-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Stocks Strong Into Month-End And (Long) Weekend

EXECUTIVE SUMMARY:

- ECB'S ASSET PURCHASE FLEXIBILITY TO BE DISCUSSED: SCHNABEL

- BANQUE DE FRANCE'S VILLEROY SAYS BANK DIVIDEND CURBS SHOULD BE LIFTED IN SEPTEMBER

- FRANCE SEES HIGHEST INFLATION IN 29 MONTHS; Q1 GDP REVISED DOWN

- B.O.E. SHOULD BE MORE READY TO WITHDRAW MONETARY STIMULUS

- "SIMPLISTIC" TO SEE RBNZ AS HAWKISH: EX OFFICIAL (MNI INTERVIEW)

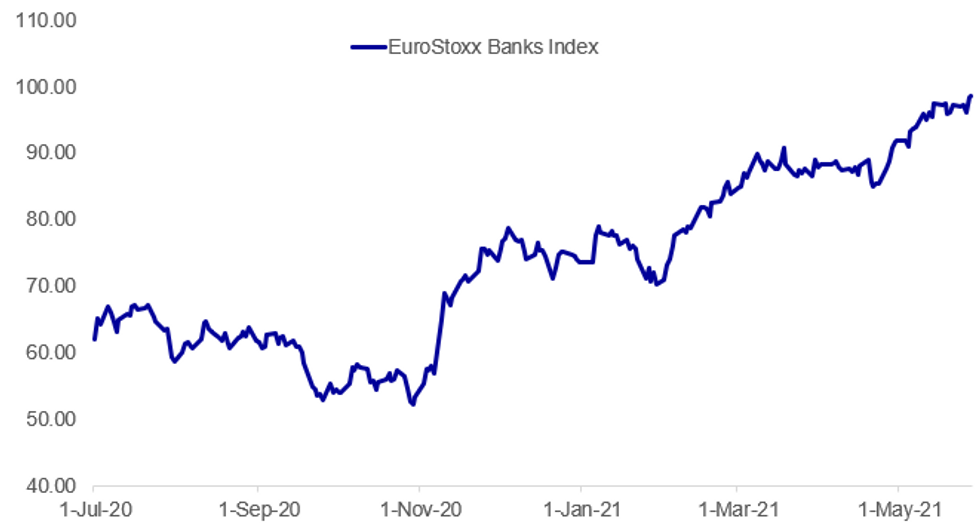

Fig. 1: European Bank Stocks Continue To Gain

Source: BBG, MNI

Source: BBG, MNI

NEWS:

ECB: With the European Central Bank's Governing Council set to reassess the pace of PEPP purchases at next month's meeting, Executive Board member Isabel Schnabel has stressed that the "whole concept of PEPP is inconsistent with the idea that there will be a mechanical tapering of asset purchases," and could instead be linked more explicitly to financing conditions. In an interview published Friday, Schnabel expressed scepticism towards elements of average inflation targeting, and said the case for transferring PEPP's flexibility into the APP -- in terms of the pace and jurisdiction of asset purchases -- would have to be assessed very carefully as part of the ongoing strategy review.

ECB/BANKS (RTRS): Restrictions imposed last year on bank dividend payouts due to the economic crisis caused by the coronavirus pandemic are likely to be lifted in September, the head of the French central bank said on Friday. "Restrictions on dividends can and should be lifted from next September," Francois Villeroy de Galhau told journalists, speaking in his role as head of the ACPR French financial regulator. "It's a question of the attractiveness of our financial institutions against the backdrop of intense international competition," he said. The European Central Bank's final decision is due by the summer break, he added.

B.O.E. (BBG): Bank of England Chief Economist Andy Haldane speaks in an interview with the Centre for the Study of Financial Innovation posted on YouTube. "An atypically sharp recession will be followed by an atypically sharp recovery. That means we shouldn't be expecting the same policy playbook as we did after thew global financial crisis"" Then, policy stimulus stuck around a long, long time. This time the recovery will be very rapid" "We as policy makers should be more ready to withdraw our stimulus. If we don't, it does carry some risk of over-egging this particular pudding, by which I mean demand outstripping the economy's supply side" and boosting inflation.

