-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsy Yields Reverse CPI Rally To Surge Higher Ahead Of FOMC

- Treasuries reverse a reasonable but ultimately brief rally on a CPI report with modestly softer details, to head towards the close with double digit yield increases for the front end to belly and a reversal of post-CPI steepening.

- Strong labour data have seen BOE rate expectations surge and cable flirt with a close above the 1.2600 mark for just the fifth time this year.

- Global macro factors stemming from hopes of further China stimulus help crude oil rise strongly to reverse yesterday's slide, with metals & mining leading S&P 500 gains on the day after the S&P E-mini more convincingly cleared further resistance after the CPI report.

- Tomorrow sees further UK data with monthly GDP before focus turns to US PPI inflation and then of course the FOMC decision.

US TSYS: Ending A Mixed Session Notably Cheaper Despite Softer CPI Details

- Cash Tsys have seen a significantly mixed session, with a sharp rally on the CPI report before fully reversing the move and them plumbing new lows since March 10 for the 2Y and 5Y after brief respite ahead of and only shortly after the solid 30Y auction.

- Headline drivers have been relatively light but it follows a substantial 26bp increase in 2Y Gilt yields ahead strong labour data sent BoE rate expectations surging, decent increases in planned T-bill issuance and Russia mulling quitting the safe corridor grain deal for Black Sea ports, plus the PBoC cutting short-term rates ahead of CPI. Clearance of key support for TY helped extend lows.

- Coming on the eve of the FOMC decision, the end result is yields currently 10-11bps higher on the day for 2-7Y tenors, with the 2Y at the high end of its wide 4.49-4.704% range. 10s only modestly outperform with +9.3bps whilst the very long end more clearly outperforms at +5bps after the auction traded through with decent internals.

- TYU3 at 112-24 off a low of 112-20+ easily cleared key support at 112-29+ to open 112-16 (76.4% retrace of Mar 2 – May 4 rally).

- FOMC-dated OIS doesn’t shake off the post-CPI hit for near-term meetings with just +2bps for tomorrow and a cumulative +17bps for July (-5bps since the data) but the Dec’23 has continued to increase to 5.13% for +6bps on the day and just 15bp of cuts from the 5.28% terminal now seen in September.

- Tomorrow sees PPI land with the usual implications for core PCE inflation, before of course the FOMC decision at 1400ET.

EGBs-GILTS CASH CLOSE: UK Short End Crushed On Jobs Data

Stronger-than-expected UK jobs and wage data triggered the biggest selloff in short-dated Gilts in over 8 months Tuesday, with bear flattening in the curve that triggered a similar move in German yields.

- 2Y UK yields rose relentlessly over the day, shrugging off a US inflation report that was largely in line with expectations, and closed up over 26bp (most since Sep 26, 2022)

- Several BoE speakers today (incl Dhingra, Greene) did little to quell the hawkish speculation - Gov Bailey noted “we still think inflation is going to come down but it’s taking a lot longer than expected".

- That "longer than expected" is also the theme of UK rates markets, with BoE peak rates now seen reached in Feb 2024 (vs Dec 2023) and with pricing nearing a 6% handle for the first time since late last year (5.85% peak priced, 135bp from here).

- Eurozone bond / rate action was relatively tame by comparison to the UK, another theme of late. ECB hike pricing edged up marginally on the day, with a 25bp hike this Thursday fully expected - our meeting preview went out today.

- Periphery spreads narrowed, with 10Y BTP at fresh 14-month tights to Bund.

- Wednesday sees UK GDP data and the Federal Reserve decision.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 6bps at 2.974%, 5-Yr is up 5.4bps at 2.475%, 10-Yr is up 3.5bps at 2.423%, and 30-Yr is up 1.4bps at 2.564%.

- UK: The 2-Yr yield is up 26.1bps at 4.897%, 5-Yr is up 18.1bps at 4.528%, 10-Yr is up 9.6bps at 4.434%, and 30-Yr is up 4.3bps at 4.615%.

