-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Upbeat Start To H2

EXECUTIVE SUMMARY:

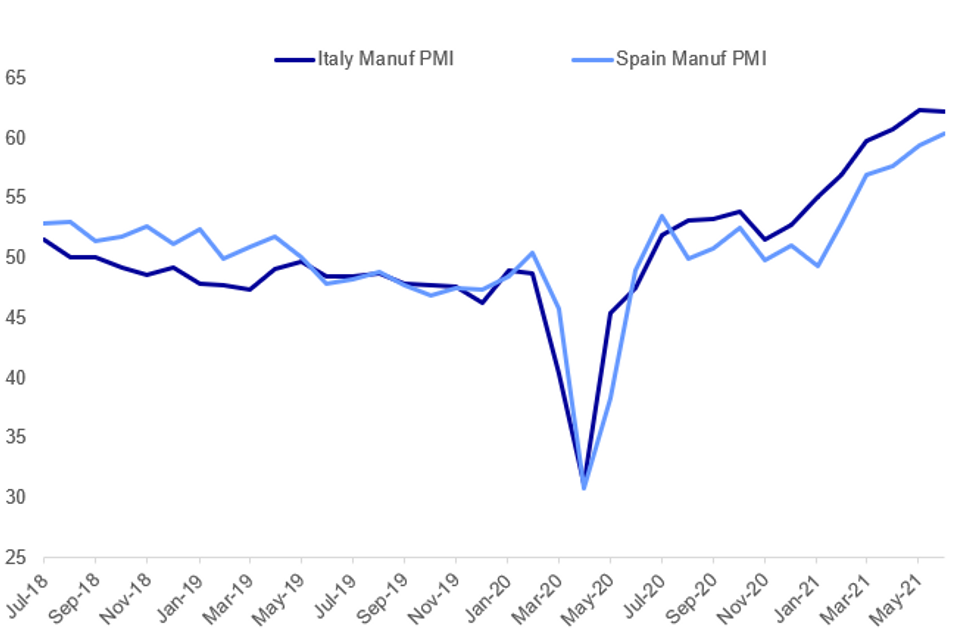

- ITALY, SPAIN MANUFACTURING PMIS MAINTAIN STRENGTH

- B.O.E.'S BAILEY: INFLATION RISE SHOULD BE TEMPORARY

- U.K.'S SUNAK TELLS E.U. HE'LL SET CITY'S RULES AS EQUIVALENCE STALLS

- SWEDISH RIKSBANK KEEPS RATES AT ZERO, FORECASTS NO CHANGE AHEAD

- E.C.B. TO HOLD SPECIAL STRATEGY MEETING NEXT WEEK, OMFIF SAYS

Source: IHS Markit, MNI

Source: IHS Markit, MNI

NEWS:

BOE: While UK inflation has risen faster than expected the increase was likely to be temporary, Bank of England Governor Andrew Bailey said Thursday. Base effects, a slower recovery in supply than demand and distortedly strong demands for goods as opposed to services, with the latter still hampered by social restrictions, were all cited by Bailey as reasons why inflation is likely to continue to pick-up near term but then decline again. Bailey, delivering his annual Mansion House speech, warned of upside risks to inflation, if labour supply remained diminished or price expectations rose, and said that the Bank would "respond with the tools of monetary policy" if there was evidence of more persistent price pressures.

U.K./E.U. (BBG): Chancellor of the Exchequer Rishi Sunak suggested he has given up on securing the financial services equivalence agreements he had been seeking with the European Union and will now move on and make the most of the U.K.'s freedom to set its own rules. Addressing an audience of executives and young business leaders at his first annual Mansion House speech, Sunak said the U.K.'s "ambition" to reach a series of equivalence agreements with the EU to grant access to each other's markets for financial services "has not happened." "Now, we are moving forward, continuing to cooperate on questions of global finance, but each as a sovereign jurisdiction with our own priorities," Sunak said. "We now have the freedom to do things differently and better, and we intend to use it fully, but I can equally reassure you, the EU will never have cause to deny the U.K. access because of poor regulatory standards."

RIKSBANK: The Riksbank Executive Board left the policy rate on hold at zero percent at its end June meeting and the board 's collective judgement was that it would stay there throughout its three-year forecast. The unchanged policy decision was inevitable but in the run-up to the announcement there was speculation that the central bank might show the rate forecasts sloping upwards at the end of the forecast. The central bank did raise its inflation forecast, with inflation on the target CPIF measure expected to go above the 2.0% goal towards the end of this year, peaking at 2.11% in November before slipping lower and then moving back above 2.0% in early 2024 and staying there.

ECB (BBG): European Central Bank policy makers will hold a special meeting in Frankfurt next week in a bid to wrap up the institution's strategy review, according to Omfif.The gathering is expected to put the finishing touches on a new definition of price stability, wrote David Marsh, chairman of the the Official Monetary and Financial Institutions Forum, a think tank for economic policy.The meeting is expected to start with a Governing Council dinner on Tuesday and could extend through Thursday, Marsh wrote, adding that an announcement may be made afterward if agreement can be reached.

