-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: UK Rate Hike Expectations Spike

EXECUTIVE SUMMARY:

- BANK OF ENGLAND 2021 RATE HIKE EXPECTATIONS RISE SHARPLY ON BAILEY COMMENTS

- VISCO: ECB HASN'T DISCUSSED RAISING LIMIT ON INT'L BOND BUYS

- SURGE IN CHINA FACTORY PRICES NEEDS PBOC CREDIT EXPANSION (MNI)

- U.K. COVID SURGE SPARKS CALL FOR PROBE INTO "DELTA PLUS" MUTATION

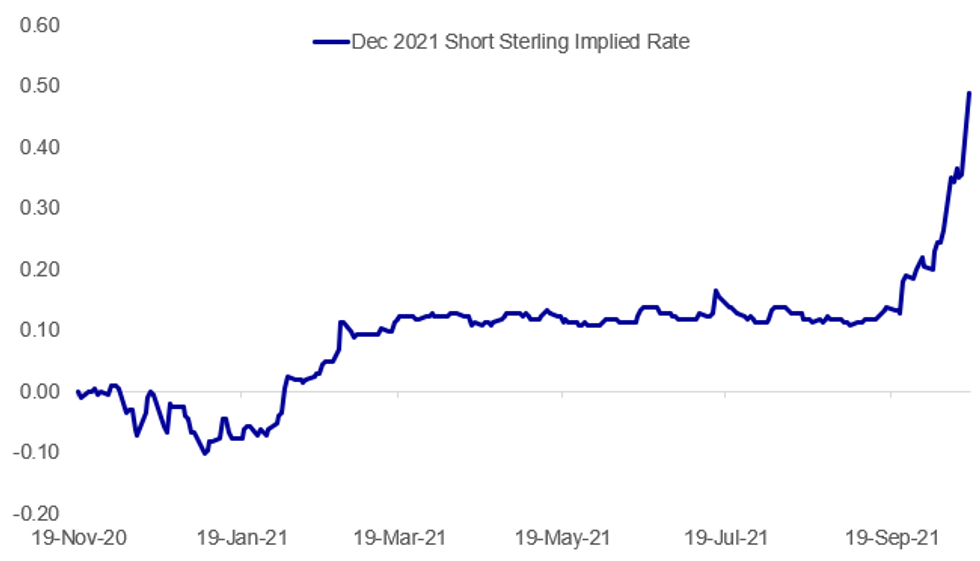

Fig. 1: UK Rate Hike Expectations Continue To Be Brought Forward

Source: BBG, MNI

Source: BBG, MNI

NEWS:

BOE: Big move lower for short sterling on the open this morning following comments from BOE Governor Bailey, who said over the weekend that rising energy prices will remain higher for longer and push inflation higher and "That raises for central banks the fear and concern of embedded expectations. That's why we, at the Bank of England have signaled, and this is another signal, that we will have to act. But of course that action comes in our monetary policy meetings."

BOE (BBG): Former Bank of England policy maker Danny Blanchflower said lifting U.K. interest rates anytime soon would be "a terrible error.""I think they may go and do that, but it would be a very foolish thing to do, especially with what the data is doing and the chancellor is doing, but also the possibility and this is a distinct possibility that the U.S. is going into recession," Blanchflower said on BBC Radio 4's "Today" program on Monday"These seem very early days to be thinking that. The economy is very hard to understand right now. It looks to me as with every interest rate rise since 2008 that they have all been in error"

ECB (BBG): The European Central Bank should keep some of the flexibility embedded in its pandemic bond-buying program for post-crisis stimulus measures, Governing Council member Ignazio Visco said."I think flexibility should remain -- we certainly have to discuss how to adjust our purchase programs," the Bank of Italy governor said in an interview with Bloomberg Television. "It will help against unexpected shocks, and it will help to avoid fragmentation that may rise again."

ECB (BBG): Visco said that one option cited by the Financial Times over the weekend -- raising the share of European Union-issued debt that can be bought -- is "something that we may end up doing," but still needs to be discussed.

ECB (BBG/FT, PUBLISHED SUNDAY):The European Central Bank is exploring raising its limit on purchases of debt issued by international bodies such as the European Union from the current cap of 10%, the Financial Times reported, citing four ECB governing council members. The idea is expected to be discussed at two special ECB council meetings starting in November and would need majority support from the ECB council's 25 members. The ECB declined to comment to the newspaper.

ECB (BBG): Consumer-price growth in the euro area remains transitory but there are signs that inflation expectations may be changing, according to Bostjan Vasle, a member of the European Central Bank's Governing Council. "There haven't been any big changes in inflation expectations yet," Vasle, who's also the governor of Slovenia's central bank, says before round-table in Ljubljana. "We also haven't seen second-round effects that usually happen on the labor market, which make inflation more permanent""Despite what I've just said, the circumstances are changing lately. I think we're nearing a turning point where we're starting to see changed inflation expectations."