- Italian BTP spread down 3.7bps at 163.2bps / Greek down 4.4bps at 128.4bps

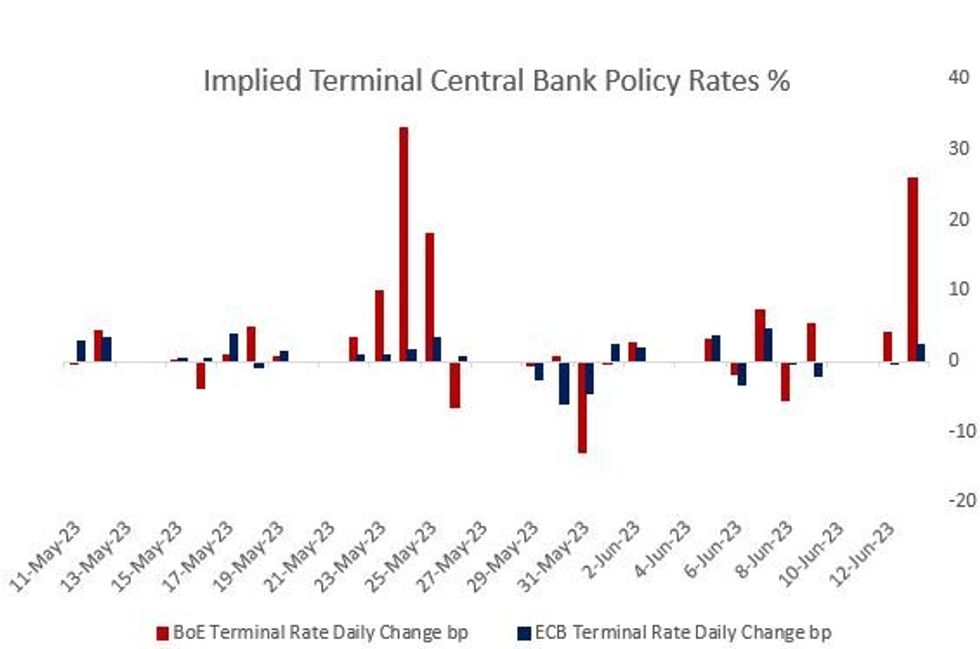

EU STIR: BoE Seen Going Higher For Longer, While ECB Pricing Stagnates

Today's post-UK jobs market price action, and parade of BoE speakers, have effectively added a 25bp hike to the BoE's tightening cycle, now seen peaking in Feb 2024 at 5.85% (up 28bp on the day, and 135bp from current rates).

- That's higher and longer than previously expected - coming into today, the peak was seen arriving in Dec 2023. There's a chance seen of a 50bp hike this month (around 20% implied).

- While an impressive increase, it's not even the biggest single day move of the past month for peak rate pricing, which was the +33bp on May 24 following much stronger-than-expected April CPI data; that was followed up by +18bp on May 25.

- Meanwhile ECB policy is seen as much more predictable and peak hike pricing continues to effectively stand still: +1.5bp today to 3.80%, implying 56bp of further hikes in this cycle, including 96% probability of a quarter point raise this week (as seen in MNI's meeting preview).

FOREX: JPY Under Renewed Pressure Following Core Yield Surge, GBP Buoyed By Domestic Data

- The US inflation report came in largely in line with expectations which looks likely to prompt the Federal Reserve to keep rates unchanged on Wednesday. Despite a sharp reversal higher for US yields, the path of least resistance in currency markets was generally lower for the greenback, with the Japanese Yen performing the worst in G10.

- USDJPY has bounced around 125 pips from the earlier 139.01 lows, reinforcing the bullish technical trend conditions. Attention is on key resistance at the top of a bull channel drawn from the Jan 16 low. The line intersects at 141.30 today. A clear break of this hurdle would reinforce a bullish theme and open 141.61, the Nov 23 2022 high.

- Interestingly, GBPJPY has extended its move back above 175 and looks set to close at its highest level since late 2015.

- The GBP strength comes hot on the heels of stronger-than-expected UK jobs and wage data, which triggered the biggest selloff in short-dated Gilts in over 8 months. GBPUSD has also thrived, bouncing back strongly following yesterday’s underperformance that saw the pair briefly drop as low as 1.2487. Cable is flirting with a close above the 1.2600 mark for just the fifth time this year. A sustained move above this level would expose key resistance at 1.2680, May 10 high. The first support moves up to 1.2468, the 20-day EMA.

- Wednesday sees UK GDP data where the economy is expected to advance +0.2% m/m in April. US PPI data for May will also cross before the focus then quickly shifts to the FOMC decision.

US RATES OPTIONS: Rate Cut Plays Added And Faded Tuesday As CPI Comes In Line

Tuesday's US rates / bond options flow included:

- SFRM3 94.81/94.87cs, traded for 1.25 in 1k.

- SFRM3 94.81c, traded for 1.5 in 2.5k.

- SFRM3 94.81/94.75/94.68p fly, traded for 1.25 in 1k.

- SFRM3 94.87/94.81/94.75/94.68p condor traded for 3 in 4k.

- SFRU3 94.75/94.62/94.50p fly, traded 2 in 1k.

- 0QM3 95.87/96.00/96.12c fly, traded 1.5 in 1.5k.

