-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK- Trump White House Offers More Press Access

MNI US MARKETS ANALYSIS - Euro Equities Hit New Highs

MNI EUROPEAN OPEN: Tech Leading Equity Rebound

EXECUTIVE SUMMARY

- US CONGRESS PASSES BILL TO AVERT GOVERNMENT SHUTDOWN, SENDS IT TO BIDEN - RTRS

- FED’S BOSTIC - SOFT INFLATION COULD BRING CUTS BEFORE Q3 - MNI

- BOARD TO CONSIDER HOLD: WAGES, SERVICES IN FOCUS - MNI BOJ WATCH

- JAPAN DEC CORE CPI RISES 2.3% VS. NOV 2.5% - MNI BRIEF

- JAPAN CLOSELY WATCHING FOREIGN EXCHANGE MARKET, SUZUKI SAYS - BBG

- CHINA TO SLOW LOCAL GOVERNMENT OFFSHORE FINANCING FURTHER - MNI

- NORTH KOREA TESTS UNDERSEA NUCLEAR WEAPON SYSTEM, WARNS OF MORE - BBG

- RBA SHAKES UP FORECASTING FRAMEWORK - MNI POLICY

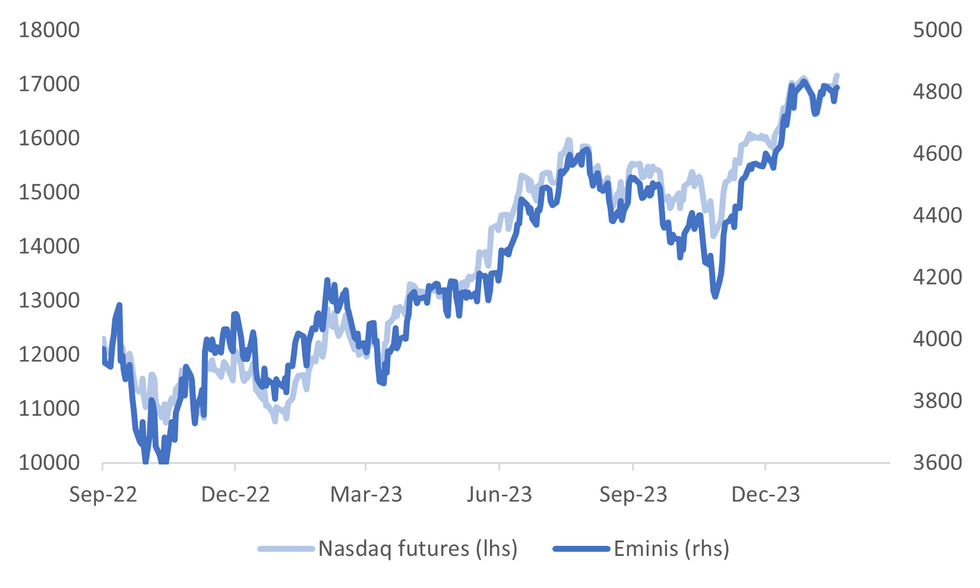

Fig. 1: US Eminis & Nasdaq Equity Futures

Source: MNI - Market News/Bloomberg

U.K.

POLITICS (BBG): Prime Minister Rishi Sunak challenged the House of Lords not to “frustrate” his flagship bill to enable the deportation of asylum seekers to Rwanda, warning that the policy is an “urgent national priority.”

EUROPE

ECB (MNI): An early consensus within the European Central Bank is forming for a first interest rate cut of the cycle to take place in June, Eurosystem officials told MNI, but they added that signs of a significant further easing in the inflation outlook could still prompt the Governing Council to move in April.

ECB (MNI BRIEF): A “very large majority” of the European Central Bank Governing Council members agreed with the proposal to begin tapering the Pandemic Purchases Emergency Programme (PEPP) reinvestments from June 30, but some members favoured an earlier end of the programme while others argued that full reinvestments should continue until the end of 2024, accounts of the December policy meeting showed on Thursday.

GERMANY (MNI INTERVIEW): Previous German pay rises are likely to continue to put upward pressure on prices this year even as new nominal wage demands become more closely aligned with falling levels of inflation, a leading German labour market specialist and government “Wise Man” adviser told MNI.

