down quickly "based on what we know now". Policy is less restrictive in Australia and so we need to be a bit more "careful". But if there is a shock overseas and employment and inflation ease, they will cut. But the Board won't react to one number. * She noted that services inflation remains high and "sticky" and that as the return to target was pushed out a hike was discussed. The larger gap between demand and supply and its impact on inflation persistence was also mentioned.

RUSSIA/UKRAINE (MNI): Fighting in Russia's Kursk Continues Amid Major Ukrainian Incursion

Despite the claims of Gen. Valery Gerasimov, chief of staff of the Russian Armed Forces, that the Russian army had halted Ukraine's surprise advance into the Kursk oblast of the Russian Federation, reports today suggest that fighting in the border region around the town of Sudzha remains intense. Russian state-run Tass claims that Russian forces are actively fighting in the Sudzha district, and are pushing back Ukrainian forces according to a local official. The Russian Defence Ministry is claiming that its forces are 'thwarting Ukrainian attempts to break through deeper into the Kursk region'.

RBI (BBG): RBI Strikes Cautious Tone as India Food Prices Prevent Rate Cuts

India’s central bank left its benchmark interest rate unchanged as expected, with policymakers worrying that high food prices will continue to keep inflation above its target. Four of the six monetary policy committee members voted to keep the benchmark repurchase rate at 6.5% Thursday, while the other two called for a quarter-point cut. Almost all economists surveyed by Bloomberg predicted the rate would stay on hold for a ninth policy meeting. The committee, whose four-year term ends in October, also opted to retain its relatively hawkish policy stance of “withdrawal of accommodation.”

TURKEY (BBG): Turkey Keeps Year-End Inflation Outlook on Slowing Demand

Turkey’s central bank kept its inflation forecast unchanged, showing confidence that domestic demand will keep weakening thanks to its restrictive monetary policy. Governor Fatih Karahan, speaking at a quarterly presentation in Ankara on Thursday, said the central bank still projects inflation ending 2024 at 38%. The bank also left next year’s estimate at 14%.

COMMODITIES (BBG): European Gas Gains as Ukraine Border Fighting Adds to Risks

European natural gas prices resumed gains, trading at the highest levels this year as market participants monitor the transit of Russian fuel across Ukraine. Benchmark futures rose as much as 2.6% to near €39 a megawatt-hour, the highest since December. Russia declared a state of emergency in the Kursk region on the border with Ukraine, as fighting continues after Ukraine’s incursion into the area which hosts a key gas intake point.

DATA

UK DATA (MNI): Only Modest Easing in Permanent Wage Growth - KPMG-REC Report on Jobs

The KPMG-REC Report on Jobs showed "below trend" permanent pay growth in July whilst permanent placements fell for a second month. That said, the pace of permanent pay growth is still somewhat sticky and there continues to appear to be a skills mismatch despite staff availability rising again. Permanent staff placements declined again in July "extending the current downturn to nearly two years" due to "subdued demand", albeit by less then they did in June. Similarly, temporary placements also edged down slightly "as firms chose not to renew or replace expiring temporary contracts."

UK DATA (BBG): UK Job Surveys Show More Private Sector Hiring and Stronger Pay

Britain’s employers stepped up hiring for white-collar roles and permanent staff, pointing to upward pressure on wages that the Bank of England is worried may feed inflation, two separate surveys indicated. Vacancies for professional jobs in the private sector jumped to almost 37,000 in July, the most since March 2023, according to data from company websites and job boards provided to Bloomberg by recruiter Robert Walters Plc. That’s up by a third from last month, when companies paused recruitment ahead of the July 4 general election. It’s also a 14% annual rise — a rate not seen since the post-Covid rebound in 2022.

UK JULY RICS HOUSE PRICE BALANCE FALL TO -19%; EST. -11% (BBG)

JAPAN DATA (MNI): Japan July Sentiment Index, Outlook Index Rise

Japan's sentiment and outlook indices posted their second straight rise, supporting the view that higher nominal wages boosted consumer sentiment and will strengthen spending, the Economy Watchers report released by the Cabinet Office showed Thursday. The Economy Watchers sentiment index for the current economic climate stood at a seasonally adjusted 47.5 in July, up from 47.0 in June, while the outlook index for two to three months ahead rose 0.4 points to 48.3 in July from 47.9 in June. The indexes linked to households and businesses rose but the index linked to labour market fell.