- 0QM3 95.68/95.43ps 2x3, traded for 11 and 11.5 in 9k.

- 0QU3 95.75p, traded 17.5 in 3k.

- SFRM4 98.00/99.00cs traded for 7.5 in 10k.

- SFRN3 94.50/94.62/94.75c fly, bought for 2.5 in 1k

- SFRU3 94.87/95.00/95.12/95.25c condor, bought for flat in 2.5k

- SFRU3 94.8125/94.9375 call spread 2.5K lots blocked at 3.5. CME email suggests a buyer of the call spread. Covered vs. selling of the underlying SFRU3 at 94.735 with a delta of +9%.

- SFRU3 94.75/94.62/94.50 put fly bought for 2.25 up to 2.5 in 25k all day

EU RATES OPTIONS: Sonia Upside Features Tuesday On Hawkishly Repriced UK Rates

Tuesday's Europe rates / bond options flow included:

- OEN3 115/118^^ sold at 12.5 in 2.5k

- SFIU3 94.55/94.70/94.85c fly, bought for 2 in 3.2k

- SFIU3 94.65/94.75/94.85c fly, bought for 1 in 3k

US STOCKS: Gains Stall After Post-CPI Push But Shrug Off Jump In Real Yields

- ESA at 4412.75 has pulled back slightly off session highs and newfound initial resistance at 4423.25 but still sees solid gains after the CPI report helped breach the round 4400 tested prior to the data.

- The continued push higher has opened a string of resistance levels running off projections based on the May 4-19-24 price swing, with 4427.19 (1.618) and 4452.42 (1.764) next ahead.

- The 0.6% increase on the day is decent from a macro perspective considering a 7.5bp increase in 10Y Tsy real yields.

- SPX is also +0.7%, and whilst banks (+1%) and energy (+0.6%) partly bounce back after yesterday’s underperformance, it’s led by materials (+2.3%). The latter is led by metals & mining (+3.8%) as part of sizeable gains for commodity producers generally after iron ore pushed higher overnight.

- Away from SPX, the Nasdaq 100 trades broadly in line whilst the Dow Jones lags with +0.3%, as does the TSX (+0.4%) north of the border despite strong energy gains on the day.

COMMODITIES: Stimulus Hopes Boost Oil, Nat Gas Surges On Norwegian Works

- Crude oil has gained strongly today to unwind yesterday’s slide but no more than that.

- China cutting short-term rates and hopes of further Chinese stimulus have played a role, as seemingly did a rally in Treasuries after the US CPI data although a subsequent sharp reversal of that and yields pushing significantly higher on the day has had a relatively modest impact.

- EU TTF natural gas meanwhile has surged 16% on tight supply concerns as Norway extends the outages at gas plants and fields. Nyhamna gas plant, Ormen Lange and Aasta Hansteen field works were extended until 15 July.

- WTI is +3.1% at $69.2, moving back nearer to resistance at $71.30 (20-day EMA).

- Brent is +3.1% at $74.05, moving back nearer to resistance at $75.59 (20-day EMA).

- Gold is -0.85% at $1941.26 as it moves closer to support at $1932.2 (May 31 low) with notably higher Tsy yields offseting a softer USD index on the day.

US DATA: Relatively Well Behaved Core Services Non-Housing

- Core services ex OER and rent primary lifts in May from 0.11% to 0.24% M/M but still below the 0.42% averaged in Q1.

- Core services ex all shelter (stripping out the volatile lodging component which bounced to the higher end of expectations) meanwhile dips fractionally from 0.22% to 0.21% M/M, vs 0.31% averaged in Q1.

US DATA: Particularly Tepid CPI Core Goods Ex Used Vehicles

- As noted above, used & trucks cars led the strength in core goods, rising 4.4% M/M for the second month running and right at the top end of analyst expectations of 1-4.5% seen beforehand.

- In contribution terms, it provided 0.14pps of the 0.15pps that core goods added to overall core CPI (off its 0.55% M/M increase).

- It meant core goods ex used vehicles saw another particularly tepid 0.00% M/M after 0.04% M/M, a new low since Feb'21 and with measures such as the NY Fed’s GSCPI suggesting scope for potential further room to the downside.

US DATA: Some PCE-Relevant Areas That Accelerated In May

Whilst there weren’t many areas of the report that saw standout strength of a potentially more sustained nature (perhaps aside from vehicle insurance), there are two that could imply marginally hotter pressures from a core PCE perspective. Playing devil’s advocate from a hawkish FOMC member’s perspective though, they aren’t hugely strong arguments to hang on.

