-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Beijing To Protect Firms From U.S. Bill - MOFCOM

MNI BRIEF: SNB Cuts Policy Rate By 50 BP To 0.5%

MNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

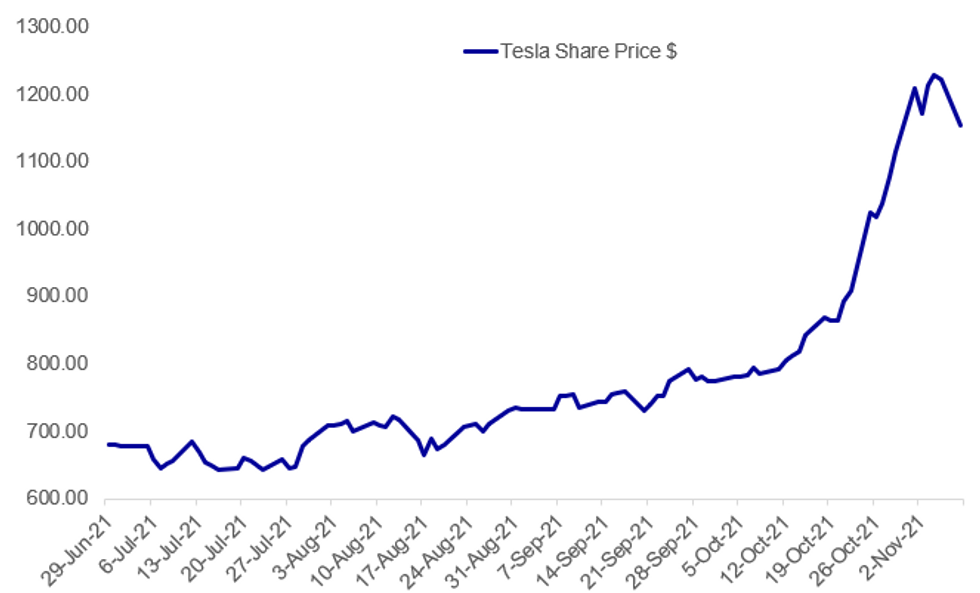

MNI US Open: Tesla Drop Restrains Equity Index Gains

EXECUTIVE SUMMARY:

- TESLA DROPS 7% PREMARKET AFTER MUSK POLL ON STAKE SALE

- EUROPE GAS JUMPS ON SIGNS RUSSIAN FLOWS WON'T GET PROMISED BOOST

- HIGH-CONTACT SERVICES FACE HEADWINDS: ECB BULLETIN

Fig. 1: Tesla Weighs On Equities

Source: BBG, MNI

Source: BBG, MNI

NEWS:

TESLA (BBG): Tesla shares fall 7% in U.S. premarket trading after CEO Elon Musk conducted a Twitter poll over the weekend that said he should sell 10% of his stake in the EV maker. Musk said he was "prepared to accept either outcome" to the poll, in which 58% of those who took part said they supported him selling a stake. The stake would be valued at about $21b based on 170.5 million Tesla shares he holds.

EUROPE GAS (BBG): European gas surged on signs Russia won't deliver the boost in supplies President Vladimir Putin promised. At least not on Monday. Benchmark futures traded in the Netherlands surged as much as 9.7% as gas orders via a key Russian pipeline signaled shipments will remain well below normal on Monday. To make matters worse, gas was flowing eastward from Germany to Poland in early morning, the reverse of the normal direction. Europe's biggest supplier of the fuel had promised to send more gas to the region starting Monday, with Putin ordering Gazprom PSJC to fill its European storage sites following the completion of Russia's domestic stockpiling campaign. Instead, the Russian gas giant said it won't sell any spot fuel at its sales platform this week and there was also no extra capacity booked to send more supplies to Europe on Monday in auctions over the weekend.

GLOBAL TRADE (BBG): Several countries including Japan, the U.K. and the U.S. are urging Chinese customs officials to pause the rollout of regulations on food imports, arguing the measures risk further disrupting global supply chains. Diplomats from seven economies, which also include Australia, Canada, the European Union and Switzerland, expressed their concerns in an Oct. 27 letter to Customs Minister Ni Yuefeng, according to a copy seen by Bloomberg News. They were objecting to a pair of decrees handed down in April that require food importers to meet sweeping new registration, inspection and labeling requirements by Jan. 1.

COVID (BBG): Shares tied to reopening trades from casinos to airlines surged in Asia on Monday after Pfizer Inc. said that its Covid-19 pill could reduce hospitalizations and deaths in high-risk patients by 89%. A Bloomberg gauge of Macau casino shares jumped 5.9%, the biggest move in over two months, while an index of Asia-Pacific airline stocks rallied 4.5%, the most since March. Luggage manufacturer Samsonite International SA climbed 14% in Hong Kong.