NEW ZEALAND DATA (MNI): Inflation Expectations Ease Further Signalling Lower Price Pressures

RBNZ Q3 business inflation expectations eased to lows not seen since H1 2021. 1-year ahead moderated 0.3pp to 2.4% and 2-year ahead 0.3pp to 2.0%, both of which are in the band and the latter at the mid-point and signalling further downside in the CPI. With easing in demand and the labour market and inflation expectations around target, the RBNZ can communicate a rate hike before the end of the year at its August 14 meeting, which will also include updated staff forecasts. But with elevated domestic inflation, we don't see a cut in August. Household inflation expectations are released on August 13.

FOREX: AUD Benefits From Bullock's Vigilance

- Following the acute spell of weakness posted off the July high, AUD trades on a more stable footing early Thursday, ahead of all others in G10 on the back of an appearance from the RBA governor Bullock. Bullock did not shy away from talking up the prospect of a rate hike in the near future, with the central bank retaining their vigilant approach to inflation.

- Elsewhere, JPY trades marginally firmer, but USD/JPY holds comfortably north of the Y145 handle as the fraught equity backdrop persists. Index futures trades lower across Europe, and US markets are mixed ahead of the cash equity open.

- The NOK is the poorest performer in G10 as the currency reverses a small part of the two-day rally posted off the Monday low. USD/NOK has shrugged off the slowing wages data evident in this morning's Q2 release, which should keep the wage picture off the Norges Bank's lists of concerns ahead of next week's rate decision. CPI data should prove more eventful for the currency, set for release early Friday.

- Weekly jobless claims data tops the docket Thursday, with wholesale inventories and trade sales unlikely to move the market needle. The speakers slate is similarly muted, with just Fed's Barkin appearing for a fireside chat just ahead of the US cash close.

EGBS: EGBs Push Higher as Equities Weaken, Spreads Widen A Touch

Bunds have pushed higher alongside core FI this morning, with equities trading weaker amid a light macro calendar.

- Bund futures are +44 at 134.56, but remain well short of Monday’s high at 136.28. A renewed sell-off through 133.77 (Aug 1 low) and 133.34 (20-day EMA) would allow for the continued unwind of an overbought technical condition.

- OAT and BTP futures are also stronger today, but lag Bunds a little with European equities on the defensive.

- Major spreads to Bunds are wider as a result, but are off intraday wides.

- The German cash curve has bull steepened this morning, after bear steepening yesterday, allowing the 2s10s curve to reach -12.5bps.

- Euribor futures are +1.0 to +6.5 ticks higher, rallying alongside short-end EGBs. Meanwhile ECB-dated OIS continue to price over 70bps of cuts through the remainder of this year.

- US initial jobless claims provides the main release of interest this afternoon.

GILTS: Bull Steepening Extends as Equities Move Lower

Gilts are off session highs but still firmer on the day.

- Weakness in European equity benchmarks drove the early bid.

- Futures last +28 at 99.77 vs. highs of 99.88.

- Initial resistance remains some distance away at the August 6 high (100.43), although the recent pullback is deemed corrective, with initial support at the Jun 21 (99.23) high untested.

- Yields are 2-6bp lower.

- Recent curve steepening theme maintained, 2s10s above 30bp for the first time since Q422, while 5s30s is ~7bp off YtD highs.

- The delivery of the first BoE rate cut and broader market sentiment have allowed the steepening to extend further over the last week.

- STIRs see a dovish move alongside the rally in the long end.

- SONIA futures flat to +7.5.

- BoE-dated OIS shows 10bp of cuts for September and ~48bp of cuts through year end.

- The UK calendar is very limited until next week’s CPI & labour market reports, leaving broader risk sentiment at the fore.