- i) Within medical care services, the average of professional and hospital services accelerated slightly to 0.28% M/M after last month’s bounce to 0.24% M/M preceded a strong rise in PCE healthcare of 0.49% M/M which helped underline strong supercore PCE. (PCE healthcare is a separate series but these components are a better predictor than total medical care services which is distorted by health insurance).

- ii) Food away from home (in core PCE but not CPI) accelerated from 0.37% to 0.47% M/M although remained below the 0.62% averaged in Q1.

- On a similar vein, airfares were a larger than expected drag on May CPI at -2.95% (analyst expectations had been grouped between -2% and +2%) but the series relevant for PCE comes from tomorrow’s PPI data.

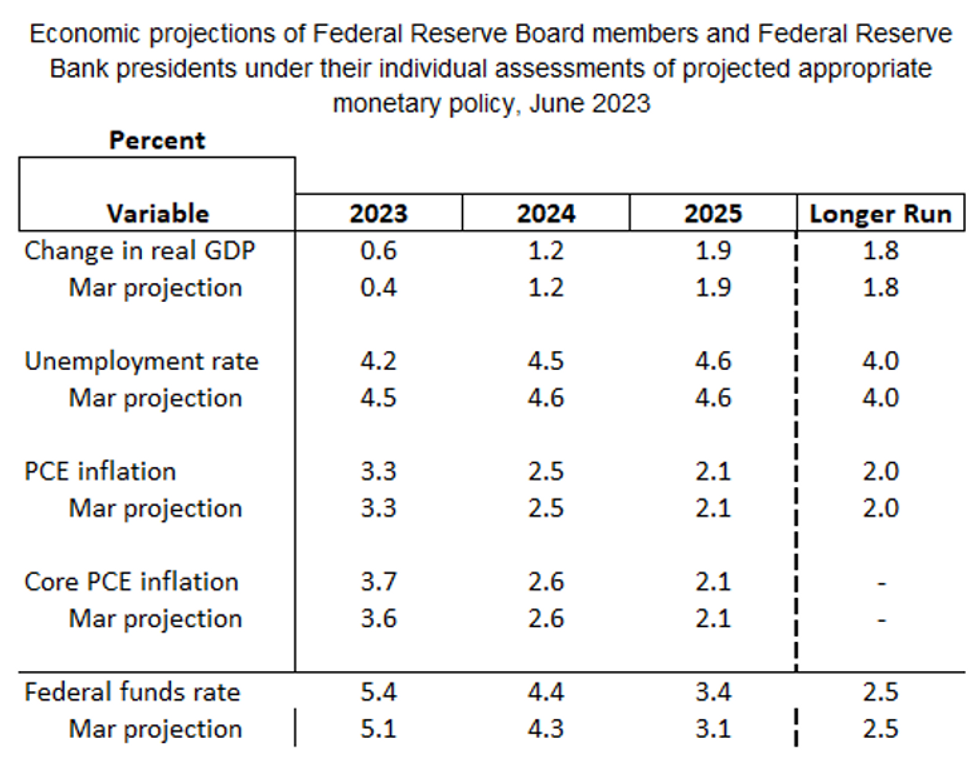

FED: June Macro Projections: Inflation Could Move Up With Lower Unemployment

With the May CPI data (though not yet the PCE data that the Fed uses in its projections) in hand, below are MNI's expectations for the June Summary of Economic Projections.

- Outside of the Fed funds rate medians, we don’t expect many changes in the projected SEP macro variables in the June edition.

- There could be an uptick in the GDP growth rate for 2023 based on recent activity data tracking through Q2 and a modest tweak to PCE inflation projections.

- But the biggest change is likely to be to the 2023 unemployment rate. Even with the 0.3pp uptick in May, at 3.7% the unemployment rate would have to rise a fairly rapid 0.8pp in the remaining months of the year to reach the FOMC’s 4.5% March projection.

- We think the FOMC median will split the difference and revise the end-2023 unemployment rate down a few percentage points though we’ve seen sell-side expectations as low as 4.0%.

- Indeed that lower unemployment forecast combined with stronger GDP growth may force an upward revision to end-year PCE prices as the implication of a tighter jobs market.

- The March estimates of 3.3% headline PCE / 3.6% core are exactly in line with current analysts' estimates consensus, but we see core PCE at least being raised for 2023.

Source: MNI Expectations

Source: MNI Expectations

FED: RRP Usage Starts To Show More Of A Decline, Lowest Since March 16

- RRP uptake has started to show a bit more of a decline, with today’s -$52B from yesterday is the largest daily decline since Jun 1 after month-end build up, whilst the overall level of $2.075T is the lowest since Mar 16.

- The number of counterparties edged 1 lower to 105 after rising by 4 yesterday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.