-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China Crude Oil Imports Accelerate In November

MNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI US Open: Stocks Stabilize, But Bunds And USD Still Bid

EXECUTIVE SUMMARY:

- CHINA DENIES MICROSOFT HACK, SAYS US AND ALLIES GANGING UP

- EUROZONE Q2 BANK CREDIT STANDARDS LITTLE CHANGED: ECB

- BOE HASKEL: ENDING QE EARLY WOULD BE TIGHTENING

Fig. 1: U.S. Tsys 2s5s (bps)

Source: BBG, MNI

Source: BBG, MNI

NEWS:

CHINA / U.S. (BBG): China rejected accusations by the U.S., U.K. and their allies that actors linked to the Asian nation's government were behind the Microsoft Exchange hack and other "malicious cyber activities.""The U.S. ganged up with its allies and launched an unwarranted accusation against China on cybersecurity," Chinese Foreign Ministry spokesman Zhao Lijian said Tuesday at a regular press briefing in Beijing. "It is purely a smear and suppression out of political motives. China will never accept this."Zhao added that the details released by the U.S. "do not constitute a complete chain of evidence. In fact, the U.S. is the largest source of cyber attacks in the world."

EUROZONE / ECB: Loan approval criteria for banks across the euro area were little changed in the 3 months to July, according to the European Central Bank's latest Bank Lending Survey published Tuesday. According to the survey, credit conditions were broadly unchanged for loans to enterprises, standing at -1 (zero is unchanged). Standards for consumer credit and other non-mortgage lending to households was flat. In Q3, the survey shows banks expecting a slight tightening of standards form loans to firms, while remaining broadly unchanged on loans to households.

BOE: Bank of England Monetary Policy Committee member Jonathan Haskel made clear Monday that his opposition to tightening early extended to opposing early termination of the current GBP150 billion round of asset purchases and to stopping reinvestment of the maturing gilts held by the Bank. Asked by Market News at a University of Liverpool event if he believed changes to quantitative easing, such as natural run-off of maturing gilts, amounted to tightening, Haskel said "Yes, I do. We are involved in completing our quantitative easing programme that we announced in the height of the pandemic last year. So were we to stop that, in my view, would be a tightening."

PBOC: MNI highlights the chances for a second cash reserve ratio requirement cut by the People's Bank of China in an exclusive story -- On MNI Policy MainWire now, for more details please contact sales@marketnews.com

SOUTH AFRICA (BBG): South Africa's High Court postponed former South African President Jacob Zuma's trial on corruption, money laundering and racketeering charges until Aug. 10.Judge Piet Koen agreed to the delay at a hearing in the eastern town of Pietermaritzburg on Tuesday, after Zuma's lawyer Dali Mpofu argued that his client should to be physically present in court. Proceedings have taken place remotely this week due to security concerns linked to a wave of protests in the region.

SPAIN POLITICS: Spain's main opposition centre-right People's Party (PP) recorded its lowest polling support of any survey carried out by outlet Sigma Dos since early May on 19 July.

- General election poll : PP : 28,8 % (-1,3), PSOE : 25,1 % (+0,6), Vox : 14,1 % (-1,4), Podemos : 10 % (-1,4), Mas Pais : 4,8 % (+0,4), Republican Left of Catalonia : 3,4 % (-0,1), Citizens : 2,8 % (+0,3). Sigma Dos/Antena 3, released 19/07/21

- Overall, the PP retains its narrow lead over Prime Minister Pedro Sanchez's centre-left Spanish Socialist Workers' Party (PSOE), the latter of which has not yet seen a significant boost from last week's Cabinet reshuffle.

