-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Gilt Week Ahead

Policy/Commodity Divergences Become Clearer in CEMEA FX & Rates in September

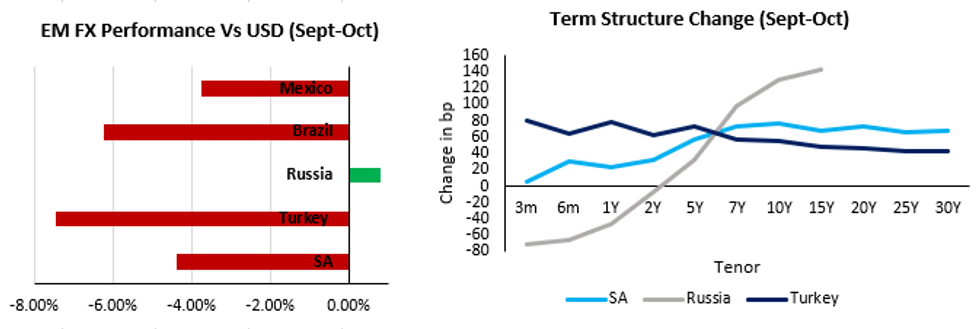

- Looking at the term structure changes in Turkey, Russia & SA since the start of September we can see the effects of inflation, monetary policy, commodity prices and overarching risk aversion from a more hawkish Fed driving yields and currencies in different directions.

- Most notably, we see a steepening pivot in Turkey's term structure and idiosyncratic RUB strength standing out among the market moves. The former coming as a result of last month's surprise 100bp rate cut from the CBRT (ahead of schedule), and the latter from record high RUB-denominated oil & gas prices, combined with a CBR hiking cycle.

- On the rates front, we see sustained bear flattening in Russia's term structure – driven by stubborn inflationary pressures, forcing a prolonged CBR hiking cycle. While in SA, bear steepening momentum has accelerated due to the high-beta nature of SAGBs, an accommodative SARB, the downturn in Chinese economic activity, higher near-term inflation concerns and general risk aversion surrounding a more hawkish Fed. The bear steepening bias in both Turkey & SA also reflects their higher vulnerability to rising LT bond yields in the US vs the relatively more insulated OFZs.

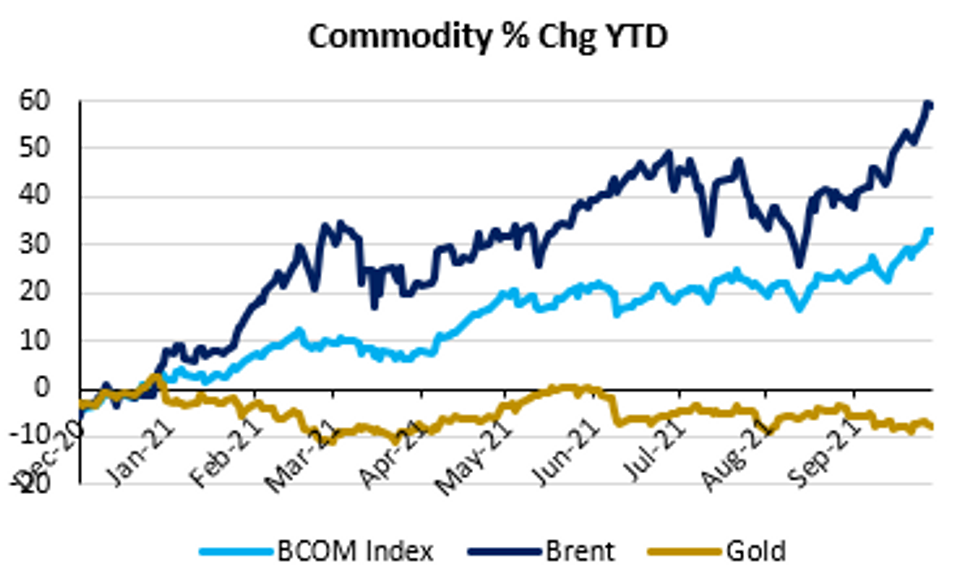

- In terms of currencies, RUB stands out as a notable outperformer against a backdrop of broad-based EM weakness. In the liquid high-beta basket, TRY & BRL are the clear underperformers with inflationary and political concerns driving weakness, while Mexico & SA face less endemic idiosyncratic risks and align more with the current global risk off environment. Commodity prices also play a key role in the space with raw materials and metals underperforming on higher UST yields, while tight supply continues to drive oil prices to fresh highs.

- Going into year end, the focal point will remain squarely on the Fed's tapering programme and expectations for rates lift-off and growth with brewing stagflation concerns denting global risk sentiment. Higher oil prices will also continue to place upside pressure on both headline CPI & PPI metrics requiring a tactical approach to central bank forecasts into 1Q22 – with analysts keeping an eye on OPEC for any supply reprieve to temper rising prices.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.