-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessNow Little Changed On The Day, Marginally Mixed Vs. USD

Early USD strength vs. Asia FX unwinds alongside moves in the broader BBDXY, leaving USD/CNH and the major USD/Asia 1- & 3-month NDFs that we track little changed on the session, either side of flat vs. the USD, but generally within 0.1% or so of yesterday’s closing levels.

- Chinese stimulus speculation/hope continues to do the rounds, with the re-airing of an article pointing to a deposit rate cut for USD accounts at some of the largest Chinese banks apparent (larger cuts than that which have been touted for CNY deposits are seemingly incoming) also noted. That would represent back-channel defence re: yuan weakness, with little steer via the CNY mid-point fixing forthcoming at present.

- A recovery in U.S. equity futures from session lows will be aiding broader risk appetite, after the disappointing Chinese export data and smaller than expected fall in Chinese imports in May (in Y/Y USD terms) resulted in a narrower trade surplus and set the tone in Asia-Pac hours.

- A bid in crude oil futures will be capping any rally in the currencies of the region’s net oil importers.

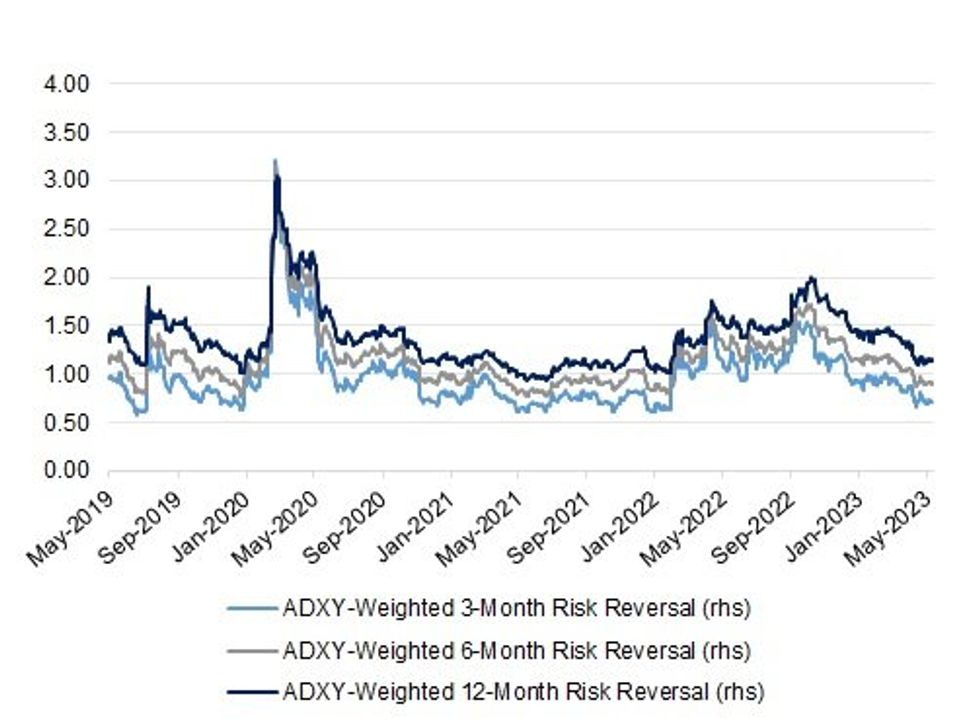

- Our weighted ADXY risk reversal measures (based on historic weights after the index was discontinued) haven’t shown any meaningful pan-region hedging worry during the recent run higher in USD/Yuan, with downticks in those metrics seen in recent weeks.

- In terms of the major impending events, we flag tomorrow’s RBI decision, whereby the broad consensus looks for the Bank to leave the policy rate at 6.50%. Recent inflation prints have undershot to the downside and it's likely the y/y pace will lose further altitude in the next few months (click for our full preview of that event).

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.