ECB (BBG): The European Central Bank has asked some lenders to provide information on their exposure to Grifols SA, according to people familiar with the matter. The lenders have been asked about their risk metrics, said the people, who added that it’s not an uncommon request. The questions come after Grifols’s accounting was criticized by short seller Gotham City Research LLC last week, causing the shares to collapse by more than 40%.

CORPORATE (BBG): Amazon.com Inc.’s proposed $1.4 billion acquisition of Roomba maker iRobot Corp. is expected to be blocked by the European Union’s antitrust regulator over concerns that the deal will harm other robot vacuum makers.

U.S.

FED (MNI): Atlanta Federal Reserve President Raphael Bostic Thursday repeated he expects policymakers to begin cutting interest rates in the third quarter, but added if there is a further accumulation of soft inflation data then cuts could begin sooner.

FED (MNI BRIEF): Philadelphia Fed President Patrick Harker said Thursday he expects inflation to fall steadily toward 2% and labor market tightness to continue to ease, suggesting heightened chances of a soft landing.

OIL (MNI INTERVIEW): Oil prices are likely to move down over the year as the market increasingly looks oversupplied in the face of stuttering demand growth and high U.S. output, Dallas Fed senior business economist Garrett Golding told MNI.

FED (BBG): US regulators are preparing to introduce a plan to require that banks tap the Federal Reserve’s discount window at least once a year to reduce the stigma and ensure lenders are ready for troubled times. The proposal, which is being drafted behind closed doors by the Office of the Comptroller of the Currency, Fed and Federal Deposit Insurance Corp., is the latest response to last year’s regional-bank crisis. The turmoil spotlighted that some lenders weren’t even set up operationally to quickly borrow from the window in a pinch.

FISCAL (RTRS): The U.S. House of Representatives on Thursday approved a stopgap bill to fund the federal government through early March and avert a partial government shutdown, sending it to President Joe Biden for final approval. The measure passed 314-108, with 106 Republicans and two Democrats in opposition. Earlier on Thursday, the Senate had easily passed the bill, with a 77-18 vote ahead of the weekend deadline.

OTHER

MIDEAST (BBG): Israel will insist on security control over the West Bank and Gaza Strip in the foreseeable future after the war, Prime Minister Benjamin Netanyahu said, rejecting rule by the Palestinian Authority despite calls from the US.

MIDEST (BBG): Houthi militants in Yemen fired missiles at an American-owned commercial vessel on Thursday, the same day President Joe Biden acknowledged US airstrikes have not halted the Red Sea attacks.

TECH (BBG): Semiconductor stocks from Tokyo Electron Ltd. to Nvidia Corp. gained more than $160 billion of market value after Taiwan Semiconductor Manufacturing Co.’s outlook for capital spending and revenue lifted hopes of a broad tech recovery in 2024.

JAPAN (MNI BOJ WATCH): The Bank of Japan will likely maintain its easy policy, including negative interest rates and yield curve control, at the Jan 22-23 meeting, despite strong wage hike reports from branch managers, as the economy fails to show signs of meeting the Bank’s 2% inflation target.

JAPAN (MNI BRIEF): The y/y rise of Japan's annual core consumer inflation rate decelerated to 2.3% in December from November’s 2.5%, showing the pass-through of cost increases continues to weaken, data released by the Ministry of Internal Affairs and Communications showed on Friday.

JAPAN (BBG): The Japanese government is closely watching movements in the foreign exchange market, Finance Minister Shunichi Suzuki says in a regular briefing in Tokyo.

NORTH KOREA (BBG): North Korea claimed it conducted an “important” test of an underwater nuclear weapon system off the nation’s east coast, the latest development stirring up tensions on the Korean Peninsula

AUSTRALIA (MNI POLICY): The Reserve Bank of Australia will implement a wider range of economic models as it shakes up its forecasting framework to help it better navigate unforeseen shocks which it believes may occur more frequently in future amid geopolitical uncertainty, MNI understands.

AUSTRALIA (AFR): The Reserve Bank of Australia should lift interest rates further and the Albanese government must deliver federal and state spending cuts to reduce inflation to target before 2026, the International Monetary Fund has advised. In a major review of the economy, the IMF ramped up calls for “comprehensive tax reform” to fix weak labour productivity growth.

COLUMBIA (BBG): S&P Global Ratings lowered Colombia’s outlook citing the risk of a prolonged period of weak economic growth. The agency cut the outlook to negative from stable, but maintained its BB+ rating, which is one notch below investment grade.