EQUITIES: Trend Outlook for E-Mini S&P Remains Bearish

A bear threat in Eurostoxx 50 futures remains present and the contract traded lower Monday having starting the week on a bearish note. Last week’s sell-off resulted in a break of 4846.00, the Apr 19 low. The breach highlights a stronger reversal and signals scope for an extension towards 4478.81 next, a Fibonacci projection. Firm resistance is 4904.34, the 50-day EMA. First resistance is 4720.53, a Fibonacci retracement. S&P E-Minis traded lower Monday, starting this week on a bearish note, confirming an extension of the bear cycle. The move down has resulted in a print below 5185.50, 76.4% of the Apr 19 - Jul 16 bear leg. A clear break of this level would open 5092.00 next, the May 2 low. Wednesday’s intraday high of 5359.25 marks initial resistance. The 50-day EMA, a firmer level, is at 5465.14. Gains are considered corrective - for now.

- Japan's NIKKEI closed lower by 258.47 pts or -0.74% at 34831.15 and the TOPIX ended 27.51 pts lower or -1.11% at 2461.7.

- Elsewhere, in China the SHANGHAI closed higher by 0.067 pts or +0% at 2869.901 and the HANG SENG ended 13.97 pts higher or +0.08% at 16891.83.

- Across Europe, Germany's DAX trades lower by 134.3 pts or -0.76% at 17478.21, FTSE 100 lower by 90.08 pts or -1.1% at 8076.32, CAC 40 down 83.93 pts or -1.16% at 7181.89 and Euro Stoxx 50 down 52.31 pts or -1.12% at 4615.25.

- Dow Jones mini down 104 pts or -0.27% at 38802, S&P 500 mini down 13 pts or -0.25% at 5214.5, NASDAQ mini down 18.75 pts or -0.1% at 17947.

Time: 09:50 BST

COMMODITIES: WTI Futures Hold Onto the Bulk of Wednesday's Gains

A bear threat in WTI futures remains present and the contract traded lower Monday, extending the current downtrend, before recovering. Sights are on the next key support at $72.23, the Jun 4 low. It has been pierced, a clear break would reinforce bearish conditions and pave the way for an extension towards $70.73, the Feb 5 low. Key resistance is seen at $78.88, the Aug 1 high. Short-term gains would allow an oversold condition to unwind. Recent weakness in Gold appears to be a correction. However, note that the yellow metal has managed to pierce support at the 50-day EMA - at $2375.6. A clear break of this EMA would signal scope for a deeper retracement towards $2277.4, the May 3 low and a key support. For bulls, a resumption of gains would open $2483.7, the Jul 17 high and a bull trigger. Clearance of this hurdle would resume the uptrend.

- WTI Crude down $0.14 or -0.19% at $75.01

- Natural Gas down $0.03 or -1.42% at $2.081

- Gold spot up $10.52 or +0.44% at $2393.73

- Copper up $0.8 or +0.2% at $395.85

- Silver up $0.23 or +0.86% at $26.8468

- Platinum up $6.67 or +0.73% at $924.78

Time: 09:50 BST

| Date | GMT/Local | Impact | Country | Event |

| 08/08/2024 | 1230/0830 | *** | Jobless Claims | |

| 08/08/2024 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 08/08/2024 | 1400/1000 | ** | Wholesale Trade | |

| 08/08/2024 | 1430/1030 | ** | Natural Gas Stocks | |

| 08/08/2024 | 1530/1130 | * | US Bill 08 Week Treasury Auction Result | |

| 08/08/2024 | 1530/1130 | ** | US Bill 04 Week Treasury Auction Result | |

| 08/08/2024 | 1700/1300 | *** | US Treasury Auction Result for 30 Year Bond | |

| 08/08/2024 | 1900/1500 | *** | Mexico Interest Rate | |

| 08/08/2024 | 1900/1500 | Richmond Fed's Tom Barkin | ||

| 09/08/2024 | 0130/0930 | *** | CPI | |

| 09/08/2024 | 0130/0930 | *** | Producer Price Index | |

| 09/08/2024 | 0600/0800 | *** | HICP (f) | |

| 09/08/2024 | 0600/0800 | ** | Private Sector Production m/m | |

| 09/08/2024 | 0600/0800 | *** | CPI Norway | |

| 09/08/2024 | 0800/1000 | ** | Italy Final HICP | |

| 09/08/2024 | 1230/0830 | *** | Labour Force Survey | |

| 09/08/2024 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.