-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI US Open: Trump Pledges "Orderly Transition"

EXECUTIVE SUMMARY

- U.S. CONGRESS CONFIRMS BIDEN AS PRESIDENT-ELECT

- "THERE WILL BE AN ORDERLY TRANSITION ON JANUARY 20TH": TRUMP STATEMENT

- EUROZONE RETAIL SALES DATA DISAPPOINTS, BUT ECONOMIC SENTIMENT IMPROVES

- CHINA DATA A WARNING TO YUAN BULLS - GUAN TAO (MNI EXCLUSIVE)

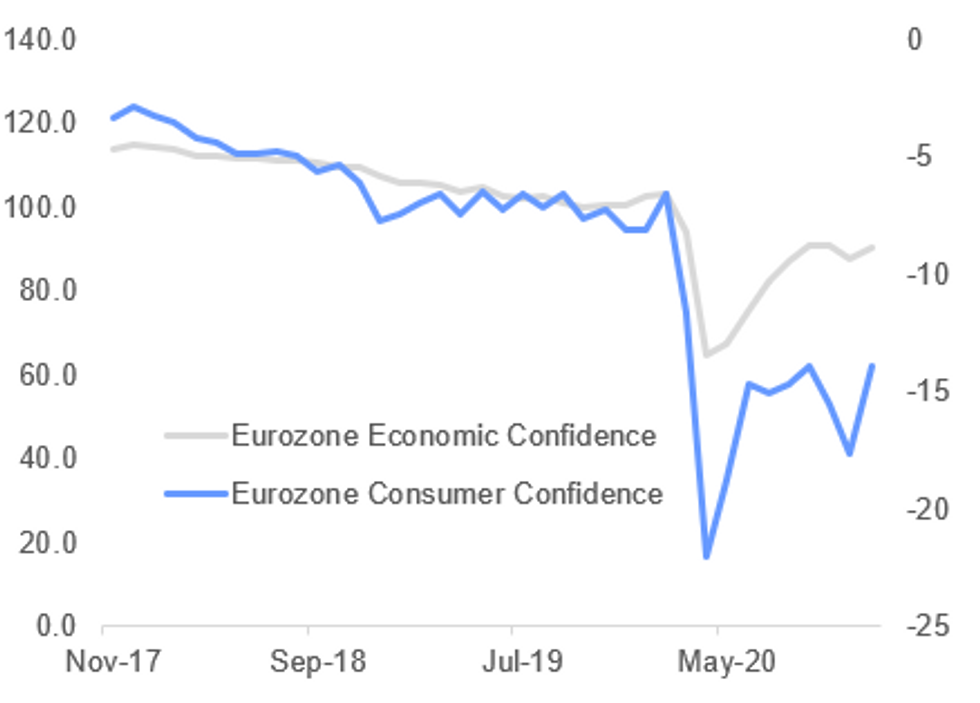

Fig. 1: Eurozone Econ Sentiment Improves

EC, MNI

EC, MNI

NEWS:

U.S.: A reconvened joint sitting of the U.S. Senate and the House of Representatives has voted to accept the results of the Electoral College, reconvening after a break for both chambers to debate an objection to the result in Pennsylvania. Vice President Mike Pence (R) read out the state results, recording that Joseph R Biden (D) was duly declared President-elect and Kamala Harris as Vice President-elect. The official outcome saw Biden win 302 electoral college votes compared to incumbent Donald Trump's 232. The result follows a day of high drama in Washington, that saw proceedings disrupted by objections and demonstrations that saw protestors breach security and enter the Capitol building.

U.S.: Issued through Twitter via White House aide Dan Scavino, U.S. President Trump promises an orderly transfer of power on January 20. In his own words, Trump said: "Even though I totally disagree with the outcome of the election, and the facts bear me out, nevertheless there will be an orderly transition on January 20th. I have always said we would continue our fight to ensure that only legal votes were counted. While this represents the end of the greatest first term in presidential history, it's only the beginning of our fight to Make America Great Again!"

EUROZONE DATA: The EZ ESI rose 2.7pt to 90.4 in Dec, coming in slightly above marketexpectations (BBG: 89.5) but remaining well below pre-crisis levels* The index rose to a two-month high in Dec, almost offsetting the drop seen inNov, as several countries eased some of their strict lockdown measures. * Among the largest EZ economies, the ESI saw the largest increase in Italy(+6.8pt to 88.3) following by Spain (+3.3pt to 90.8).

EUROZONE DATA: M/M retail sales slumped by 6.1% in Nov, worse than market expectations looking for a smaller drop of 3.4%. Nov's decline marks the sharpest decrease since Apr, as several countries went into lockdown due to a strong increase in infection rates.

