-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

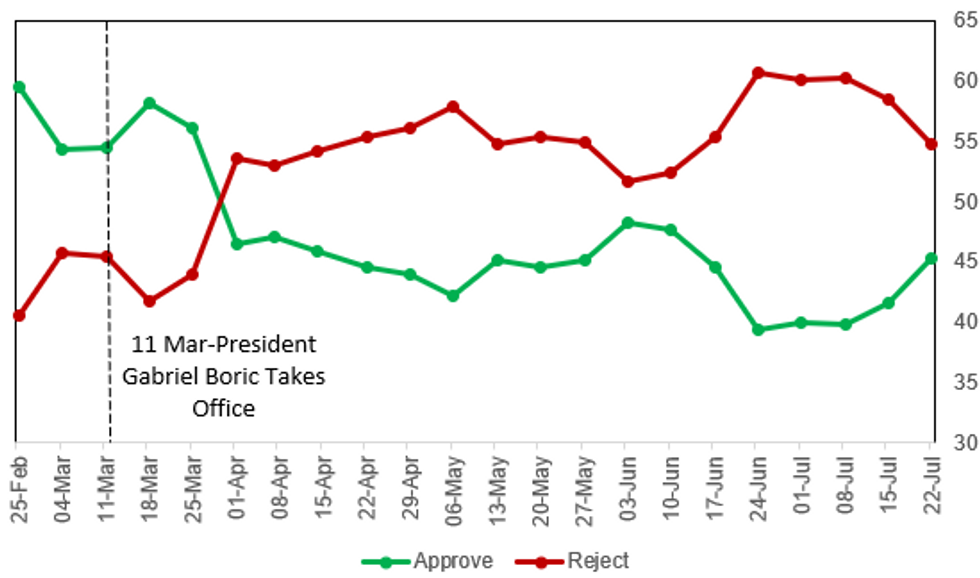

'No' To New Constitution Still Leads Polls, But Gap Narrowing

Latest polling from Cadem shows respondents opposed to the new constitution, which is set to be voted on in a national plebiscite on 4 September. However, the gap between those opposed and those in favour of a new national legal document has narrowed notably since late-June, with support trending towards the 'approve' camp.

- Cadem poll: "With all the information you have at this time, would you vote to Approve or Reject the proposed new Constitution?" Approve: 45.3% (+3.7), Reject: 54.7% (-3.7), (+/- vs. 13-15 Jul). Fieldwork: 20-22 July 2022. Sample size: 701

- The steep rise in opposition to the new constitution came shortly after left-wing President Gabriel Boric came into office, with the fortunes of the Chilean leader and the new constitution seemingly intertwined. Rising inflationary pressures and slowing economic growth have seen protest movements spring up and Boric's approval ratings decline significantly, along with support for the new constitution that he and his gov't have advocated for.

- Earlier this week, JP Morgan issued a note stating that, "In the medium term, uncertainty may linger even if rejection is favored in the polls...there seems to be a majority in favor of additional reforms...Last week, President Boric stated that if rejection wins, the Convention process is to start again...we may face a new process that could last for another 1.5 to 2 years, with adverse impact on investment, growth, and likely the fiscal accounts On the other side, if approval wins on Sep-4, steadfast legislation to clarify investors concerns on water rights, mining concessions, and expropriation terms seems paramount for uncertainty to abate."

Source: CADEM, MNI. Sample sizes: 701-712

Source: CADEM, MNI. Sample sizes: 701-712

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.