-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Tentative Relief Rally

EXECUTIVE SUMMARY:

- S AFRICA SAYS VACCINE PROTECTS FROM SEVERE OMICRON SYMPTOMS

- JAPAN BARS FOREIGN VISITORS; AUSTRALIA PAUSES EASING OF BORDER RESTRICTIONS

- MODERNA SURGES AFTER SAYING OMICRON VACCINE READY EARLY 2022

- BIONTECH STARTS DEVELOPING NEW ADAPTED COVID-19 VACCINE

- EUROZONE ECONOMIC CONFIDENCE RETREATS AS CONSUMER MOOD SLIPS

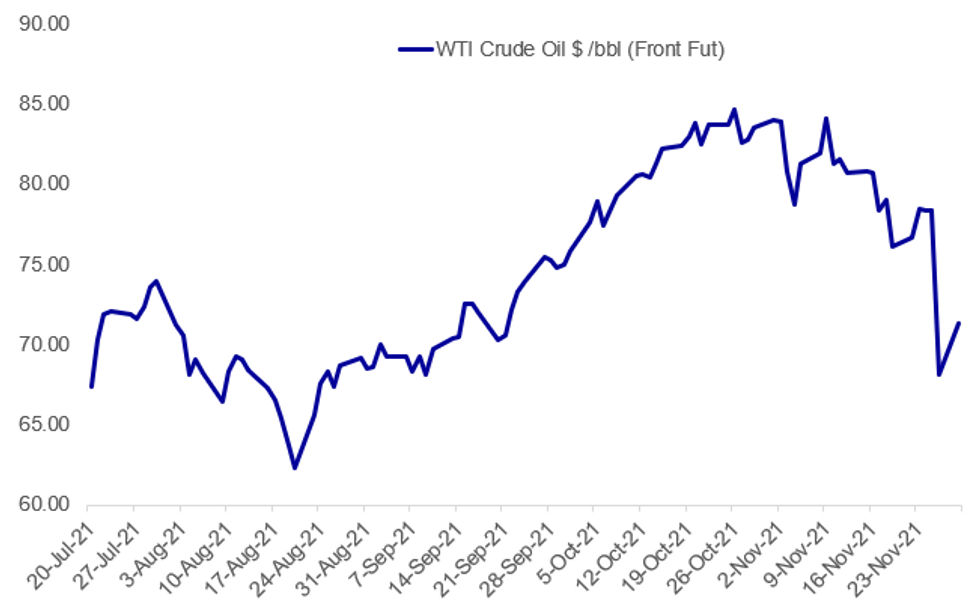

Fig. 1: Oil Bounces, But A Long Way To Go To Regain Friday's Lost Ground

Source: BBG, MNI

Source: BBG, MNI

NEWS:

SOUTH AFRICA / COVID (BBG): Bloomberg reporting some good and some bad news about the Omicron COVID-19 variant. Reporting comments from South African epidemiologist Salim Abdool Karim on a webcast for the Caprisa charity, the scientist states that the new variant is expected to have enhanced transmissibility compared to other variants. Karim also expects the variant to add to already-existing pressures on hospitals in the country. However, he does say that he sees vaccines as continuing to protect individuals from severe symptoms of the Omicron variant.

AUSTRALIA / COVID (BBG): Australia's National Security Committee will temporarily pause the next step to reopen Australia to international skilled and student cohorts, as well as humanitarian, working holiday maker and provisional family visa holders from 1 December until 15 December, according to a statement. The reopening to travelers from Japan and the Republic of Korea will also be paused until December 15Temporary pause is to allow it to gather more information on the Omicron variant.

JAPAN / COVID (RTRS): Japan said on Monday it would shut its borders to foreigners to prevent the spread of the Omicron variant of coronavirus, joining Israel in imposing some of the strictest border controls since the variant's discovery in southern Africa.

Japan will bar entry to foreigners from midnight on Monday, and Japanese returnees from specified nations will have to quarantine in designated facilities, Prime Minister Fumio Kishida told reporters. "These are temporary, exceptional measures that we are taking for safety's sake until there is clearer information about the Omicron variant," Kishida told reporters.

RUSSIA / COVID (RTRS): Russia's coronavirus task force will soon announce new restrictions related to the Omicron variant of COVID-19, the RIA news agency cited the foreign ministry as saying on Monday. Several countries have closed borders to people from certain countries in response to the new strain. RIA reported that Russia had taken some decisions on Friday.

