-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Weak PMIs Underline Europe Recession Risks

EXECUTIVE SUMMARY:

- RECESSION CONCERNS RISE FOLLOWING EUROZONE, UK PMIS

- NORGES BANK HIKES 50BPS, SEES PEAK JUST OVER 3%

- GERMANY TAKES STEP CLOSER TO GAS RATIONING WITH HEIGHTENED ALERT

- UK BY-ELECTIONS TODAY, 2 DEFEATS WOULD PUT PM JOHNSON UNDER GREATER PRESSURE

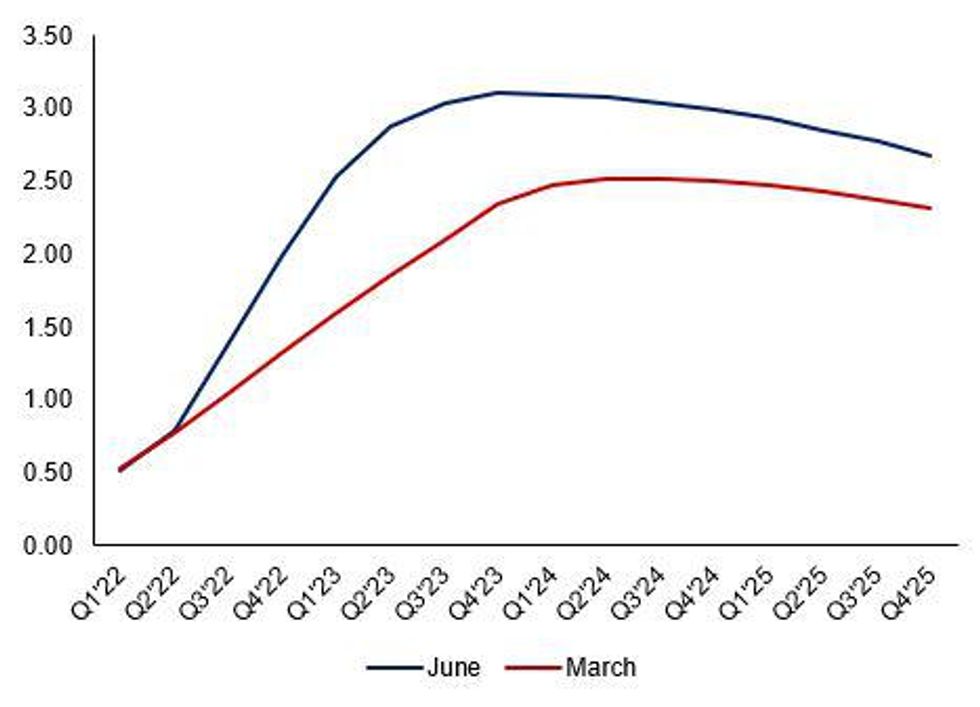

Fig. 1: New Norges Bank Policy Path

Source: Norges Bank, MNI

Source: Norges Bank, MNI

NEWS:

NORGES BANK (MNI): Norges Bank hiked its key policy rates by 50 basis points at its June meeting, taking the policy rate to 1.25% and it said that the next hike would likely come at its August meeting. The Monetary Policy and Financial Stability Committee forecasts showed the policy rate rising to some 3% in 2023, before holding near steady with the rate in 2024 at 3.1%, up from the previous 2.5% projected peak, and then falling back to 2.8% in 2025. Analysts had been divided over whether the Norwegian central bank would raise by 25 or 50 bps, and the larger move and higher peak were at the hawkish end of analysts' expectations although market pricing has shown even more aggressive tightening ahead.

NORGES BANK (MNI): Policy Report Highlights - Looks to confirm front-loading of policy rate hikes: "A faster rate rise now will reduce the risk of inflation remaining high and the need for a sharper tightening of monetary policy further out"

- Key driver for rate path is high economic activity meeting "little spare capacity". This is a firming of language after March's "above a normal level".

- Balance of risks leaves chance of faster action required than statement suggests: if sustained global inflationary pressure persists "the policy rate may be raised more than currently projected." Indeed the path does factor in a off chance of larger-than-25bps increments this year despite today's statement looking for 25bps in August.On the jobs market, report points directly to output constraints a key driver for capacity constraints: "output constraints due to labour shortages is now just as high as preceding the financial crisis"

GERMANY / EUROPEAN ENERGY (BBG): Germany elevated the risk level in its national gas emergency plan to the second-highest “alarm” phase, following steep cuts in supplies from Russia. The heightened alert tightens monitoring of the market, and some coal-fired power plants will be reactivated, the Economy Ministry said in a statement on Thursday. The government said it would hold off on an option of enacting legislation to allow energy companies to pass on cost increases to homes and businesses. “It will be a rocky road that we have to travel as a country,” Economy Minister Robert Habeck said. “Even if we don’t feel it yet, we are in a gas crisis.”