CHINA (MNI): China's central bank is likely to push for expanded credit support to manufacturers hit by high input costs as a surge in producer prices reinforces the need to relieve pressure on the economy and employment, policy advisors told MNI. On MNI Policy MainWire now, for more details please contact sales@marketnews.com

UK / EU (BBG): Brexit Minister David Frost "set out the U.K. position and reaffirmed the need for significant changes to the current arrangements, as set out in the 21 July Command Paper, including on governance," U.K. government says in statement Monday, after a meeting between Frost and European Commission vice-president Maros Sefcovic last week to discuss Northern Ireland's trade arrangements. U.K. will look at EU's Brexit proposals "constructively and in a positive spirit:" statement.

U.K. / COVID (BBG): Former U.S. Food and Drug Administration Commissioner Scott Gottlieb called for "urgent research" into a mutation of the delta variant -- known as delta plus -- following a surge in Covid-19 cases in the U.K. "We need urgent research to figure out if this delta plus is more transmissible, has partial immune evasion," Gottlieb said in a tweet. "There's no clear indication that it's considerably more transmissible, but we should work to more quickly characterize these and other new variants. We have the tools."

DATA:

No key data releases in the European morning session.

FIXED INCOME: Bailey's comments lead FI lower

The Governor of the BoE, Andrew Bailey's comments over the weekend that central banks must act if inflation expectations rise, and that energy prices are likely to push inflation expectations higher has been the driving point for markets this morning.

- The short sterling curve is aggressively lower, with Bailey seen as one of three swing voters and his support is seen as pivotal to a rate hike in 2021. The Sep22 contract has seen the biggest move, down 20 ticks at the time of writing. The Euribor and Eurodollar curves have been dragged up to 10.5 ticks and 7.0 ticks lower on the day respectively. However, the moves in those strips have been more focused around the late Reds/early Greens.

- Gilts have led the selloff, too with 2-year gilt yields 14.1bp higher on the day, with the curve flattening with 10-year yields up 6.0bp (against 4.0bp for 10-year Bunds and 3.8bp for 10-year USTs).

- As markets focus on the withdrawal of global monetary policy support, EGB peripheral spreads have widened, led by BTP-Bund spreads with the 10-year spread 3.1bp wider on the day.

- The calendar is fairly light today, so Bailey's comments will continue to be digested.

- TY1 futures are down -0-12 today at 130-19 with 10y UST yields up 3.6bp at 1.608% and 2y yields up 3.2bp at 0.428%.

- Bund futures are down -0.72 today at 168.84 with 10y Bund yields up 3.7bp at -0.132% and Schatz yields up 3.8bp at -0.666%.

- Gilt futures are down -0.66 today at 124.00 with 10y yields up 5.7bp at 1.160% and 2y yields up 13.9bp at 0.714%.

FOREX: GBP Fails to Find Support From Higher Front-End Rates

- Once again, much focus was paid to the higher front-end of the UK Gilt curve, with money markets bringing forward pricing for the expected beginning of a tightening cycle from the BoE. Despite the move in UK fixed income, GBP is seeing no reprieve, with the currency strictly mid-table against the rest of G10.

- Nonetheless, GBP/USD 3m risk reversals capture the date of a possible BoE rate hike and remain heavily in favour of puts over calls, reinforcing the narrative that GBP may not benefit from the imminent beginning of higher rates.

- Early trade saw a return lower for EUR/USD, partially reversing some of the strength seen late last week off the 2021 low of 1.1524.

- The greenback is the best performing currency in G10 ahead of the NY crossover, returning the USD Index back above the 94.00 handle, although remains well off the best levels of last week at 94.561.

