-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI US Open: Stocks Shrug Off Stagflation Concerns

EXECUTIVE SUMMARY:

- MNI ECB PREVIEW: PUSHING BACK AGAINST THE MARKET

- GERMAN GOV'T EXPECTS INFLATION TO SURGE TO 2.9% IN 2021; CUTS GDP GROWTH FORECAST (RTRS)

- EU'S GENTILONI: GROWTH STRONG, BUT DOWNSIDE RISKS

- SPAIN FACTORY GATE INFLATION HIGHEST SINCE 1977; SWEDEN ALL-TIME HIGH

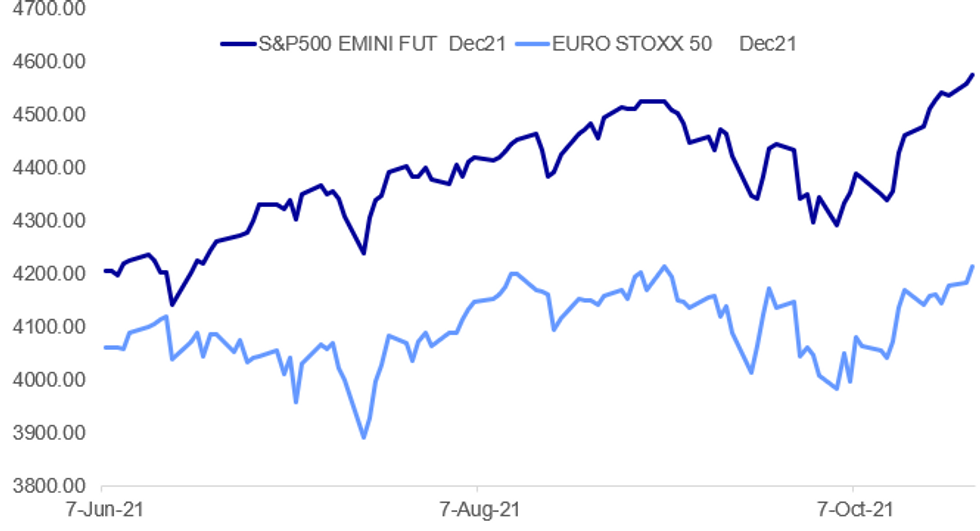

Fig. 1: Equities Continue To Rise

Source: BBG, MNI

Source: BBG, MNI

NEWS:

ECB (MNI PREVIEW): Coming mid-quarter and following President Lagarde's indication that major policy decisions will be announced in December, the October ECB meeting will be a relatively low-key event. That is not to say that the meeting will be entirely uneventful. The ECB is likely to push back against the recent hawkish shift in market rate expectations and restress the forward guidance. For full preview: https://marketnews.com/mni-ecb-preview-october-202...

GERMANY (RTRS): The German government expects consumer price inflation to surge to 2.9% this year and ease to 2.2% next year, a source told Reuters on condition of anonymity.In its updated economic forecasts, the government expects inflation to ease further to 1.7% in 2023, the source said. The figures compare with a consumer price inflation of 0.6% in 2020.Economy Minister Peter Altmaier will present the updated economic forecasts during a news conference on Wednesday. A spokesperson for the Economy Ministry declined to comment.

GERMANY (RTRS): The German government has slashed its economic growth forecast for this year to 2.6%, but lifted its estimate for next year to 4.1%, two sources told Reuters on condition of anonymity on Tuesday. The revised government forecast for gross domestic product growth compares with an April prediction for the economy to grow by 3.5% in 2021 and by 3.6% in 2022.

EU: Growth across the European Union is still looking strong ahead of the publication of the European Commission's Autumn Forecasts to be delivered on November 11, Economic Affairs Commissioner Paolo Gentiloni said Tuesday. Speaking in Madrid, Gentiloni said that euro zone growth was "still looking strong", but he warned of increasing downside risks, including supply chain disruption, inflation and rising Covid infections in some parts of the EU.

JAPAN (BBG): Japan's Dai-ichi Life Insurance company plans to boost its holding of yen bonds, such as project and asset finance and Japanese government bonds, for the October-March period, after increasing the balance of yen bond holdings through the first half of this fiscal year to September, the company's fund manager said on Tuesday.

EUROZONE BANKS (RTRS): Euro zone banks tightened access to mortgages in the three months to September and expect to continue doing so in the final quarter of the year, a European Central Bank survey showed on Tuesday.ECB policymakers are set to take stock of the economic situation at a meeting on Thursday, paving the way for a decision in December on the future of the central bank's bond-buying programmes. The ECB's Bank Lending Survey painted an unchanged picture for corporate borrowers but the bar was raised for households looking for a home loan, who also faced less favourable mortgage terms. "For housing loans, the net tightening was related to banks' risk tolerance and their cost of funds and balance sheet constraints," the ECB said.