MODERNA / COVID (BBG): Moderna shares rise 11% in U.S. premarket trading after the vaccine maker said that a treatment for the new omicron Covid-19 variant may be ready in early 2022.Chief Medical Officer Paul Burton said he suspects the omicron variant may elude current vaccines, and if so, a reformulated shot could be available early in the new year.

BIONTECH / COVID (BBG): BioNTech is starting with the first steps of developing a new adapted vaccine, according to e-mailed statement.Until proven otherwise, assumes that a variant vaccine might be needed

EUROZONE CONFIDENCE (BBG): Economic confidence in the euro area slipped in November as consumers struggled with an inflation spike and resurgent coronavirus infections that turned the region into a pandemic hotspot yet again.A European Commission sentiment index fell to 117.5 in November from 118.6 the previous month, data released Monday showed. A gauge for consumers dropped to the lowest in seven months, reflecting deteriorations in households' assessments of their past and future financial conditions, their intentions to make major purchases and their expectations about the general economic situation.

HONG KONG / EQUITIES (BBG): Hong Kong's stock benchmark closed at the lowest level in more than a year on Monday, as the omicron Covid-19 strain fueled worries about the outlook of border reopening and economic growth.The Hang Seng Index fell 1% to its lowest level since October 2020, extending a 2.7% drop on Friday. Meituan led the declines after reporting widening net loss for the September quarter. It was followed by Macau casino operators Galaxy Entertainment Group Ltd. and Sands China Ltd. after police arrested the city's junket king.

DATA:

MNI: BAVARIA NOV CPI -0.2% M/M, +5.3% Y/Y; OCT +4.6% Y/Y

SPAIN NOV FLASH HICP +0.3% M/M, +5.6% Y/Y; OCT +5.4% Y/Y

FIXED INCOME: Bounce on European open doesn't last

After Treasuries sold off in the Asia session following some headlines that the Omicron variant is only causing mild illness and headlines suggesting that it would not take too long to develop adapted booster doses if required. On the European open Bunds bounced higher, but have since given up these gains to also trade lower on the day.

- On the data front, we had Spanish HICP data in line (but the national print a tenth higher) while German state CPI data so far is coming in a bit on the high side, which is probably helping EGBs off their highs.

- Focus will continue to be on the Omicron reaction through the rest of the day.

- TY1 futures are down -0-11+ today at 130-26 with 10y UST yields up 6.3bp at 1.539% and 2y yields up 4.5bp at 0.546%.

- Bund futures are down -0.47 today at 171.87 with 10y Bund yields up 2.9bp at -0.309% and Schatz yields up 3.1bp at -0.798%.

- Gilt futures are down -0.55 today at 125.95 with 10y yields up 4.7bp at 0.869% and 2y yields up 4.4bp at 0.499%.

FOREX: Currencies Revert as Markets Reassess Omicron Risk

- Growth proxies and commodity-tied FX are trading higher ahead of the NY open, with markets reassessing the overarching risks of the new Omicron variant that had sent markets spiraling on Friday. Equities have similarly bounced, with US futures indicating a higher open of 0.7% or so. While risks surrounding the new Omicron variant remain, markets are reassessing the impact on global economies, with renewed lockdowns across the likes of the UK and US looking unlikely.

- Expected vaccine protection also received a boost, with Moderna announcing they expect a new variant-targeting jab to be ready for use by early next year.

- The moves have favoured CAD and AUD, while haven FX has weakened. This puts AUD/JPY back above 81.00, but still well short of the Friday highs at 83.02.

- EUR/USD trades softer, working against much of Friday's rally as markets re-price the US curve, reversing some of last week's volatility that had priced out near-term Fed rate rises through 2022.

- Focus turns to central bank speak, with a number of Fed representatives on the docket including Powell, Williams and Bowman. Although the speech topics aren't directly policy-related, markets remain on watch for clues on policy trajectory in the face of the variant.

EQUITIES: Hang Seng Hits 13-Month Low; US Futures Clawing Back Losses

- Asian markets closed weaker, with Japan's NIKKEI down 467.7 pts or -1.63% at 28283.92 and the TOPIX down 36.5 pts or -1.84% at 1948.48. China's SHANGHAI closed down 1.392 pts or -0.04% at 3562.697 and the HANG SENG ended 228.28 pts lower or -0.95% at 23852.24.

- European futures are bouncing a bit vs Friday's rout, with the German Dax up 96.93 pts or +0.64% at 15338.99, FTSE 100 up 46.18 pts or +0.66% at 7089.05, CAC 40 up 42.25 pts or +0.63% at 6784.06 and Euro Stoxx 50 up 39.13 pts or +0.96% at 4124.13.

