-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI US Open: Stocks Stall Ahead Of Pre-Thanksgiving Session

EXECUTIVE SUMMARY:

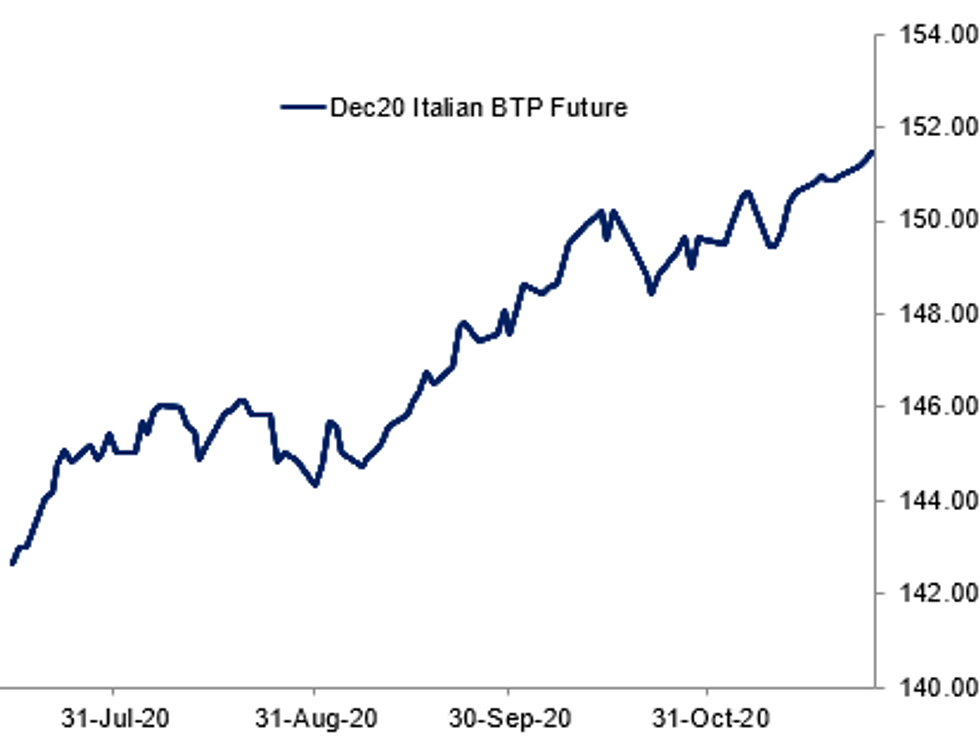

- EQUITY GAINS STALL BUT ITALIAN BONDS HIT RECORD HIGHS

- MNI CHINA LIQUIDITY INDEX: CONDITIONS EASE; GOV'T BOND RATES UP

- UK CHANCELLOR SUNAK TO PRESENT SPENDING REVIEW LATER TODAY

- DIFFERENCES REMAIN BETWEEN EU, UK: VON DER LEYEN

- MNI RIKSBANK PREVIEW: A FINELY BALANCED DECISION

Fig.1: Italian Bond Futures Hit Fresh Highs

BBG, MNI

BBG, MNI

NEWS:

MNI CHINA LIQUIDITY INDEX: Liquidity across China's interbank market eased modestly in November, recovering from the modest tightening seen in the previous month, the latest MNI Liquidity Conditions Index shows. The Index fell to 43.8 in November from the 78.1 recorded in October, hitting the lowest reading in the last six months, this survey showed, with almost a third of respondents reporting an easing in conditions over the four-week period. The higher the index reading, the tighter liquidity appears to survey participants. For full analysis contact sales@marketnews.com

UK: Chancellor Sunak will present the Spending Review (i.e. mini-budget) this afternoon after PMQs (roughly 12:30GMT). The scope for this has been scaled back from a multiyear review to something that might leave a lot of the harder decisions on how to raise extra revenue to plug the gaps from the Covid-induced deficit until the March Budget. Extra money for the NHS is expected, a national infrastructure bank based in the North of England and possibly reforms to how pension contributions are taxed to make them less generous to higher rate taxpayers are among the measures expected to be announced today. The Spending Review will contain the OBR's updated forecasts for the economy and with it updated expectations for issuance.* The DMO will release its new remit alongside the Spending Review and the agenda for the consultation for the investor/GEMMs meetings which will likely contain a broad overview of the gilts expected to be issued alongside a provisional calendar for January-March issuance. The outcome of the RPI review will also be announced, something that will be watched particularly closely by the linker market.