EUROZONE BANKS (RTRS): The effects of the climate change could lead to a major source of risks for banks exposed to them if environmental risks were not properly mitigated, European Central Bank (ECB) governing council member Pablo Hernandez de Cos said on Tuesday. "If climate change is not mitigated, the effect would be concentrated in certain geographical areas, mainly due to physical risks in the long run, leading to a major source of risk particularly for banks exposed to them," De Cos told a financial event in Madrid.

SWEDEN (BBG): Sweden's factory-gate prices soared most on record in September, adding inflation pressures even as the Riksbank considers the energy-driven surge in consumer prices as transitory. Producer price index jumped 17.2% from a year earlier, led by a 44.3% surge on energy-related products, Statistics Sweden reports

DATA:

MNI BRIEF: Spain Factory Gate Inflation At 44-Year High

There was no let up in the surging costs for producers in Spain, with year-on-year producer inflation surging by 23.6% in September -- 5.6 percentage points higher than August levels. The September surge leaves Spain's factory gate inflation at the highest level since 1977 and will undoubtedly make uncomfortable reading for the European Central Bank's Governing Council as they gather on Thursday.

All sectors added to PPI across the month, but by far the main driver was energy costs, higher by 59.6% y/y -- the highest since the series started in 1976, according to Spanish stats agency IPRI.

Spain annual PPI (%)

Source: IPRI

FIXED INCOME: Better bid throughout the morning European session

- EGBs have been better bid today, and not very clear on the actual driver.

- Flows have favoured fading, RECeiving, as we traded towards Yield resistances last Friday.

- Moves are more corrective with short covering going through.

- Volumes are still mostly below averages, which has helped exacerbate the price action.

- Early action is squarely in Equities.

- European peripheral spreads are a touch wider this morning against the German 10yr, but we trade well within past ranges.

- Greece leads though, by 2bps wider.

- Gilts have traded in line with Bunds, translating in a 0.5bp tighter spread at 124.5bps.

- UK 5s/30s is leaning flatter, but short of the October low at 48.7333, now at 51.789.

- Treasuries have lagged somewhat behind, but volumes to the buy side have also picked up in the past few minutes as we trade through the intraday high, printed 130.22+.

- Looking ahead, speakers include ECB de Cos and Villeroy, but unlikely to learn anything new, with ECB this week

FOREX: EUR/GBP Prints a Fresh 2021 Low

- Further strength in US equity futures is fueling a risk-on backdrop, helping USD/JPY trade well ahead of the NY crossover. The pair trades either side of the Y114 handle at pixel time, with resistance at last Friday's high of Y114.21 the first upside resistance. As a result, the JPY and CHF are the poorest performers on the day, while growth proxies and commodity-tied FX including AUD and NZD trade at the top-end of the G10 pile.

- GBP trades well, with EUR/GBP trading a fresh 2021 low this morning. Markets eye near-term support at the 1.0% 10-dma envelope initially at 0.8369 and 0.8356, the Low from Feb 26, 2020. Firmer support is expected headed into the 2019/2020 lows of 0.8282/77.

- US new home sales data crosses alongside October consumer confidence, with a speech from ECB's Villeroy also on the docket.

EQUITIES: Cyclicals Lead European Stocks Higher

- Asian stocks closed mixed, with Japan's NIKKEI up 505.6 pts or +1.77% at 29106.01 and the TOPIX up 22.98 pts or +1.15% at 2018.4. China's SHANGHAI closed down 12.225 pts or -0.34% at 3597.638 and the HANG SENG ended 93.76 pts lower or -0.36% at 26038.27.

- European stocks are higher, with the German Dax up 143.99 pts or +0.92% at 15742.57, FTSE 100 up 53.8 pts or +0.74% at 7276.65, CAC 40 up 52.03 pts or +0.78% at 6764.7 and Euro Stoxx 50 up 31.38 pts or +0.75% at 4219.67.

- U.S. futures are gaining, with the Dow Jones mini up 92 pts or +0.26% at 35712, S&P 500 mini up 17.75 pts or +0.39% at 4575.75, NASDAQ mini up 101.5 pts or +0.66% at 15597.25.

COMMODITIES: Metals Stumble

- WTI Crude down $0.5 or -0.6% at $83.29

- Natural Gas up $0.01 or +0.24% at $5.912

- Gold spot down $5.95 or -0.33% at $1801.61

- Copper down $3.5 or -0.77% at $449.3

- Silver down $0.3 or -1.23% at $24.2613

- Platinum down $12.24 or -1.15% at $1050.15

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.