-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

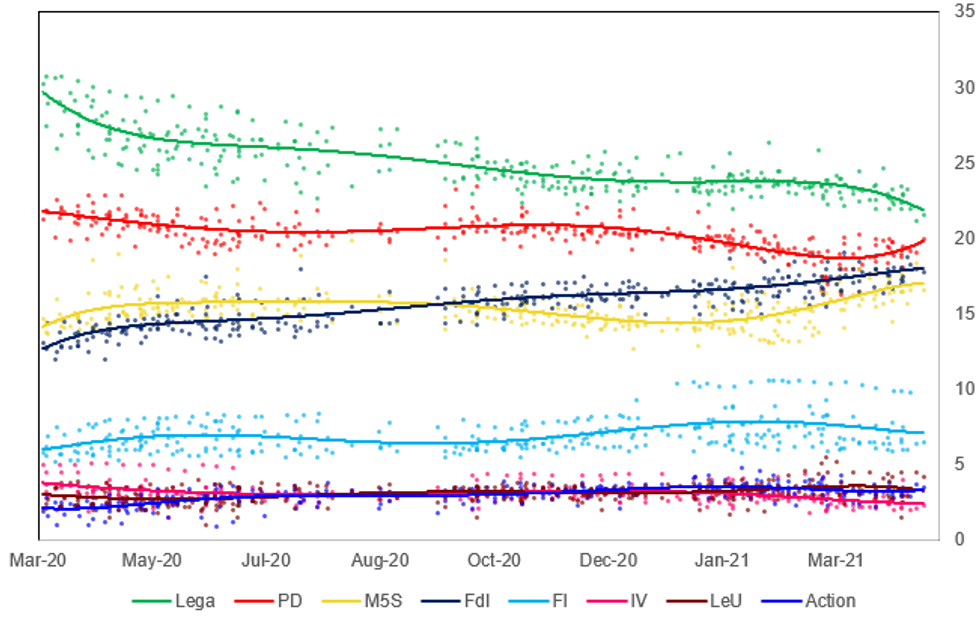

Free AccessPolls Continue To Show Muddled Picture As Path To Reopening Decreed

Opinion polls in Italy continue to show the four largest parties all with a similar level of support amidst a gov't decree setting out a path to reopening the economy and society.

- The right-wing populist League (Lega) of former Deputy PM Matteo Salvini continues to lead, as it has done for several years, but a sustained gradual decline in the party's support has not been arrested by its joining the coalition gov't of PM Mario Draghi.

- The main beneficiary of the League's decline is the right-wing nationalist Brothers of Italy (FdI). The FdI is the only major Italian party that is not part of the governing coalition, and as such has become receptacle for opponents of the current administration.

- The next election is not due until 2023 and despite Italy's frequent political crises, parliament has managed to avoid snap elections so far.

- The next big challenge to political stability may be the end to the COVID-19 pandemic. Draghi came in as an unelected PM to steer Italy through a political crisis and the pandemic. It may be the case that once the pandemic passes, the broad support he has enjoyed so far begins to ebb as politicians demand accountability and an elected PM.

Chart 1. Italy Opinion Polling, % and Trendline

Source: Index, SWG, Tecne, Termometro Politico, Piepoli, EMG, Noto, BiDiMedia, Euromedia, Ipsos, Winpoll, Format Research, Demos & Pi, Ixe, Quorum-YouTrend, Lab2101, MNI

Source: Index, SWG, Tecne, Termometro Politico, Piepoli, EMG, Noto, BiDiMedia, Euromedia, Ipsos, Winpoll, Format Research, Demos & Pi, Ixe, Quorum-YouTrend, Lab2101, MNI

- This could come within the next 12 months, with the gov't issuing a decree on 21 April setting out the path towards the reopening of the economy and ending of COVID-19 restrictions. The unwinding begins on 26 April , with cinemas, theatres, concert halls and other similar venues allowed to open in yellow zones. The next steps are due to come in on 15 May, 1 June, 15 June, and 1 July.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.