-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessPotential Snap Election Unlikely To Oust PM Costa

The rejection of the Portuguese gov'ts budget by the Assembly of the Republic on 27 October could lead to a snap election at the first months of 2022. However, given the robust support for Prime Minister Antonio Costa's centre-left Socialist Party (PS), the most likely outcome at present is that he remains at the head of a minority administration.

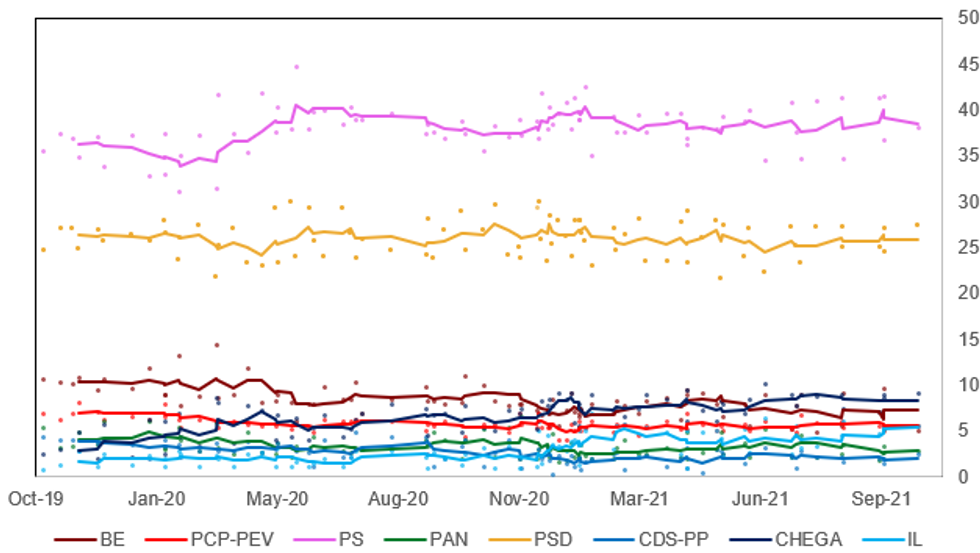

- Opinion polling since the previous legislative election in October 2019 has shown very little change for the two major parties: Costa's PS and the centre-right Social Democratic Party (PSD), with the former's support holding steady in the high 30's and the latter in the high 20's.

- The main shift has come among the smaller parties. On the left, support for the populist Left Bloc (BE) and communist/eco-socialist Unitary Democratic Coalition (PCP-PEV) - two parties that previously propped up Costa's minority administration - has fallen. On the right, the conservative CDS-People's Party (CDS-PP) - previously part of governing coalitions - continues its steady decline.

- The party with the most notable increase in support is the right-wing populist Chega (Enough) party, which won just a singe seat in the 2019 election but is now polling in a consistent third/fourth place in opinion polling.

- A small increase in support could see the PS win an overall majority, but if this is not possible then another PS minority gov't remains on the cards. The PSD is unlikely to find enough willing coalition allies to oust the PS and form a majority coalition or even a stable minority gov't.

Source: Euirosondagem, Intercampus, Pitagorica, Aximage, CESOP-UCP, ICS, MNI

Source: Euirosondagem, Intercampus, Pitagorica, Aximage, CESOP-UCP, ICS, MNI

- The next steps over the coming days are not set in stone, but given that the Portuguese constitution views the 'rejection of the government's programme' as an implied resignation by the gov't it would seem likely that President Marcelo Rebelo de Sousa will be forced into calling a vote. The authorities will want to avoid the Christmas period, so early 2022 seems the most likely option.

- Until then, the Sousa gov't will likely continue in a caretaker capacity. This will mean no major new legislation being passed, and no approval for new spending measures or deciding on how to distribute any EU Recovery and Resilience Facility funding.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.