CHINA (MNI EXCLUSIVE): The growing gap between data on China's trade surplus and cross-border receipts and payments may contain a warning for investors tempted to bet on an uninterrupted appreciation of the yuan, a former senior foreign exchange regulator official told MNI, predicting that the country's trade surplus will narrow in 2021. For full article contact sales@marketnews.com

UK: Prime Minister Boris Johnson is set to hold a press conference at 1700GMT (1200ET, 1800CET) on the rollout of the COVID-19 vaccine. Alongside the PM will be the Health Secretary but also Brigadier Phil Prosser, with the expectation that the armed forces could be drafted in tothe nationwide vaccine rollout effort.

UK: The BOE survey of business executives, its Decision Maker Panel, highlighted the continuing heavy hit on sales and employment from Covid-19, with businesses estimating that sales would be 16% lower in Q4 than they would have been excluding Covid with the hit easing slightly to -14% in Q1 2021 and -9% in Q2. Employment was assessed to be 8% lower in Q4. The survey was carried out between Dec 4 and 18, before the latest national lockdown announcement, which suggests the hit in Q1 could be larger than assumed.

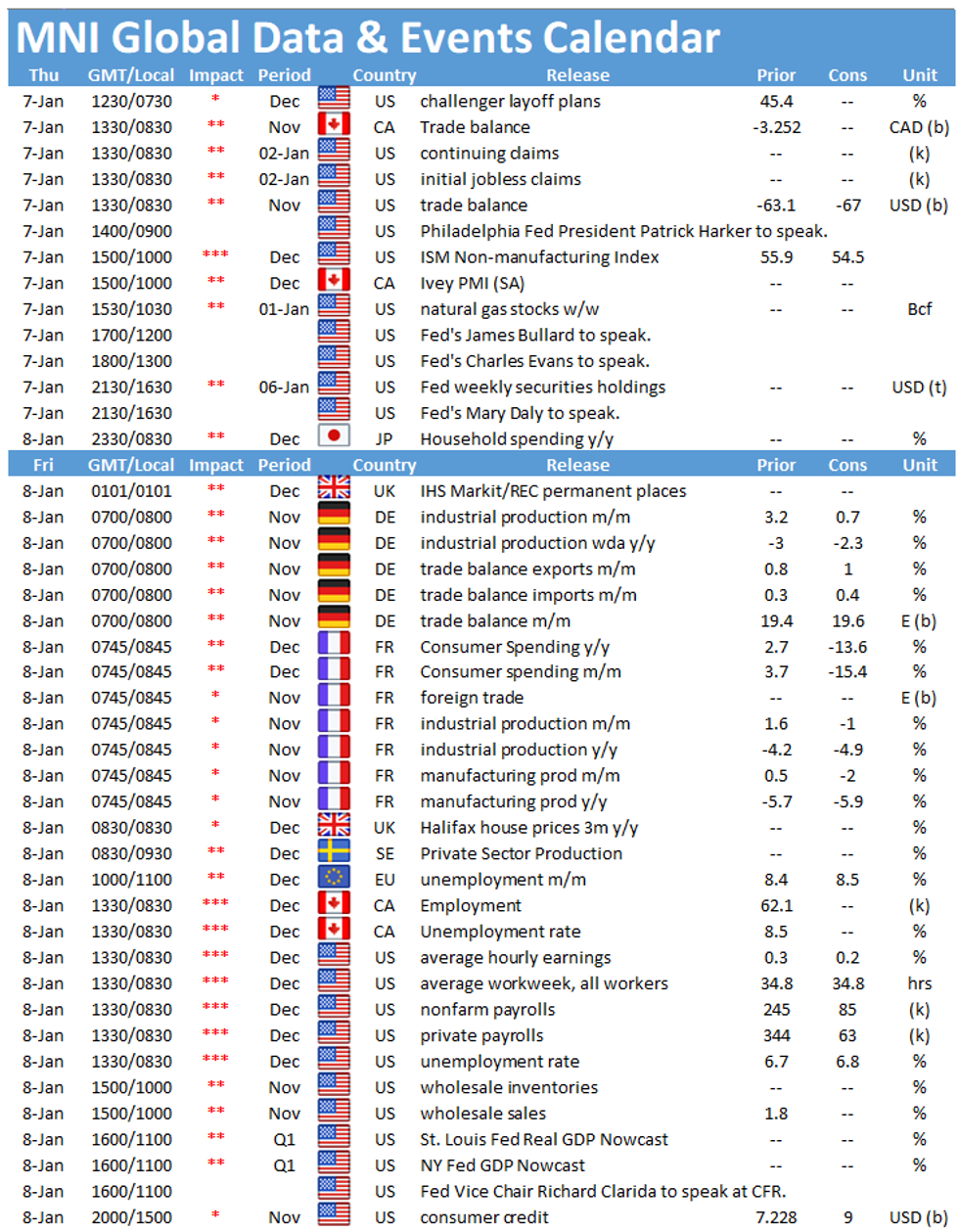

DATA:

