-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI:Largest Canada New Home Price Dip Since `09 Led By Toronto

MNI: Canadian Oct Retail Sales Rise For Fourth Straight Month

MNI POLITICAL RISK - Trump Cabinet Hits First Roadblock

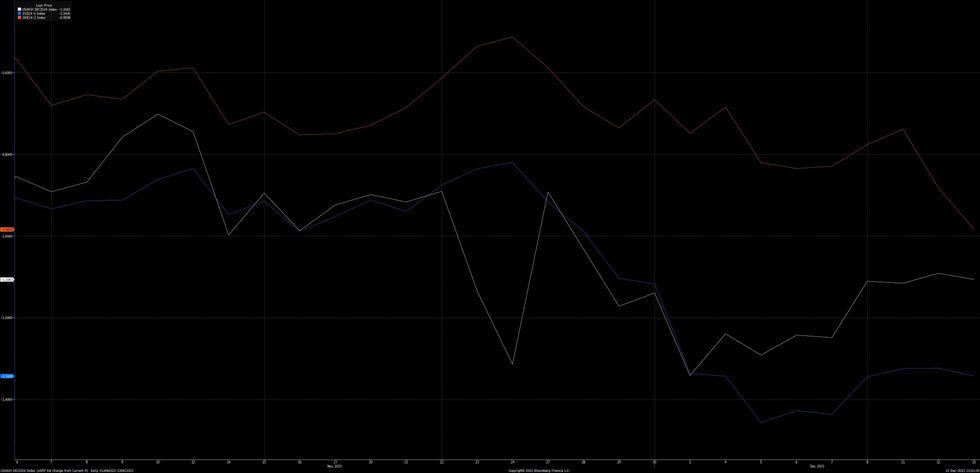

Overview Of Major Central Bank Pricing, BoE Catching Down A Little In Wake Of Recent Data

A quick overview of market pricing re: major central banks ahead of the final Fed, ECB and BoE meetings of ’23:

- Fed: ~111bp of cuts are currently priced through ’24, with the first 25bp cut fully discounted come the end of the May ’24 FOMC. A reminder that dovish comments from Fed Governor Waller and a run of economic data pushed Fed Funds futures to briefly price in ~135bp of ’24 cuts in recent times, before the latest NFP and CPI data prints helped take the edge of off that dovish swing. The Fed has retained the optionality for further hikes in recent post-meeting statements and we don’t expect this to change today.

- ECB: With the ECB ultimately calling time on the hiking cycle, barring any surprises, focus has moved to QT and rate cuts. A subsequent adjustment towards a more centrist stance on the part of some of the traditionally hawkish voices on the Governing Council, as well as data-driven expectations, briefly allowed ~150bp of cuts to show in ’24 pricing. Latest market pricing shows ~135bp of cuts through ’24, with the first 25bp cut more than fully discounted through the May ’24 meeting and greater than even odds of a 25bp cut priced for the March ’24 gathering.

- BoE: UK STIR pricing has seen a degree of ‘catching down’ to global peers in recent sessions, with the softer-than-consensus AWE data within yesterday’s labour market report, as well as today’s softer-than-expected economic activity and GDP data, driving matters. 98.5bp of cuts now show through ’24 on the whole, with the first 25bp cut more-than-fully discounted come the end of the June ’24 MPC, alongside greater than even odds of a 25bp cut come the end of the April '24 MPC. Perceptions surrounding inflation stickyness and wage dynamics are the widely cited reasons for BoE pricing not being as dovish as Fed & ECB peers.

- Our previews for the impending central bank decisions can be found below:

- Fed

- ECB

- BoE

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.