RBNZ (MNI INTERVIEW): Market perceptions that the Reserve Bank of New Zealand has turned hawkish are "simplistic," and the Bank is still taking an accommodative policy approach despite forecasting a rate rise late next year, a former senior RBNZ official told MNI. For full article contact sales@marketnews.com

U.S.-CHINA (BBG): - The Senate was moving slowly toward passage of an expansive bill to bolster U.S. economic competitiveness and confront China's rise, debating some last amendments before a final vote.The legislation cleared an initial procedural vote after a deal was struck between Senate Majority Leader Chuck Schumer and Republicans on some changes to the bill. But the debate dragged into Friday morning as several Republicans demanded consideration of additional amendments and objected to voting without fully reading the lengthy bill.

U.S./COVID VACCINES (WSJ): WSJ On Twitter: The FDA and Johnson & Johnson expect to announce as early as Friday that contamination problems at a Covid-19 vaccine plant in Baltimore are resolved, clearing the way for millions more doses to become available.

E.U.: Yesterday the final two member state national parliaments approved the European Commission's Own Resources Decision, which will allow the Commission to issue debt in order to fund a EUR750bn COVID-19 recovery fund (the Recovery and Resilience Facility). The Austrian Federal Council and the Polish Senate both approved the decisions, with the formality of approval from each nation's president the final procedural hurdle to cross.

- With all member state parliaments having ratified the decision, each gov't has to submit for approval plans to the Commission and Council on how they plan to spend their allocated funds. Some, including Austria and Poland, submitted their plans before ratification by their parliaments.

- So far 19 of the 27 member states have submitted their plans with Romania, Bulgaria, Malta, Ireland, Estonia, Sweden and the Netherlands yet to do so.

DATA:

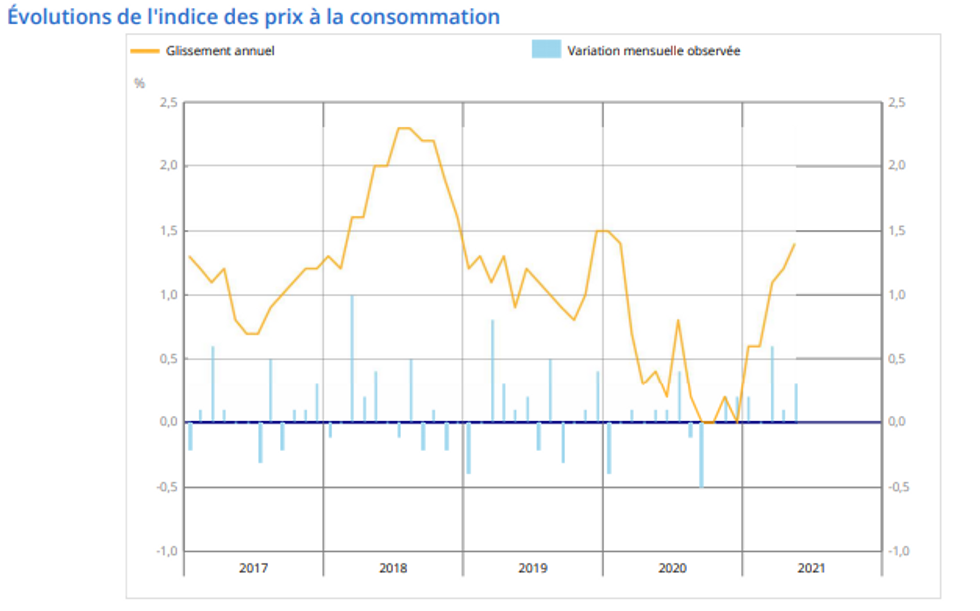

French Flash Inflation At 29-month high

MAY FLASH HICP +0.4% M/M, +1.8% Y/Y; APR +1.6% Y/Y

MAY FLASH CPI +0.3% M/M, +1.4% Y/Y; APR +1.2% Y/Y

- Annual inflation jumped to 1.8% in May, up from 1.6% seen in April, hitting the highest level since Dec 2018 where the index also stood at 1.9%.

