-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessQuiet Ahead Of Key Events

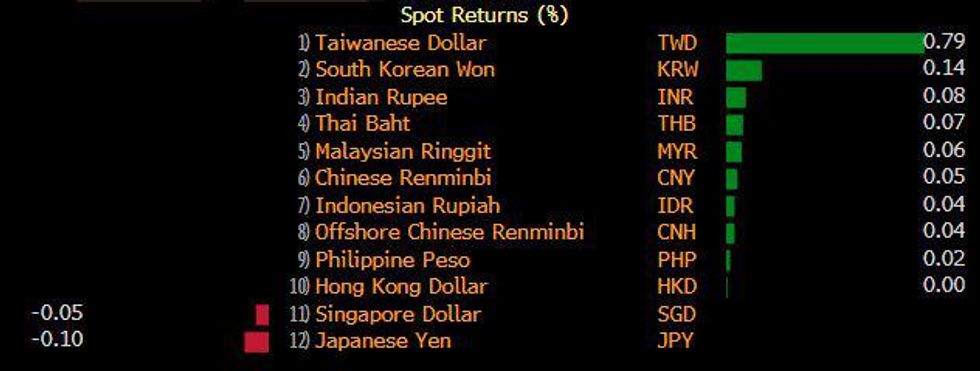

A fairly quiet session for Asia EM FX as markets await the FOMC rate announcement. The greenback caught a bid mid-way through the session which saw most USD/Asia crosses bounce off lows.

- CNH: Yuan strengthened after strong industrial profits data. The PBOC drained CNY 100bn, the second day of drain despite LNY approaching. Repo rates increased again. USD/CNH last down 17 pips at 6.4709.

- SGD: Singapore's aims to have one community vaccination centre in every town by the end of March according to Minister for Trade and Industry Chan Chun Sing. USD/SGD last up 8 pips at 1.3254.

- TWD: Some comments from the Chinese government crossed the wires, says hopes US sticks to "one-China" principle, and hopes that the US will proceed on the issue with caution. USD/TWD lower on the day at 27.98.

- KRW: Won is higher after weakening yesterday. Data before the open showed consumer confidence rose in January. The BOK said consumer sentiment improved as new cases of coronavirus infections slowed down amid expectations for vaccinations. USD/KRW last down 1.20 at 1105.10

- IDR: Spot USD/IDR failed to take out its 50-DMA yesterday and continues to trade below that moving average, last virtually unchanged at 14,066. Indonesia's Covid-19 case count has topped 1mn, marking the worst outbreak in Southeast Asia.

- MYR: Gained in early trade amid fading prospects for a hard lockdown after the current Movement Control Order expires. USD/MYR last down 22 pips at 4.044.

- PHP: Data today showed the trade deficit unexpectedly expanded, on the back of a surprise fall in exports, which was coupled with a slightly smaller than exp. decline in imports. USD/PHP sticks to a familiar range, last trades marginally below neutral levels at 48.058

- THB: Thai gov't came under attack from opposition lawmakers for its handling of the coronavirus situation, the country declared a record number of new Covid-19 infections on Tuesday. USD/THB down 20 pips at 29.96

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.