UK ELECTIONS: Political betting markets show the governing centre-right Conservative Party on course to lose two parliamentary by-elections today in a result that would place even more pressure on embattled PM Boris Johnson. Political bettors make it almost a certainty that the centre-left Labour Party will retake the northern English seat of Wakefield, having lost it in the 2019 general election for the first time in almost 90 years. The betting market assigns a 99% implied probability that Labour will win the seat.

BANK INDONESIA: Indonesia's central bank left its benchmark reverse repo rate unchanged at 3.5% Thursday, citing relatively benign inflation. The move was largely expected by financial markets. CPI inflation came in at 3.55%, inside Bank Indonesia's 2% to $4 target range and was the key driver for the decision by the board of governors, who also left the overnight deposit and lending facility rates unchanged at 2.75% and 4.25%.

US-CHINA: China and the U.S. should meet 'halfway' and make joint efforts to create conditions for economic and trade cooperation, Shu Jueting, spokeswoman of the Ministry of Commerce told a briefing Thursday, after Washington's recent comment about considering the easing of additional tariffs on Chinese goods imposed since 2018. "The earlier the tariffs are lifted, the sooner consumers and businesses will benefit at the backdrop of high inflation," said Shu, adding that China always believe the cancellation of all additional tariffs is beneficial to both sides.

DATA:

MNI: FRANCE FLASH JUNE SERVICES PMI 54.4 (FCST 57.5); MAY 58.3

* FRANCE FLASH JUNE MANUFACTURING PMI 51.0 (FCST 54.0); MAY 54.6

* FRANCE FLASH JUNE COMPOSITE PMI 52.8 (FCST 55.9); MAY 57.0

FRANCE: Details weak in French PMI report

- Weak details in the French PMI, with employment falling, backlogs of work falling and the falls were in spite of easing supply chain disruptions. Highlights from the press release:

- "Amid a less positive outlook towards the future, private sector employment in France rose at the slowest rate in four months during June. The slowdown in jobs growth was particularly notable in the manufacturing sector and came amid the first reduction in backlogs of work since November 2020."

- "While June’s survey indicated a persistence of supply-chain disruptions, which firms attributed to the war in Ukraine, staff shortages and inadequate item availability across the market, the extent to which supplier delivery times lengthened was the weakest for almost a year-and-a half. However, input buying activity fell for the first time since November 2020 as businesses noted sufficient stock levels and a preference to use them over making additional purchases at current prices."

MNI: GERMANY FLASH JUNE SERVICES PMI 52.4 (FCST 54.5); MAY 55.0

* GERMANY FLASH JUNE MANUFACTURING PMI 52.0 (FCST 54.0); MAY 54.8

* GERMANY FLASH JUNE COMPOSITE PMI 51.3 (FCST 53.0); MAY 53.7

GERMANY: New orders weak, expectations low, price pressures less intense

- Very weak details in the German PMI report. New orders declining (and output would have been worse had it not been for the big backlogs of work), expectations the lowest in over 2 years and also price pressures (albeit still rising) not rising quite as quickly as previously.

- "Falling exports acted as a drag, while there were also signs of domestic demand coming under pressure from heightened economic uncertainty and sustained strong inflation. Firms’ expectations towards future activity slumped to their lowest since the first wave of the COVID pandemic over two years ago, with manufacturers growing increasingly pessimistic about the outlook."

- "Output of goods and services was supported somewhat by work on backlogs, masking an even weaker trend in inflows of new business. Overall new orders fell for the first time this year and to the greatest extent since June 2020. Services firms saw a first – albeit marginal – drop in new work for six months, attributing this to a growing reluctance among clients and price increases. However, the main drag came from manufacturing, where firms recorded a steep and accelerated decline in new orders that was the sharpest for two years."

- "Average prices charged for goods and services, on the other hand, rose at a slower rate in June. Although still among the quickest in the series history, the rate of inflation eased for a second straight month to the lowest since March. Slower rises in output prices were recorded across both monitored sectors."