- The headline HICP was in line with market forecasts (median 1.8%)

- May's uptick was driven by another sharp increase in energy prices, rising by 11.8% to the highest level since Oct 2018, as prices are compared to the low figures seen at the beginning of the pandemic.

- Energy inflation recorded negative rates throughout the pandemic and registered the first increase in Mar 2021.

- Service inflation slowed to 1.0% in May, down from 1.2% seen in Apr, showing a 3-month low.

- Similarly, tobacco prices decelerated to 5.3% in May, down from 5.8% seen in Apr, while prices for manufactured products were flat.

- Food inflation eased by 0.2% in May, its second decline in a row after having recorded positive rates since Nov 2016. The decline was again driven by a fall in prices for fresh food, down 3.0%.

Source: Insee

FRANCE Q1 FINAL REAL SA GDP -0.1% Q/Q, +1.2% Y/Y

MNI: FRANCE APR CONSUMER SPENDING -8.3% M/M, +32.0% Y/Y

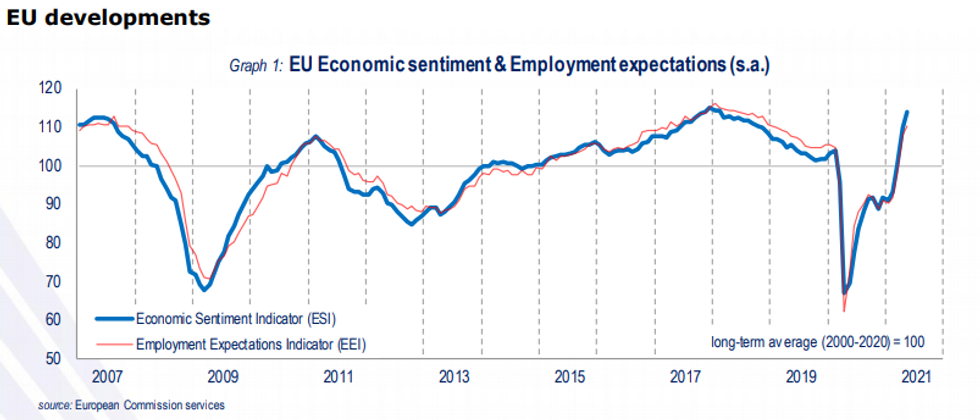

EZ ESI Beats Expectations in May

Economic Sentiment Indicator (ESI): 114.5; Prev (Apr): 110.5

Consumer: -5.1(Apr: -8.1); Industry: +11.5 (Apr: +10.9); Services: +11.3 (Apr: +2.2); Retail: -0.4 (Apr: -3.0); Construction: +4.9 (Apr: +3.0)

- The EZ ESI rose markedly again by 4.0pt to 114.5 in May, beating expectations of an uptick to just 112.0.

- The index now stands at the highest level since Jan 2018 and showed the fourth consecutive gain.

- May's increase was broad-based with every industry posting m/m gains, led by an 9.1pt uptick in the service sector with service sentiment recording the highest reading since Feb 2020.

- Retail trade confidence gained 3.4pt to a 17-month high in May and posted the first positive reading since Dec 2019, while consumer sentiment registered in line with the flash estimate showing an increase to -5.1.

- Industrial sentiment ticked up again in May by 0.6pt, marking the sixth consecutive gain and a new record high, while confidence in the construction sector ticked up 1.9pt and recorded the strongest reading since the start of the crisis.

