-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: UK to announce plans for schools in the new term

EXECUTIVE SUMMARY:

- UK APPROVES AZ/OXFORD COVID-19 VACCINE AND WILL DEPLY FROM MONDAY

- UK TO ANNOUNCE NEW COVID TIERS AND WHETHER SCHOOLS WILL RE-OPEN AS PLANNED

NEWS:

UK/COVID: The Oxford-AstraZeneca vaccine has been approved for use in the UK, with the first doses due to be given on Monday amid rising coronavirus cases (BBC).

UK/COVID: The big point about the first dose of the Oxford/AstraZeneca vaccine is that it massively reduces the risk of serious disease and hospitalisations. In the trials, no one given the vaccine was hospitalised. Which is why the government has decided to increase to three months the gap between the two doses. (ITV)

UK/COVID: "Health Secretary tells me the NHS will roll out the Oxford vaccine as quickly as AstraZeneca can manufacture it. This morning the company said it can make 2 million doses a week, so that would imply the NHS can administer 2 million a week too." (Paul Brand, ITV via Twitter).

FIXED INCOME: Light day with focus on the UK

Volumes have been very light this morning with Treasuries, Bunds and gilts all giving up gains seen earlier in the week. The focus of attention is on the UK as MPs debate the Brexit trade deal (although there is little doubt that it will pass). Later today, Health Secretary Hancock will give an update on Covid tiers, with many more areas expected to move into tier 4.

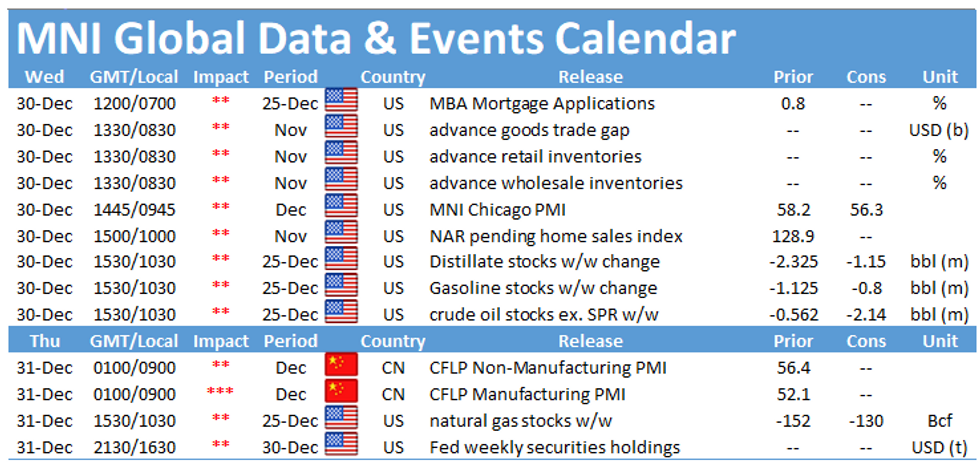

- Data this morning have been light, with Spanish inflation in line with expectations. Later today we will receive US trade, inventories, pending home sales and the MNI Chicago PMI.

- TY1 futures are down -0-4 today at 137-25+ with 10y UST yields up 1.2bp at 0.951% and 2y yields up 0.3bp at 0.131%.

- Bund futures are down -0.35 today at 177.35 with 10y Bund yields up 1.7bp at -0.557% and Schatz yields up 1.3bp at -0.711%.

- Gilt futures are down -0.33 today at 134.98 with 10y yields up 2.6bp at 0.237% and 2y yields up 1.5bp at -0.148%.

FOREX SUMMARY: A light turnover session in FX as we near year end; USD is once again trading on the back foot.

- NOK is the best performer in G10 versus the Dollar on the higher Oil, after another drop in US stockpile.

- Some early small EUR was noted as the currency tested lows GBP, CAD, SEK, AUD, JPY, and in EM the TRY

- EURGBP tested initial support at 0.9032, printed a 0.90292 low.

- Today, the House of Commons is holding debate on the Brexit trade deal between the EU and U.K, which will last all day and votes expected later tonight.

- On the Covid front, Matt Hancock is set to give out new tier details around 14.30GMT.

- The most notable move today was seen in EM and the Turkish Lira, which was up 1% at some point of the morning session.

- USDTRY tested the big 200d MA support situated today at 7.3058 ), which has held (traded 7.3089 low.

- USDTRY is now just down 0.66%, and trading at 7.34 at the time of typing. Looking ahead, US Wholesale Inventories and MNI Chicago PMI are the data of note.

- Focus for the UK will be on the new lockdown measures.

EQUITIES: LEVELS UPDATE

- Japan's NIKKEI down 123.98 pts or -0.45% at 27444.17 and the TOPIX down 14.5 pts or -0.8% at 1804.68

- China's SHANGHAI closed up 35.417 pts or +1.05% at 3414.453 and the HANG SENG ended 578.62 pts higher or +2.18% at 27147.11

- The German Dax up 11.72 pts or +0.09% at 13771.84, FTSE 100 up 15.84 pts or +0.24% at 6618.76, CAC 40 up 7.22 pts or +0.13% at 5619.34 and Euro Stoxx 50 up 3.79 pts or +0.11% at 3584.77.

- Dow Jones mini up 105 pts or +0.35% at 30343, S&P 500 mini up 15.75 pts or +0.42% at 3736, NASDAQ mini up 50.25 pts or +0.39% at 12891.25.

COMMODITIES: LEVELS UPDATE

- WTI Crude up $0.18 or +0.42% at $42.94

- Natural Gas down $0.05 or -2.14% at $2.473

- Gold spot up $1.02 or +0.05% at $1971.21

- Copper up $1 or +0.33% at $303.85

- Silver down $0.1 or -0.34% at $28.0119

- Platinum down $6.37 or -0.67% at $940.41

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.