-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Tariffs Curbs Risk Rally

MNI EUROPEAN OPEN: China Announces Tariffs As Deadline Passes

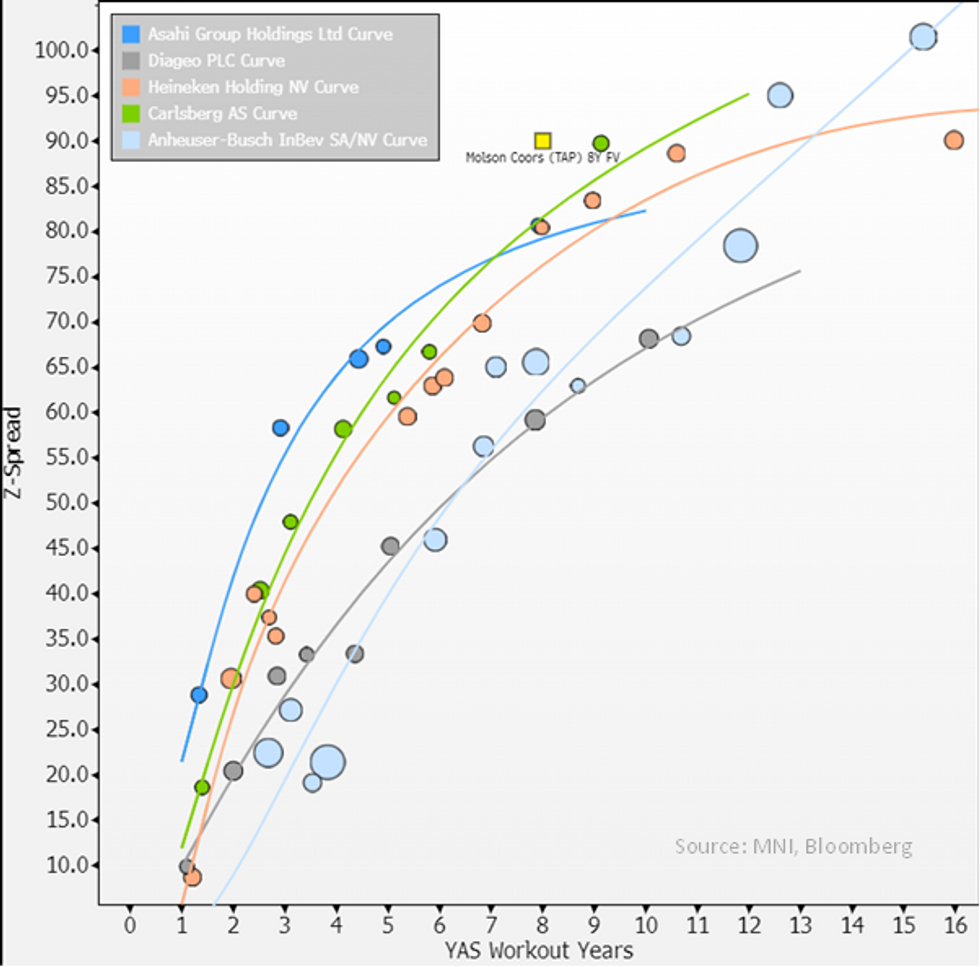

Molson Coors (TAP; Baa2 Pos/BBB S) FV

€benchmark 8Y FV: MS+90

- Molson Coors should price wide of all brewers for its smaller scale (on par with Carlsberg), lack of geographical diversification (80% in Americas, no other brewer is as poorly diversified), weaker volume growth in recent years & mid-pack margins with little progress - though its move towards premium may help that heading forward. This is somewhat captured in ratings (lowest) but BS is well into upgrade territory (Baa1) at Moody's - it could move on the firm 1Q results.

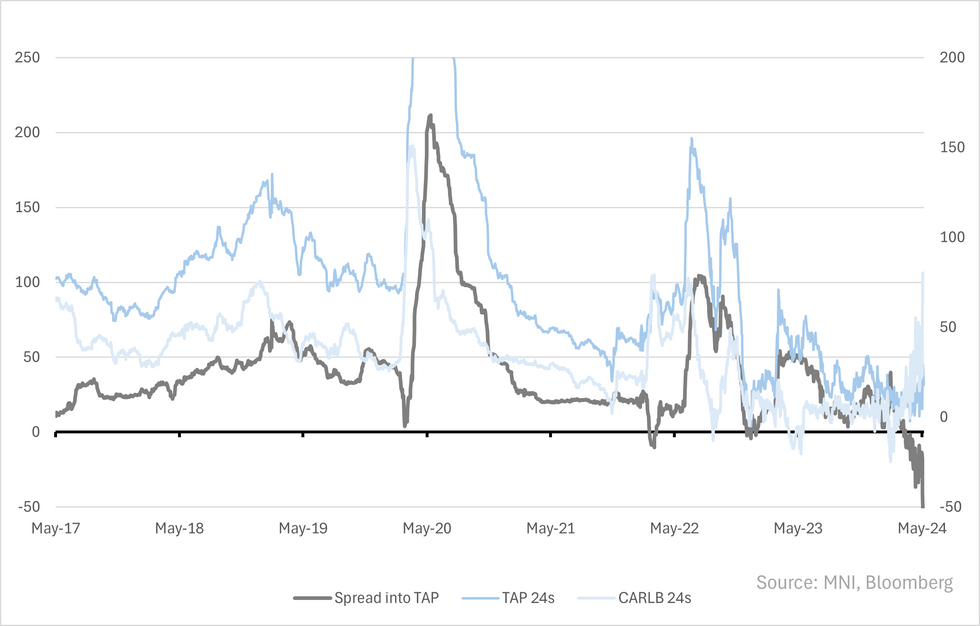

- Existing 24s gave a sizeable discount vs. Carlsberg (Baa1/NR/BBB+) (below) but BS was much higher levered post the '16 acquisition of MillerCools - it was Baa3/BBB- which was one notch lower at Moody's vs. CARLB (till latter's upgrade this year). Net we think current co's exposure & BS should give 10bps over CARLB curve that trades in-line with (New Asahi) & Heineken 8Y/32s at Z+80.

- Re. the equity px action post Q1 results and ensuing analyst debates; we don't think credit needs to care (for now). If FY guidance gets revised up its likely dividends will be scaled up with it and vice versa - i.e. beta to earnings revisions is low for us here.

- On future brewer supply; AB-Inbev & Asahi have already come this year. Heineken, Carlsberg & Diageo all have ~€1b in local maturities coming up and makes them likely next candidates.

As a aside we don't view the sector as cheap. It may have found a bid for its staple nature but there is nearly rating free spread pickup of 70bps into BAT & 30bps into H&M (on 8Y). See our retailers note from last week for more on H&M.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.