-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: AUD & AU Yields Lower Post RBA Minutes

EXECUTIVE SUMMARY

- CHINA LOAN PRIME RATE CUT 10BPS TO BOOST ECONOMY - MNI BRIEF

- CHINESE BANKS DISAPPOINT WITH MODEST CUT TO FIVE-YEAR RATE - BBG

- HOUSING, SERVICES INFLATION CONCERNING - RBA MINUTES - MNI BRIEF

- RBA TARGETS NAIRU AT 4.5% BY MID-2025 - MNI BRIEF

- JAPAN TRUST BANK BUY RECORD AMOUNT OF SUPER-LONG BONDS - JSDA

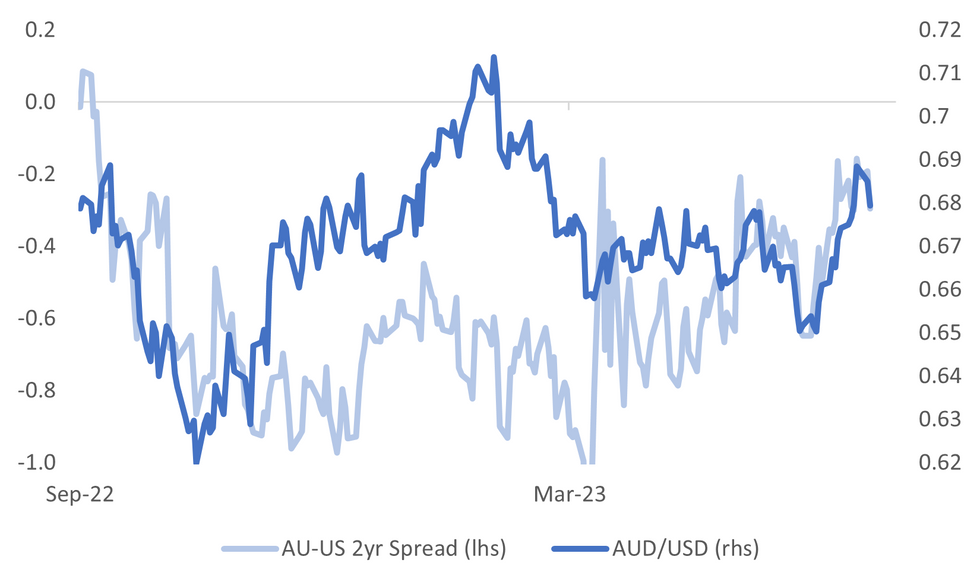

Fig. 1: AUD/USD & AU-US 2yr Swap Rate Spread

Source: MNI - Market News/Bloomberg

U.K.

ECONOMY: Britain has fallen six places down the global economic competitiveness rankings because business leaders have lost confidence in the country, due in part to “government incompetence.” The annual World Competitiveness ranking from the International Institute for Management Development saw the UK plunge from 23rd to 29th out of 64 countries. (BBG)

INFLATION: Production costs for UK food and drink manufacturers fell for the first time last month since 2016, an early sign that inflationary pressures in the sector may be starting to ease. The industry’s score on Lloyds Bank Plc’s sector tracker survey fell to 49.4 in May, the first time in more than seven years that it’s been below the crucial no-change level of 50. The decline was driven by falling commodity prices and energy costs. (BBG)

EUROPE

UKRAINE: The European Union is ready to propose a financial aid package of around €50 billion ($55 billion) to support Ukraine as the country embarks on a critical counteroffensive to retake territory lost since Russia’s invasion more than a year ago. The proposal from the European Commission, the EU’s executive arm, will help finance the Ukrainian government’s current expenditures and pay for urgent reconstruction priorities, according to people familiar with the plan.(BBG)

CHINA/GERMANY: China and Germany can cooperate on high quality development and cooperation to maintain industrial supply chain stability, according to Chinese Premier Li Qiang. Speaking on a recent visit to Germany, Li said cooperation should be open, inclusive and benefit both countries. In particular, firms from both sides should have opportunities for partnerships in emerging fields such as innovation, green technology and low-carbon transition. Li met with leaders from Siemens, Volkswagen and Mercedes Benz. (Xinhua)

U.S.