EVERGRANDE (BBG): Two holders of dollar notes sold by a unit of China Evergrande Group are yet to receive payment for coupons that were officially due Saturday.The developer's Scenery Journey Ltd. unit had two dollar-bond coupons due Nov. 6: $41.9 million on a 13% note and $40.6 million on a 13.75% bond. Coupons that come due on holidays or over weekends may be paid by issuers at the end of the next business day. Both of the coupons in question have a 30-day grace period before any missed interest payment would be considered a default, according to a bond prospectus.

SOFTBANK (BBG): Masayoshi Son said his SoftBank Group Corp. will buy back as much as 1 trillion yen ($8.8 billion) of its stock after a decline in the value of its portfolio companies led to a record loss in its Vision Fund investment unit.The Tokyo-based company said Monday it would repurchase up to 14.6% of its outstanding stock and retire the shares in a program that will run for a year. Son said that if the buyback isn't completed in the next year, it could be extended.

CHINA POLITICS: The Central Committee of the Communist Party of China started its sixth plenum today. The closed-door meeting of senior party officials is scheduled to last until Thursday. Xinhua reported that President Xi Jinping delivered a work report on behalf of the Politburo and explained a "draft resolution on the major achievements and historical experience" of the CPC in its 100-year history. It will be the third so-called historical resolution in the CPC'scentury-long history, following seminal documents issued under the rule of Mao Zedong and Deng Xiaoping. Its adoption is expected to set the stage forXi's bid to defy precedent and secure a third term in office next year.

EUROZONE / ECB: The outlook Europe's high-contact services remains uncertain, with the ECB's latest Economic Bulletin citing the need to replace obsolete productive capacity, expand labour input and reallocate resources, alongside risks associated with long-term Covid-19 containment measures and the sharp withdrawal policy support as key determinants for medium-term growth. Capacity utilisation in travel and tourism, food and accommodation, remains between five eight per cent below its pre-pandemic level, though continued improvement is expected.

ECB: Nothing new from ECB chief economist Lane as he underscores his well-trodden dovish tones in an interview with El Pais. Lane points to a very unusual inflation period, which he stresses is not "chronic." He goes on to reaffirm his view re: expectations for a pullback in the inflation rate in '22, while noting that the Bank should not overreact to a temporary rise in inflation which is linked to a strong global recovery.

FRANCE POLITICS: French President Emmanuel Macron leads in all latest hypothetical 2nd round election match-ups in the latest polling from Ifop Opinion. This cements his place as the current frontrunner for the spring 2022 presidential election. The polls come as the centre-right Les Republicains (LR) prepare for the first of their primary debates taking place this evening.