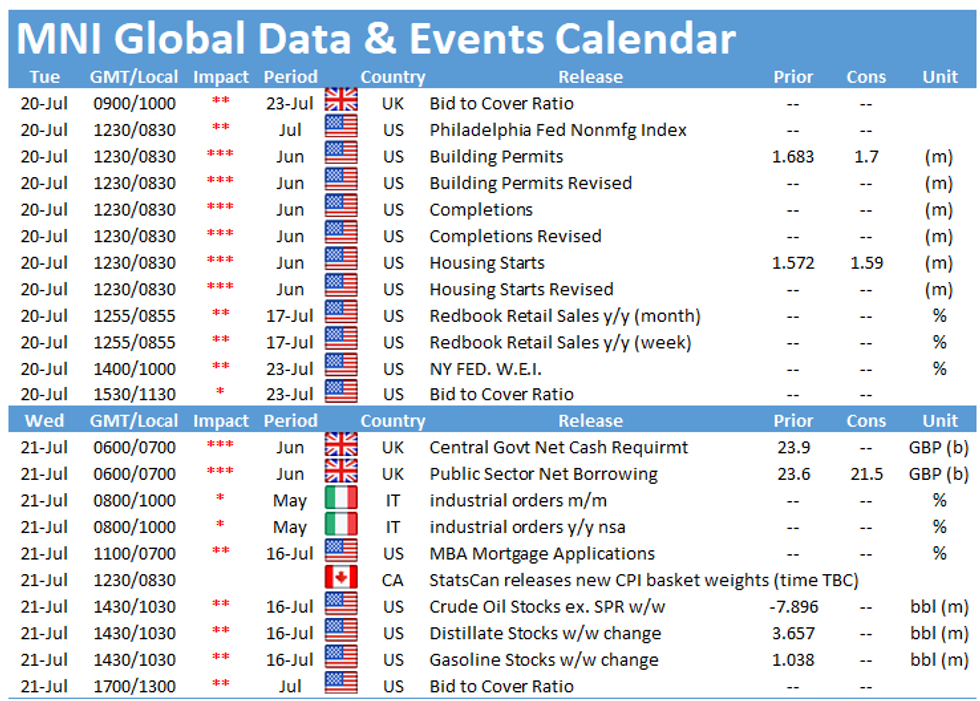

DATA:

FIXED INCOME: Bunds propelled higher by technical levels

Bunds are outperforming Treasuries and gilts this morning with technicals dictating the divergences here amongst decent moves so far this week.

- Bunds yields yesterday moved below the mid-February gap at -0.4010% and the 200-dma at -0.3897% but the move was not consolidated as Bund yields closed above these levels. However, despite equities rebounding somewhat this morning, Bunds continue to press higher with these levels under pressure.

- Concerns surrounding the Delta variant continue to be the predominant talking point for markets, but there is also a view that some of the moves yesterday were a little too much, too fast. Hence, gilts and Treasuries are unch to a little lower this morning while peripheral spreads are mixed.

- The highlight on the data calendar will be US housing starts / building permits. There are no further ECB/Fed/BOE speakers due up later today.

- TY1 futures are down -0-2+ today at 134-19+ with 10y UST yields up 0.7bp at 1.197% and 2y yields down -0.6bp at 0.211%.

- Bund futures are up 0.33 today at 175.85 with 10y Bund yields down -2.6bp at -0.413% and Schatz yields down -1.1bp at -0.708%.

- Gilt futures are up 0.04 today at 129.99 with 10y yields down -1.7bp at 0.542% and 2y yields down -1.9bp at 0.057%.

FOREX: Market Still Favours USD as Stock Selloff Abates

- The dollar is firmer for a fourth session, with the greenback rising against most others in G10. Greenback strength comes despite the easing of selling pressure in equity markets, with stocks across Europe and in US futures space both staging a modest bounce.

- Nonetheless, the recovery in stocks has been tepid at best, with the e-mini S&P still around 50 points shy of the week's best levels. As a result, growth proxies and high beta currencies are yet to have felt any benefit, with NZD and AUD among the session's poorest performers so far.

- GBP/USD's downtrend persists Tuesday, with the pair bottoming out a new multi-month low of 1.3627. The outlook is deteriorating with prices south of the 200-dma, opening losses toward the next key support at the February low of 1.3567.

- Today's session is a little busier, but there's still a relative lack of tier 1 data releases. US building permits/housing starts are due and there are no notable central bank speakers.

EQUITIES: Asian Markets Close Weaker; US And Europe Clawing Back Losses

- Asian markets closed weaker, with Japan's NIKKEI down 264.58 pts or -0.96% at 27388.16 and the TOPIX down 18.24 pts or -0.96% at 1888.89. China's SHANGHAI closed down 2.332 pts or -0.07% at 3536.791 and the HANG SENG ended 230.53 pts lower or -0.84% at 27259.25.

- European stocks have bounced a bit, with the German Dax up 76.62 pts or +0.51% at 15211.01, FTSE 100 up 48.9 pts or +0.71% at 6893.38, CAC 40 up 58.47 pts or +0.93% at 6353.77 and Euro Stoxx 50 up 25.93 pts or +0.66% at 3954.34.

- U.S. futures are edging higher, with the Dow Jones mini up 214 pts or +0.63% at 34053, S&P 500 mini up 21.25 pts or +0.5% at 4272.5, NASDAQ mini up 67.75 pts or +0.47% at 14608.5.

COMMODITIES: Stable After Monday's Weakness, With Copper Outperforming

- WTI Crude up $0.08 or +0.12% at $66.5

- Natural Gas down $0.01 or -0.19% at $3.769

- Gold spot up $2.07 or +0.11% at $1814.75

- Copper up $3.2 or +0.76% at $423.55

- Silver down $0.04 or -0.17% at $25.1361

- Platinum up $2.25 or +0.21% at $1079.7

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.