-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Thune Defends Two-Step 2025 Agenda

MNI US MARKETS ANALYSIS - EUR Steadies Ahead of ECB

Price Signal Summary: Risk-On Sentiment Reverses Recent Trends

- In the equity space, S&P E-minis continue to recover and extend the bounce from last week’s low of 4492.00 on Dec 3. The contract is back above the 50-day EMA. The focus is on resistance at 4681.85, 76.4% of the Nov 22 - Dec 3 downleg. Initial support to watch is today’s low of 4587.25. EUROSTOXX 50 futures have rallied sharply higher today. The contract has breached resistance at 4186.00, the Dec 1 high and price is also through both the 20- and 50-day EMAs. Attention is on 4251.20, the 61.8% retracement of the recent downleg between Nov 18 - 30 ahead of the 76.4% level at 4311.70.

- In FX, EURUSD continues to pull away from last week’s high. 1.1383, the Nov 30 high is the key resistance to watch where a break is required to suggest potential for a stronger recovery that would open 1.1514, Nov 5 low. The bear trigger is unchanged at 1.1186/85, Nov 24 and Jul 1, 2020 low. GBPUSD trend signals continue to point south with attention on support at 1.3195, Dec 1 low. A break would confirm a resumption of the downtrend and open 1.3165, 38.2% retracement of the Mar ‘20 - Jun ‘21 upleg. 1.3379 is resistance, the 20-day EMA. USDJPY is firmer this morning. Yesterday’s price action appears to be a bullish engulfing reversal. If correct, it suggests the pair has found a base. The 20-day EMA at 113.71 is being tested. A clear break would reinforce the reversal pattern and open the November high of 115.52. Key support is 112.53, the Nov 30 low.

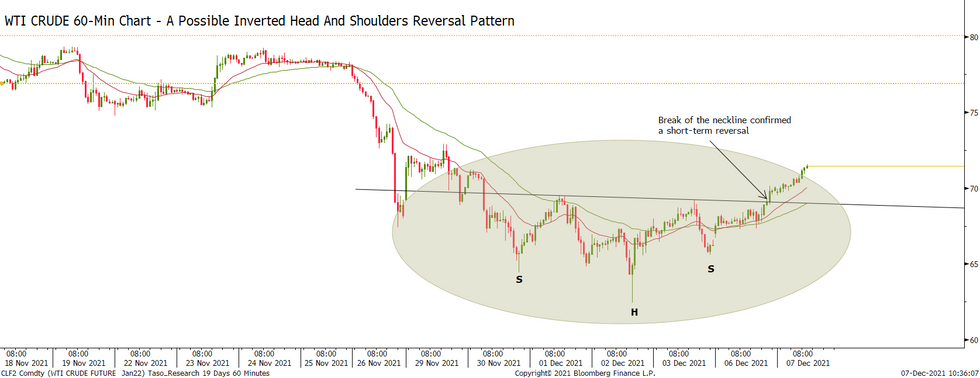

- On the commodity front, Gold remains vulnerable. Attention is on the base of the bull channel at $1763.0, drawn from the Aug 9 low. This level represents a key short-term support. WTI futures are firmer. On the 60-min chart, the move higher has confirmed an inverted head and shoulder reversal, reinforcing the current bull cycle, suggesting scope for stronger gains near-term. Attention is on $73.18, the 20-day EMA. Initial support lies at $65.60, the Dec 3 low.

- In the FI space, Bund futures remain in an uptrend. The focus is on 175.02 1.382 projection of the Nov 11 - 22 - 24 price swing. Support is at 173.31, Dec 2 low. Gilts maintain a bullish tone. The 127.00 handle has been breached and this opens 127.36 Sep 7 high. Initial firm support is at 125.44, Nov 26 low and a gap high on the daily chart.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.