- The ESI increased markedly in the six biggest EZ economies, led by Italy (+11.0pt) and followed by Poland (+5.1pt), France (+5.0pt), the Netherlands (+3.2pt), Germany (+2.8pt) and Spain (+2.3pt).

- The employment expectations index increased to 110.1 in May, marking the highest level since Dec 2018.

Source: European Commission

FIXED INCOME: Busy data day at month-end ahead of the holiday

After some initial Bund-led weakness on the open, cored fixed income has recovered and is now trading almost flat to yesterday's close.

- With the US and UK on holiday on Monday, there is some focus on month-end flows today.

- It is also a busy day on the data front. We have already had French flash HICP data (in line Y/Y at 1.8%, the highest since 2018), Spanish retail sales (better than expected) and Eurozone confidence data come in better than expected. Later today we have US personal income/spending, inventory and trade data as well as the MNI Chicago PMI.

- This morning we also saw the release of the gilt operations calendar for FQ2 (July to Sep). For more details, see our earlier bullets.

- ECB's Schnabel said rising yields are a "natural development at a turning point in the recovery"; Villeroy said bank dividend restrictions should be lifted from next September.

- TY1 futures are down -0-2 today at 131-23 with 10y UST yields up 0.1bp at 1.610% and 2y yields up 0.2bp at 0.148%.

- Bund futures are down -0.04 today at 169.75 with 10y Bund yields up 0.3bp at -0.170% and Schatz yields up 0.3bp at -0.662%.

- Gilt futures are down -0.03 today at 127.00 with 10y yields up 0.8bp at 0.817% and 2y yields up 1.1bp at 0.058%.

FOREX: Month-End Flow a Focus

- The greenback is moderately higher Friday morning, helping bump the USD Index back above the 90.00 handle. Similarly, the EUR trades more favourably, with month-end flow a focus into the early US close. Despite the final May fix falling on Monday, the US and UK market holidays may prompt participants to bring forward month-end flow into today's close. Most sell-side models point to a weak requirement to buy USD.

- Antipodean FX trades weaker, with AUD and NZD the poorest performers so far Friday. AUD/USD sits just above 50-dma support at 0.7714 while NZD/USD is edging off the multi-month highs posted this week at 0.7316.

- China FX remains a focal point, with CNH & CNY again stronger and hitting the highest level against the USD since 2018.

- Today's MNI Chicago PMI will be a highlight, with markets expecting the pace of expansion to slow to 68.0 from 72.1. April PCE data also crosses alongside the latest personal income/spending update. There are no central bank speakers of note.

EQUITIES: Shaping Up To Be A Strong End To The Week

- Asian stocks closed mostly higher, with Japan's NIKKEI up 600.4 pts or +2.1% at 29149.41 and the TOPIX up 36.42 pts or +1.91% at 1947.44. China's SHANGHAI closed down 8.067 pts or -0.22% at 3600.784 and the HANG SENG ended 11.21 pts higher or +0.04% at 29124.41

- European equities are gaining, with the German Dax up 75.56 pts or +0.49% at 15406.73, FTSE 100 up 17.47 pts or +0.25% at 7019.67, CAC 40 up 26.62 pts or +0.41% at 6435.71 and Euro Stoxx 50 up 18.58 pts or +0.46% at 4039.21.

- U.S. futures are higher, led by the Dow: Dow Jones mini up 187 pts or +0.54% at 34625, S&P 500 mini up 14.25 pts or +0.34% at 4213.25, NASDAQ mini up 30.5 pts or +0.22% at 13696.

COMMODITIES: WTI Futures At 2.5-Month High

- WTI Crude up $0.21 or +0.31% at $66.92

- Natural Gas up $0 or +0.07% at $2.962

- Gold spot down $2.66 or -0.14% at $1888.37

- Copper down $3.85 or -0.83% at $462.9

- Silver down $0.14 or -0.52% at $27.6418

- Platinum up $0.87 or +0.07% at $1179.64

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.