-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessNZD/USD Has Typically Rallied Following Recent CPI Prints

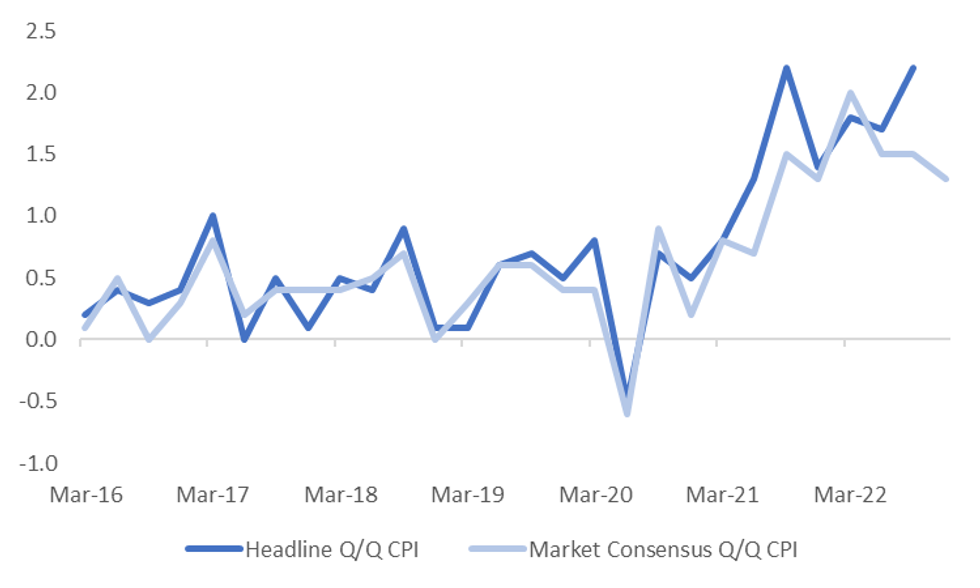

Tomorrow's NZ Q4 CPI print shapes as a key one ahead of the February RBNZ meeting. Market expectations look for a down shift in q/q pressures to 1.3% (range of 0.9%-1.8%), from 2.2% in Q3. This would take the y/y pace to 7.1% from 7.2%. The market expects tradables q/q to be at 0.8%, from 2.2% in Q3, with a (range of 0.3% to 1.1%), while non-tradeables is forecast at 1.7% q/q, from 2.0% in Q3 (range of 1.4% to 2.0%).

- The general trend has been for upside inflation surprises over the past 18 months, see the first chart below.

- A sharp pull back in petrol prices is expected to weigh on headline momentum from Q4, although underlying inflation pressure trend (non-tradables/core) will still be watched closely in terms of the RBNZ outlook.

- Current market pricing (OIS) has the policy rate peaking close to 5.45% near the middle of the year, versus the current rate of 4.25%.

Fig 1: NZ Headline Inflation Versus Expectations

Source: MNI - Market News/Bloomberg

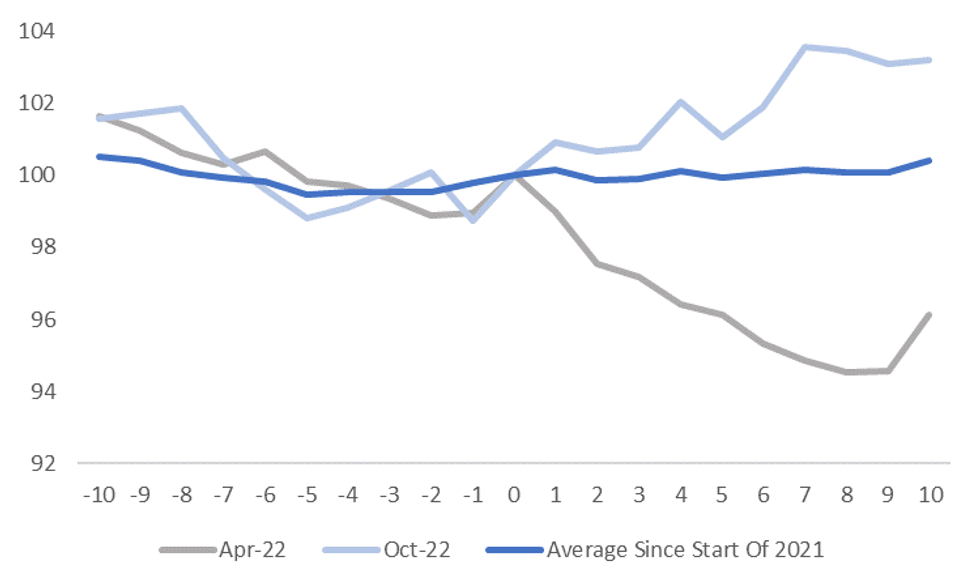

- The NZD/USD reaction post recent CPI prints has generally been positive, which is not surprising given the upside surprises. 2 weeks after the Q3 print in October last year, NZD/USD was 3.2% higher, in July (post the Q2 print), we were 2.9% higher.

- In April 2022 though, the Q1 CPI miss, coupled with the strengthening USD trend, drove a sharp NZD/USD sell-off.

- The chart below plots the average performance of NZD/USD in the 2 weeks prior and 2 weeks after CPI prints since the start of 2021. On average, NZD is 0.40% higher 2 weeks post, flat after the first week. If we exclude the April 2022 result it is 1% firmer. The 2 other lines on the chart represent the worst (April 2022) and best (October 2022) outcomes post CPI prints for this sample period.

- An upside surprise tomorrow may not carry as much weight as it did in 2022, given we are arguably closer to the end of the tightening cycle.

- A downside surprise may temper peak RBNZ expectations, but softer USD momentum/better risk appetite in the equity space, may help contain the fallout for NZD.

Fig 2: NZD/USD Reaction 2weeks Before & 2weeks After CPI Prints (2021-2022)

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.