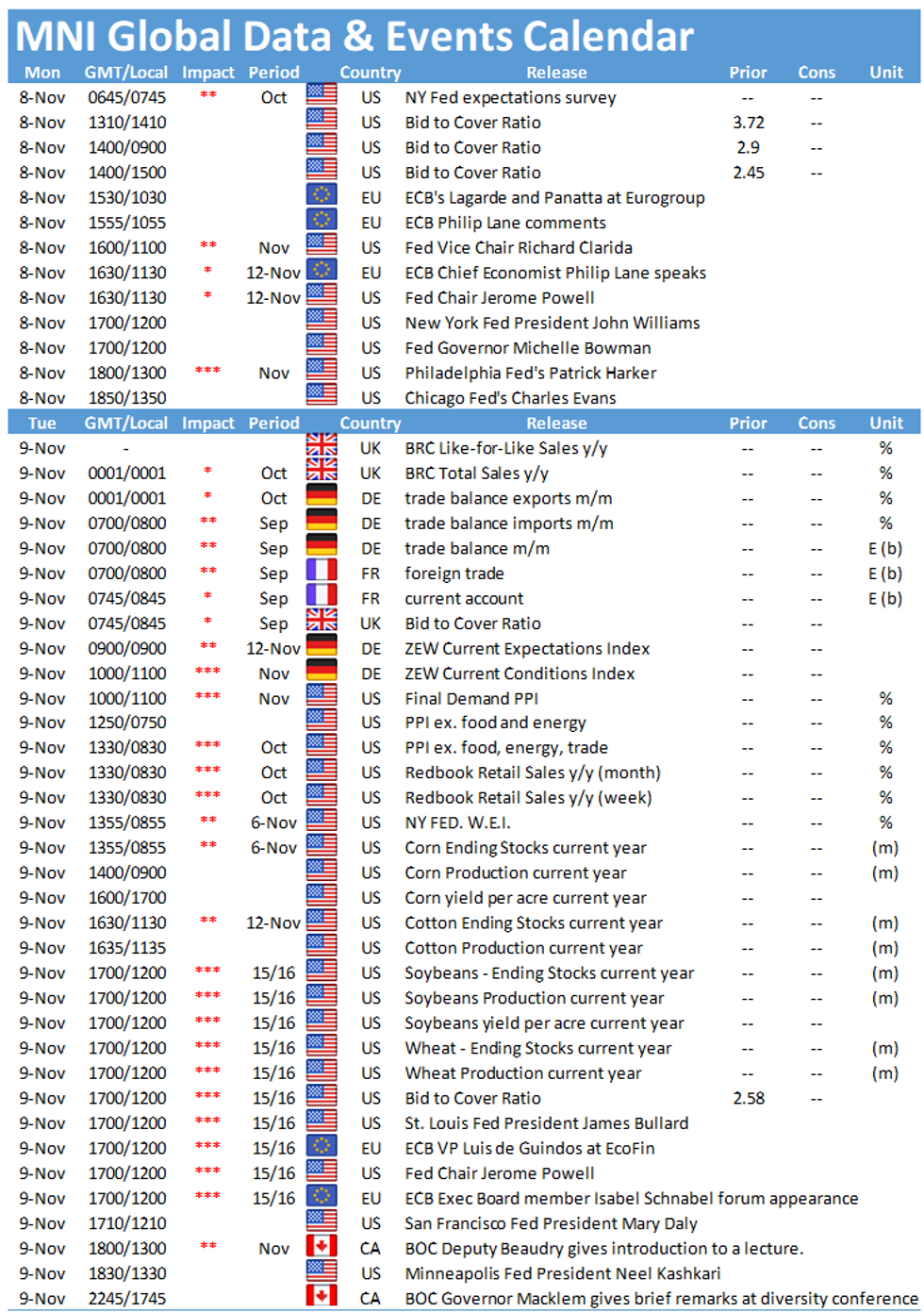

DATA:

FIXED INCOME: Mixed moves

After the events of last week, the beginning of this week has been a bit calmer with equity markets mixed and moves in core fixed income more mixed.

- Across the Eurozone inflation breakevens have picked up as energy prices rise once more (with renewed concerns about Russian supply). Despite more negligible increases in breakevens in the US and UK, Bunds continue to outperform in core income space on the day.

- Having said there, there are some interesting curve dynamics at play with the German and UK curves steepening a little, but the UST curve flattening.

- There are a number of Fed speakers due up today (Clarida, Powell, Harker, Bowman, Evans) while Lane and Makhlouf are both due to speak again for the ECB (after comments early this morning). BOE Governor Bailey is due to take part in a Citzens' Panel this afternoon, in the only real BOE appearance due this week which will touch on monpol, but given the nature of the event it may be difficult to move market pricing.

- TY1 futures are down -0-8 today at 131-18+ with 10y UST yields up 2.3bp at 1.477% and 2y yields up 2.9bp at 0.433%.

- Bund futures are down -0.14 today at 170.93 with 10y Bund yields up 1.1bp at -0.272% and Schatz yields up 0.3bp at -0.769%.

- Gilt futures are down -0.26 today at 126.86 with 10y yields up 2.0bp at 0.863% and 2y yields up 1.4bp at 0.414%.

FOREX: GBP Vols Remain Perky After Last Week's Downtick in Spot

- Sterling remains soft following last week's BoE bait-and-switch, with GBP among the poorest performers so far in G10. GBP/USD remains above last Friday's lows of 1.3424 which forms first support along which the late September print of 1.3412. GBP vols remain perky, with the 1m implied contract inching higher again early Monday to clear 7 points.

- At the other end of the table, NZD and NOK make up Monday's modest outperformers, with strength across commodities markets assisting high beta and growth proxy currencies higher.

- US equity futures trade higher ahead of the Monday bell, with the exception of the tech-led NASDAQ future, which trades softer as Tesla shares dip over 5% pre-market on Musk's tweet warning he could sell 10% of his stake in the company driving prices lower.

- The Monday data slate is bereft of any tier one releases, keeping focus on the busier speaker slate which includes Fed's Powell, Clarida, Harker, Bowman and Evans as well as BoE's Bailey and ECB's Lane.

EQUITIES: Tesla Drop Weighs On US Futures

- Asian markets closed mixed, with Japan's NIKKEI down 104.52 pts or -0.35% at 29507.05 and the TOPIX down 6.2 pts or -0.3% at 2035.22. China's SHANGHAI closed up 7.063 pts or +0.2% at 3498.631 and the HANG SENG ended 106.74 pts lower or -0.43% at 24763.77

- European equities are mixed as well, with the German Dax down 19.04 pts or -0.12% at 16035.49, FTSE 100 up 3.04 pts or +0.04% at 7306.17, CAC 40 up 11.9 pts or +0.17% at 7053.09 and Euro Stoxx 50 down 5.84 pts or -0.13% at 4356.97.

- U.S. futures are flat, with the Dow Jones mini up 66 pts or +0.18% at 36281, S&P 500 mini up 1.25 pts or +0.03% at 4691.5, NASDAQ mini down 17 pts or -0.1% at 16334.75.

COMMODITIES: Energy Prices Lead The Way Higher

- WTI Crude up $1.29 or +1.59% at $82.58

- Natural Gas up $0.09 or +1.7% at $5.604

- Gold spot down $1.52 or -0.08% at $1815.88

- Copper up $0.85 or +0.2% at $435.05

- Silver up $0.03 or +0.11% at $24.1718

- Platinum up $4.52 or +0.44% at $1040.25

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.