US/CHINA: China and the United States agreed on Monday to stabilize their intense rivalry so it does not veer into conflict, but failed to produce any major breakthrough during a rare visit to Beijing by U.S. Secretary of State Antony Blinken. Chinese President Xi Jinping welcomed "progress" after shaking hands with Blinken at the Great Hall of the People, a grand venue usually reserved for greeting heads of state. (RTRS)

OTHER

JAPAN: Japanese trust banks bought a record amount of the nation’s super-long government bonds last month, according to the latest data from the Japan Securities Dealers Association on Tuesday. (BBG)

JAPAN: Analysts are rushing to raise target prices on Japanese trading companies as Warren Buffett’s increased holdings drive their shares to record highs. Four of the top 10 firms that saw the steepest target increases among Japan’s largest companies were trading houses, according to data compiled by Bloomberg. The nation’s five biggest trading companies advanced in Tokyo after Berkshire Hathaway Inc. said on Monday it raised its stake further in the firms to an average of over 8.5%. (BBG)

AUSTRALIA: The strength of the Australian housing market continues to imply less drag on the consumer than the Reserve Bank of Australia had expected, while mortgage approvals suggest financial conditions may not be as tight as previously judged, according to the published minutes of the June 6 meeting. The increase in the housing market, likely driven by strong population growth and expectations that the interest-rate cycle was near its peak, was noted across all major cities in May. (MNI)

AUSTRALIA: (MNI) Sydney - An unemployment rate of 4.5% with inflation back within the 2-3% target by mid-2025 would be consistent with some current estimates of the non-accelerating inflation rate of unemployment, according to Michele Bullock, deputy governor at the Reserve Bank of Australia. Speaking at an industry event Tuesday, Bullock noted an unemployment rate at 4.5% would resemble pre-pandemic levels. “In other words, the economy would be closer to a sustainable balance point,” she said. (MNI)

AUSTRALIA: Australia’s central bank weighed the risk of upside surprises to inflation from a tight labor market and rising home prices when it decided to deliver a surprise interest-rate increase this month. The Reserve Bank’s board discussed the case to pause but concluded the “finely balanced” arguments were in favor of raising the cash rate to 4.1% — a level not seen since April 2012. The decision came after a monthly inflation indicator for April unexpectedly accelerated. (BBG)

AUSTRALIA: NSW is on the verge of losing its long-held AAA credit rating as Treasurer Daniel Mookhey warns the state is probably in breach of every metric used by global credit agencies to determine the prized rankings. (SMH)

NZ: New Zealand’s government announced an inquiry into its banking sector amid concerns that lenders are making excessive profits. Cabinet has agreed to a market study into competition in the sector for personal banking services to ensure the market is working well for New Zealanders, Finance Minister Grant Robertson said Tuesday in Wellington. It will be conducted by the antitrust watchdog Commerce Commission and be completed by August 2024. (BBG)

INDIA: Indian Prime Minister Narendra Modi said on Monday that ties between New Delhi and Washington are stronger and deeper than ever, in an interview with the Wall Street Journal. "India deserves a much higher, deeper and wider profile and a role," Modi said in the interview, ahead of his visit to the U.S. this week that is billed as a turning point for bilateral relations. (RTRS)

CHINA

POLICY: China's Loan Prime Rate was cut on Tuesday to guide down funding costs and boost credit, according to a People's Bank of China statement. The one-year LPR, based on the PBOC’s Medium-term Lending Facility rate and quotes submitted by 18 banks, was reduced to 3.55% from 3.65% and the five-year plus maturity was lowered to 4.2% from 4.3% – the first cut since last July. The rate cut was expected as the PBOC reduced the MLF rate last week to 2.65% from 2.75%, also the first cut since last July. (MNI)

POLICY: Chinese banks followed the central bank by lowering their benchmark lending rates on Tuesday, although a relatively modest reduction to the mortgage reference rate disappointed some analysts. The one-year and five-year loan prime rates were reduced by 10 basis points each, according to a statement by the People’s Bank of China. (BBG)

GDP: Weak demand also expected to linger during quarter, Securities Daily article says, citing analysts. 1H GDP could grow by 6%: cites Golden Credit Rating analyst Wang Qing. Weak demand has been dragging China’s economic recovery since second quarter; adds uncertainy to economic growth in 2H: cites Pang Ming, Greater China chief economist for Jones Lang LaSalle. (CSJ)

MARKETS: Analysts expect regulators in Hong Kong and Mainland China to expand the number of securities on the HKD-RMB dual counter, according to Yicai. Authorities have started the programme with 24 large cap companies, but will expand to smaller firms in the future. China will benefit from an acceleration of the yuan's internationalisation through the new counter. Analysts expect the programme next to allow mainland investors direct access to the Hong Kong stock market using yuan. (MNI)

CHINA MARKETS

PBOC Injects Net CNY180 Bln Via OMOs Tuesday

The People's Bank of China (PBOC) conducted CNY182 billion via 7-day reverse repos on Tuesday, with the rates at 1.90%. The operation has led to a net injection of CNY180 billion after offsetting the maturity of CNY2 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.9346% at 09:27 am local time from the close of 2.0368% on Monday.

- The CFETS-NEX money-market sentiment index closed at 49 on Monday, compared with the close of 46 on Friday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 7.1596 TUES VS 7.1201 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1596 on Tuesday, compared with 7.1201 set on Monday.