MNI: EZ FLASH JUNE SERVICES PMI 52.8 (FCST 55.5); MAY 56.1

* EZ FLASH JUNE MANUFACTURING PMI 52.0 (FCST 53.8); MAY 54.6

* EUROZONE FLASH JUNE COMPOSITE PMI 51.9 (FCST 54.0); MAY 54.8

EUROZONE: Manufacturing "near-stalling" and services weak in EZ-ex DE/FR

- From the PMI press release:

- "Output growth across the rest of the eurozone as a whole meanwhile also slowed further from April’s recent peak, down to the lowest since January, thanks to a near-stalling of manufacturing output growth and the weakest service sector expansion in five months"

MNI: UK FLASH JUNE SERVICES PMI 53.4 (FCST 52.9); MAY 53.4

* UK FLASH JUNE MANUFACTURING PMI 53.4 (FCST 53.6); MAY 54.6* UK FLASH JUNE COMPOSITE PMI 53.1 (FCST 52.4); MAY 53.1UK: Still seeing high inflation, wage growth and job creation

From a monpol perspective, we are still seeing high inflation, high wage growth and strong job creation. So all the reasons the BOE are hiking are still reflected in this survey. There was a big pullback in expectations, but still not enough to derail the MNI Markets team's expectation that there is around a 60% probability of a 50bp hike in June (which is still less than the market prices).

- "Despite weaker new business growth, the latest survey signalled a robust and accelerated rise in staffing numbers. Job creation was the fastest for three months, led by stronger hiring in the service sector."

- "Worries about customer spending cutbacks and the impact of rapid inflation on the longer-term economic outlook led to another fall in business activity expectations. Optimism at UK private sector companies has declined in each month since February and is now the lowest for just over two years."

- "Strong wage pressures added to cost burdens at private sector companies in June. Measured overall, input prices increased at a slightly slower pace than in May, but the rate of inflation was still the second-fastest since the index began in January 1998. Service providers typically noted higher salary payments, fuel costs and the impact of supply shortages. Manufacturers mostly cited higher energy costs and raw material prices, although the overall rate of purchase price inflation eased to a four-month low in June"

- "Exceptionally strong cost pressures resulted in a steep increase in average prices charged in June. The rate of output charge inflation eased to its lowest since February, but remained higher than at any other time in the past two decades."

MNI BRIEF: UK Debt Costs Up, Set To Soar Further In June

UK debt interest payments rose to the third highest on record in May, touching GGP7.6 billion, the Office for National Statistics said Thursday, but they warned that the inflationary surge this year meant worse was to come, with June set to be by far the biggest month on record to date.

The ONS notes the Office for Budget Responsibility forecasts June debt interest costs are set to soar to GBP19.7 billion, more than double the previous high of GBP9.1 billion. The sharp increase in the June costs is being driven by the sharp increase in the RPI inflation measure between March and April, the benchmark for June calculations. This, as the chart below shows, will likely be the biggest monthly cost in FY22/23 -- a year where the OBR forecast total interest costs at GBP87.2 billion, up from GBP69.9 billion.

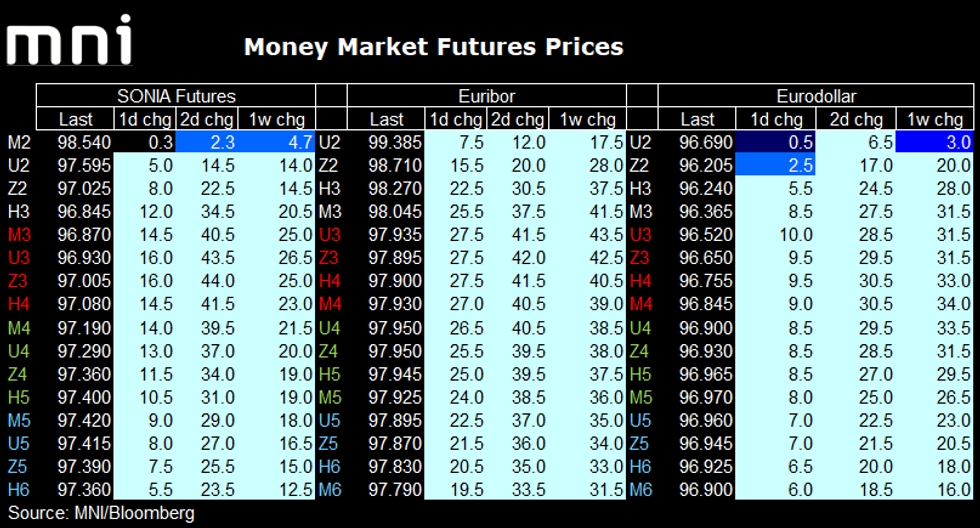

FIXED INCOME: PMI data driving markets this morning

- Bunds lead gilts which lead Treasuries with the PMIs being the biggest drivers this morning. Eurozone data saw the biggest misses versus expectations driving Euribor futures higher and seeing the terminal ECB rate lowered across the strip. Gilts moved higher in sympathy before pulling back somewhat when UK data missed expectations by less than the Eurozone. Treasuries have seen the smallest moves of the day. With larger moves at the front-end curves have generally bull steepened this morning.