RIKSBANK: MNI's Riksbank preview. Tomorrow's decision is finely balanced with 45% of market participants expecting a QE extension and 7/12 of the sell side notes we have read looking for more QE. This is our most comprehensive ever Riksbank preview and we talk through the dilemma facing the Riksbank and why, although we have a low conviction, we ultimately think that the Riksbank will sway towards extending QE bySEK100bln tomorrow. For the full preview click here: https://marketnews.com/riksbank-preview-november-2...

UK-EU: There has been some progress in talks between the European Union and UK to secure a trade deal, but large differences remain, European Commission President Urusla von der Leyen said Wednesday. There are three main areas of difference, with serious issues in the area of state aid, she told the European Parliament, noting all efforts would be taken through lead negotiator Michel Barnier to reach a deal.

E.C.B.: Risks are building across the eurozone's corporate sector as the pandemic evolves which could test the resilience of regional banks in the future, the European Central Bank's latest Financial Stability Review notes. The extensive policy measures are helping euro area corporates and households to cope with Covid-19 fallout, but risks can arise "either from a premature end to measures or from prolonged support," the report says. According to the ECB, premature withdrawal of fiscal support could set back the recovery, turning corporate liquidity issues into solvency issues.

BOE: The longer-term impact of Brexit on the UK economy could be more permanent that the effects of Covid-19, Bank of England Monetary Policy Committee member Michael Saunders said in an interview published Wednesday. "Businesses will shake off the effect of Covid-19 as they're temporary, but the long-term effects of Brexit could be more permanent," Saunders told the East Midlands-based thebusinessdesk.com, accepting a 'no-deal' Brexit had been hard for firms to prepare for due to the unknown.

GERMANY: The Ifo export expectations index dropped to -2.1 in November, down from October's 7.0, signalling a drop in sentiment among German exporters. The severity of the second wave of Covid-19 across many European countries has weighed on exports, Ifo added.

GERMANY (BBG): A passenger vehicle was apparently deliberately driven into the gates of German Chancellor Angela Merkel's office in central Berlin on Wednesday, though it appeared to have caused little damage. Unverified photographs posted on Twitter showed a car halted next to the gate, with police and ambulance personnel standing nearby. The car had a slogan painted on it reading: "You damn child and old people killers." Chancellery officials and police did not immediately respond to requests for comment.

JAPAN: Japan's government on Wednesday left its main economic assessment unchanged for the fifth straight month saying the situation, while still severe, is improving but for the first time in two months it changed its view on production and capital investment. "The Japanese economy is still in a severe situation due to the Novel Coronavirus, but it is showing movements of picking up," the report said. The government referred to industrial production also as "picking up," an upgrade from its previous view that industrial production is showing "movements of picking up."