CHINA

LGFV (MNI): Local government financing vehicles will find issuing into the offshore bond market increasingly difficult as authorities aim to reduce their debt levels and the risk of asset mismatch between low return municipality projects and high offshore financing costs, a policy advisor and market insiders told MNI.

EQUITIES (BBG): China’s largest brokerage has suspended short selling for some clients in mainland markets amid a deepening rout in the nation’s stocks, according to people familiar with the matter.

SHIPPING (RTRS): For Chinese businessman Han Changming, disruptions to Red Sea freight are threatening the survival of his trading company in the eastern province of Fujian.Han, who exports Chinese-made cars to Africa and imports off-road vehicles from Europe, told Reuters the cost of shipping a container to Europe had surged to roughly $7,000 from $3,000 in December, when Yemen's Iran-aligned Houthi movement escalated attacks on shipping.

NRDC (21st Century Business Herald): The National Development and Reform Commission will focus on promoting spending on big-ticket items such as new energy vehicles and electronic products, and the replacement of old consumer goods by upgrading technology and emission standards, said Yuan Da, deputy secretary-general at the NDRC.

HOUSING (YICAI): China’s efforts to transform urban villages will require about CNY10 trillion, including land purchases and construction investment, over the next five years, according to Huang Yu, executive vice-president at the China Index Research Institute. Huang said the project will generate 44 million square meters of new residential demand every year on average.

CHINA MARKETS

MNI: PBOC Injects Net CNY6 Bln Via OMO Fri; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY71 billion via 7-day reverse repo on Friday, with the rates unchanged at 1.80%. The reverse repo operation has led to a net injection of CNY6 billion reverse repos after offsetting CNY65 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8212% at 10:19 am local time from the close of 1.8311% on Thursday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 46 on Thursday, the same as the close on Wednesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1167 Friday vs 7.1174 Thursday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1167 on Friday, compared with 7.1174 set on Thursday. The fixing was estimated at 7.1953 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND DEC BUSINESSNZ MFG PMI 43.1; PRIOR 46.5

NEW ZEALAND NOV NET MIGRATION SA 2740; PRIOR 9090

JAPAN DEC NATL CPI Y/Y 2.6%; MEDIAN 2.5%; PRIOR 2.8%

JAPAN DEC NATL CPI EX FRESH FOOD Y/Y 2.3%; MEDIAN 2.3%; PRIOR 2.5%

JAPAN DEC NATL CPI EX FRESH FOOD, ENERGY Y/Y 3.7%; MEDIAN 3.7%; PRIOR 3.8%

JAPAN NOV TERTIARY INDUSTRY INDEX M/M -0.7; MEDIAN 0.2%; PRIOR -0.8%

MARKETS

US TSYS: Cash Bonds Slightly Cheaper, More Fedspeak Later Today

TYH4 is trading at 111-03, -0-03+ from NY closing levels.

- Cash bonds are dealing 1-2bps cheaper in today’s Asia-Pac session.

- There hasn’t been anything meaningful on the newsflow front today.

- Later today will see U. of Mich. Sentiment, Existing Home Sales and Total Net TIC Flows. Also, Fed's Goolsbee Speaks on CNBC, and Fed's Daly Speaks on Fox Business and in Fireside Chat.

JGBS: Cheaper After BoJ Rinban Results, BoJ Policy Decision On Tuesday

In Tokyo afternoon dealings, JGB futures are holding in positive territory and the middle of today’s range, +7 compared to the settlement levels.

- There hasn’t been much in the way of domestic data drivers to flag, outside of the previously outlined National CPI data, which broadly printed in line with expectations.

- Elsewhere, cash US tsys are dealing 1-2bps cheaper in today’s Asia-Pac session.

- Cash JGBs are dealing mixed but yields are higher than Tokyo lunch break levels after today’s BoJ Rinban operations showed mixed results. There were flat to negative spreads but higher offer cover ratios across the buckets. JGB yields are flat (3-year) to 2.1bps higher (40-year). The benchmark 10-year yield is 0.7bp higher at 0.658% versus the Nov-Dec rally low of 0.555%.

- The swaps curve has bear-steepened, with rates flat to 3.1bps higher. Swap spreads are mostly wider.

- Next week, the local calendar is empty on Monday ahead of the BoJ Policy Decision on Tuesday.