- Likewise, US futures are clawing back some of Friday's losses, with the Dow Jones mini up 138 pts or +0.4% at 34996, S&P 500 mini up 28.75 pts or +0.63% at 4624.5, NASDAQ mini up 142.75 pts or +0.89% at 16192.5.

COMMODITIES: Oil Leading Gains, But Still Well Below Friday's Open

- WTI Crude up $3.2 or +4.7% at $71.25 (note: opened Friday at $78.17)

- Natural Gas down $0.38 or -6.92% at $5.097

- Gold spot down $3.86 or -0.21% at $1798.89

- Copper up $7.8 or +1.82% at $436.85

- Silver up $0.19 or +0.81% at $23.341

- Platinum up $13.55 or +1.41% at $970.92

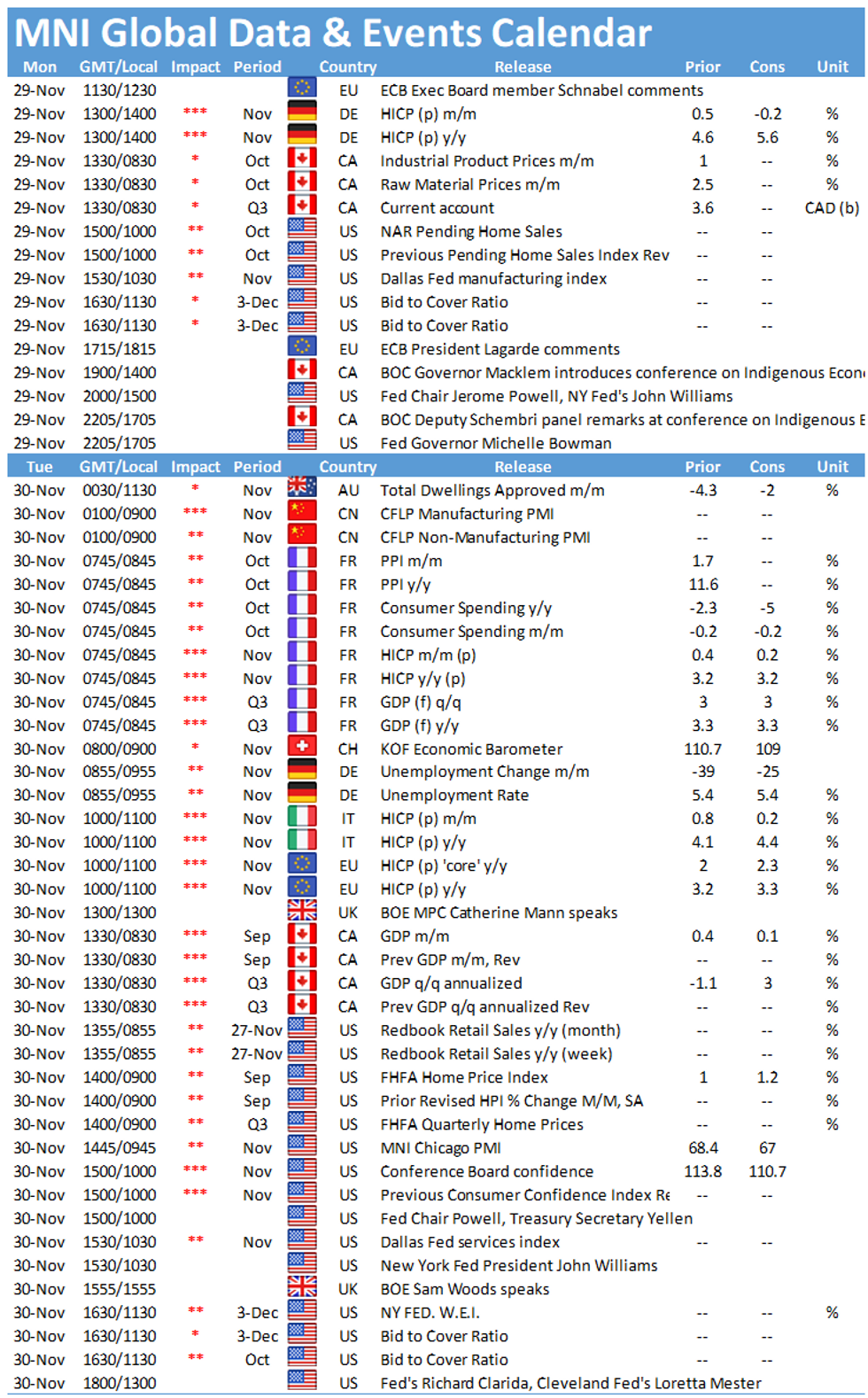

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.