OVERNIGHT DATA

NZ 2Q WESTPAC CONSUMER CONFIDENCE 83.1; PRIOR 77.7

CHINA 5-LPR 4.20%; MEDIAN 4.15%; PRIOR 4.30%

CHINA 1-LPR 3.55%; MEDIAN 3.55%; PRIOR 3.65%

JAPAN APR F INDUSTRIAL PRODUCTION M/M 0.7%; PRIOR -0.4%

JAPAN APR F INDUSTRIAL PRODUCTION Y/Y -0.7%; PRIOR -0.3%

JAPAN APR CAPACITY UTILIZATION M/M 3.0%; PRIOR 0.8%

MARKETS

US TSYS: Marginally Cheaper In Asia

TYU3 deals at 112-28+, -0-05, a 0-07+ range has been observed thus far.

- Cash tsys sit 2-4bps cheaper than Friday's closing levels across the major benchmarks, the curve has bear steepened. Cash US markets were closed yesterday for the observance of a US holiday.

- Tsys firmed off session lows, on spillover from ACGB's rallying after the RBA minutes of the June policy meeting.

- The move didn't follow through and tsys ticked away from session highs, holding marginally cheaper.

- Flow wise a block buyer in TU (2k lots) was the highlight.

- There is a thin docket in Europe today. Further out we have Housing Starts and Philadelphia Fed Non-Mfg. Fedspeak from St Louis Fed President Bullard, NY Fed President Williams and VC Barr will cross.

JGBS: Futures Holding Morning Gains, Narrow Afternoon Range

JGB futures are holding firmer at 148.57, +14 compared to the settlement levels, after strengthening in morning Tokyo trade after the latest data from Japan Securities Dealers revealed trust banks had bought a record amount of super-long JGBs last month as speculation of a possible tweak to the BoJ’s yield-curve control policy receded. JBU3 reached a session high of 148.69.

- There hasn’t been much in the way of domestic drivers to flag, outside of the JSDA announcement.

- The local data calendar saw April Industrial Production (Final) print +0.7% m/m versus -0.4% prior. April Capacity Utilisation rose 3.0% versus +0.8% in March. The final May Machine Tool Orders are due to print at the top of the hour.

- The cash JGB curve bull flattens with yield movement ranging from 0.2bp lower (2-year zone) to 1.8bp lower (30-year zone). The benchmark 10-year yield is 1.0bp lower at 0.390%, below the BoJ's YCC limit of 0.50%.

- The 5-year benchmark is underperforming on the curve ahead of supply later in the week with the yield 0.2bp lower at 0.078%.

- The swap curve has also bull flattened with swap spreads tighter across the curve.

- The local calendar tomorrow sees the BoJ Minutes of the April meeting.

AUSSIE BONDS: Richer After RBA Minutes But Off Best Levels

ACGBs are currently sitting in the middle of the Sydney session’s range (YM flat & XM -5.0) after the initial favourable response to the release of the June RBA Minutes faded. Currently, 3-year and 10-year futures are 6bp and 3bp firmer post-Minutes after being as much as +11bp and +7.5bp at one stage.

- Despite the RBA minutes not showing explicit dovishness, market sentiment appears to have been influenced by subtle changes in wording regarding the necessity of additional tightening, along with the finely balanced decision on whether to raise interest rates or maintain the status quo. The surge in pricing can also be attributed to an oversold condition for futures prior to the release.

- RBA Deputy Governor Bullock has just addressed the AIG in Newcastle. Her speech was focused on recent labour market developments.

- The 3/10 cash curve has twist steepened with pricing 1bp richer to +5bp cheaper.

- Swaps are flat to 5bp higher on the day.

- Bills strip steepens with pricing -1 to +3.

- RBA dated OIS pricing is 2-5bp softer across meetings with November leading.

- The local calendar is light tomorrow with Westpac-MI Leading Index as the highlight.

- The AOFM plans to sell A$700mn of the 3.50% 21 December 2034 bond tomorrow.

NZGBS: Weaker On The Day But Richer After RBA Minutes

NZGBs closed 3bp weaker, but off session cheaps as ACGBs positive reaction to the release of the June RBA Minutes crossed the Tasman. Australian market sentiment was influenced by subtle changes in wording regarding the necessity of additional tightening, along with the finely balanced decision on whether to raise interest rates or maintain the status quo. The NZ/AU 10-year yield differential was unchanged on the day at +43bp, a five-week low.

- Swap rates closed 2-3bp higher with implied swap spreads little changed.

- RBNZ dated OIS pricing closed 1-2bp firmer for meetings beyond November. Terminal OCR expectations closed at 5.60%.

- The government wants to help Kiwibank to continue to be a disruptor in NZ’s banking market, Finance Minister Grant Robertson told reporters Tuesday in Wellington. (See link)

- Later today sees the results of the Global Dairy Trade Auction. The last result was -3.0% reflecting strong NZ autumn supply and soft Chinese demand.