- (MNI ICYMI) The BoJ will likely maintain its easy policy, including negative interest rates and yield curve control, at the Jan 22-23 meeting, despite strong wage hike reports from branch managers, as the economy fails to show signs of meeting the Bank’s 2% inflation target. (See link)

- On Monday the MoF will conduct Liquidity Enhancement Auctions for OTR 5-15.5-year JGBs at 1700 local time.

AUSSIE BONDS: Cheaper But Well Off Lows, IMF Reports’ Impact Proves Fleeting

ACGBs (YM -3.0 & XM -3.5) are dealing cheaper but well above Sydney session lows. Without domestic data drivers, the local market largely drifted with dealings in US tsys in today’s Asia-Pac session. Cash US tsys are currently dealing 1-2bps cheaper.

- Later today will see U. of Mich. Sentiment, Existing Home Sales and Total Net TIC Flows. Also, Fed's Goolsbee Speaks on CNBC, and Fed's Daly Speaks on Fox Business and in Fireside Chat.

- Earlier in the session, ACGBs were pressured by AFR reports that the IMF had advised the RBA that it should lift interest rates further and the Albanese government must deliver federal and state spending cuts to reduce inflation to target before 2026 (See link). However, this negative catalyst proved short-lived.

- Cash ACGBs are 2-3bps cheaper, with the AU-US 10-year yield differential 4bps tighter at +14bps.

- Swap rates are 2-3bps higher, with the 3s10s curve steeper.

- The bills strip is cheaper, with pricing flat to -4.

- RBA-dated OIS pricing is little changed across meetings out to September and 2bps firmer beyond. A cumulative 35bps of easing is priced by year-end.

- The local calendar is empty on Monday.

- The AOFM plans to sell A$800mn of 3.00% Nov-33 bond next Wednesday.

NZGBS: Cheaper, But Off Worst Levels, Q4 CPI Next Wednesday

NZGBs closed 3-6bps cheaper but off session cheaps. The morning’s release of December’s Manufacturing PMI data failed to provide a market-moving catalyst. Accordingly, local participants appear to have been happy to take their lead from US tsys’ heavy close on Thursday and ongoing weakness in today’s Asia-Pac session. Cash US tsys are dealing 1-2bps cheaper, with a slightly steepening bias.

- Swap rates closed 1-7bps higher, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed flat to 3bps firmer across meetings, with July-November leading. A cumulative 88bps of easing is priced by year-end. This compares to -102bps seen earlier in the week and -121bps on January 2.

- Next week's highlight is likely to be Q4 CPI data on Wednesday. Bloomberg Economics (BE) expects the CPI data to show an easing in inflation and undershoot of the RBNZ’s forecast. The central bank projects the CPI will climb 0.8% q/q, slowing from a 1.8% rise in 3Q23. That translates into 5% annual inflation. BE thinks the CPI will surprise on the downside, with a 0.3% q/q rise that brings annual inflation to 4.5%.

- Elsewhere, the BoJ Policy Decision is due on Tuesday, although there is minimal expectation within the market that the BoJ will alter its current yield-curve control and negative short-term rate policy.

EQUITIES: Tech Optimism Drives Taiwan Outperformance

Regional equities are mostly higher, with HK and China markets the main exceptions. US futures are higher at this stage, led by Nasdaq futures, up 0.35%, Eminis were last near +0.10% higher (index close to 4815.). This follows fairly broad based gains in cash trading in US and EU markets on Thursday.

- Fresh tech/chip optimism following TSMC's earnings update is aiding broader sentiment in the space. The company stated it expects earnings growth to be solid this quarter and has room to raise Capex spending this year (BBG).

- The Taiex is up +2.4% at this stage. A potential return of some offshore flows (with -$4.5bn in outflows in the first part of the week) are a further source of support.

- The Kospi is up around 1% at this stage, while the Nikkei 225 is up +1.2% in Japan, the Topix +0.60%.

- Hong Kong and Mainland China indices are lagging. The HSI is off 0.20% at the break, the CSI 300 down close to 0.30%, unwinding some of yesterday's late afternoon rally. A report that brokerage Citic Securities has suspended short sales for some clients hasn't aided aggregate sentiment at this stage.

- In Australia, the ASX 200 is up around 1%, while in SEA most markets are up by less. Philippines bourse is down modestly, while Indian markets have opened up strongly, with gains of nearly 1% at this stage.

