-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - The Spectre of Lockdown Returns To Europe

MNI US OPEN - The Spectre of Lockdown Returns To Europe

EXECUTIVE SUMMARY

- Sovereign bonds have rallied sharply while the dollar has made broad gains.

- Austria goes back to full lockdown, while the German health minister does not rule out a similar move.

- UK public borrowing fell less than expected in December

NEWS

EUROPE-COVID (BBC): Days after Austria imposed a lockdown on the unvaccinated, it has announced a full national Covid-19 lockdown starting on Monday. Chancellor Alexander Schallenberg said it would last at least 10 days and there would be a legal requirement to get vaccinated from 1 February 2022. He was responding to record cases numbers and one of the lowest vaccination levels in Western Europe. Many other European countries are imposing restrictions as cases rise. "We don't want a fifth wave," said Mr Schallenberg after meeting the governors of Austria's nine provinces at a resort in western Austria. Slovak Prime Minister Eduard Heger announced that what he called a lockdown for the unvaccinated would start on Monday, and the Czech government is also limiting access to a variety of services. German leaders have agreed to introduce restrictions for unvaccinated people in areas with high Covid hospital admissions that would affect 12 of Germany's 16 states.

UK (FT): UK public borrowing fell less than expected in October, reflecting higher interest payments on public debt and the cost of the Covid vaccination programme even as tax receipts increased thanks to stronger economic activity. Public sector net borrowing was estimated to have been £18.8bn last month, £200m less than in October 2020, data from the Office for National Statistics showed on Friday. This was much higher than the £13.8bn forecast by economists polled by Reuters. Martin Beck, chief economic adviser to the EY Item Club, said that this was "surprisingly disappointing". However, he added that public sector net borrowing remains "broadly" on track to reach the latest forecast of £183bn for the 2021/22 financial year by the Office for Budget Responsibility, the UK fiscal watchdog. Borrowing remained high because central government bodies spent £78.8bn, £1.5bn more than in the same month last year. The increase reflects £1.2bn higher spending on procurement, which includes the cost of the vaccination programme and £3.8bn more on interest payments.

INDIA (GUARDIAN): Narendra Modi has announced he will repeal three contentious farm laws that prompted a year of protests and unrest in India, in one of the most significant concessions made by his government. In a huge victory for India's farmers, who had fought hard for the repeal of what they called the "black laws', the prime minister announced in an address on Friday morning that "we have taken the laws back". "We have decided to repeal all three farm laws. We will start the constitutional process to repeal all the three laws in the parliament session that starts at the end of this month," said Modi, in a surprise announcement on Friday. He added: "I appeal to all the farmers who are part of the protest … to now return to your home, to your loved ones, to your farms, and family. Let's make a fresh start and move forward."

DATA

UK Oct Retail Sales Break Losing Streak, Small Gain

UK retail sales rose by 0.8% in October, breaking a record-long five-month losing streak, exceeding expectations of a 0.5% gain. Non-food sales rose by 4.2%, lifted by a 6.2% jump in clothing sales, while supermarket sales declined by 0.3%. Fuel sales plunged by 6.2%, as September's panic buying abated.

Internet sales declined by 0.6% in October, pushing the proportion of all sales down to 27.3%, the lowest since March of 2020. Despite the weak run of retail activity, sales remain 5.8% above pre-pandemic levels.

UK Oct Borrowing Higher than Expected

UK government borrowing exceeded expectations in Oct, hitting GBP18.799 billion, well above the GBP14.0 billion forecast by City analysts, but below the GBP 20.702 billion recorded in September (down from the initially-reported GBP21.778 billion).

PSNCR rose to GBP 61.45 billion, boosted by a GBP 57+ billion addition to the Bank of England's term funding scheme (TFS), the Office for National Statistics said Friday.

Debt interest payments hit GBP5.6 billion, up from GBP1.8 billion a year earlier, after RPI increased by a full percentage point between July and August, the reference point for October payments.

FIXED INCOME: European lockdown fears push FI higher

- Core fixed income has been pushed higher by Covid-19 lockdown concerns. First there were headlines that Austria would enter a 22-day lockdown on Monday for all citizens (previously a lockdown for the unvaccinated had been in force). Then there were headlines from German Health Minister Jens Spahn that he could not rule out a lockdown in Germany.

- Bund curves had bull flattened with Schatz up 2.4bp and 5+ year up 4+bp.

- The US Treasury curve has seen a near parallel shift with yields up around 3.0bp across the curve.

- Gilts are outperforming up around 5bp across the curve. The outperformance is due to more rate hikes being priced into the UK curve (and the probabilities of those hikes therefore being more sensitive).