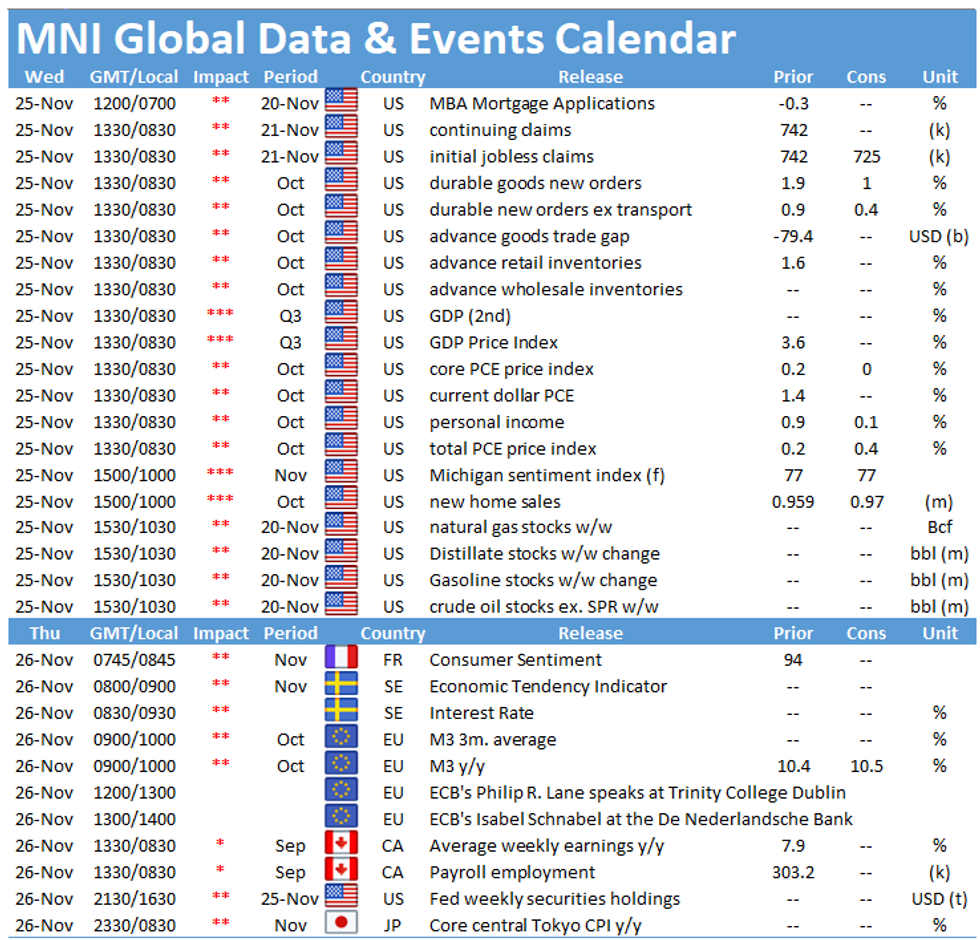

DATA:

FIXED INCOME: UK Spending review, FOMC Mins and US data make for a busy schedule

Core fixed income has drifted higher this morning despite equities being largely mixed and peripheral spreads tightening.

- Focus today will be on the UK Spending Review which will include new economic and fiscal forecasts from the OBR, a new gilt remit from the DMO and the results of the RPI review. The latter is important for the linker market as it is expected to formalize the phase-out of RPI with expectations for a transition around 2030 (not that the longest-dated linker matures in 2068).

- Today will also see the release of the second print of US Q3 GDP alongside claims, durable goods and personal income/spending data. GDP is arguably the least important of these with the other data giving a more timely indication of the state of the economy in October and beyond. The FOMC Minutes today will be watched for any discussion surrounding QE with Powell alluding to a lengthy discussion on asset purchases during the press conference - so any potential changes will be noteworthy.

- TY1 futures are up 0-2 today at 138-10 with 10y UST yields down -0.7bp at 0.874% and 2y yields down -0.1bp at 0.161%.

- Bund futures are up 0.07 today at 175.33 with 10y Bund yields down -0.9bp at -0.573% and Schatz yields down -0.7bp at -0.758%.

- Gilt futures are up 0.10 today at 135.03 with 10y yields down -1.4bp at 0.315% and 2y yields down -1.2bp at -0.36%.

FOREX: Position-Squaring Ahead of US Data Deluge

EUR/USD started the session strongly, bidding up to 1.1930 to mark a new multi-month high. Profit-taking and position squaring then dragged the pair lower, with markets keeping an eye on option interest in the pair layered between 1.1835-70.

Macro/news drivers have been few and far between, with markets looking ahead to a deluge of US data brought forward by the mid-week Thanksgiving market closures. Later today we get weekly jobless claims, trade balance, secondary Q3 GDP, October durable goods, personal income/spending, Uni of Michigan confidence, new home sales and, finally, the FOMC minutes. Markets will be on watch for any mention of QE or asset purchase arrangements, as the market bakes in expectations of action as soon as December's meeting.

GBP is marginally softer, but Brexit news has been thin on the ground as negotiations continue. The still-firm oil price continues to prop up commodity-tied FX, with NOK outperforming.

EQUITIES: Nasdaq Futures Outperforming As Broader Market Pauses For Breath

Equities have eased off following Tuesday's gains, though notably we're seeing an outperformance in Nasdaq futures.

- Asian equities closed mixed, with Japan's NIKKEI up 131.27 pts or +0.5% at 26296.86 and the TOPIX up 5.27 pts or +0.3% at 1767.67. China's SHANGHAI closed down 40.496 pts or -1.19% at 3362.327 and the HANG SENG ended 81.55 pts higher or +0.31% at 26669.75.

- European futures are lower, with the German Dax down 17.32 pts or -0.13% at 13308.16, FTSE 100 down 27.15 pts or -0.42% at 6464.67, CAC 40 down 6.7 pts or -0.12% at 5584.67 and Euro Stoxx 50 down 5.73 pts or -0.16% at 3512.68.

- U.S. futures are mixed, with the Dow Jones mini down 44 pts or -0.15% at 29954, S&P 500 mini down 1.75 pts or -0.05% at 3631, NASDAQ mini up 34.75 pts or +0.29% at 12110.75.

COMMODITIES: Precious Gains As Dollar Softens

Oil is outperforming once again, with precious metals up slightly as the dollar softens (gold trading a little above support at $1800.50).

- WTI Crude up $0.42 or +0.94% at $45.38

- Natural Gas down $0.06 or -2.05% at $2.718

- Gold spot up $4.26 or +0.24% at $1812.32

- Copper down $0.45 or -0.14% at $332.2

- Silver up $0.17 or +0.75% at $23.3688

- Platinum up $0.13 or +0.01% at $963.42

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.