FOREX: USD/JPY Off Highs On Suzuki Comments, AUD/NZD Recovers Further

The BBDXY sits marginally lower, off 0.10%, last near 1237.10. There have been mixed trends in the G10 space though. AUD has outperformed against both NZD and JPY. Equity sentiment is mostly positive for the region and in terms of US futures, albeit led by the tech side. UST yields sit marginally higher.

- USD/JPY threatened to push above 148.50 in earlier trade, amidst a slightly higher yield backdrop and a close to expected Dec national CPI print.

- However, we saw some fresh verbal jawboning from FinMin Suzuki around watching FX levels closely and that FX rates should reflect fundamentals. This is the first such comments in a little over a month from the FinMin.

- USD/JPY dipped back to 148.15, but remained above earlier lows (147.94). We last tracked around 148.30/35.

- AUD/USD sits marginally higher, last around 0.6580. NZD/USD has lost ground back towards 0.6100, off around 0.25% at this stage. The AUD/NZD cross has recovered further, back to 1.0785, fresh highs from early Jan for the pair. We have seen a move higher in AU-NZ 2yr swap rate differentials this week, back to -60bps. This is highs back to Sep 2022.

- Looking ahead, UK and Canada retail sales figures for December are published. In the US, UMich consumer sentiment and inflation expectations may garner some interest, as well as existing home sales data.

OIL: Tracking Higher For The Week

Oil benchmarks sit just off Thursday highs. Brent crude front month was last near $78.90/bbl, down around 0.30% so far in Friday trade. We are still up for the week (+0.75%). WTI front month was last near $74/bbl having followed a similar trajectory so far today. It's week to date gain is more impressive though, +1.84%.

- Brent sits towards the upper end of its recent ranges. $80.75 (Jan 12 high) will be eyed, while the bull trigger higher still at $81.45 (Dec 26 high). Recent lows rest at $76.50/bbl.

- Sentiment was aided on Thursday by the US stocks draw. EIA Weekly US Petroleum Summary - w/w change week ending Jan 12: Crude stocks -2,492 vs Exp -426, Crude production +100, SPR stocks +596, Cushing stocks -2,099. North Dakota oil production was also down.

- On the demand side, the global oil demand growth forecast for 2024 has been revised higher by 180kbpd to 1.2mbpd to reach almost 103mbpd, according to the IEA Monthly Oil Market Report.

- In the background Red Sea tensions continue, with further attacks reportedly launched by Houthis in the past day or so.

GOLD: Solid Gains On Geopolitical Concerns

Gold is little changed in the Asia-Pac session, after closing +0.9% at $2023.34 on Thursday, unwinding a large part of yesterday’s second-half slide.

- The rally came despite net USD strength and higher US Treasury yields. Haven flows dominated due to geopolitical tensions including further US strikes on Houthi targets and Pakistan striking Iran in retaliation.

- US tsys twist-steepened, pivoting at the 5s, with yields 1bp lower to 5bps higher. US tsys reversed early gains after lower-than-expected Initial Jobless Claims and higher-than-expected Building Permits and Housing Starts. MNI’s Chicago Business Barometer was also revised up to 47.2 in December from 46.9.

- Fedspeak: Philly Fed Harker suggested a heightened chance of a soft landing, while Atlanta Fed Bostic repeated that he expected policymakers to begin cutting interest rates in the third quarter. He did however add that if there is a further accumulation of soft inflation data then cuts could begin sooner.

- From a technical standpoint, bullion’s recent clearance of support including the 50-day EMA has strengthened the bearish threat with $1973.2 (Dec 13 low) exposed, according to MNI’s technicals team.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/01/2024 | 0700/0800 | ** |  | DE | PPI |

| 19/01/2024 | 0700/0700 | *** |  | UK | Retail Sales |

| 19/01/2024 | 1000/1100 |  | EU | GDP Q3 2023 revisions | |

| 19/01/2024 | 1000/1100 |  | EU | ECB's Lagarde participates in Stakeholder Dialogue at WEF | |

| 19/01/2024 | 1330/0830 | ** |  | CA | Retail Trade |

| 19/01/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 19/01/2024 | 1500/1000 | *** |  | US | NAR existing home sales |

| 19/01/2024 | 1500/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 19/01/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 19/01/2024 | 1800/1300 |  | US | Fed Vice Chair Michael Barr | |

| 19/01/2024 | 2100/1600 | ** |  | US | TICS |

| 19/01/2024 | 2115/1615 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.