- Looking ahead we have round two of Powell's testimony today as well as the US PMI print and weekly claims data.

- TY1 futures are up 0-14 today at 117-12+ with 10y UST yields down -4.9bp at 3.111% and 2y yields down -4.5bp at 3.013%.

- Bund futures are up 2.22 today at 147.50 with 10y Bund yields down -18.0bp at 1.453% and Schatz yields down -21.0bp at 0.832%.

- Gilt futures are up 0.77 today at 113.14 with 10y yields down -11.0bp at 2.387% and 2y yields down -12.4bp at 2.006%.

- Euribor and Eurodollar futures sit at or close to their highs of the day, while SONIA futures saw a bit of a pullback as the UK data was not quite as bad as the European data (despite still missing consensus expectations).

- Euribor Reds are now up to 28 ticks higher on the day. For the ECB, markets price 29bp for July (down from 31bp yesterday), 81bp by September and 156bp by year-end (down 17bp from yesterday's close of 173bp).

- The SONIA strip is up to 16 ticks higher on the day. For the BOE, markets now pricing about 52bp for August (from 56bp on Tuesday and high of 61bp post-MPC meeting), 96bp (cumulatively) by September, 141bp by November and 168bp by year-end (down around 10bp from yesterday's close).

- Eurodollar futures are up to 10 ticks higher on the day, with the Sep-23 contract leading the gains. For the Fed, around 69bp is priced for July (around yesterday's low), 130bp (cumulatively) by September and 188by by year-end (moving through yesterday's low).

FOREX: EUR/USD Marked Down on Sluggish PMIs

- JPY trades stronger for a second session, putting USD/JPY back below the Y135.50 level as markets maintain a general risk-off tone with equities on the backfoot. The e-mini S&P is well off the Wednesday highs, with core government bonds the beneficiary - pushing the US 10y yield to trade either side of the 3.10% level.

- The Norwegian central bank rate decision delivered mixed messages: the bank raised rates by 50bps - a larger hike than forecast - but indicated this more sizeable pace of tightening would not be maintained further out the curve, with just 25bps likely to follow in August. As a result, the NOK initially rallied firmly, before moderating and trading broadly flat into the NY crossover.

- EUR/USD sustains losses ahead of US hours following a very disappointing turnout from Eurozone preliminary PMI data. German and French services and manufacturing sectors grew far slower than forecast, marking EUR/USD down to 1.0483 in response.

- Weekly jobless claims and preliminary US PMI data for June are the highlights going forward, with markets looking to see if the US follows the pattern set by the Eurozone this morning, in which both services and manufacturing components fell well below forecast.

- Focus turns to the second part of Powell's semi-annual testimony later today, where the Fed chair appears in front of the House Financial Services Panel. ECB's Nagel and Villeroy are also both due to speak.

EQUITIES: Futures Off Overnight Lows

- Asian markets closed mixed: Japan's NIKKEI closed up 21.7 pts or +0.08% at 26171.25 and the TOPIX ended 0.91 pts lower or -0.05% at 1851.74. China's SHANGHAI closed up 52.947 pts or +1.62% at 3320.149 and the HANG SENG ended 265.53 pts higher or +1.26% at 21273.87.

- European stocks are sharply lower, with the German Dax down 175.67 pts or -1.34% at 12969.33, FTSE 100 down 58.58 pts or -0.83% at 7030.25, CAC 40 down 68.1 pts or -1.15% at 5848.59 and Euro Stoxx 50 down 40.29 pts or -1.16% at 3424.47.

- U.S. futures are a little higher vs overnight lows: Dow Jones mini down 105 pts or -0.34% at 30366, S&P 500 mini down 6 pts or -0.16% at 3756.75, NASDAQ mini up 21.5 pts or +0.19% at 11587.25.

COMMODITIES: Crude And Copper Drops Underpinned By Economic Pessimism

- WTI Crude down $2.41 or -2.27% at $103.68

- Natural Gas down $0.11 or -1.57% at $6.75

- Gold spot down $4.71 or -0.26% at $1832.91

- Copper down $8.45 or -2.14% at $386.45

- Silver down $0.2 or -0.93% at $21.2158

- Platinum down $5.38 or -0.58% at $924.7

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/06/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 23/06/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 23/06/2022 | - |  | EU | ECB Lagarde at European Council Meeting | |

| 23/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 23/06/2022 | 1230/0830 | * |  | US | Current Account Balance |

| 23/06/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/06/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 23/06/2022 | 1400/1000 |  | US | Fed Chair Jerome Powell | |

| 23/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 23/06/2022 | 1500/1100 | ** |  | US | DOE weekly crude oil stocks |

| 23/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 23/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 23/06/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 23/06/2022 | 1800/1400 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.