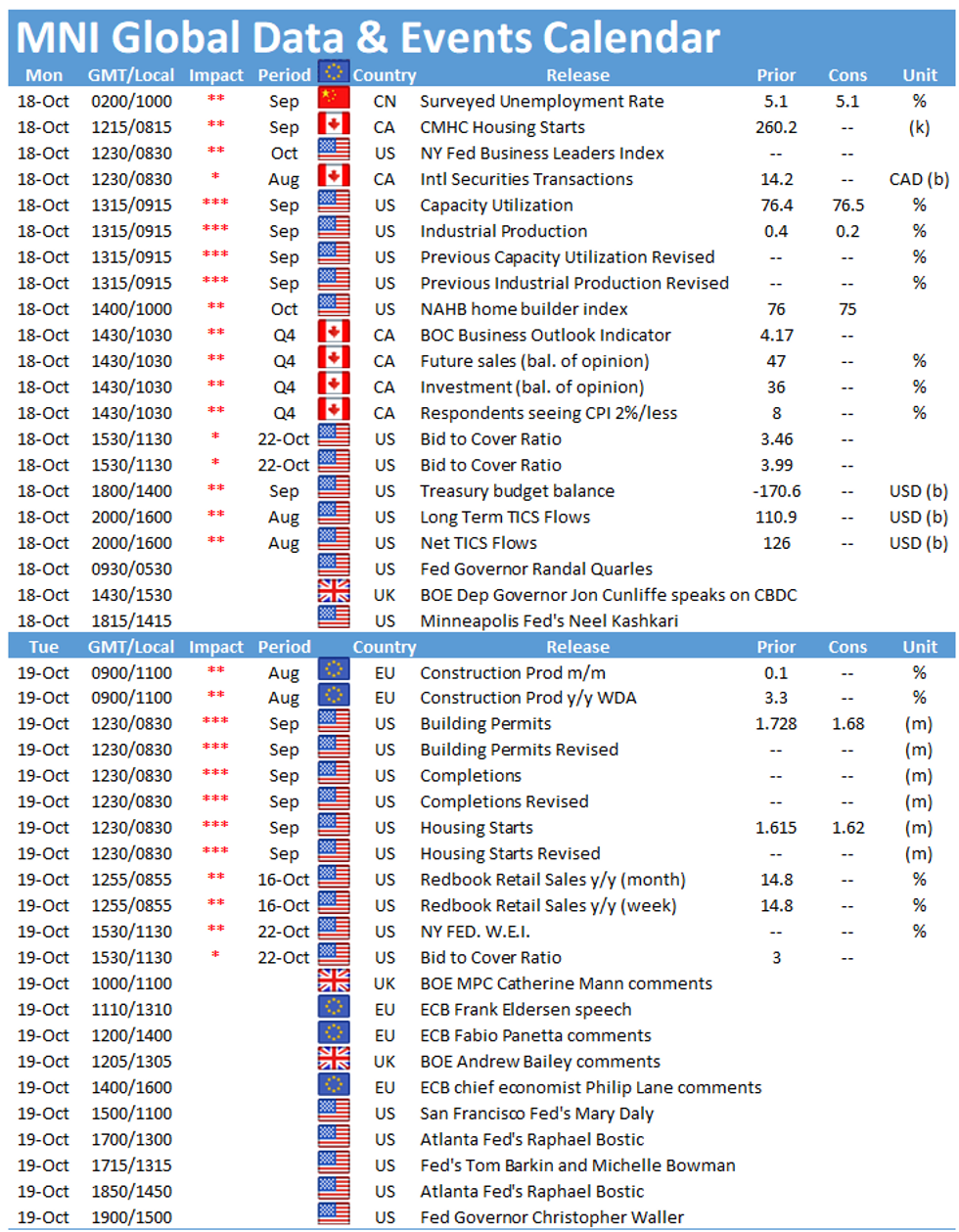

- Data points are few and far between across Europe, with focus turning to US industrial production data at 1415BST/0915ET. There are a series of CB speakers, with BoE's Cunliffe, Fed's Quarles & Kashkari on the docket, although none speak directly on monetary policy.

EQUITIES: A Little Softer To Start The Week

- Asian markets closed mixed, with Japan's NIKKEI down 43.17 pts or -0.15% at 29025.46 and the TOPIX down 4.7 pts or -0.23% at 2019.23. China's SHANGHAI closed down 4.228 pts or -0.12% at 3568.138 and the HANG SENG ended 78.79 pts higher or +0.31% at 25409.75.

- European stocks are weaker, with the German Dax down 75.54 pts or -0.48% at 15505.63, FTSE 100 down 11.38 pts or -0.16% at 7222.88, CAC 40 down 50 pts or -0.74% at 6676.66 and Euro Stoxx 50 down 25.9 pts or -0.62% at 4156.24.

- U.S. futures are off slightly, with the Dow Jones mini down 99 pts or -0.28% at 35072, S&P 500 mini down 15.25 pts or -0.34% at 4447.25, NASDAQ mini down 63.25 pts or -0.42% at 15071.25.

COMMODITIES: Another Post-2014 High For WTI

- WTI Crude up $1.03 or +1.25% at $83.41

- Natural Gas down $0.17 or -3.05% at $5.26

- Gold spot down $4.27 or -0.24% at $1764.02

- Copper up $2.85 or +0.6% at $476.55

- Silver down $0.03 or -0.15% at $23.2963

- Platinum down $11.27 or -1.06% at $1051.47

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.