ECB / BANKS (BBG): European banks could see a cap on dividends and share buybacks lifted at the end of September, according to European Central Bank President Christine Lagarde.The European Systemic Risk Board could allow its call for restrictions to lapse if economic and financial sector conditions do not deteriorate materially, Lagarde told European lawmakers on Thursday in her capacity as head of that institution. "The improved economic outlook on the back of rapid progress in vaccination campaigns has reduced the probability of severe scenarios," she said.

CHINA (BBG): President Xi Jinping struck a defiant tone in a speech marking the Communist Party's 100-year anniversary, calling China's quest to gain control of Taiwan a "historic mission" and warning the country's adversaries to avoid standing in the way of his government.In a nationwide address from above the portrait of Mao Zedong in Tiananmen Square, Xi hailed the party's successes, saying China wanted to promote peace in the world and was open to "constructive criticism." Yet he quickly warned that the country would no longer listen to "sanctimonious preaching" and that "the time when the Chinese nation could be bullied and abused by others was gone forever."

SPAIN DATA: Another High For Manuf PMI, But Price Pressures Persist

Spanish manufacturing PMI was a little stronger than expected in June, at 60.4 (59.6 exp., 59.4 prior). This was the highest reading going back to May 1998, and came amid "surging levels of orders and demand, especially from sectors related to hospitality", per the IHS Markit report.

- From the report: "Underpinning the latest PMI reading was the sharpest rise in production for over 23 years. Rising output has now been recorded in each of the past five months and was again underpinned by sharply rising levels of incoming new orders. Although easing since May's near 15-year high, growth in new orders during June was again considerable amid widespread reports of firmer demand."

- Supply chain pressures and strong demand continued to boost inflation concerns: "Panellists reported a considerable excess of demand over supply on global product markets...Unsurprisingly, this resulted in another round of considerable input price inflation. June's survey marked another record high for cost increases (data were first collected in February 1998)... output charges were raised at a series record pace as firms sought to take advantage of positive demand conditions."

ITALY DATA: Manufacturing PMI Report Shows Continued Price Pressures

June Italian Manufacturing PMI came in exactly in line with expectations at 62.2 (May: 62.3).

- From the IHS Markit release: "Key to the sustained upturn in June were further expansions of both new orders and output, with growth remaining rapid, despite slowing from their respective all-time and 40-month record rates. According to anecdotal evidence, improved client confidence, firmer demand conditions and the easing of lockdown measures were key drivers of the latest increases".

- Employers took on workers to meet the quickest rise in backlogs in series history - overall, supply chain pressures and other factors boosted inflation pressures, a common theme in recent months.

- From the report: "Shortages continued to push costs higher still during June, according to panellists, with the rate of input price inflation the strongest in the survey's history [going back 24 years]. Factory gate charges also rose, with the pace of increase slowing only slightly from May's record. Respondents noted that greater costs burdens had been passed through to clients where possible."