GERMANY NOV IND ORD +2.3% M/M, +6.3% Y/Y; OCT +3.3% M/M

MNI: EZ DEC CONSTRUCTION PMI 45.5; NOV 45.6

MNI: UK DEC CONSTRUCTION PMI 54.6; NOV 54.7

MNI: BAVARIA DEC CPI +0.4% M/M, -0.3% Y/Y; NOV -0.2% Y/Y

MNI: SWISS NOV RET SALES -2.0% M/M, +1.7% Y/Y; OCT +3.2% M/M

MNI: ITALY DEC FLASH HICP +0.2% M/M, -0.3% Y/Y; NOV -0.3% Y/Y

EZ DEC FLASH HICP +0.3% M/M; -0.3% Y/Y; NOV -0.3% Y/Y

EZ DEC ECONOMIC SENTIMENT INDICATOR 90.4; NOV 87.7

FIXED INCOME: Little action but lots of conversation

- There has been little in terms of market moving headlines this morning for fixed income markets but there has been lots of market talk about the implications for US politics surrounding the protests at the Capitol and the confirmation of Biden as the next US President. Any new news on US stimulus will likely be closely watched.

- There will also be focus on US data later today with claims, trade balance and ADP data all likely to be followed.

- TY1 futures are down -0-1 today at 137-05+ with 10y UST yields up 1.0bp at 1.048% and 2y yields up 0.1bp at 0.140%.

- Bund futures are up 0.13 today at 177.50 with 10y Bund yields down -0.9bp at -0.532% and Schatz yields down -0.4bp at -0.712%.

- Gilt futures are down -0.16 today at 134.80 with 10y yields up 1.2bp at 0.254% and 2y yields up 0.1bp at -0.140%.

FOREX: Trump Commits to Peaceful Transition, USD Tepid Bounce

With the challenges to certifying Biden's Presidency defeated in Congress, Trump issued a statement confirming there will be a peaceful transition of power to a Biden White House on January 20th, which looks to put an end to yesterday's civil unrest in the US capital.

Markets were largely unreactive to the final confirmation of Biden's victory and equities are broadly mixed. The e-mini S&P holds close to yesterday's highs, with a test of the record levels printed Wednesday at 3774.75 on the cards.

In currency space, the USD is modestly stronger, with GBP also trading well. JPY is on the backfoot after a Japanese MoF official reaffirmed that the government and central bank would work together "as needed".

Weekly US jobless claims data crosses later today, as well as the services ISM and November trade balance. A number of Fed speakers are due, with Harker, Barkin, Bullard, Evans and Daly all on the docket.

EQUITIES: Edging Higher

- Asian stocks closed mixed, with Japan's NIKKEI up 434.19 pts or +1.6% at 27490.13 and the TOPIX up 30.12 pts or +1.68% at 1826.3. China's SHANGHAI closed up 25.328 pts or +0.71% at 3576.205 and the HANG SENG ended 143.78 pts lower or -0.52% at 27548.52

- European equities are mixed, with the German Dax up 82.59 pts or +0.59% at 13891.97, FTSE 100 down 29.13 pts or -0.43% at 6841.86, CAC 40 up 19.3 pts or +0.34% at 5630.6 and Euro Stoxx 50 up 9.66 pts or +0.27% at 3611.08.

- U.S. futures are higher, with the Dow Jones mini up 101 pts or +0.33% at 30821, S&P 500 mini up 16.5 pts or +0.44% at 3757, NASDAQ mini up 71.75 pts or +0.57% at 12688.5.

COMMODITIES: Gold And Silver Weaken On Dollar Rally

Precious metals are underperforming, mirroring the US dollar index's 0.4% rise so far.

- WTI Crude up $0.25 or +0.49% at $51.03

- Natural Gas down $0.05 or -1.73% at $2.682

- Gold spot down $1.88 or -0.1% at $1920.7

- Copper up $0.8 or +0.22% at $366.2

- Silver down $0.17 or -0.61% at $27.1875

- Platinum down $3.9 or -0.35% at $1103

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.