- The US calendar is slated to release May Housing Starts and Building Permits.

FOREX: AUD Pressured In Asia

The AUD is the weakest performer in the G-10 space at the margins on Tuesday. After weakening post the RBA-minutes AUD extended losses as risk off flows weighed.

- Support at $0.6810, high from May 10, was breached and the AUD/USD prints a touch above $0.68. Iron Ore and Copper are weaker also weighing on the AUD. The next support level is $0.6727 the low from 12 June.

- Kiwi is also pressured, NZD/USD is down ~0.4%. The pair sits a touch above session lows, bears target the 20-Day EMA at $0.6159.

- Yen is marginally firmer, USD/JPY briefly dealt about ¥142 handle before paring gains and grinding lower through the session. The pair last prints at ¥141.70/80.

- Elsewhere in G-10, NOK and SEK are both down ~0.4% however liquidity for both is generally poor in Asia.

- Cross asset wise; e-minis are ~0.2% lower and the Hang Seng is down ~1.6%. BBDXY is up ~0.1%. The Bloomberg Commodity Index is down ~0.4%.

- The data calendar is light today, German PPI headlines in Europe. Further out we have US Housing Starts and Philadelphia Fed Non-mfg Index.

EQUITIES: China LPR Cuts Fail To Lift Broader Sentiment

Most regional markets are tracking lower in the first part of Tuesday trade. China LPR cuts have failed to generate positive sentiment, although they had been well anticipated by the market. EU equities were weaker on Monday trade, while US futures are in the red by -0.20-0.25% at this stage. Eminis were last near 4443. These trends have also weighed on regional sentiment.

- Mainland bourses are close to flat at the break, the CSI 300 near 3931 in index terms. The real estate sub index is down 1.22%, now off around 3.5% since last Thursday. The 10bps cut to the 5yr LPR was less than the consensus expected (-15bps forecast), although it was a close call.

- HK shares are struggling the main HSI off by 1.53% at the break. The tech sub index off by 2.56% at this stage.

- Japan stocks are weaker, with the Nikkei 225 down around 0.40% in latest dealings. The electric appliances sector is weighing, with positive sentiment from Warren Buffett raising allocations to 5 trading houses, not enough to offset broader headwinds.

- South Korea and Taiwan stocks are also lower, but falls are fairly modest at this stage.

- Australian shares are higher, the ASX 200 last up 0.90%, with banks and mining leading the gains. Lower yields, which has weighed on the AUD post the RBA minutes has aided sentiment.

- In SEA, most markets are weaker, with Thai stocks off by nearly 1%.

OIL: Crude Under Pressure As Market Focuses On Lack Of China Stimulus

Oil prices are down again during APAC trading as risk appetite remained soft due to the lack of China stimulus details. WTI is 0.5% lower at $71.16/bbl and Brent -0.2% to $75.94. Both are off their intraday lows of $70.98 and $75.73 respectively. Currently WTI is down 5.7% in Q2 and Brent -4.4% despite further OPEC output cut announcements as demand concerns remain the core driver. The USD index is 0.1% higher.

- Oil has weakened again on continued concerns that measures to stimulate China’s economy will disappoint. This is important to the market as China is the largest crude importer.

- The Fed’s Bullard, Williams and Barr speak later. There are also US May housing starts & permits data plus Philly Fed non-manufacturing activity for June. ECB’s De Guindos also speaks.

GOLD: Extends Last Week’s Decline On Monday

Gold is unchanged in the Asia-Pac session, following a 0.4% decrease on Monday.

- The decline in gold prices continues as the market anticipates further monetary tightening and a decrease in safe-haven demand.

- Last week, the precious metal experienced a 0.2% decrease, reflecting indications that both the US Fed and the ECB are likely to continue raising interest rates. This trend negatively affects gold, which does not offer interest-bearing returns.

- During this month, the price of gold has been trading within the range of $1,925 and $1,985 per ounce.

- Additional downward pressure on gold occurred on Monday after a meeting between Chinese President Xi Jinping and US Secretary of State Antony Blinken, which raised hopes of improved stability in the relationship between the two countries. Gold is often sought as a hedge against geopolitical tensions.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/06/2023 | 0600/0800 | ** |  | DE | PPI |

| 20/06/2023 | 0800/1000 | ** |  | EU | EZ Current Account |

| 20/06/2023 | 0900/1100 | ** |  | EU | Construction Production |

| 20/06/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 20/06/2023 | 1030/0630 |  | US | St. Louis Fed's James Bullard | |

| 20/06/2023 | 1230/0830 | *** |  | US | Housing Starts |

| 20/06/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 20/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 20/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 20/06/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 20/06/2023 | 1710/1910 |  | EU | ECB de Guindos Remarks at German Bernacer Prize |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.