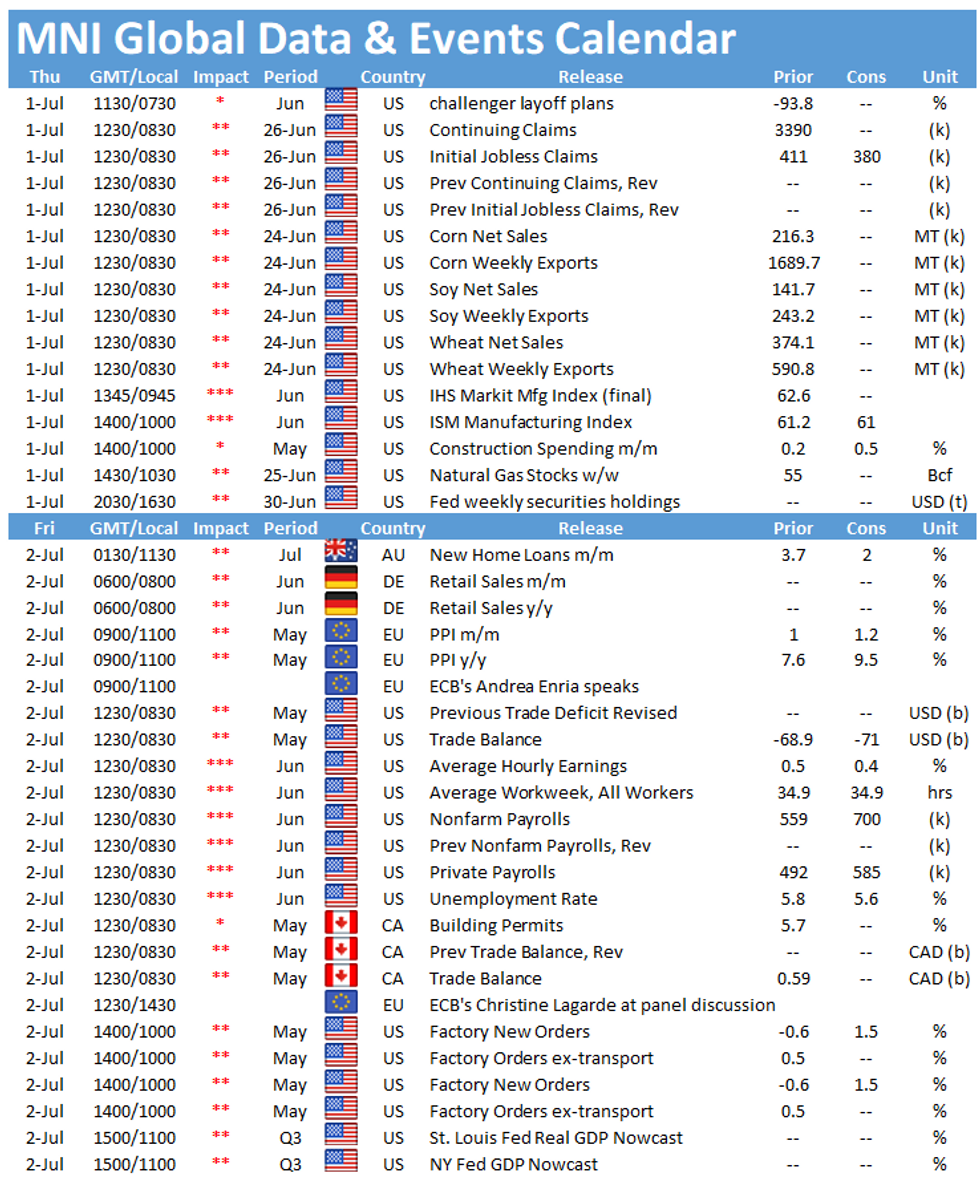

MNI: GERMANY FINAL JUN MFG PMI 65.1; FLASH 64.9; MAY 64.4

MNI: EZ FINAL JUN MFG PMI 63.4; FLASH 63.1; MAY 63.1

MNI: UK FINAL JUN MFG PMI 63.9; FLASH 64.2; MAY 65.6

FIXED INCOME: Busy morning, partially reversing yesterday's rally

Bunds, gilts and Treasuries have all partially reversed some of yesterday's rally today.

- It has been a busy morning in terms of events: final PMI across the Eurozone and UK has largely been in line with flash prints while Governor Bailey's Mansion House speech was eagerly anticipated but contained little that was new.

- We have also had some decent supply with Spain, France and the UK all holding auctions this morning.

- Looking ahead the main focus is on ISM manufacturing and (to a lesser extent) weekly claims data ahead of tomorrow's labour market report.

- TY1 futures are down -0-7 today at 132-09 with 10y UST yields up 1.0bp at 1.479% and 2y yields up 0.4bp at 0.254%.

- Bund futures are down -0.36 today at 172.25 with 10y Bund yields up 2.6bp at -0.183% and Schatz yields up 0.4bp at -0.663%.

- Gilt futures are down -0.21 today at 127.89 with 10y yields up 2.4bp at 0.739% and 2y yields up 0.4bp at 0.061%.

FOREX: GBP/USD Makes Light Work of June Lows

- GBP is the early underperformer in currency space, with GBP/USD making light work of the Wednesday low to extend losses through the June lows and touch the lowest level since mid-April. Fundamental catalysts and drivers for the GBP weakness are few and far between, keeping markets focussed on the technical break below 1.3787. This opens the Apr16 low of 1.3717.

- The strongest currency so far Thursday is NZD, which recovers modestly against the USD as markets reverse a minority of this week's weakness. The pair needs to top the 200-dma at 0.7058 to solidify and near-term recovery.

- Equity markets across Europe are positive, helping extend the USD/JPY rally that began in earnest around the Wednesday month-end WMR fix. This puts the pair at new multi-year highs, with the price touching 111.50 at the day's high.

- Friday's US jobs data remains top of mind, keeping focus on today's release of weekly jobless claims data, the challenger job cuts release for June and manufacturing ISM. Fed's Bostic is the sole central bank speaker on the docket Thursday.

EQUITIES: S&P Futures Hit Fresh Record

- Asian stocks closed lower, with Japan's NIKKEI down 84.49 pts or -0.29% at 28707.04 and the TOPIX down 4.36 pts or -0.22% at 1939.21. China's SHANGHAI closed down 2.416 pts or -0.07% at 3588.781.

- European equities are gaining, with the German Dax up 137.2 pts or +0.88% at 15616.68, FTSE 100 up 81.56 pts or +1.16% at 7037.47, CAC 40 up 59.78 pts or +0.92% at 6507.83 and Euro Stoxx 50 up 34.05 pts or +0.84% at 4092.68.

- U.S. futures continue to push higher, with the Dow Jones mini up 94 pts or +0.27% at 34493, S&P 500 mini up 9.5 pts or +0.22% at 4298, NASDAQ mini up 12 pts or +0.08% at 14561.

OIL: Crude Leads Gains Ahead Of OPEC+ Meeting

- WTI Crude up $1 or +1.36% at $74.02

- Natural Gas up $0.08 or +2.25% at $3.719

- Gold spot up $4.48 or +0.25% at $1776.34

- Copper down $0.2 or -0.05% at $428.2

- Silver up $0.09 or +0.35% at $26.2616

- Platinum up $9.84 or +0.92% at $1081.6

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.