- TY1 futures are up 0-8 today at 130-26+ with 10y UST yields down -3.0bp at 1.556% and 2y yields down -3.2bp at 0.472%.

- Bund futures are up 0.72 today at 171.96 with 10y Bund yields down -4.4bp at -0.321% and Schatz yields down -2.1bp at -0.861%.

- Gilt futures are up 0.52 today at 126.82 with 10y yields down -5.5bp at 0.868% and 2y yields down -5.4bp at 0.470%.

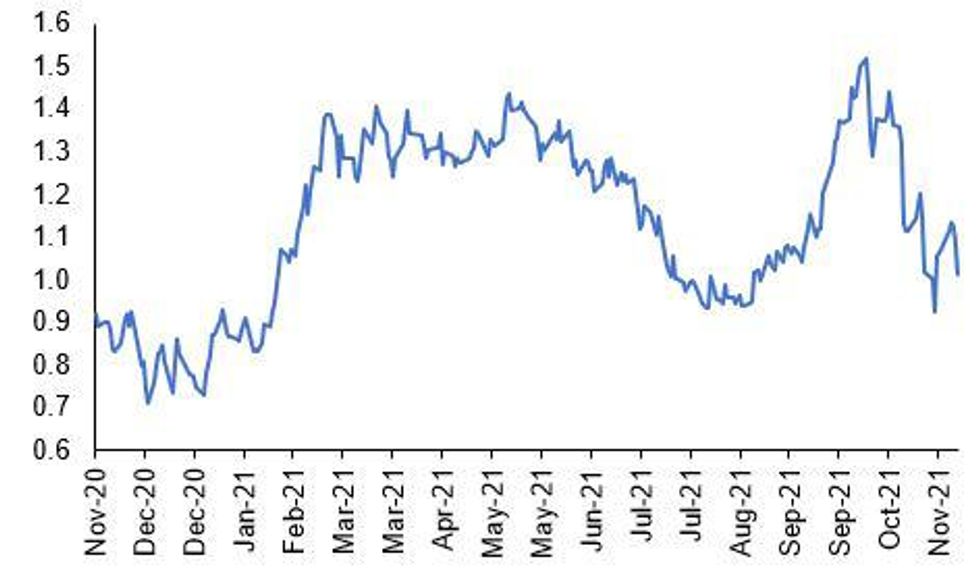

FOREX: Lockdown Spectres Loom, EUR/CHF Makes Clean Break Lower

- The single currency trades markedly weaker against most others in G10, with the looming spectre of lockdowns weighing heavily on sentiment. Austria have become the first European nation to impose a full three-week lockdown for both the vaccinated and unvaccinated, with markets speculating that other countries could follow. The German health minister stated that Germany cannot rule out a lockdown this winter, further unsettling markets.

- EUR/USD was sold down to fresh session lows of 1.1283, but stopped short of a test on the YTD lows at 1.1264. The more major move was seen in EUR/CHF, which has now made a clean break of the 1.05 handle - again trading at the lowest levels since mid-July 2015.

- Haven currencies have been the main beneficiaries, with the USD, JPY and CHF among the best performers so far. NOK is the sole currency weaker vs. the EUR, with USD/NOK rallying to new multi-month highs of 8.9265 - last seen at end-August.

- The data slate is light Friday, with Canadian retail sales the sole release. The central bank schedule is busier, with BoE's Pill, ECB's Weidmann and Fed's Clarida among the highlights.

EQUITIES: Lower in Europe

- Japan's NIKKEI up 147.21 pts or +0.5% at 29745.87 and the TOPIX up 9.01 pts or +0.44% at 2044.53

- China's SHANGHAI closed up 39.662 pts or +1.13% at 3560.373 and the HANG SENG ended 269.75 pts lower or -1.07% at 25049.97

- German Dax down 42.41 pts or -0.26% at 16165.57, FTSE 100 down 18.82 pts or -0.26% at 7237.41, CAC 40 down 21.4 pts or -0.3% at 7119.67 and Euro Stoxx 50 down 23.68 pts or -0.54% at 4357.47.

- Dow Jones mini down 179 pts or -0.5% at 35681, S&P 500 mini down 10.75 pts or -0.23% at 4688, NASDAQ mini up 44 pts or +0.27% at 16517.25.

COMMODITIES: Crude hit by European lockdown fears

- WTI Crude down $1.39 or -1.76% at $77.68

- Natural Gas up $0.04 or +0.9% at $4.946

- Gold spot up $3.9 or +0.21% at $1862.24

- Copper up $4.25 or +0.99% at $435.2

- Silver up $0.01 or +0.04% at $24.7974

- Platinum down $1.09 or -0.1% at $1048.25

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.